Submitted by Tyler Durden on 07/09/2015 - 15:25 "China is not doing anything that the US has not already tried," exclaims Rick Santelli as he derides the 'entitlement' society that has reached the investor class. Whether it's US, Japan, Europe, or China, "the idea of trying to prop up returns in the equity market - admitted or not - is going on," Santelli notes, asking - after forcing every mom and pop out of savings and into investment, "if it doesn't turn out well... do they have a moral obligation to help out?" Simply put, he rages - drawing the chart of the year - "the central planners are in control... and I don't suspect they will give up the reins any time soon."

Trump'd

Submitted by Tyler Durden on 07/09/2015 - 13:52 Presented with nothing but an open-mouthed 'no comment'...

from Bearing Arms:

In a significant doctrinal shift, the U.S. military is relegating full

metal jacketed (FMJ) pistol bullets to a training role, and will be

adopting modern hollowpoint designs similar to those used by most

domestic law enforcement agencies and citizens who carry handguns for

self-defense.

In a significant doctrinal shift, the U.S. military is relegating full

metal jacketed (FMJ) pistol bullets to a training role, and will be

adopting modern hollowpoint designs similar to those used by most

domestic law enforcement agencies and citizens who carry handguns for

self-defense.

The stunning announcement was made at the U.S Army’s Picatinny Arsenal in New Jersey yesterday during the military’s two-day “industry day” for the Modular Handgun System (MHS), which will conclude today.

A military lawyer who made a presentation during the Industry Day noted that the United States is not a signatory to the Hague Conventions which outlawed the use of “dum-dum” and expanding bullets more than a century ago. It is the military’s position that the shift to jacketed hollowpoint (JHP) ammunition, which more efficiently transfers energy to the target and which presents much less of a risk of over-penetration, is more humane and less of a risk to innocent civilians downrange in modern combat where there are often no clear front lines.

Read More @ BearingArms.com

In a significant doctrinal shift, the U.S. military is relegating full

metal jacketed (FMJ) pistol bullets to a training role, and will be

adopting modern hollowpoint designs similar to those used by most

domestic law enforcement agencies and citizens who carry handguns for

self-defense.

In a significant doctrinal shift, the U.S. military is relegating full

metal jacketed (FMJ) pistol bullets to a training role, and will be

adopting modern hollowpoint designs similar to those used by most

domestic law enforcement agencies and citizens who carry handguns for

self-defense.The stunning announcement was made at the U.S Army’s Picatinny Arsenal in New Jersey yesterday during the military’s two-day “industry day” for the Modular Handgun System (MHS), which will conclude today.

A military lawyer who made a presentation during the Industry Day noted that the United States is not a signatory to the Hague Conventions which outlawed the use of “dum-dum” and expanding bullets more than a century ago. It is the military’s position that the shift to jacketed hollowpoint (JHP) ammunition, which more efficiently transfers energy to the target and which presents much less of a risk of over-penetration, is more humane and less of a risk to innocent civilians downrange in modern combat where there are often no clear front lines.

Read More @ BearingArms.com

A Union Divided: "More Europe" Means "More Germany"

Submitted by Tyler Durden on 07/09/2015 - 18:00 The tense division in Europe's union are becoming increasingly evident. Between Greece's "no" vote, yesterday's EU Parliament outbursts, and today's German parliament commentary it is clear that, as Bloomberg reports, the centerpiece of Merkel’s cure for Europe - fiscal retrenchment - has catalyzed her in the eyes of many as despite her calm but firm entreaties, an economic bully. “The lesson of this crisis is more Europe, not less Europe,” Angela Merkel said in 2012 as the integrity of the region’s monetary union was threatened by financial instability, but many, like Greece, have come to understand "more Europe" means something different: "more Germany."

3 Things: Correction, Interest Rates & Oil Prices

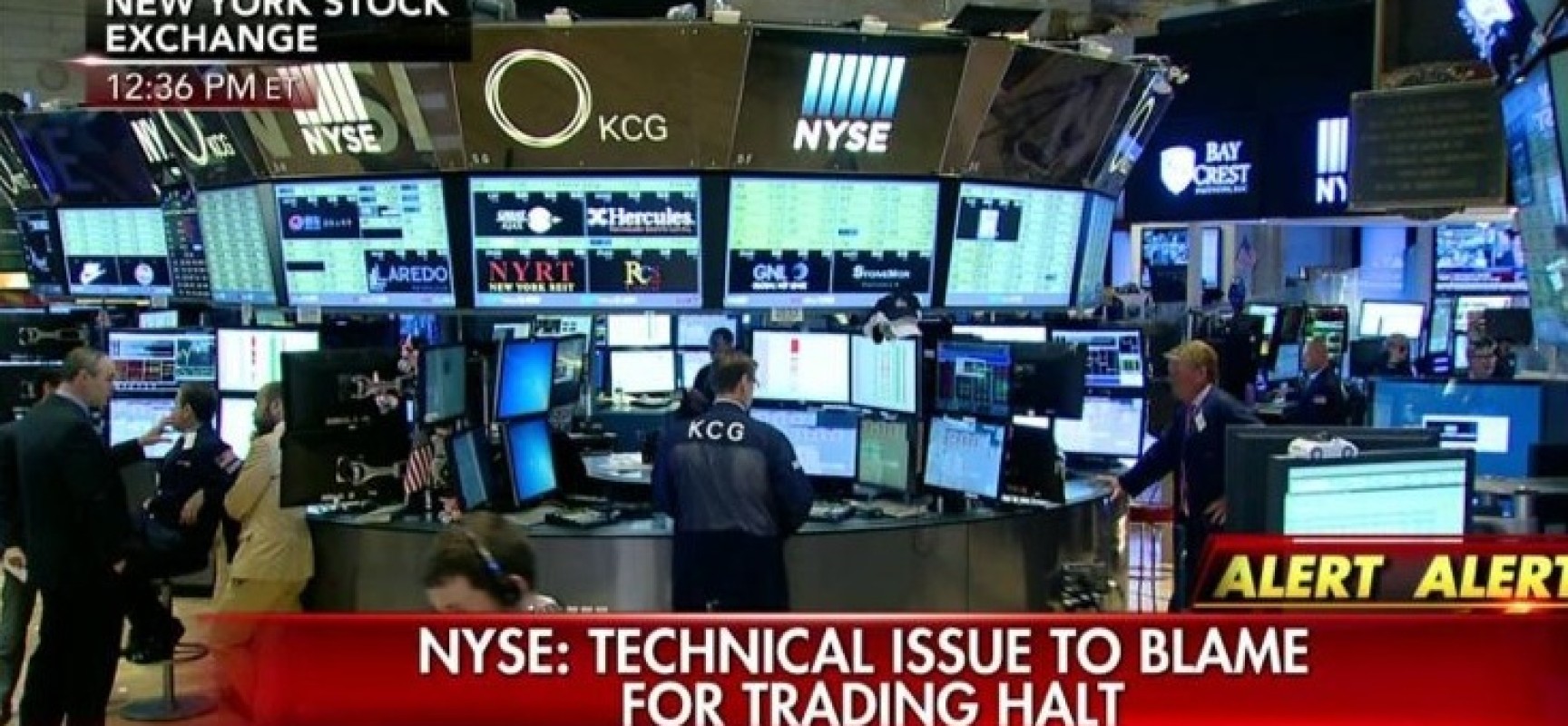

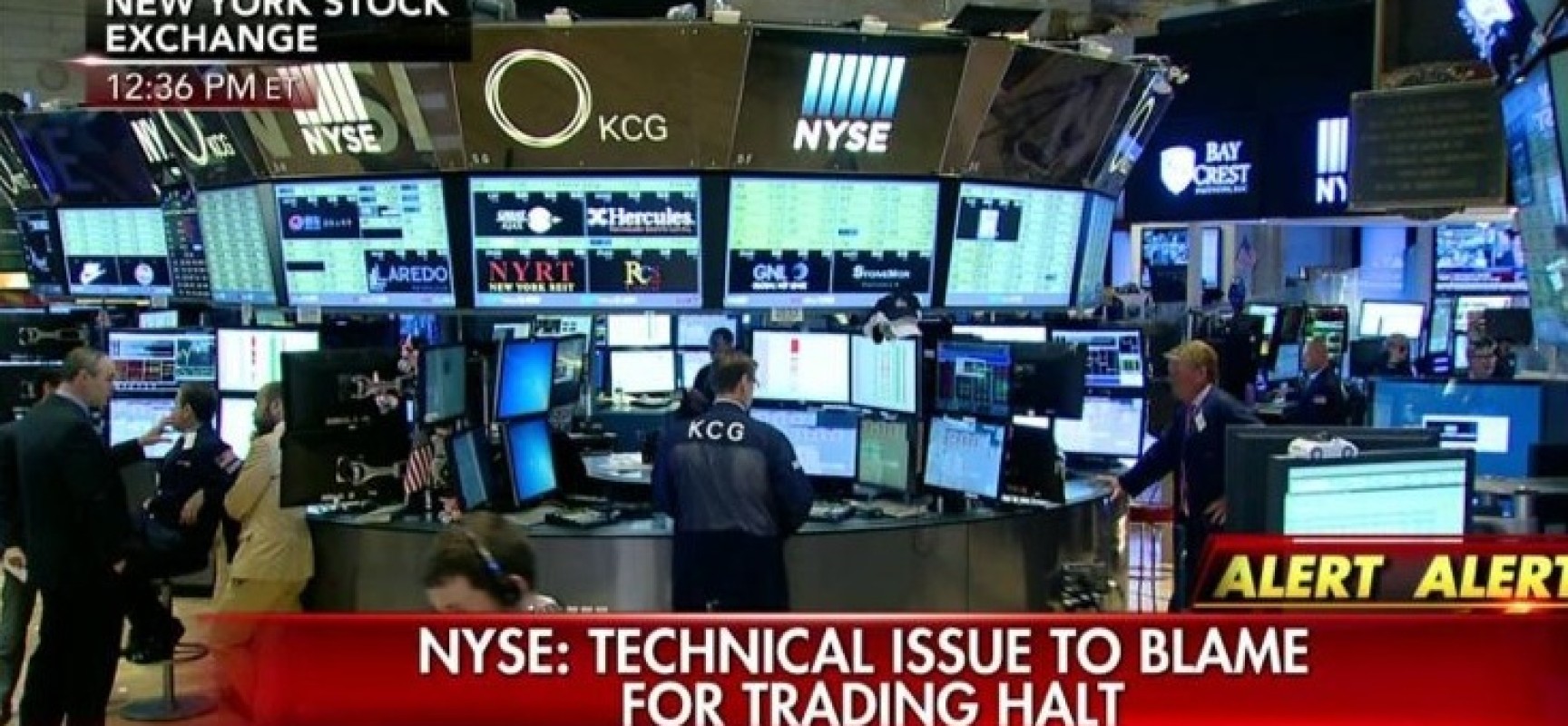

Submitted by Tyler Durden on 07/09/2015 - 17:30 While yesterday's suspension of trading on the New York Stock Exchange drew attention to the plunge in equity prices, the reality is that stocks have been in a correction since the all-time highs posted back in May. Of course, until yesterday's headlines, you may not have realized that the correction was in process as it has been "as slow as a turtle running in peanut butter."

Jade Helm Alert: Military Denies Media Requests To Cover "Texas Takeover"

Submitted by Tyler Durden on 07/09/2015 - 17:00 With just six days to go until the government begins Jade Helm 15, expect the rumor mill to come alive because as The Washington Post reports, the media will not be given access to the drills.

Nobel Prize-Winning Economist Demands US Taxpayers "Show Humanity & Save Greece"

Submitted by Tyler Durden on 07/09/2015 - 16:30 When the going gets tough, the taxed get going and that is what Nobel Prize winning economist Joseph Stiglitz thinks should happen. In a Time op-ed, Stiglitz warns (likely correctly) that if Greece continues with austerity, it would be depression without end; and so his solution is simple... "The U.S. was generous with Germany as we defeated it. Now, it is time for the U.S. to be generous with our friends in Greece in their time of need, as they have been crushed for the second time in a century by Germany, this time with the support of the troika." Strawman much?Bonds Thumped, Stocks Pump-n-Dump'd As Grexit Fear Tops China Cheer

Submitted by Tyler Durden on 07/09/2015 - 16:05

What Happens Next In Greece (In 2 Simple Charts)

Submitted by Tyler Durden on 07/09/2015 - 15:50

Submitted by Tyler Durden on 07/09/2015 - 15:50

Trouble A'brewing; This Time It Is Different

Submitted by Tyler Durden on 07/09/2015 - 15:01 This time it is different, but not in the way that the cheerleaders intended.

Greek "Compromise" Proposal Leaked, And There May Be A Problem

Submitted by Tyler Durden on 07/09/2015 - 14:45 Moments ago MarketNews reported that during today's "marathon governmental meeting" in which Greek PM Alexis Tsipras sat down with his party to hammer out and complete the "compromise" Greek proposal to be sent to the Troika before midnight, the prime minister told his ministers that he was "ready for compromises," suggesting he was willing to clash with the ultra-left part his party, Syriza. So far so good, and perhaps indeed suggestive of a big step down. The problem emerges upon a closer read of the proposal, which is clearly not nearly "capitulatory" enough.

Nasdaq Gives Up All "China & Greece Are Fixed" Gains, Dow 500-Point Pump-&-Dump

Submitted by Tyler Durden on 07/09/2015 - 14:34 Who could have seen that coming? A US equity rally on the basis of an entirely manipulated Chinese stock market rally overnight and hope for a last minute Greek deal (dashed by calls for a massive EUR80billion bailout which zee Germans will never give in to). The Dow just experienced a 500-point-pump-and-dump as this morning's exuberant TV anchors are suddenly silenced by the reality that China and Greece matter after all...

Are The EU And Asia Turning A Blind Eye To Russian Sanctions?

Submitted by Tyler Durden on 07/09/2015 - 14:13 We previously questioned whether western sanctions imposed on Russia were being regularly breached by E.U. and Asian companies, noting that sanctions only work if all countries unite behind them. Now, only one year after being imposed, the sanctions are eroding as it seems that government and business policies are pulling in opposite directions. A U.S. State Dept. representative may have let the truth slip out recently when he noted, "if you tell us you’re going [to break a sanction], we’ll probably order you not to, but if you go and don’t tell us, we’ll probably do nothing."

Why China Has No Choice But To Arrest The Sellers

Submitted by Tyler Durden on 07/09/2015 - 13:41 After dozens of separate interventions, manipulations, and central-planning machinations over the past three weeks, China resorted to threats overnight when it called for the arrest of "hostile short sellers." The reason they went full Orwell, this is the great loss of 'wealth' in China's history... losing equivalent to 15 Greeces in just 17 days.

"Hostile Sellers" Send S&P 500 Back Below 200DMA

Submitted by Tyler Durden on 07/09/2015 - 13:25 The Dow is now down 170 points from its intraday highs and the S&P 500 is at the cash session lows, breaking back below the 200-day moving-average. It appears we have some "malicious short sellers" in the US equity market that need to be reprimanded...Greek Drachma Makes Mysterious Appearance In Hotel Bill

Submitted by Tyler Durden on 07/09/2015 - 13:21 Between June 28 and July 4 at a Hilton hotel in Athens, transactions on a Bloomberg reporter's Visa credit card issued by Citigroup Inc. were posted as being carried out in "Drachma EQ." Financial

regulators around the world have recognized an immediate and pressing

need to address possible regulatory protections in the OTC derivatives

market. – Brooksley Born, 1998 as Chairman of the CFTC – LINK

Financial

regulators around the world have recognized an immediate and pressing

need to address possible regulatory protections in the OTC derivatives

market. – Brooksley Born, 1998 as Chairman of the CFTC – LINK(Please note: this scheme too will blow up in their face just like Long Term Capital, Enron, Bear Stearns, Lehman, AIG/Goldman. The taxpayers will be bailing out the banks – and now we know why Citigroup wrote the legislation that enabled banks to move their OTC derivatives positions to their FDIC insured units – but gold and silver will go parabolic)

Back in the late 1990’s, the then head of the CFTC – Commodities and Futures Trading Commission, the Government entity which is supposed to oversee futures and derivatives markets (enforce the laws in place to prevent criminal activity in these markets) – Brooksley Born embarked on an effort to impose oversight and regulation on the burgeoning OTC derivatives markets. We all saw back then the dangers they impose on the system when Long Term Capital imploded and almost took down the global financial system.

Read More @ Investmentresearchdynamics.com

from MyBudget360.com:

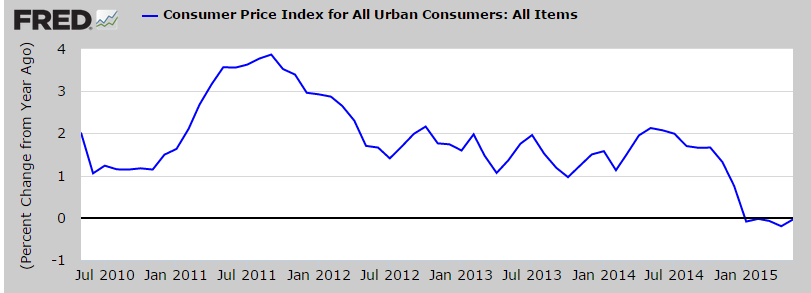

Inflation. Few people think about inflation but simply accept the reality that prices will go up. However prices going up has a deeper economic reason than simply momentum. Inflation is notorious at destroying your standard of living. Our current financial system is now setup in a way to punish savers. Most banks are offering near 0 percent on standard savings accounts. However, they are able to borrow from the Federal Reserve near 0 percent and lend out mortgages at 4 percent or credit cards at 15 percent. Money out of nothing. If everything goes down in flames, the Fed will bailout the too big to fail. It is really the perfect system if you were a bank. However most people are not banks. And policy is dictated on the inflation rate as measured by the CPI. The CPI on a year-over-year basis is coming in at a neutral level. But look at housing values, college tuition, and healthcare. None of these are even remotely close to coming in at neutral for the year. Prices are going up and wages are not. So why is there a motivation to hide the truth regarding inflation?

Read More @ MyBudget360.com

Has the Greek massive “No” vote to austerity triggered a wave of

popular demand for referendums on austerity and exiting the eurozone?

Has the Greek massive “No” vote to austerity triggered a wave of

popular demand for referendums on austerity and exiting the eurozone?It was reported this week that “[o]ver 260,000 Austrians have signed a petition calling for the EU exit for the country, and now the Austrian parliament must discuss a referendum on the issue.” Inspired by the Greeks, the British population is now asking for a referendum on austerity.

But is the financial world order threatened at all?

Michel Chossudovsky and James Corbett discuss “financial cleansing”, or how “bankers and their political cronies will be able to use the bail-in, this weapon of financial destruction, not against the megabanks but against smaller banks, credit unions and independent banks that threaten their monopoly of power.”

Read More @ Globalresearch.ca

from Off Grid Survival:

Three major cyber failures today is causing concern among cyber

security experts. Within the span of a couple of hours, United Airlines,

the Wall Street Journal and the New York Stock Exchange all experienced

cyber outages that ground business to a screeching halt.

Three major cyber failures today is causing concern among cyber

security experts. Within the span of a couple of hours, United Airlines,

the Wall Street Journal and the New York Stock Exchange all experienced

cyber outages that ground business to a screeching halt.

United Airlines Goes Down

This morning, right around 8 a.m. EDT, United Airlines was forced to ground their fleet of airplanes due to what the airline is calling a “network connectivity issue.” The outage lasted for over two hours, and affected somewhere around 3,500 flights.

Read More @ OffGridSurvival.com

Three major cyber failures today is causing concern among cyber

security experts. Within the span of a couple of hours, United Airlines,

the Wall Street Journal and the New York Stock Exchange all experienced

cyber outages that ground business to a screeching halt.

Three major cyber failures today is causing concern among cyber

security experts. Within the span of a couple of hours, United Airlines,

the Wall Street Journal and the New York Stock Exchange all experienced

cyber outages that ground business to a screeching halt.United Airlines Goes Down

This morning, right around 8 a.m. EDT, United Airlines was forced to ground their fleet of airplanes due to what the airline is calling a “network connectivity issue.” The outage lasted for over two hours, and affected somewhere around 3,500 flights.

Read More @ OffGridSurvival.com

by Mac Slavo, SHTFPlan:

Let’s face it: police are a controversial subject these days.

Let’s face it: police are a controversial subject these days.

The inventor of an app called Peacekeeper aims to introduce a “disruptive and cutting edge” alternative platform to personal and neighborhood protection that involves notifying trusted “tribe” members during an emergency with the tap of a button.

Countless stories of systematic corruption and shocking killings in the hands of police have left many wondering if it is even worth dialing 9-1-1, or whether police presence could make a difficult situation worse. With domestic disturbances or episodes with mentally impaired individuals, calling law enforcement could lead to arrests or even deaths, when temporary restraint and a moment for calm is perhaps what is needed. Every situation is different

Read More @ SHTFPlan.com

Let’s face it: police are a controversial subject these days.

Let’s face it: police are a controversial subject these days.The inventor of an app called Peacekeeper aims to introduce a “disruptive and cutting edge” alternative platform to personal and neighborhood protection that involves notifying trusted “tribe” members during an emergency with the tap of a button.

Countless stories of systematic corruption and shocking killings in the hands of police have left many wondering if it is even worth dialing 9-1-1, or whether police presence could make a difficult situation worse. With domestic disturbances or episodes with mentally impaired individuals, calling law enforcement could lead to arrests or even deaths, when temporary restraint and a moment for calm is perhaps what is needed. Every situation is different

Read More @ SHTFPlan.com

from TruthNeverTold:

from KingWorldNews:

Gerald Celente:

“It’s very suspicious to me that the New York Stock Exchange was

closed for nearly 4 hours yesterday, especially considering what was

unfolding overseas in China….

Gerald Celente:

“It’s very suspicious to me that the New York Stock Exchange was

closed for nearly 4 hours yesterday, especially considering what was

unfolding overseas in China….

“For the past two weeks China has done everything it could to prop up its failing equity markets. China’s stock markets have crashed. So China just stepped in to rig its markets in a desperate attempt to halt the crash, which has resulted in today’s bounce.

In fact, today the China Security Regulatory Commission said that any shareholders, including foreign investors and investment companies, who hold more than 5 percent stakes in any Shanghai or Shenzhen listed companies cannot sell their stocks for the next 6 months! (Laughter). This is unprecedented. So China is literally rigging its stock markets.

Gerald Celente Continues @ KingWorldNews.com

Gerald Celente:

“It’s very suspicious to me that the New York Stock Exchange was

closed for nearly 4 hours yesterday, especially considering what was

unfolding overseas in China….

Gerald Celente:

“It’s very suspicious to me that the New York Stock Exchange was

closed for nearly 4 hours yesterday, especially considering what was

unfolding overseas in China….“For the past two weeks China has done everything it could to prop up its failing equity markets. China’s stock markets have crashed. So China just stepped in to rig its markets in a desperate attempt to halt the crash, which has resulted in today’s bounce.

In fact, today the China Security Regulatory Commission said that any shareholders, including foreign investors and investment companies, who hold more than 5 percent stakes in any Shanghai or Shenzhen listed companies cannot sell their stocks for the next 6 months! (Laughter). This is unprecedented. So China is literally rigging its stock markets.

Gerald Celente Continues @ KingWorldNews.com

/

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment