Submitted by Tyler Durden on 07/10/2015 - 20:38

Submitted by Tyler Durden on 07/10/2015 - 20:38

GREEK LAWMAKERS APPROVE GOVERNMENT'S BAILOUT PROPOSAL: TALLY

I don’t usually cover pure politics here on Natural News, but watching

the surge of Bernie Sanders (on the left) and Donald Trump (on the

right) is so refreshing that I had to share it with you. It turns out

these two have a lot more in common than you might expect.

I don’t usually cover pure politics here on Natural News, but watching

the surge of Bernie Sanders (on the left) and Donald Trump (on the

right) is so refreshing that I had to share it with you. It turns out

these two have a lot more in common than you might expect.They’re both independent-minded individuals who aren’t afraid to buck the system… or even to threaten it! Sanders openly talks about obliterating Wall Street capitalist cronies while Donald Trump openly threatens to build a giant wall on the border to block illegal immigration. These aren’t cowardly, mainstream ideas; they’re bold, controversial positions that simply aren’t designed to appease the middle ground.

Both of these ideas are, of course, viciously attacked by the corporate-controlled lamestream media. Yet despite the attacks, both Sanders and Trump are surging in popularity. In fact, both are now leading the pack for their respective parties, according to some polls. See Donald Trump Leads The Pack as GOP Frontrunner at Breitbart.com.

Read More @ NaturalNews.com

A recent Rasmussen poll indicates a growing number of Americans agree

with James Madison and support state refusal to cooperate with the

federal government.

A recent Rasmussen poll indicates a growing number of Americans agree

with James Madison and support state refusal to cooperate with the

federal government. The first key finding was that a majority of likely voters in the U.S. believe states should have the right to opt out of federal programs.

The poll indicates that 54 percent believe states should ignore federal programs they don’t agree with. The number jumps if the program includes unfunded mandates. A full 61 percent of likely voters think states should have the right to opt out of federally mandated programs if the feds don’t help pay for them.

Read More @ ActivistPost.com

The Chart That Keeps Angela Merkel Up At Night

Submitted by Tyler Durden on 07/10/2015 - 21:40 There is one thing that keeps Angela Merkel awake at night. It's not the cries of despair from Greek pensioners; it's not the stomach rumbles of starving Portuguese; it's not the penniless Cypriots... it's the rise of the euroskeptic and the possibility that her empire will be forced to wage not financial war but another type of conflict...Jim Sinclair’s Commentary

Next in line?

Spain Government Goes Full Police State; Enacts Law Forbidding Dissent, ‘Unauthorized’ Photography Of Law Enforcement

from the shut-up-citizen-or-we’ll-put-your-money-where-your-mouth-is dept

Well, Spain’s officially a police state now. On July 1st, its much-protested "gag" law went into effect, instantly making criminals of those protesting the new law. Among the many new repressive stipulations is a €30,000-€600,000 fine for "unauthorized protests," which can be combined for maximum effect with a €600-€300,000 fine for "disrupting public events."

This horrible set of statutes has arisen from Spain’s position as a flashpoint for anti-austerity protests, the European precursor to the Occupy Wall Street movement. Fines, fines and more fines await anyone who refuses to treat authority with the respect it’s forcibly requiring citizens to show it.

The law also extends its anti-protest punishments to social media, where users can face similar fines for doing nothing more than encouraging or organizing a protest. Failing to present ID when commanded is another fine. And then there’s this:

Showing a "lack of respect" to those in uniform or failing to assist security forces in the prevention of public disturbances could result in an individual fine of between €600 and €30,000.

Spain’s legislators thought of everything. To ensure these crackdowns on protests go off with a minimum of public backlash, "respected" police officers are being given a blank check to use as much force as they feel necessary when breaking up "unauthorized protests." The law doesn’t directly instruct police to behave badly, but it does provide a very helpful increase in opacity.

A clause in the wide-ranging legislation that critics have dubbed the "gag law" provides for fines of up to 30,000 euros ($33,000) for "unauthorized use" of images of working police that could identify them, endanger their security or hinder them from doing their jobs.

More…

Greek Prime Minister Alexis Tsipras has proposed eleventh hour

concessions to European central banks despite the overwhelming rejection

of an austerity deal by the Greek people. He told Syriza lawmakers they

must back reforms and keep the country in the euro. “We are confronted

with crucial decisions,” he said during a party meeting, according to officials.

Greek Prime Minister Alexis Tsipras has proposed eleventh hour

concessions to European central banks despite the overwhelming rejection

of an austerity deal by the Greek people. He told Syriza lawmakers they

must back reforms and keep the country in the euro. “We are confronted

with crucial decisions,” he said during a party meeting, according to officials.

“We got a mandate to bring a better deal than the ultimatum that the Eurogroup gave us, but certainly not given a mandate to take Greece out of the eurozone,” he added.

The “cap-in-hand capitulation” proposal offered by Tsipras is strikingly similar to the harsh austerity measures rejected on July 5 by 61 percent of voters.

Read More @ Infowars.com

from GordonTLong:

The Financial Attack On Greece: Where Do We Go From Here?

Submitted by Tyler Durden on 07/10/2015 - 21:05 Every nation has a right to defend itself against attack – financial attack just as overt military attack. That is an essential element in the principle of self-determination. Greece, Spain, Portugal, Italy and other debtor countries have been under the same mode of attack that was waged by the IMF and its austerity doctrine that bankrupted Latin America from the 1970s onward. International law needs to be updated to recognize that finance has become the modern-day mode of warfare. Its objectives are the same: acquisition of land, raw materials and monopolies. A byproduct of this warfare has been to make today’s financial network so dysfunctional that nations need a financial Clean Slate. According to the CNN Fear & Greed Index, investors have become

panicky. Fewer than 1% of all days since 1998 have shown the level of

pessimism suggested by the index, and stock returns in the months ahead

have been significantly positive (see charts below).

According to the CNN Fear & Greed Index, investors have become

panicky. Fewer than 1% of all days since 1998 have shown the level of

pessimism suggested by the index, and stock returns in the months ahead

have been significantly positive (see charts below).Measured by a handful of metrics, the Shanghai index of Chinese stocks has entered panic territory. Over the past 15 years, that panic has not equated with an exact low in the index, as it tended to test the panic in the weeks ahead.

Jason Goepfert Continues @ KingWorldNews.com

Peter Schiff On The Big Picture: The Party's Ending

Submitted by Tyler Durden on 07/10/2015 - 20:00 While the party in the 1990s ended badly, the festivities currently underway may end in outright disaster. The party-goers may not just awaken with hangovers, but with missing teeth, no memories, and Mike Tyson's tiger in their hotel room.How The World Works - The Santelligram

Submitted by Tyler Durden on 07/10/2015 - 19:40 Rick Santelli recently unleashed his own brand of truthiness on an unsuspecting CNBC audience, that, just like in China, "the central planners are in control" in Japan, Europe, and most of all America. As part of the 3 minutes of lack-of-free-market despair, Santelli drew what we called "the chart of the year." By popular request, it is reproduced below... A Greek exit – “Grexit” – from the 19-nation currency bloc seems more possible than ever. – USA Today, July 9, 2015

A Greek exit – “Grexit” – from the 19-nation currency bloc seems more possible than ever. – USA Today, July 9, 2015The drama gripping Europe seems to have grown tiresome for the continent’s leaders. They look intent on ending it one way or the other at summit meetings this weekend. Greece may leave the currency union, voluntarily or not.

We hope they do. A “Grexit” would be the best outcome for at least five reasons.

First, it would be a blow to the soft dictatorship of Europe’s technocrats. The Brussels bureaucracies live in a bubble of their own design in which national borders and public opinion are meaningless distractions. Losing Greece will prove their power has limits, particularly if Greece can bounce back quickly on its own.

Read More @ TheDailyBell.com

Silver’s fate will be determined over the next few weeks by the events unfolding around China’s stock market.

Silver’s fate will be determined over the next few weeks by the events unfolding around China’s stock market.If their equity markets stabilize, and if it looks as if the worst is over, silver will stabilize as well. If not, then neither will silver.

The reason is simple – the further the stock market of China falls, the more concerns will grow about slowing global growth overall, but especially growth in China, which is the world’s largest consumers of most raw materials and many commodities. Poor demand never bodes well for commodities, and silver is no exception.

Read More @ TraderDanNorcini.Blogspot.com

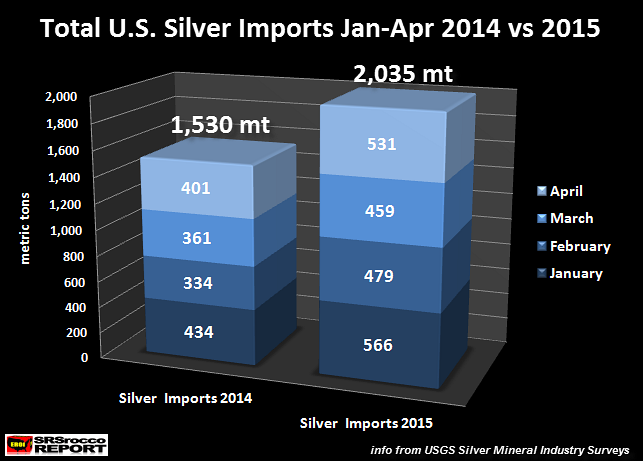

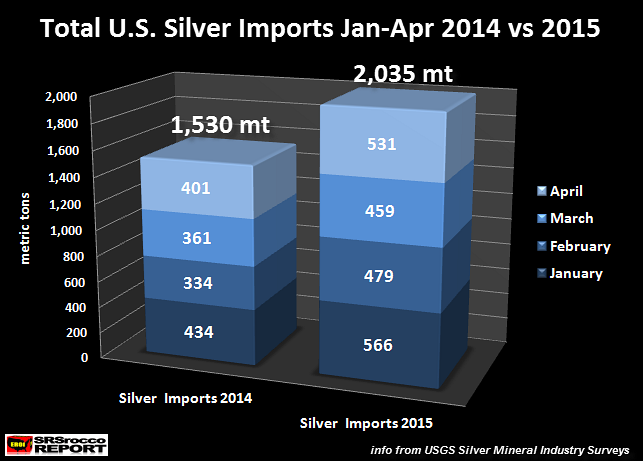

by Steve St. Angelo, SRS Rocco Report:

As the situation in the global financial system deteriorates, large

U.S. buyers continue to stockpile silver. How do I know this? Well,

according to the most recently released USGS data, U.S. silver imports

surged even higher in April. How much? Let’s look at the chart below:

As the situation in the global financial system deteriorates, large

U.S. buyers continue to stockpile silver. How do I know this? Well,

according to the most recently released USGS data, U.S. silver imports

surged even higher in April. How much? Let’s look at the chart below:

As we can see, U.S. silver imports surged to 531 metric tons (mt) in April, up from 459 mt in March. Total U.S. silver imports in the first four months of the year are up a stunning 505 metric tons (2,035 mt) compared to the same period last year (1,530 mt).

As I mentioned in my previous article, Why Is The U.S. Importing So Much Silver?:

Read More @ SRSroccoreport.com

As the situation in the global financial system deteriorates, large

U.S. buyers continue to stockpile silver. How do I know this? Well,

according to the most recently released USGS data, U.S. silver imports

surged even higher in April. How much? Let’s look at the chart below:

As the situation in the global financial system deteriorates, large

U.S. buyers continue to stockpile silver. How do I know this? Well,

according to the most recently released USGS data, U.S. silver imports

surged even higher in April. How much? Let’s look at the chart below:As we can see, U.S. silver imports surged to 531 metric tons (mt) in April, up from 459 mt in March. Total U.S. silver imports in the first four months of the year are up a stunning 505 metric tons (2,035 mt) compared to the same period last year (1,530 mt).

As I mentioned in my previous article, Why Is The U.S. Importing So Much Silver?:

Read More @ SRSroccoreport.com

from ReasonTV:

by Christina Sarich, Natural Society:

Bill Maher, one of the most outspoken funny men around, is making his

comedic rounds, and one stop is in Hawaii. In the islands, he is

conducting the Aloha Live Stand Up Tour, and he has some hilarious, if not pertinent advice for the people of Maui regarding their fight against Monsanto and GMOs.

Bill Maher, one of the most outspoken funny men around, is making his

comedic rounds, and one stop is in Hawaii. In the islands, he is

conducting the Aloha Live Stand Up Tour, and he has some hilarious, if not pertinent advice for the people of Maui regarding their fight against Monsanto and GMOs.

During his tour, Maher spoke to Maui Now about the island’s fight against Big Biotech:

“MN: . . .you may have heard that Maui had its own “power of the people” moment with respect to passing a bill calling for the suspension on the growth, testing and cultivation of GMO crops here in Maui County?

Read More @ NaturalSociety.com

Bill Maher, one of the most outspoken funny men around, is making his

comedic rounds, and one stop is in Hawaii. In the islands, he is

conducting the Aloha Live Stand Up Tour, and he has some hilarious, if not pertinent advice for the people of Maui regarding their fight against Monsanto and GMOs.

Bill Maher, one of the most outspoken funny men around, is making his

comedic rounds, and one stop is in Hawaii. In the islands, he is

conducting the Aloha Live Stand Up Tour, and he has some hilarious, if not pertinent advice for the people of Maui regarding their fight against Monsanto and GMOs.During his tour, Maher spoke to Maui Now about the island’s fight against Big Biotech:

“MN: . . .you may have heard that Maui had its own “power of the people” moment with respect to passing a bill calling for the suspension on the growth, testing and cultivation of GMO crops here in Maui County?

Read More @ NaturalSociety.com

by Jeff Nielson, Bullion Bulls:

Most readers are familiar with the colloquial definition of insanity:

repeating a (failed) policy/plan, but expecting a different outcome.

Then we have the International Monetary Fund: it makes a mistake,

explains that mistake to the entire world (twice), but still keeps

repeating that same mistake, year after year – (supposedly) expecting a

different outcome.

Most readers are familiar with the colloquial definition of insanity:

repeating a (failed) policy/plan, but expecting a different outcome.

Then we have the International Monetary Fund: it makes a mistake,

explains that mistake to the entire world (twice), but still keeps

repeating that same mistake, year after year – (supposedly) expecting a

different outcome.

The hopeless/incurable/corrupt insanity of the IMF can be illustrated with absolute clarity by simply looking at two nations: Iceland and Greece. Following the Crash of ’08; the International Monetary Fund (and its other partners-in-crime) issued “advice” to all of the governments of the corrupt West, advice which, in the case of Greece, has now turned into demands.

1) “Bail-out” all of the Big Banks (i.e. cave-in to their pay-me-or-else extortion).

2) Designate these Big Banks as being “too big to fail”, so that they can play their pay-me-or-else extortion game forever.

3) While rewarding the Big Banks for their extortion (and reckless gambling), punish your people with crippling/suicidal Austerity.

One nation – Iceland – didn’t listen to the IMF. Instead of submitting to the extortion of its Big Banks; it ignored their demands. Instead of dubbing them “too big to fail”, and permanently protecting the Big Banks; it put them to death. Instead of taking care of the Big Banks (who caused the economic crash/crisis) and punishing their people; it took care of its people – and punished the Criminals.

Read More @ Bullionbullscanada.com

Most readers are familiar with the colloquial definition of insanity:

repeating a (failed) policy/plan, but expecting a different outcome.

Then we have the International Monetary Fund: it makes a mistake,

explains that mistake to the entire world (twice), but still keeps

repeating that same mistake, year after year – (supposedly) expecting a

different outcome.

Most readers are familiar with the colloquial definition of insanity:

repeating a (failed) policy/plan, but expecting a different outcome.

Then we have the International Monetary Fund: it makes a mistake,

explains that mistake to the entire world (twice), but still keeps

repeating that same mistake, year after year – (supposedly) expecting a

different outcome.The hopeless/incurable/corrupt insanity of the IMF can be illustrated with absolute clarity by simply looking at two nations: Iceland and Greece. Following the Crash of ’08; the International Monetary Fund (and its other partners-in-crime) issued “advice” to all of the governments of the corrupt West, advice which, in the case of Greece, has now turned into demands.

1) “Bail-out” all of the Big Banks (i.e. cave-in to their pay-me-or-else extortion).

2) Designate these Big Banks as being “too big to fail”, so that they can play their pay-me-or-else extortion game forever.

3) While rewarding the Big Banks for their extortion (and reckless gambling), punish your people with crippling/suicidal Austerity.

One nation – Iceland – didn’t listen to the IMF. Instead of submitting to the extortion of its Big Banks; it ignored their demands. Instead of dubbing them “too big to fail”, and permanently protecting the Big Banks; it put them to death. Instead of taking care of the Big Banks (who caused the economic crash/crisis) and punishing their people; it took care of its people – and punished the Criminals.

Read More @ Bullionbullscanada.com

from Sovereign Man:

Spontaneous combustion.

Spontaneous combustion.

Alien invasion.

Zombie apocalypse.

What do these have in common? Their likelihood is next to impossible. So why worry?

This is how people tend to think about the financial system.

Mentioning even the possibility, for example, that the US could default on its debt is met with so much scorn and contempt it would be safer to stand on the street corner warning about an alien invasion.

The same goes for the imposition of capital controls. Or a collapse in the banking system. Or a currency crisis.

Read More @ SovereignMan.com

Spontaneous combustion.

Spontaneous combustion.Alien invasion.

Zombie apocalypse.

What do these have in common? Their likelihood is next to impossible. So why worry?

This is how people tend to think about the financial system.

Mentioning even the possibility, for example, that the US could default on its debt is met with so much scorn and contempt it would be safer to stand on the street corner warning about an alien invasion.

The same goes for the imposition of capital controls. Or a collapse in the banking system. Or a currency crisis.

Read More @ SovereignMan.com

Clinton insider Larry Nichols reveals and confirms that Bill Clinton is NOT Chelsea’s Biological father.

Just wait until the shit hits the fan...

Violent Crime Is Surging In Major U.S. Cities And The Economy Is Not Even Crashing Yet

Submitted by Tyler Durden on 07/10/2015 - 19:20 Don’t let anyone tell you that crime is going down in America. All over the United States, rates of violent crime in our major cities are increasing by double digit percentages. Murders are way up, shootings are way up and rapes are way up. So what is behind this sudden spike in crime? In Baltimore, authorities are pointing to the racial tensions that were stirred up by the riots that erupted in protest to the death of Freddie Gray. But what about the rest of the country? From coast to coast, we are witnessing a dramatic increase in violent crime, and the economy is not even crashing yet. So what is going to happen when the next great economic crisis hits us, unemployment skyrockets, and people really start hurting?

Mapping The World's "Grey Swans"

Submitted by Tyler Durden on 07/10/2015 - 18:45 As H2 2015 begins, Goldman looks at so-called "grey swans" - known market risks that could prove particularly disruptive. From China credit risks to Russia and from rate volatility to Russia with Middle East tensions, cyber threats, and illiquidity-induced 'flash-crashes', the known-but-not-priced-in risks are rising... because - simply put - central bank omnipotence remains the narrative (for now).

Organized Plunder, a.k.a. The State

Submitted by Tyler Durden on 07/10/2015 - 18:10 Businesses usually begin as productive enterprises. But almost all have zombie tendencies. Once they reach a certain size, they recognize that the best investment they can make is in politics. They hire lobbyists. They pay crony politicians. In return, government enacts rules and regulations to stifle competition. But as with so many of its activities, government succeeds when it fails. As a new industry arises, the money still flows from the cronies, while the feds get a piece of action from the new enterprises, too. And households? They grouse and groan. But the masses usually love government. They think business people are greedy SOBs. But they often hold the fellows who run the government racket in the same exalted category as saints, TV stars, and sports heroes. Don’t believe it?Greek Businesses Accept Lira, Lev As Grexit Looms

Submitted by Tyler Durden on 07/10/2015 - 17:35

The

Greek Drachma has made two mysterious appearances this week, suggesting

that the EU is on the verge of forcing the Greek economy into the

adoption of a parallel currency and while this week’s Drachma

“sightings” might properly be called anecdotal, a report from

Kathimerini and comments from deposed FinMin Yanis Varoufakis suggest

redenomination rumors are not entirely unfounded. Now, with the ECB set

to cut Greek banks off from the ELA lifeline on Monday morning in the

absence of a deal, some businesses are mitigating the liquidity shortage by accepting foreign currency.

Submitted by Tyler Durden on 07/10/2015 - 17:35

The

Greek Drachma has made two mysterious appearances this week, suggesting

that the EU is on the verge of forcing the Greek economy into the

adoption of a parallel currency and while this week’s Drachma

“sightings” might properly be called anecdotal, a report from

Kathimerini and comments from deposed FinMin Yanis Varoufakis suggest

redenomination rumors are not entirely unfounded. Now, with the ECB set

to cut Greek banks off from the ELA lifeline on Monday morning in the

absence of a deal, some businesses are mitigating the liquidity shortage by accepting foreign currency.

5 Things To Ponder: "China Rising" Or Not?

Submitted by Tyler Durden on 07/10/2015 - 17:00 "Where ignorance is bliss, it's folly to be wise..."/

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment