from Front Page Mag:

On May 7th, it was revealed that

the Obama administration spent $8.35 billion on a “demonstration

project” designed to postpone the vast majority of Obamacare’s Medicare

Advantage cuts until after the election. On July 31st, it was revealed that

the Labor Department warned defense contractors against notifying

workers of impending layoffs before the election as well, despite the

fact that it would require violating the law to do so. On September 21,

it was revealed that

a report on the Greek bailout will also be postponed until after the

U.S. election. On September 13th, Fed Chief Ben Bernanke announced that

he will be pursuing a third round of Quantitative Easing (QE3), once

again under the auspices of “stimulating” the economy. The over-arching

theme here is clear: anything that constitutes an “inconvenient reality”

for this president, especially with respect to economics, will be

delayed until after the election.

On May 7th, it was revealed that

the Obama administration spent $8.35 billion on a “demonstration

project” designed to postpone the vast majority of Obamacare’s Medicare

Advantage cuts until after the election. On July 31st, it was revealed that

the Labor Department warned defense contractors against notifying

workers of impending layoffs before the election as well, despite the

fact that it would require violating the law to do so. On September 21,

it was revealed that

a report on the Greek bailout will also be postponed until after the

U.S. election. On September 13th, Fed Chief Ben Bernanke announced that

he will be pursuing a third round of Quantitative Easing (QE3), once

again under the auspices of “stimulating” the economy. The over-arching

theme here is clear: anything that constitutes an “inconvenient reality”

for this president, especially with respect to economics, will be

delayed until after the election.Read More @ FrontPageMag.com

Sanctions against Iran are making their impact, on the innocent working-class people of Iran–and the destruction of the currency may be getting a boost from the CIA.

International trade is dying and the currency is in free fall. It fell 17% this morning. The rial has lost more than 80 percent of its value since the start of the year.

I am also hearing that the CIA may be pumping newly (CIA printed) rial into the country in an effort to destabilize the country through hyper-inflation. The Fed may think money printing boosts an economy, but the CIA knows what it really does.

Read More at The Economic Policy Journal:

from The Daily Bell:

Euro-zone jobless rate hit record highs … The number of people out of work in the euro zone climbed further in August reaching a fresh record high, underscoring the hardship that the currency area’s fiscal crisis is inflicting on households, and suggesting any economic recovery is some way off. Eurostat, the European Union‘s official statistics agency, said Monday that 18.196 million people were without jobs in August, an increase of 34,000 from the previous month and the highest total since records for the 17 nations that use the euro were first compiled in January 1995. – MarketWatch

Dominant Social Theme: Capitalism provides us with terrible consequences.

Free-Market Analysis: It is really sad to watch what’s going on in Europe. One can almost imagine reading the history books about this period and getting a completely different picture of what is going on than the reality that should be evident to anyone who has lived through this time.

Appearances are important! Those who follow free-market economics know what needs to be done to pull Europe out of its slump. But the reporting gives no clue of the reality.

Read More @ TheDailyBell.com

The Global Spring

Serfdom has simply been pushed too far.

Globally. What we are about to witness, incredibly, is not just a

change in the way that one or two countries or even a specific region

of the world operates. No, what we are about to witness is a complete

transformation globally, a change that we believe will be incredibly

positive and will ultimately free us from the shackles upon the minds

of humanity as a species. Whether it was the intention from the outset

or not, what globalization has created is a very small class of

incredibly wealthy people that are extraordinarily corrupt as a group

and also above the law. The writing is on the wall folks. The

global economy is headed back down into depths that will prove worse

than 2008, and this time no amount of money printing and propaganda will be enough to hold things together. TPTB know this. What we have today is not Socialism or Capitalism, it is Ponzism.

Serfdom has simply been pushed too far.

Globally. What we are about to witness, incredibly, is not just a

change in the way that one or two countries or even a specific region

of the world operates. No, what we are about to witness is a complete

transformation globally, a change that we believe will be incredibly

positive and will ultimately free us from the shackles upon the minds

of humanity as a species. Whether it was the intention from the outset

or not, what globalization has created is a very small class of

incredibly wealthy people that are extraordinarily corrupt as a group

and also above the law. The writing is on the wall folks. The

global economy is headed back down into depths that will prove worse

than 2008, and this time no amount of money printing and propaganda will be enough to hold things together. TPTB know this. What we have today is not Socialism or Capitalism, it is Ponzism. As Legendary Nurburgring Files For Bankruptcy, Broke Greece Launches Its Own Formula 1 Race Track

There is something very wrong with this story. Two months ago, the world's most legendary race track, Germany's Nürburgring filed for bankruptcy. As AP wrote then: "Germany's legendary Nürburgring racetrack and entertainment complex is effectively bankrupt. The circuit—which hosted Formula One's German Grand Prix last year—is to launch insolvency proceedings amid fears that it could run out of cash while the European Commission considers planned government aid. The state government in Rhineland-Palatinate, which owns the financially troubled Nuerburgring GmbH, decided on the move on Wednesday, the dapd news agency reported.... A state subsidy had been in place since a disastrous development plan left the 'Ring organization saddled with more than 350 million euros in debt. While the Nordschleife—the circuit's famous “North Loop” which covers more than 13 miles—generates healthy operating profits, the income does not cover the interest payments on the enormous debt incurred when the state entered into the plan with two developers, Kai Richter and Jorg Lindner." Sadly such is life in a world in which not everyone is bailed out by the government, and when it comes to the "fairness for everyone, bankruptcy for no one" doctrine, Germany has still not jumped on the bandwagon. One country which has is the country which many say is alive only due to German generosity, is Greece. And in what may be the biggest slap in the face to Germany, and its recently defunct race track, is the news that Greece is now "unblocking a subsidy" (a subsidy which came from Germany) for €29 billion to, get this, build a Formula 1 racetrack. The same type of racetrack that just went belly up in Germany and cost countless jobs.

Australian Government 'Finds' Extra $338bn Assets (But No Unicorns Yet)

In what could easily be a Friday Humor post, Reuters reports that the Aussie government's statisticians, taking a page out of the German's 'creative' accounting book, have found an additional $338bn of assets for the nation. 'Cheers' all around as the Australian Bureau of Statistics (and Lies) revised household wealth up by AUD14,380 for every one of the country's 22.6 million people - as new estimates of unlisted shares and other equity pushed the nation's total financial assets to AUD3.1tn (compared to an originally reported AUD2.77tn. As the miners from down-under continue to struggle against a fading China, this miraculous 'find' has dropped the ratio of debt to liquid assets from a worrisome 170.1% to a meager 129.1%. Rumors are circulating that the ABS is now looking for the ark of the covenant, the philosopher's stone, and Shangri-La.

China PMI still in contraction mode/European PMI also weak/UK PMI plummets/Greek bad loans now reach 25%/

Harvey Organ at Harvey Organ's - The Daily Gold and Silver Report - 7 hours ago

Good

evening Ladies and Gentlemen:

Gold closed up today to the tune of $8.40 finishing the comex session at

$1779.50. Silver also advanced by

36 cents to $34.88. Gold, early in the European session, was down to

around the $1764.00 level. However once the comex session started, the

demand for physical simply overpowered our bankers as they retreated to

higher ground. The bankers held silverLacy Hunt: "No Increase in Standard of Living Since 1997"

There's

a belief among certain economists – and the wider population – that if

the government takes a more active role in the economy, the social

outcome can be improved. Dr. Lacy Hunt, executive VP of Hoisington

Investment Management Company (HIMCO), says it's a false belief… and he

has proof to back it up. An unprecedented buildup of debt, he shows, can only lead to one outcome: a drop in Americans' standard of living. Must watch!

There's

a belief among certain economists – and the wider population – that if

the government takes a more active role in the economy, the social

outcome can be improved. Dr. Lacy Hunt, executive VP of Hoisington

Investment Management Company (HIMCO), says it's a false belief… and he

has proof to back it up. An unprecedented buildup of debt, he shows, can only lead to one outcome: a drop in Americans' standard of living. Must watch!JPMorgan Sued By NY AG Over "Shit-Breathing" Bear Stearns RMBS Fraud

NY Attorney General Eric Schneiderman is suing JPMorgan over "multiple fraudulent and deceptive acts" in selling mortgage-backed securities causing losses of over $20bn. The suit appears to be related to conduct at Bear Stearns and is on the back of the monoline insurer lawsuits, and whistleblower affidavits such as the following:While we hope this would effectuate some real change, the likelihood is that it will at best result in a $300mm civil-lawsuit slap-on-the-wrists and brownie points for Schneiderman while nothing changes.In connection with the Bear Stearns Second Lien Trust 2007-1 (“BSSLT 2007- 1”) securitization, for example, one Bear Stearns executive asked whether the securitization was a “going out of business sale” and expressed a desire to “close this dog.” In another internal email, the SACO 2006-8 securitization was referred to as a “SACK OF SHIT” and a “shit breather.”

Presenting Spain's Economic Collapse In Context

We

have presented many charts over the last few weeks showing the

collapse in retail sales in Spain, along with surging unemployment,

bankruptcies and non-performing bank loans. But to do justice to the

situation, you’ve got to put it in context of the last 150 years, and

JPMorgan's Michael Cembalest provides just such context. Spain’s

adventure in the Eurozone has sent it into an economic tailspin the

likes of which have not been seen, with the exception of the Spanish

Civil War, since the 19th century. At that time, the Spanish

empire was at the tail end of its colonial decline, and was an

under-regulated, agrarian, closed economy subject to frequent crises.

The chart shows the details, highlighting the economic declines during

revolutions, depressions and agricultural epidemics. Spain’s recent

decline has now matched them.

We

have presented many charts over the last few weeks showing the

collapse in retail sales in Spain, along with surging unemployment,

bankruptcies and non-performing bank loans. But to do justice to the

situation, you’ve got to put it in context of the last 150 years, and

JPMorgan's Michael Cembalest provides just such context. Spain’s

adventure in the Eurozone has sent it into an economic tailspin the

likes of which have not been seen, with the exception of the Spanish

Civil War, since the 19th century. At that time, the Spanish

empire was at the tail end of its colonial decline, and was an

under-regulated, agrarian, closed economy subject to frequent crises.

The chart shows the details, highlighting the economic declines during

revolutions, depressions and agricultural epidemics. Spain’s recent

decline has now matched them.

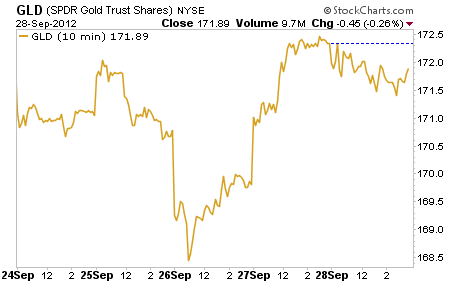

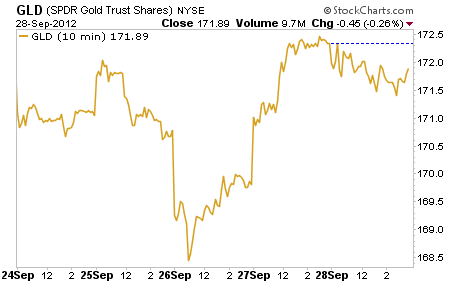

by Graham Summers, Gains Pains & Capital:

Last week was options expiration week as well as the end of the Third Quarter. So hedge funds were highly incentivized to gun stocks and precious metals higher (hedge funds are currently mostly long stocks and precious metals) to game their 3Q12 performance.

However, what’s notable is that despite this, stocks actually finished the week down. Indeed, as the below chart shows, hedgies continually pushed the market up only to find that there were few real buyers in the market, as a result, stocks tended to drift downward towards the end of each session.

Read More @ GainsPainsCapital.com

Last week was options expiration week as well as the end of the Third Quarter. So hedge funds were highly incentivized to gun stocks and precious metals higher (hedge funds are currently mostly long stocks and precious metals) to game their 3Q12 performance.

However, what’s notable is that despite this, stocks actually finished the week down. Indeed, as the below chart shows, hedgies continually pushed the market up only to find that there were few real buyers in the market, as a result, stocks tended to drift downward towards the end of each session.

Read More @ GainsPainsCapital.com

Donations will help defray the operational costs. Paypal, a leading provider of secure online money transfers, will handle the donations. Thank you for your contribution.

I'm PayPal Verified

China's Broken Growth Model

Even now, after the Chinese economy

has consistently disappointed everyone, we still get the impression

from market participants that it will all be fine in the end, because

the Chinese government know what they are doing, and all they need is to

let the floodgate of money open. Whenever a bad data point comes out, the market interprets that as more easing ahead, and it will most certainly save the economy. If only running the Chinese economy is that easy. Every growth engine of the Chinese economy is failing, and there is only one thing which can sustain these failing engines for longer, which is government stimulus, and whether the government is actually willing to deploy massive stimulus that is questionable.

Even now, after the Chinese economy

has consistently disappointed everyone, we still get the impression

from market participants that it will all be fine in the end, because

the Chinese government know what they are doing, and all they need is to

let the floodgate of money open. Whenever a bad data point comes out, the market interprets that as more easing ahead, and it will most certainly save the economy. If only running the Chinese economy is that easy. Every growth engine of the Chinese economy is failing, and there is only one thing which can sustain these failing engines for longer, which is government stimulus, and whether the government is actually willing to deploy massive stimulus that is questionable. Stocks Hold Green Close As VIX/Credit/Rates Signal Risk-Off

From the knee-jerk spike after the ISM data, US equity markets sold off relatively calmly for the rest of the day. Headlines will crow of a gain to start the quarter and what that means empirically, the real stories are under the surface: AAPL dropped 3% from its early-day highs to end at one-month lows; VIX jumped 0.6 vols to 16.3%; HYG, the high-yield credit ETF, was weaker all day and dumped into the close on huge volume; Treasuries were bid into the close ending the day down 1-2bps; and FX carry slid all afternoon as the USD rallied from -0.4% to -0.1% at the close. Commodities were juiced by Evans' dovishness (and Iranian fears) but the spikes in Silver (and less so gold) were retraced - though they all ended outperforming USD's implied strength. Tech and Discretionary underperformed as Staples and Healthcare were the winners. Not exactly the herd of performance-chasing monkeys everyone expected eh?

by Brendan James, Yahoo News:

Former presidential contender

and billionaire Ross Perot is worried that America is a sitting duck

for an unnamed foreign invader. In an interview for his new

autobiography, Perot said the nation’s weak economy has left us open for

a hostile takeover—and neither presidential candidate is the man to

save the country.

Citing an impending fiscal

cliff, Perot warned of disaster. “If we are that weak, just think of

who wants to come here first and take us over,” the former CEO of

info-tech company Perot Systems told USA Today on Monday.

“The last thing I ever want to

see is our country taken over because we’re so financially weak, we

can’t do anything,” Perot says.

When asked for his take on the

presidential race, Perot added, “Nobody that’s running really talks

about it, about what we have to do and why we have to do it. They would

prefer not to have it discussed.”

Read More @ News.Yahoo..com

by David Schectman, MilesFranklin.com:

The question that I am asked most frequently is “Will they confiscate my gold?”

The question that I am asked most frequently is “Will they confiscate my gold?”

I wish I could give you a definitive answer, but the fact is no one knows. I pay close attention to what Richard Russell and Jim Sinclair have to say and to the best of my knowledge; both of them believe it simply will never happen. Of course, that is not a “guarantee,” simply a viewpoint. When it comes to YOUR money, an “opinion” is not enough, even one from Russell and Sinclair.

The way I approach the subject is to expect the worst and hope for the best. So, if you allow for the possibility of gold confiscation, how does that affect your decision whether you should own any? Here is my strategy and I am comfortable that it will serve me well.

The key word here is diversification. Diversification in both portfolio choices and in location. Let’s start with portfolio diversification. I do own gold, a fair amount of it. It is mostly bullion, but I do have some semi-numismatic gold which could qualify as a “collectible” and be exempt from government confiscation. That was the case in 1933 when Roosevelt did in fact confiscate gold.

Read More @ MilesFranklin.com

The question that I am asked most frequently is “Will they confiscate my gold?”

The question that I am asked most frequently is “Will they confiscate my gold?”I wish I could give you a definitive answer, but the fact is no one knows. I pay close attention to what Richard Russell and Jim Sinclair have to say and to the best of my knowledge; both of them believe it simply will never happen. Of course, that is not a “guarantee,” simply a viewpoint. When it comes to YOUR money, an “opinion” is not enough, even one from Russell and Sinclair.

The way I approach the subject is to expect the worst and hope for the best. So, if you allow for the possibility of gold confiscation, how does that affect your decision whether you should own any? Here is my strategy and I am comfortable that it will serve me well.

The key word here is diversification. Diversification in both portfolio choices and in location. Let’s start with portfolio diversification. I do own gold, a fair amount of it. It is mostly bullion, but I do have some semi-numismatic gold which could qualify as a “collectible” and be exempt from government confiscation. That was the case in 1933 when Roosevelt did in fact confiscate gold.

Read More @ MilesFranklin.com

from Capital Account:

US Presidential candidates Mitt Romney and Barack Obama may be gearing for a “face-off” in their first presidential debate this Wednesday, but are they both already losers in the deficit debate? Can any amount of rhetoric fill the gaps in their deficit plans, and where is the country headed without sound math, let alone sound MONEY! And what about the hidden GDP tax? We’ll hear from blogger, author and radio host Karl Denninger of the Market Ticker, for his take.

And while the budget plans of presidential candidates may not add up, we already know the *lack of government planning entirely* has the US to head off the so-called “fiscal cliff,” in January of 2013. Daunting names aside, what exactly is the fiscal cliff, and what does falling off it entail? We’ll break down the potential damage in word of the day and give our audience a glaring example of the wasteful costs of political uncertainty already documented.

Plus we have a manufacturing data dump out today, but some of it points in opposite directions. We have a slew of negative numbers out of Europe, too (PMI, inflation and unemployment). Our guest will help make sense of these ingredients and tell us why he thinks a US recession is already baked into the cake.

US Presidential candidates Mitt Romney and Barack Obama may be gearing for a “face-off” in their first presidential debate this Wednesday, but are they both already losers in the deficit debate? Can any amount of rhetoric fill the gaps in their deficit plans, and where is the country headed without sound math, let alone sound MONEY! And what about the hidden GDP tax? We’ll hear from blogger, author and radio host Karl Denninger of the Market Ticker, for his take.

And while the budget plans of presidential candidates may not add up, we already know the *lack of government planning entirely* has the US to head off the so-called “fiscal cliff,” in January of 2013. Daunting names aside, what exactly is the fiscal cliff, and what does falling off it entail? We’ll break down the potential damage in word of the day and give our audience a glaring example of the wasteful costs of political uncertainty already documented.

Plus we have a manufacturing data dump out today, but some of it points in opposite directions. We have a slew of negative numbers out of Europe, too (PMI, inflation and unemployment). Our guest will help make sense of these ingredients and tell us why he thinks a US recession is already baked into the cake.

Jim Sinclair’s Commentary

Here is today’s story in gold. The cash number for the boys is $1775. This would represent the 10th major operation by gold banks to keep CASH gold below that $1775. It has much more to do with $1775 than this morning’s challenge of $1800.

Someday, sooner than expected, both $1775 and $1800 will behind us with the manipulators pushing gold higher, not lower. Behind us is not one or two dollars.

All this talk in the community of cycles and one more decline before a bonanza rise strikes me as disinformation and meaningless when $3500 is pulling gold up. As soon as the big boys have all your gold and gold shares you are willing to give them of the good gold companies, the manipulators will be on the long side just like in 1979-1980.

There is no way that the present giant shorts in the good gold shares can cover. The only reason they are not yet in panic is their long period of winning has made even the smartest of them stupid.

If you did not need to cover for a long time you dream that you will never have to. If today was not an experience of "Shaking the Tree to Pick Up the Fruit" in both shares as well as gold, I have not been watching gold and currency for more than 50 years.

The manipulators take their lead from the euro these days and push gold hard in the same direction. Watch the euro to define the direction of gold on the day. Good charts are available to you on INO.com.

Jim

Jim Sinclair’s Commentary

Pensions will have to be bailed out. It will be direct by the government or tangentiality by the Fed.

DeMint joins national effort to keep feds from bailing out state pension systems Published September 30, 2012

Illinois Democratic Gov. Pat Quinn is getting hit with a nationwide backlash over his suggestion that the federal government bail out the state employees’ pension program.

Critics have in the past several days pounced on the suggestion, made last year when Quinn, in announcing the state’s fiscal 2012 budget, said part of Illinois’ long-term effort to reduce the estimate $167 billion in under-funded liabilities would be to seek “a federal guarantee of the debt.”

Among those leading the charge is Republican Sen. Jim DeMint. The South Carolina senator has joined the Illinois Policy Institute’s national “No Pension Bailout” campaign — an effort to stop Congress from attempting to rescue failing state and municipal pension plans.

“Our greatest concern is states will assume they can run their pension systems into bankruptcy and then turn to the federal government for bailout,” DeMint said Thursday.

He also suggested the problem is the result of state legislators trying for decades to win over voters through pension promises based “on accounting methods that would put any business in jail.”

The conservative policy group estimates the total amount of under-funded pension liabilities in states is at least $2.5 trillion, with Illinois leading the nation.

The basic plan floated by Quinn would be for the federal government to rescue the pension program through buying the state’s bonds, which critics say are too financially risky to attract investors.

Quinn said after announcing the budget that seeking the federal guarantee was only a precaution, then later called the related wording a “drafting error,” according the non-partisan Citizens Against Government Waste, which nevertheless gave the governor its September 2012 “Porker of the Month” award.

More…

Jim,

This is interesting. Gold suddenly ripped higher this morning. Why? What caused it?

There are TWO theories, but the teleprompter readers of the FTV complex are only reporting ONE of them, and as usual it’s a false narrative/the wrong one:

Theory #1: It’s what the Chicago Fed President Charlie Evans just said on CNBC that caused this spike." Really? He didn’t say anything new or different, just inanely repeated the Fed’s "party line" on QEternity (digital money-printing to infinity and beyond). But, it was on FTV and it’s an easy, albeit quite stupid, theory. [Pardon the redundancy here.]

Theory #2: Germany, France, and Poland are moving towards establishing a "banking union" which is yet almost completely unreported outside Reuters Europe right now. [Read: bye-bye and adios to the EU.]

Of course, anyone who has not been drinking the FTV complex cough syrup about ‘fiat good’ and ‘QEternity even better’ and ‘Precious Metals bad’ (especially Gold) is already aware of how fiat currencies are performing vs. Gold in this environment.

Take a look and decide for yourself if the 40-pound Keynesian brains are right, or the shiny metal stuff is.

CIGA Richard S.

.

Donations will help defray the operational costs. Paypal, a leading provider of secure online money transfers, will handle the donations. Thank you for your contribution.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment