by Susanne Posel, Occupy Corporatism:

According to Deutsche Bank analysts Daniel Brebner and Xiao Fu, gold is “not really a commodity at all.” Berbner and Fu explain: “While it is included in the commodities basket it is in fact a medium of exchange and one that is officially recognized (if not publically used as such). We see gold as an officially recognized form of money for one primary reason: it is widely held by most of the world’s larger central banks as a component of reserves.”

Gold is deemed “good money” and fiat currency is represented as “bad money” because the central banking cartels confuse the worth of paper over precious metals to keep the populace in the dark as to currency value to claim a monopoly over worth and circulation as well as hoard precious metals for consumption purposes.

Berbner and Fu further elaborate that: “Fiat currencies physically have no use other than that which is prescribed to them by government and accepted by the public. That fiat currencies cost little to produce is of a secondary concern and we believe, quite irrelevant to the primary purpose.”

Read More @ OccupyCorporatism.com

Spot The Odd One Out

There

have been a few nations in the world over the last decade or so that

have garnered somewhat mind-blowingly negative attention and have been

forced to restructure, take losses, or default (semantics) on their

debt (or financial system). Three of the best known are Argentina,

Iceland, and most recently Greece. The following chart of GDP growth may

have a lesson for every investor around the world (especially those in

sovereign bonds) - and maybe more importantly for the Greek (and

European) leadership. Is there something different about the post-restructuring growth in Greece that did not occur in the other two nations? Perhaps

taking your medicine is indeed the right way to go - and enables

growth to once again re-emerge - and the constant use of the M.A.D.

argument is pure bluff.

There

have been a few nations in the world over the last decade or so that

have garnered somewhat mind-blowingly negative attention and have been

forced to restructure, take losses, or default (semantics) on their

debt (or financial system). Three of the best known are Argentina,

Iceland, and most recently Greece. The following chart of GDP growth may

have a lesson for every investor around the world (especially those in

sovereign bonds) - and maybe more importantly for the Greek (and

European) leadership. Is there something different about the post-restructuring growth in Greece that did not occur in the other two nations? Perhaps

taking your medicine is indeed the right way to go - and enables

growth to once again re-emerge - and the constant use of the M.A.D.

argument is pure bluff.Venture C(r)apital: Myth And Reality

Venture capital (VC) has delivered poor returns for more than a decade. VC returns haven’t significantly outperformed the public market since the late 1990s, and, since 1997, less cash has been returned to investors than has been invested in VC. Speculation among industry insiders is that the VC model is broken, despite occasional high-profile successes like Groupon, Zynga, LinkedIn, and Facebook in recent years. As The Kauffman Foundations finds, from its 20-year history, investment committees and trustees should shoulder blame for the broken LP investment model, as they have created the conditions for the chronic misallocation of capital (no doubt driven by the failure of 'hope' over experience). All is not lost to the money-pumping narrative-followers though as five myths are destroyed and five recommendations made that may help LPs allocate and follow-through more effectively.

The Bernank Just Told A Massive Lie About Milton Friedman

Ben Bernanke is so desperate to find support regarding his steal from the poor and give to the 0.01% policies he is now telling blatant lies about famous, dead economists that can’t refute what he says. In this case Milton Friedman. In his Q&A today, The Bernank claimed:BERNANKE: MILTON FRIEDMAN WOULD HAVE SUPPORTED WHAT FED DOING

Well I suppose it’s easy to make things up about people that can’t claim otherwise, but he made a big mistake this time. Why? Because Anna Schwartz, who co-wrote the famous work “A Monetary History of the United States” with Milton Friedman in 1963, actually came on the record on several occasions calling out The Bernank and saying there’s no way Friedman would agree. The sad part about this is it seems Bernanke waited until Schwartz died to really start spewing the lies. This guy is not only dangerous he is despicable and increasingly desperate… Don’t take it from me though, back in October 2008 Anna Schwartz had this to say in the Wall Street Journal.

The 71%

According to a recent CNN poll, 60% of Americans want

go to war with Iran to prevent them from getting nuclear weapons. This

in spite of the fact that the US intelligence community is fairy

unanimous that Iran is not even currently pursuing nuclear weapons. Simultaneously 71% of Americans

— in total contradiction to the evidence recognised by both the CIA

and Mossad that Iran is not currently even developing a nuclear weapon — believe that Iran currently has nuclear weapons.

Unlike the 71%, I’m not really convinced by this — if anything, it

could be Iranian disinformation to try and avoid an American or Israeli

attack. More importantly, the US and Israeli intelligence community at large don’t buy it.

If they had any real evidence that Iran had a bomb today, Netanyahu

would have been presenting it at the UN instead of drawing red lines on

Wile E. Coyote bomb diagrams.

According to a recent CNN poll, 60% of Americans want

go to war with Iran to prevent them from getting nuclear weapons. This

in spite of the fact that the US intelligence community is fairy

unanimous that Iran is not even currently pursuing nuclear weapons. Simultaneously 71% of Americans

— in total contradiction to the evidence recognised by both the CIA

and Mossad that Iran is not currently even developing a nuclear weapon — believe that Iran currently has nuclear weapons.

Unlike the 71%, I’m not really convinced by this — if anything, it

could be Iranian disinformation to try and avoid an American or Israeli

attack. More importantly, the US and Israeli intelligence community at large don’t buy it.

If they had any real evidence that Iran had a bomb today, Netanyahu

would have been presenting it at the UN instead of drawing red lines on

Wile E. Coyote bomb diagrams.

by Chris Isidore, CNN Money:

The Federal Reserve’s efforts to keep interest rates exceptionally low

are in the best interest of those living off their savings, Fed Chairman

Ben Bernanke argued Monday.

The Federal Reserve’s efforts to keep interest rates exceptionally low

are in the best interest of those living off their savings, Fed Chairman

Ben Bernanke argued Monday.In a speech to the Economic Club of Indiana in Indianapolis, Bernanke said the Fed’s recently announced plans to buy $40 billion in mortgages every month for the foreseeable future, a plan widely known as QE3, would help spur greater economic activity and higher home prices. He said that would help many more savers than would be hurt.

“Many savers are also homeowners; indeed, a family’s home may be its most important financial asset,” he said. “Only a strong economy can create higher asset values and sustainably good returns for savers.”

Bernanke acknowledged that the problems low interest rates cause those people, such as retirees, who are living off savings.

Read More @ Money.CNN.com

from KitcoNews:

from The Daily Bell:

Euro-zone jobless rate hit record highs … The number of people out of work in the euro zone climbed further in August reaching a fresh record high, underscoring the hardship that the currency area’s fiscal crisis is inflicting on households, and suggesting any economic recovery is some way off. Eurostat, the European Union‘s official statistics agency, said Monday that 18.196 million people were without jobs in August, an increase of 34,000 from the previous month and the highest total since records for the 17 nations that use the euro were first compiled in January 1995. – MarketWatch

Dominant Social Theme: Capitalism provides us with terrible consequences.

Free-Market Analysis: It is really sad to watch what’s going on in Europe. One can almost imagine reading the history books about this period and getting a completely different picture of what is going on than the reality that should be evident to anyone who has lived through this time.

Appearances are important! Those who follow free-market economics know what needs to be done to pull Europe out of its slump. But the reporting gives no clue of the reality.

Read More @ TheDailyBell.com

Euro-zone jobless rate hit record highs … The number of people out of work in the euro zone climbed further in August reaching a fresh record high, underscoring the hardship that the currency area’s fiscal crisis is inflicting on households, and suggesting any economic recovery is some way off. Eurostat, the European Union‘s official statistics agency, said Monday that 18.196 million people were without jobs in August, an increase of 34,000 from the previous month and the highest total since records for the 17 nations that use the euro were first compiled in January 1995. – MarketWatch

Dominant Social Theme: Capitalism provides us with terrible consequences.

Free-Market Analysis: It is really sad to watch what’s going on in Europe. One can almost imagine reading the history books about this period and getting a completely different picture of what is going on than the reality that should be evident to anyone who has lived through this time.

Appearances are important! Those who follow free-market economics know what needs to be done to pull Europe out of its slump. But the reporting gives no clue of the reality.

Read More @ TheDailyBell.com

by Graham Summers, Gains Pains & Capital:

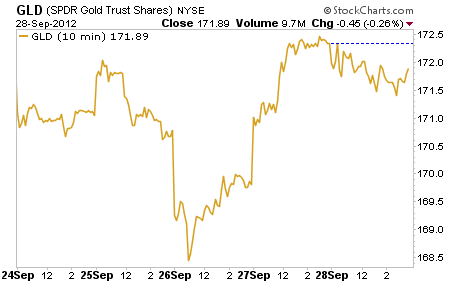

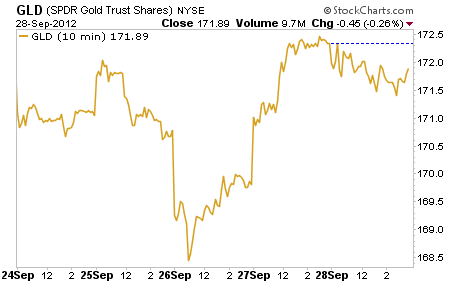

Last week was options expiration week as well as the end of the Third Quarter. So hedge funds were highly incentivized to gun stocks and precious metals higher (hedge funds are currently mostly long stocks and precious metals) to game their 3Q12 performance.

However, what’s notable is that despite this, stocks actually finished the week down. Indeed, as the below chart shows, hedgies continually pushed the market up only to find that there were few real buyers in the market, as a result, stocks tended to drift downward towards the end of each session.

Read More @ GainsPainsCapital.com

Last week was options expiration week as well as the end of the Third Quarter. So hedge funds were highly incentivized to gun stocks and precious metals higher (hedge funds are currently mostly long stocks and precious metals) to game their 3Q12 performance.

However, what’s notable is that despite this, stocks actually finished the week down. Indeed, as the below chart shows, hedgies continually pushed the market up only to find that there were few real buyers in the market, as a result, stocks tended to drift downward towards the end of each session.

Read More @ GainsPainsCapital.com

from europarl:

• European Parliament, Strasbourg, 23 May 2012

• Speaker: Godfrey Bloom MEP, UKIP (Yorkshire & Lincolnshire), Europe of Freedom and Democracy (EFD) group – Godfreybloommep.co.uk

• European Parliament, Strasbourg, 23 May 2012

• Speaker: Godfrey Bloom MEP, UKIP (Yorkshire & Lincolnshire), Europe of Freedom and Democracy (EFD) group – Godfreybloommep.co.uk

by Mac Slavo, SHTFPlan:

Everywhere we look the masses are hurting. Whether it be the 100 million Americans dependent on the government safety net to survive, or the millions of Europeans rioting in the streets of Spain and Greece, a sense of serious crisis is in the air.

Over the last four years, slowly and without abatement, the economic outlook across the globe has worsened significantly.

In France, a new 75% income tax on individuals earning over a million Euro ($1.2 million) per year was announced today. Incomes of $150,000 will be taxed at 40%. French business owners and citizens are scrambling to leave the country to avoid the new legislation. This has been done to offset the billions being used to bail out failing banks and reckless government spending.

Read More @ SHTFPlan.com

Everywhere we look the masses are hurting. Whether it be the 100 million Americans dependent on the government safety net to survive, or the millions of Europeans rioting in the streets of Spain and Greece, a sense of serious crisis is in the air.

Over the last four years, slowly and without abatement, the economic outlook across the globe has worsened significantly.

In France, a new 75% income tax on individuals earning over a million Euro ($1.2 million) per year was announced today. Incomes of $150,000 will be taxed at 40%. French business owners and citizens are scrambling to leave the country to avoid the new legislation. This has been done to offset the billions being used to bail out failing banks and reckless government spending.

Read More @ SHTFPlan.com

by Theodore Butler, Silver Seek:

No matter how convinced I may be that silver has been manipulated downward in price by JPMorgan’s concentrated and rapidly increasing short position in COMEX futures contracts; it is vital to explore why that may be wrong. Particularly with a conviction held for a long period of time, it is important to make sure I am not missing anything basic. The best way to do that is to listen closely to those who may disagree with the silver manipulation allegations. However, uncovering the arguments against a silver manipulation is not as easy as you might think.

“By ‘uncertain’ knowledge, let me explain, I do not mean merely to

distinguish what is known for certain from what is only probable. The

game of roulette is not subject, in this sense, to uncertainty; nor is

the prospect of a Victory bond being drawn. Or, again, the expectation

of life is only slightly uncertain. Even the weather is only moderately

uncertain. The sense in which I am using the term is that in which the

prospect of a European war is uncertain, or the price of copper and the

rate of interest twenty years hence, or the obsolescence of a new

invention, or the position of private wealth owners in the social system

in 1970. About these matters there is no scientific basis on which to

form any calculable probability whatever.”

“By ‘uncertain’ knowledge, let me explain, I do not mean merely to

distinguish what is known for certain from what is only probable. The

game of roulette is not subject, in this sense, to uncertainty; nor is

the prospect of a Victory bond being drawn. Or, again, the expectation

of life is only slightly uncertain. Even the weather is only moderately

uncertain. The sense in which I am using the term is that in which the

prospect of a European war is uncertain, or the price of copper and the

rate of interest twenty years hence, or the obsolescence of a new

invention, or the position of private wealth owners in the social system

in 1970. About these matters there is no scientific basis on which to

form any calculable probability whatever.”

-John Maynard Keynes, The General Theory of Employment, 1937

“… there are known knowns; there are things we know that we know. There are known unknowns; that is to say there are things that, we now know we don’t know. But there are also unknown unknowns – there are things we do not know we don’t know.”

-Donald Rumsfeld, Secretary of Defense, 2002

Read More @ GoldSeek.com

Cops are the enemy.

Cops are the enemy.

A harsh – and global – statement, certainly.

But: Is it true?

Consider the nature of the job. It is to enforce the law. By definition. It is not to protect any specific individual – you or me – from harm. It is certainly not to serve – other than as automata who . . . enforce the law. Whatever the law is, it must be enforced. The cop will tell you so himself. He is merely doing his job – and his job is . . . to enforce the law. Period. “The law is the law.” We have all heard it. It does not matter whether the law is itself outrageous, or simply stupid. He may even freely confess it.

But he will nonetheless enforce it. He is required to enforce it.

Consider that for a moment.

In a doctrinal way, the cop is exactly like the people who were – rightly – strung up at Nuremburg after WWII, who stated – truthfully – that they were just following the orders issued by the lawfully constituted authority.

Read More @ LewRockwell.com

No matter how convinced I may be that silver has been manipulated downward in price by JPMorgan’s concentrated and rapidly increasing short position in COMEX futures contracts; it is vital to explore why that may be wrong. Particularly with a conviction held for a long period of time, it is important to make sure I am not missing anything basic. The best way to do that is to listen closely to those who may disagree with the silver manipulation allegations. However, uncovering the arguments against a silver manipulation is not as easy as you might think.

For one thing, there is certainly no strong case

against manipulation being made by those that should be denying it

forcefully, namely, JPMorgan and the regulators at the CFTC and the CME

Group. Aside from a brief TV appearance in April which tried

(unsuccessfully) to dismiss the matter, JPMorgan has been

uncharacteristically mute on an allegation that is serious beyond

description. That’s why I wrote to JPM’s board of directors recently.

The CFTC has certainly denied that a silver manipulation existed on

multiple occasions in the past, including public explanations in May of

both 2004 and 2008; but since the evidence of a short side concentration

by JPMorgan was revealed in August 2008, the Commission has been investigating silver again. The

way I see it, that’s less of an argument against a silver manipulation

and more that the agency is investigating silver because JPM’s

concentration may be manipulative to the price. However, like

JPMorgan, the Commission has been silent on the specific allegations of

manipulation via JPM’s concentrated position. The CME, true to its

recent tradition, is only concerned with increasing trading revenues and

can’t be bothered to address allegations of the most serious market crime possible being in progress.

Read More @ SilverSeek.com

from Silver Vigilante:

The closing of this past third quarter represents Wall Street’s best Q3 since 2010 after global, coordinated central bank actions led to a reversal in equity markets as they announced “QE until…the economy gets better” in attempts to stave off the open-acknowledgement of a Second Great Depression. According to Reuters, the S&P 500 climbed 5.9 percent over the past three months as central banks geared up to boost liquidity to markets and kick-start their failing economies. The move had lifted the benchmark as much as 17 percent this year, recently pushing the S &P to its best level in five years – but, remember, quantity, not quality, defines new markets. ”The reality is that the fundamentals of the market certainly don’t support a 17-plus-percent run-up year to date, but with all the QE (quantitative easing) action, that has had a huge, huge impact,” said Oliver Pursche, president of Gary Goldberg Financial Services. To be sure, the huge, huge monetary dope high this time around has been even more shortlived than the first two times (QE1, QE2), basically lasting half-a-month before the headlines began demonstrating that its not…really…working. After pulling back over the last two weeks 1.7 percent, the S&P 500 has gained 14.6 percent in 2012 thus far. To be sure, the S&P 500′s 1.3 percent drop last week is its worst weekly decline since the beginning of June.

Read More @ Silver Vigilante

The closing of this past third quarter represents Wall Street’s best Q3 since 2010 after global, coordinated central bank actions led to a reversal in equity markets as they announced “QE until…the economy gets better” in attempts to stave off the open-acknowledgement of a Second Great Depression. According to Reuters, the S&P 500 climbed 5.9 percent over the past three months as central banks geared up to boost liquidity to markets and kick-start their failing economies. The move had lifted the benchmark as much as 17 percent this year, recently pushing the S &P to its best level in five years – but, remember, quantity, not quality, defines new markets. ”The reality is that the fundamentals of the market certainly don’t support a 17-plus-percent run-up year to date, but with all the QE (quantitative easing) action, that has had a huge, huge impact,” said Oliver Pursche, president of Gary Goldberg Financial Services. To be sure, the huge, huge monetary dope high this time around has been even more shortlived than the first two times (QE1, QE2), basically lasting half-a-month before the headlines began demonstrating that its not…really…working. After pulling back over the last two weeks 1.7 percent, the S&P 500 has gained 14.6 percent in 2012 thus far. To be sure, the S&P 500′s 1.3 percent drop last week is its worst weekly decline since the beginning of June.

Read More @ Silver Vigilante

from TF Metals Report:

After the CNBS interview of Fed Goon Evans seemingly caught The Cartels off-guard, the coordinated response was swift and decisive.

It began this morning with this: http://www.zerohedge.com/news/2012-10-01/presenting-einsteins-definition-insanity-taxpayer-funded-suit

The reaction in the metals was almost instantaneous. Prices shot higher and were once again within a whisper of taking out critical Cartel resistance and triggering an even-more-massive short covering extravaganza. At precisely 9:00 am EDT, The Monkeys sprang into action.

The first mission was to blunt the move toward the all-important $35.50 level in silver, above which lays a tremendous amount of buy-stops. Once that was achieved and momentum halted, the real attack began and silver plunged 60c in just 4 minutes. Gold, too, was repulsed in a Gold Cartel counter-attack. After successfully holding gold under $1790 at 9:00 am and 10:00 am, the gold attack began once the London PM fix was in. Between 10:00 and 10:04, gold fell $5 but when it appeared to bottom for the third time at $1785, desperate measures were called for. An overt attack by The Forces of Darkness drove price down $12 in just two minutes at 10:39 and 10:40 EDT.

Read More @ TF Metals Report.com

Donations will help defray the operational costs. Paypal, a leading provider of secure

online money transfers, will handle the donations. Thank you for your

contribution.

After the CNBS interview of Fed Goon Evans seemingly caught The Cartels off-guard, the coordinated response was swift and decisive.

It began this morning with this: http://www.zerohedge.com/news/2012-10-01/presenting-einsteins-definition-insanity-taxpayer-funded-suit

The reaction in the metals was almost instantaneous. Prices shot higher and were once again within a whisper of taking out critical Cartel resistance and triggering an even-more-massive short covering extravaganza. At precisely 9:00 am EDT, The Monkeys sprang into action.

The first mission was to blunt the move toward the all-important $35.50 level in silver, above which lays a tremendous amount of buy-stops. Once that was achieved and momentum halted, the real attack began and silver plunged 60c in just 4 minutes. Gold, too, was repulsed in a Gold Cartel counter-attack. After successfully holding gold under $1790 at 9:00 am and 10:00 am, the gold attack began once the London PM fix was in. Between 10:00 and 10:04, gold fell $5 but when it appeared to bottom for the third time at $1785, desperate measures were called for. An overt attack by The Forces of Darkness drove price down $12 in just two minutes at 10:39 and 10:40 EDT.

Read More @ TF Metals Report.com

If

French President François Hollande thinks he can assuage the bond

markets by dishing out tax-heavy austerity instead of genuine reform, he

has been given very bad advice.

by Ambrose Evans-Pritchard, The Telegraph:

His tragically-misguided budget

offers no strategic plan to reverse — or even to stop — thirty years of

slow national decline. He offers no worthwhile measures to slim the

Leviathan state, now a Nordic-sized 55pc of GDP, without Nordic labour

flexibility or Nordic free markets.

His tragically-misguided budget

offers no strategic plan to reverse — or even to stop — thirty years of

slow national decline. He offers no worthwhile measures to slim the

Leviathan state, now a Nordic-sized 55pc of GDP, without Nordic labour

flexibility or Nordic free markets.

He does not tell us how he will stem the slide in France’s share of eurozone exports over the last decade, down from 17pc to 13pc, or what he will do about the disastrous swing in France’s trade balance from a surplus of 2.5pc of GDP to a deficit of 2.4pc since 1999.

He proposes nothing credible to restore France’s viability within EMU, or to stop public debt spiralling beyond 90pc of GDP. Instead he has served up the most drastic retrenchment in forty years, at the worst possible time, and in the worst possible way. And markets are supposed to applaud?

The budget will tighten discretionary fiscal policy by 2pc of GDP next year into the teeth of deepening depression, without offsetting monetary stimulus or exchange rate relief.

Read More @ Telegraph.co.uk

by Ambrose Evans-Pritchard, The Telegraph:

His tragically-misguided budget

offers no strategic plan to reverse — or even to stop — thirty years of

slow national decline. He offers no worthwhile measures to slim the

Leviathan state, now a Nordic-sized 55pc of GDP, without Nordic labour

flexibility or Nordic free markets.

His tragically-misguided budget

offers no strategic plan to reverse — or even to stop — thirty years of

slow national decline. He offers no worthwhile measures to slim the

Leviathan state, now a Nordic-sized 55pc of GDP, without Nordic labour

flexibility or Nordic free markets.He does not tell us how he will stem the slide in France’s share of eurozone exports over the last decade, down from 17pc to 13pc, or what he will do about the disastrous swing in France’s trade balance from a surplus of 2.5pc of GDP to a deficit of 2.4pc since 1999.

He proposes nothing credible to restore France’s viability within EMU, or to stop public debt spiralling beyond 90pc of GDP. Instead he has served up the most drastic retrenchment in forty years, at the worst possible time, and in the worst possible way. And markets are supposed to applaud?

The budget will tighten discretionary fiscal policy by 2pc of GDP next year into the teeth of deepening depression, without offsetting monetary stimulus or exchange rate relief.

Read More @ Telegraph.co.uk

I'm PayPal Verified

By: Nadeem Walayat, The Market Oracle:

It is barely four weeks since the European arm of the global central

bank crime syndicate (ECB) announced its policy of wanting to print

unlimited euro’s to monetize bankrupting PIIGS debts that was welcomed

by the markets who’s participants would be lining up to offload PIIGS

bonds bought at far higher interest rates (lower prices) onto

predominantly German tax payers because it is Germany that backs the

Euro as a sound currency rather than the Greek or Spanish versions of

the Zimbabwean Dollar.

It is barely four weeks since the European arm of the global central

bank crime syndicate (ECB) announced its policy of wanting to print

unlimited euro’s to monetize bankrupting PIIGS debts that was welcomed

by the markets who’s participants would be lining up to offload PIIGS

bonds bought at far higher interest rates (lower prices) onto

predominantly German tax payers because it is Germany that backs the

Euro as a sound currency rather than the Greek or Spanish versions of

the Zimbabwean Dollar.

However the promise made by Super Mario Draghi for unlimited Euro-zone PIIGS bond buying programme “One More Try” (OMT) is already unraveling because the fine print of a list of strings attached does not match the promises made and because of the fundamental fact that just like all of the previous bailouts, all it would do at its very best was to buy a little more time for the Euro-zone by kicking the can into the middle of 2013, because it does near nothing to address the problem at the core of the Euro-zone which are the persistently very high and expanding deficits as a percentage of GDP right across the euro-zone that ensures bankruptcy as a consequence of inability to cover government spending let alone service debt interest repayments.

Read More @ TheMarketOracle.co.uk

It is barely four weeks since the European arm of the global central

bank crime syndicate (ECB) announced its policy of wanting to print

unlimited euro’s to monetize bankrupting PIIGS debts that was welcomed

by the markets who’s participants would be lining up to offload PIIGS

bonds bought at far higher interest rates (lower prices) onto

predominantly German tax payers because it is Germany that backs the

Euro as a sound currency rather than the Greek or Spanish versions of

the Zimbabwean Dollar.

It is barely four weeks since the European arm of the global central

bank crime syndicate (ECB) announced its policy of wanting to print

unlimited euro’s to monetize bankrupting PIIGS debts that was welcomed

by the markets who’s participants would be lining up to offload PIIGS

bonds bought at far higher interest rates (lower prices) onto

predominantly German tax payers because it is Germany that backs the

Euro as a sound currency rather than the Greek or Spanish versions of

the Zimbabwean Dollar.However the promise made by Super Mario Draghi for unlimited Euro-zone PIIGS bond buying programme “One More Try” (OMT) is already unraveling because the fine print of a list of strings attached does not match the promises made and because of the fundamental fact that just like all of the previous bailouts, all it would do at its very best was to buy a little more time for the Euro-zone by kicking the can into the middle of 2013, because it does near nothing to address the problem at the core of the Euro-zone which are the persistently very high and expanding deficits as a percentage of GDP right across the euro-zone that ensures bankruptcy as a consequence of inability to cover government spending let alone service debt interest repayments.

Read More @ TheMarketOracle.co.uk

by Joel Bowman, Daily Reckoning.com.au:

“Hey! What gives?!”

“Hey! What gives?!”

Investors want to know, “What happened to all of Mr. Bernanke’s money?” You’ll recall that, a couple of weeks ago, the central banking industry’s most famous beard announced that he would flood the markets with another round of quantitative easing, or “QE.”

The Fed, under Famous Beard’s deft stewardship, would begin purchasing $40 billion “worth” of mortgage-backed securities per month until…well…until forever.

The program is supposed to boost the stock market, increase house prices and bolster GDP. One report we saw, released by very smart and capable men over at Deutsche Bank, claimed that, for every $800 billion Famous Beard prints, there will be a corresponding 0.32% fall in the unemployment rate.

Read More @ DailyReckoning.com.au

BTFD...

“Hey! What gives?!”

“Hey! What gives?!”Investors want to know, “What happened to all of Mr. Bernanke’s money?” You’ll recall that, a couple of weeks ago, the central banking industry’s most famous beard announced that he would flood the markets with another round of quantitative easing, or “QE.”

The Fed, under Famous Beard’s deft stewardship, would begin purchasing $40 billion “worth” of mortgage-backed securities per month until…well…until forever.

The program is supposed to boost the stock market, increase house prices and bolster GDP. One report we saw, released by very smart and capable men over at Deutsche Bank, claimed that, for every $800 billion Famous Beard prints, there will be a corresponding 0.32% fall in the unemployment rate.

Read More @ DailyReckoning.com.au

BTFD...

from Bullion Street:

World’s largest silver producer Mexico’s output of the white metal

dropped in July while gold production climbed 1.4 percent during the

period.

World’s largest silver producer Mexico’s output of the white metal

dropped in July while gold production climbed 1.4 percent during the

period.

According to country’s National Statistics Institute, or Inegi silver production hit 372,598 kilograms in July as against 406,987 kilograms in June.

Gold production rose 1.4% to 6,257 kilograms, or 201,000 troy ounces in July.

Mexico’s overall mining and metals production however rose 2.7% in July from the year-earlier month as declines in iron and coal output offset higher output of precious metals and copper.

Copper output was 23% higher than a year ago at 37,664 metric tons, and zinc production rose 3% to 33,495 tons.

Read More @ BullionStreet.com

World’s largest silver producer Mexico’s output of the white metal

dropped in July while gold production climbed 1.4 percent during the

period.

World’s largest silver producer Mexico’s output of the white metal

dropped in July while gold production climbed 1.4 percent during the

period.According to country’s National Statistics Institute, or Inegi silver production hit 372,598 kilograms in July as against 406,987 kilograms in June.

Gold production rose 1.4% to 6,257 kilograms, or 201,000 troy ounces in July.

Mexico’s overall mining and metals production however rose 2.7% in July from the year-earlier month as declines in iron and coal output offset higher output of precious metals and copper.

Copper output was 23% higher than a year ago at 37,664 metric tons, and zinc production rose 3% to 33,495 tons.

Read More @ BullionStreet.com

by Bruce Krasting, Bruce Krasting Blog:

Absent some earth shaking event between now and November, Obama is going to win, the House will remain in the hands of the Republicans and the Senate will continue to be equally divided. The war between Reds and Blues will be just as bad as it was a year ago. The day after the election, the fight over the fiscal cliff will commence. I expect it will be ugly.

-I think there is zero probability that all of the issues now on the cliff will be pushed off to some future period. (Ultimate-can-kicking) Some of the cutbacks/tax increases that are now scheduled, will happen.

-I put the odds on falling off the cliff without any compromises at 40%. This scenario comes about if the Reps and Dems can’t agree on anything. If that is the case, we fall very hard on January 2. (No-can-kicking)

-Therefore, I see a 60% chance of a compromise that softens the consequences of the fiscal cliff, but does not eliminate it entirely. (Semi-can-kicking, but still kicking ourselves in the face)

Read More @ BruceKrasting.blogspot.com

Absent some earth shaking event between now and November, Obama is going to win, the House will remain in the hands of the Republicans and the Senate will continue to be equally divided. The war between Reds and Blues will be just as bad as it was a year ago. The day after the election, the fight over the fiscal cliff will commence. I expect it will be ugly.

-I think there is zero probability that all of the issues now on the cliff will be pushed off to some future period. (Ultimate-can-kicking) Some of the cutbacks/tax increases that are now scheduled, will happen.

-I put the odds on falling off the cliff without any compromises at 40%. This scenario comes about if the Reps and Dems can’t agree on anything. If that is the case, we fall very hard on January 2. (No-can-kicking)

-Therefore, I see a 60% chance of a compromise that softens the consequences of the fiscal cliff, but does not eliminate it entirely. (Semi-can-kicking, but still kicking ourselves in the face)

Read More @ BruceKrasting.blogspot.com

Dr. Paul Craig Roberts: Controversy Over Iran’s Nuclear Program is a HOAX – This is About WATER, Not Nukes

by Greg Hunter, USAWatchdog:

Dr. Paul Craig Roberts, Assistant Treasury Secretary in the Reagan Administration, says, “The Israel/Iran conflict is not about nukes, but water!” Dr. Roberts says, “Israel wants to get rid of Iran as supplier to Hezbollah . . . . So they can overrun Southern Lebanon,” because that’s where the water is. So, could Israel attack Iran before the November Presidential Election?

Dr. Roberts says, “If the election is very close, Netanyahu is likely to take the gamble.” Roberts thinks the President would be forced to support Israel militarily so as to not lose the Jewish vote in places like Florida. Dr. Roberts says, “The majority of Israelis do not want an attack on Iran.” He goes on to say, “You can’t even have an honest criticism that Israel is in danger without being called an anti-Semite.” Join Greg Hunter as he goes One-on-One with Dr. Paul Craig Roberts.

Read More @ USAWatchdog.com

Dr. Roberts says, “If the election is very close, Netanyahu is likely to take the gamble.” Roberts thinks the President would be forced to support Israel militarily so as to not lose the Jewish vote in places like Florida. Dr. Roberts says, “The majority of Israelis do not want an attack on Iran.” He goes on to say, “You can’t even have an honest criticism that Israel is in danger without being called an anti-Semite.” Join Greg Hunter as he goes One-on-One with Dr. Paul Craig Roberts.

Read More @ USAWatchdog.com

by John Mauldin, Gold Seek:

“By ‘uncertain’ knowledge, let me explain, I do not mean merely to

distinguish what is known for certain from what is only probable. The

game of roulette is not subject, in this sense, to uncertainty; nor is

the prospect of a Victory bond being drawn. Or, again, the expectation

of life is only slightly uncertain. Even the weather is only moderately

uncertain. The sense in which I am using the term is that in which the

prospect of a European war is uncertain, or the price of copper and the

rate of interest twenty years hence, or the obsolescence of a new

invention, or the position of private wealth owners in the social system

in 1970. About these matters there is no scientific basis on which to

form any calculable probability whatever.”

“By ‘uncertain’ knowledge, let me explain, I do not mean merely to

distinguish what is known for certain from what is only probable. The

game of roulette is not subject, in this sense, to uncertainty; nor is

the prospect of a Victory bond being drawn. Or, again, the expectation

of life is only slightly uncertain. Even the weather is only moderately

uncertain. The sense in which I am using the term is that in which the

prospect of a European war is uncertain, or the price of copper and the

rate of interest twenty years hence, or the obsolescence of a new

invention, or the position of private wealth owners in the social system

in 1970. About these matters there is no scientific basis on which to

form any calculable probability whatever.”-John Maynard Keynes, The General Theory of Employment, 1937

“… there are known knowns; there are things we know that we know. There are known unknowns; that is to say there are things that, we now know we don’t know. But there are also unknown unknowns – there are things we do not know we don’t know.”

-Donald Rumsfeld, Secretary of Defense, 2002

Read More @ GoldSeek.com

by Eric Peters, LewRockwell.com:

Cops are the enemy.

Cops are the enemy.A harsh – and global – statement, certainly.

But: Is it true?

Consider the nature of the job. It is to enforce the law. By definition. It is not to protect any specific individual – you or me – from harm. It is certainly not to serve – other than as automata who . . . enforce the law. Whatever the law is, it must be enforced. The cop will tell you so himself. He is merely doing his job – and his job is . . . to enforce the law. Period. “The law is the law.” We have all heard it. It does not matter whether the law is itself outrageous, or simply stupid. He may even freely confess it.

But he will nonetheless enforce it. He is required to enforce it.

Consider that for a moment.

In a doctrinal way, the cop is exactly like the people who were – rightly – strung up at Nuremburg after WWII, who stated – truthfully – that they were just following the orders issued by the lawfully constituted authority.

Read More @ LewRockwell.com

by Anthony Gucciardi, Activist Post

Following in the footsteps of nations like France and Russia, South

Africa may soon be the latest nation to enact a ban on Monsanto’s GMO

corn that was recently linked to tumor development and organ damage in rats. South Africa’s African Centre for Biosafety

(ACB), a watchdog organization that was created to protect consumers

from various biotechnology dangers, is now calling on South African

authorities to enact a ban on Monsanto’s tumor-linked maize crop known

as NK603.

Following in the footsteps of nations like France and Russia, South

Africa may soon be the latest nation to enact a ban on Monsanto’s GMO

corn that was recently linked to tumor development and organ damage in rats. South Africa’s African Centre for Biosafety

(ACB), a watchdog organization that was created to protect consumers

from various biotechnology dangers, is now calling on South African

authorities to enact a ban on Monsanto’s tumor-linked maize crop known

as NK603.

This is particularly important when it comes to South Africa as white corn is a large staple food, making up for 80% of the harvest just last year. In the event that the maize were to be banned, it would be a major hit for Monsanto and an even larger victory for the 50,586,757 people who live in South Africa. If authorities take the advice of ACB, then it would not only ban the cultivation of the GMO corn, but the import and export as well. In a letter to the South African minister of agriculture, the ACB said:

Silver briefly SMASHED through the door of $35 as gold marched toward $1,800 on Monday!

Despite JP Morgan being given the green light to destroy the silver market with unlimited paper, thanks to the irrational ruling by U.S. District Judge Robert Wilkins which overturns the CFTC’s position limits on the criminal banks (JPM)… the metals – at least for a biref time – couldn’t be contained after the Chicago FED President appeared on CNBC calling for MORE QE∞ (whatever THAT is).

Got PHYSICAL?

SILVER: The Achilles’ Heel

Following in the footsteps of nations like France and Russia, South

Africa may soon be the latest nation to enact a ban on Monsanto’s GMO

corn that was recently linked to tumor development and organ damage in rats. South Africa’s African Centre for Biosafety

(ACB), a watchdog organization that was created to protect consumers

from various biotechnology dangers, is now calling on South African

authorities to enact a ban on Monsanto’s tumor-linked maize crop known

as NK603.

Following in the footsteps of nations like France and Russia, South

Africa may soon be the latest nation to enact a ban on Monsanto’s GMO

corn that was recently linked to tumor development and organ damage in rats. South Africa’s African Centre for Biosafety

(ACB), a watchdog organization that was created to protect consumers

from various biotechnology dangers, is now calling on South African

authorities to enact a ban on Monsanto’s tumor-linked maize crop known

as NK603.This is particularly important when it comes to South Africa as white corn is a large staple food, making up for 80% of the harvest just last year. In the event that the maize were to be banned, it would be a major hit for Monsanto and an even larger victory for the 50,586,757 people who live in South Africa. If authorities take the advice of ACB, then it would not only ban the cultivation of the GMO corn, but the import and export as well. In a letter to the South African minister of agriculture, the ACB said:

We urge the South African government to take the necessary steps to protect its citizens.Read More @ Activist Post

by Mike Adams, Natural News:

Yes indeed, readers, we have secured the world’s first interview with a top Monsanto scientist named Alex Blaine Layder. (Read the name out loud, quickly.) He provides some real answers about GMOs and why Monsanto’s technology can help save the world.

Adams: So, to begin, why are you saying that GMOs are such a tremendous benefit to the world?

Layder: Well, as you know, GMOs cause infertility and cancer tumors, and that reduces the birth rate which is subsequently good for the planet.

Adams: How’s that good for the planet, exactly?

Layder: Fewer people, of course. Isn’t that the goal? (Pauses) This is the interview with Bilberberg Insider, yes?

Read More @ NaturalNews.com

Yes indeed, readers, we have secured the world’s first interview with a top Monsanto scientist named Alex Blaine Layder. (Read the name out loud, quickly.) He provides some real answers about GMOs and why Monsanto’s technology can help save the world.

Adams: So, to begin, why are you saying that GMOs are such a tremendous benefit to the world?

Layder: Well, as you know, GMOs cause infertility and cancer tumors, and that reduces the birth rate which is subsequently good for the planet.

Adams: How’s that good for the planet, exactly?

Layder: Fewer people, of course. Isn’t that the goal? (Pauses) This is the interview with Bilberberg Insider, yes?

Read More @ NaturalNews.com

by Susanne Posel, Occupy Corporatism:

Patrick Clawson, deputy director of research for the Washington Institute for Near East Policy (WINEP) was caught on film last week suggesting that crisis initiation (i.e. false flags) are needed to “get America into war with Iran.” Clawson has very little confidence that Obama “can get us into war.”

WINEP was founded in 1985 by Martin Indyk, former US Ambassador to Israel and former deputy director of research for the American Israel Public Affairs Committee (AIPAC) which is the largest and most influential Zionist-controlled pro-Israeli lobby on Capitol Hill. Other founders of WINEP include self-proclaimed Zionists such as Paul Wolfowitz, president of the World Bank from 2005 – 2007; Cheryl Halpren who worked for the Corporation for Public Broadcasting (PBS); NeoCon Daniel Pipes; Bud McFarlane, involved in the Iran-Contra affair; Eugene Victor Rostow, former dean of education at Yale Law School; and James Wooley, former director of the CIA.

The Neo-conservatist (neocon) perspective originates in Trotskyism and Stalinism which is the “belief is that life of the civil society should be directed and regulated by the all-powerful state (in both its political and economic domains).” As a neocon, Clawson adheres to the Communist-based philosophy that the domination of the state in society and the symbol of the head (as realized by the President) is as the royal decree that their power to rule is divinely imbued.

Read More @ OccupyCorporatism.com

Patrick Clawson, deputy director of research for the Washington Institute for Near East Policy (WINEP) was caught on film last week suggesting that crisis initiation (i.e. false flags) are needed to “get America into war with Iran.” Clawson has very little confidence that Obama “can get us into war.”

WINEP was founded in 1985 by Martin Indyk, former US Ambassador to Israel and former deputy director of research for the American Israel Public Affairs Committee (AIPAC) which is the largest and most influential Zionist-controlled pro-Israeli lobby on Capitol Hill. Other founders of WINEP include self-proclaimed Zionists such as Paul Wolfowitz, president of the World Bank from 2005 – 2007; Cheryl Halpren who worked for the Corporation for Public Broadcasting (PBS); NeoCon Daniel Pipes; Bud McFarlane, involved in the Iran-Contra affair; Eugene Victor Rostow, former dean of education at Yale Law School; and James Wooley, former director of the CIA.

The Neo-conservatist (neocon) perspective originates in Trotskyism and Stalinism which is the “belief is that life of the civil society should be directed and regulated by the all-powerful state (in both its political and economic domains).” As a neocon, Clawson adheres to the Communist-based philosophy that the domination of the state in society and the symbol of the head (as realized by the President) is as the royal decree that their power to rule is divinely imbued.

Read More @ OccupyCorporatism.com

by Zen Gardner, ZenGardner.com

“We are no longer citizens of the United States of America and all those who live in the five-state area that encompasses our country are free to join us,” long-time Indian rights activist Russell Means told a handful of reporters and a delegation from the Bolivian embassy, gathered in a church in a run-down neighborhood of Washington for a news conference.

A delegation of Lakota leaders delivered a message to the State Department on Monday, announcing they were unilaterally withdrawing from treaties they signed with the federal government of the United States, some of them more than 150 years old.

They also visited the Bolivian, Chilean, South African and Venezuelan embassies, and will continue on their diplomatic mission and take it overseas in the coming weeks and months, they told the news conference.

Lakota country includes parts of the states of Nebraska, South Dakota, North Dakota, Montana and Wyoming.

The new country would issue its own passports and driving licences, and living there would be tax-free — provided residents renounce their US citizenship, Means said.

Read More @ ZenGardner.com

“We are no longer citizens of the United States of America and all those who live in the five-state area that encompasses our country are free to join us,” long-time Indian rights activist Russell Means told a handful of reporters and a delegation from the Bolivian embassy, gathered in a church in a run-down neighborhood of Washington for a news conference.

A delegation of Lakota leaders delivered a message to the State Department on Monday, announcing they were unilaterally withdrawing from treaties they signed with the federal government of the United States, some of them more than 150 years old.

They also visited the Bolivian, Chilean, South African and Venezuelan embassies, and will continue on their diplomatic mission and take it overseas in the coming weeks and months, they told the news conference.

Lakota country includes parts of the states of Nebraska, South Dakota, North Dakota, Montana and Wyoming.

The new country would issue its own passports and driving licences, and living there would be tax-free — provided residents renounce their US citizenship, Means said.

Read More @ ZenGardner.com

Silver briefly SMASHED through the door of $35 as gold marched toward $1,800 on Monday!

Despite JP Morgan being given the green light to destroy the silver market with unlimited paper, thanks to the irrational ruling by U.S. District Judge Robert Wilkins which overturns the CFTC’s position limits on the criminal banks (JPM)… the metals – at least for a biref time – couldn’t be contained after the Chicago FED President appeared on CNBC calling for MORE QE∞ (whatever THAT is).

Got PHYSICAL?

SILVER: The Achilles’ Heel

from Wealth Wire:

Gold no longer has a legal role in the world’s monetary system, but because of a collapse of faith in sovereign obligations – fiat currencies/paper money – and a coming complete lack of trust in governments and financial institutions, gold is going to quickly become a core banking asset.

So why do I believe gold is going to become a core banking asset, what exactly does gold have going for it to make this possible?

“Gold, measured out, became money. Gold’s beauty, scarcity, unique density and the ease by which it could be melted, formed, and measured made it a natural trading medium. Gold gave rise to the concept of money itself: portable, private, and permanent.” A brief History of Gold, onlygold.com

Historical Risk

“The history of reserve currencies reveals that the position of a country as a superpower (whose currency acts as a reserve currency) tends to rotate in a natural cycle of around 100 years. Will history repeat? From 1450 to 1530 it was Portuguese (80 years). From 1530 to 1640 (110 years) it was Spanish. From 1640 to 1720 (80 years) it was Dutch. From 1720 to 1815 (95 years) it was French. From 1815 to 1920 (105 years) it was British. And then the US dollar gradually dominated the scene….” – Richard Russell

Read More @ WealthWire.com

Gold no longer has a legal role in the world’s monetary system, but because of a collapse of faith in sovereign obligations – fiat currencies/paper money – and a coming complete lack of trust in governments and financial institutions, gold is going to quickly become a core banking asset.

So why do I believe gold is going to become a core banking asset, what exactly does gold have going for it to make this possible?

“Gold, measured out, became money. Gold’s beauty, scarcity, unique density and the ease by which it could be melted, formed, and measured made it a natural trading medium. Gold gave rise to the concept of money itself: portable, private, and permanent.” A brief History of Gold, onlygold.com

Historical Risk

“The history of reserve currencies reveals that the position of a country as a superpower (whose currency acts as a reserve currency) tends to rotate in a natural cycle of around 100 years. Will history repeat? From 1450 to 1530 it was Portuguese (80 years). From 1530 to 1640 (110 years) it was Spanish. From 1640 to 1720 (80 years) it was Dutch. From 1720 to 1815 (95 years) it was French. From 1815 to 1920 (105 years) it was British. And then the US dollar gradually dominated the scene….” – Richard Russell

Read More @ WealthWire.com

by Rick Ackerman, Rick Ackerman.com:

Spain’s deflationary quagmire lies well beyond remedy at this point,

dooming Europe’s bold but ill-conceived attempt to forge a political and

economic union under a single currency. That Spain’s collapse is

imminent should be obvious to all by now, as the country attempts to

borrow its way back to prosperity amidst 25% unemployment, savage budget

cuts and a flight of capital to banks in England, Germany and

elsewhere. Recall that it was just two weeks ago that the world’s

bourses wildly celebrated a German constitutional court’s decision to

uphold the latest bailout facility, the European Stability Mechanism

(ESM). Stocks and bullion rallied sharply on the news, acting as though

yet more monetary pump-priming would somehow surmount the irresistible

deflationary drag of the world’s imploding, quadrillion dollar

derivatives edifice. In fact, the supposedly all-knowing, all-seeing

stock markets showed themselves to be deaf, dumb and blind to fact and

reality, since the court’s decision actually raised more obstacles to a

bailout than it eliminated. (Traders have since repented, having given

up nearly all of their earlier price gains.)

Spain’s deflationary quagmire lies well beyond remedy at this point,

dooming Europe’s bold but ill-conceived attempt to forge a political and

economic union under a single currency. That Spain’s collapse is

imminent should be obvious to all by now, as the country attempts to

borrow its way back to prosperity amidst 25% unemployment, savage budget

cuts and a flight of capital to banks in England, Germany and

elsewhere. Recall that it was just two weeks ago that the world’s

bourses wildly celebrated a German constitutional court’s decision to

uphold the latest bailout facility, the European Stability Mechanism

(ESM). Stocks and bullion rallied sharply on the news, acting as though

yet more monetary pump-priming would somehow surmount the irresistible

deflationary drag of the world’s imploding, quadrillion dollar

derivatives edifice. In fact, the supposedly all-knowing, all-seeing

stock markets showed themselves to be deaf, dumb and blind to fact and

reality, since the court’s decision actually raised more obstacles to a

bailout than it eliminated. (Traders have since repented, having given

up nearly all of their earlier price gains.)

Read More @ RickAckerman.com

Spain’s deflationary quagmire lies well beyond remedy at this point,

dooming Europe’s bold but ill-conceived attempt to forge a political and

economic union under a single currency. That Spain’s collapse is

imminent should be obvious to all by now, as the country attempts to

borrow its way back to prosperity amidst 25% unemployment, savage budget

cuts and a flight of capital to banks in England, Germany and

elsewhere. Recall that it was just two weeks ago that the world’s

bourses wildly celebrated a German constitutional court’s decision to

uphold the latest bailout facility, the European Stability Mechanism

(ESM). Stocks and bullion rallied sharply on the news, acting as though

yet more monetary pump-priming would somehow surmount the irresistible

deflationary drag of the world’s imploding, quadrillion dollar

derivatives edifice. In fact, the supposedly all-knowing, all-seeing

stock markets showed themselves to be deaf, dumb and blind to fact and

reality, since the court’s decision actually raised more obstacles to a

bailout than it eliminated. (Traders have since repented, having given

up nearly all of their earlier price gains.)

Spain’s deflationary quagmire lies well beyond remedy at this point,

dooming Europe’s bold but ill-conceived attempt to forge a political and

economic union under a single currency. That Spain’s collapse is

imminent should be obvious to all by now, as the country attempts to

borrow its way back to prosperity amidst 25% unemployment, savage budget

cuts and a flight of capital to banks in England, Germany and

elsewhere. Recall that it was just two weeks ago that the world’s

bourses wildly celebrated a German constitutional court’s decision to

uphold the latest bailout facility, the European Stability Mechanism

(ESM). Stocks and bullion rallied sharply on the news, acting as though

yet more monetary pump-priming would somehow surmount the irresistible

deflationary drag of the world’s imploding, quadrillion dollar

derivatives edifice. In fact, the supposedly all-knowing, all-seeing

stock markets showed themselves to be deaf, dumb and blind to fact and

reality, since the court’s decision actually raised more obstacles to a

bailout than it eliminated. (Traders have since repented, having given

up nearly all of their earlier price gains.)Read More @ RickAckerman.com

by Blankfiend, Testosterone Pit.com:

Treasury Secretary Timothy Geithner thinks of your money as a

first-loss buffer for the financial system. He counts on you being too

involved with your iPhone to even notice. In 2009, he launched the PPIP to revive the MBS market – using your money as a first-loss buffer. On Christmas Eve of 2009, he opened your wallets to cover unlimited amounts of GSE losses. Well, he is at it again.

Treasury Secretary Timothy Geithner thinks of your money as a

first-loss buffer for the financial system. He counts on you being too

involved with your iPhone to even notice. In 2009, he launched the PPIP to revive the MBS market – using your money as a first-loss buffer. On Christmas Eve of 2009, he opened your wallets to cover unlimited amounts of GSE losses. Well, he is at it again.

This time his eyes are set on your Money Market Funds (MMF) assets.

A money market fund (also known as money market mutual fund) is an open-ended mutual fund that invests in short-term debt securities such as US Treasury bills and commercial paper. Money market funds are widely (though not necessarily accurately) regarded as being as safe as bank deposits yet providing a higher yield. MMFs are important providers of liquidity to financial intermediaries, and many Americans use them as interest bearing checking accounts, and may even have credit cards drawing on the fund.

The relative “safety” of MMFs derives from their investment in high quality, highly liquid, short-term securities. In the United States, MMFs are regulated by the Securities and Exchange Commission’s (SEC) Investment Company Act of 1940. Under Rule 2a-7 of this act, a money fund mainly buys the highest rated debt, which matures in under 13 months.

Read More @ TestosteronePit.com

Donations will help defray the operational costs. Paypal, a leading provider of secure online money transfers, will handle the donations. Thank you for your contribution.

Treasury Secretary Timothy Geithner thinks of your money as a

first-loss buffer for the financial system. He counts on you being too

involved with your iPhone to even notice. In 2009, he launched the PPIP to revive the MBS market – using your money as a first-loss buffer. On Christmas Eve of 2009, he opened your wallets to cover unlimited amounts of GSE losses. Well, he is at it again.

Treasury Secretary Timothy Geithner thinks of your money as a

first-loss buffer for the financial system. He counts on you being too

involved with your iPhone to even notice. In 2009, he launched the PPIP to revive the MBS market – using your money as a first-loss buffer. On Christmas Eve of 2009, he opened your wallets to cover unlimited amounts of GSE losses. Well, he is at it again.This time his eyes are set on your Money Market Funds (MMF) assets.

A money market fund (also known as money market mutual fund) is an open-ended mutual fund that invests in short-term debt securities such as US Treasury bills and commercial paper. Money market funds are widely (though not necessarily accurately) regarded as being as safe as bank deposits yet providing a higher yield. MMFs are important providers of liquidity to financial intermediaries, and many Americans use them as interest bearing checking accounts, and may even have credit cards drawing on the fund.

The relative “safety” of MMFs derives from their investment in high quality, highly liquid, short-term securities. In the United States, MMFs are regulated by the Securities and Exchange Commission’s (SEC) Investment Company Act of 1940. Under Rule 2a-7 of this act, a money fund mainly buys the highest rated debt, which matures in under 13 months.

Read More @ TestosteronePit.com

Donations will help defray the operational costs. Paypal, a leading provider of secure online money transfers, will handle the donations. Thank you for your contribution.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment