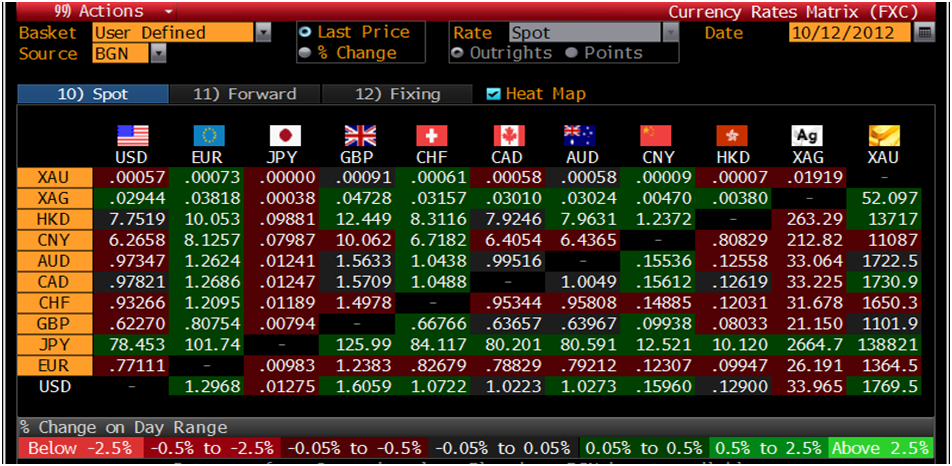

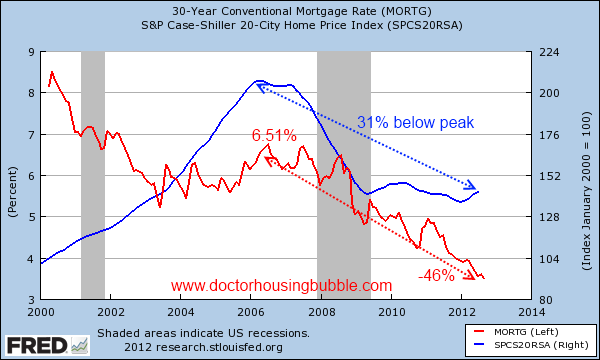

"We've seen rallies that fizzle before" is why Bob "I don't see the reason to call this a major turning point" Shiller is not calling the bottom in the housing market as he notes that while momentum helps, "right now it is partly seasonal" in an excellent reality-based discussion with CNBC's Rick Santelli. From the rise and fall of Greenspan's nationwide housing market correlations (not convinced this is anything but idiosyncratic) to the fact that a 'bottom' does not mean a recovery is coming and his expectations of longer-to-wait; the esteemed gentleman, dismissing concerns over rising interest rates and house prices - and pointing out how mortgage rates do not help forecast a house price recovery, makes a vital point: "Why the urgency" to buy a house? Despite the 'money for nothing', Shiller and Santelli explain there is "no way for Bernanke to change our 'animal spirits'" and his ZIRP is in fact psychologically damaging not invigorating. Absolute must watch!

Atlas Shrugged Part II in theaters Today 10.12.12

Kaminsky On "Hypocrite" Biden: "I'd Have Punched Him In The Face"

In

a little over three minutes, CNBC's Gary 'Golden Gloves' Kaminsky not

only pointed out the dismal reality of our political class but

explained, in his out loud voice - which we assumed was typically suppressed for career-limiting reasons

- exactly what he thinks of Joe Biden and what he would have done had

be been sat next to him on that table. In saying what we suspect a lot

of readers may have felt, Kaminsky exposes the underbelly; as like many

of Wall Street who are 'compelled' to give politicians money (Biden has raised the great majority of his funds from financial services firms)

hearing the hypocritical "wall-street-vs-main-street" double-talk and

'nasty' laughing and smirking last night made the ex-PM angry. Impressed

at Ryan's calm, Kaminsky sums it all up, about Biden: "I would have punched the guy in the face!" - the truth.

In

a little over three minutes, CNBC's Gary 'Golden Gloves' Kaminsky not

only pointed out the dismal reality of our political class but

explained, in his out loud voice - which we assumed was typically suppressed for career-limiting reasons

- exactly what he thinks of Joe Biden and what he would have done had

be been sat next to him on that table. In saying what we suspect a lot

of readers may have felt, Kaminsky exposes the underbelly; as like many

of Wall Street who are 'compelled' to give politicians money (Biden has raised the great majority of his funds from financial services firms)

hearing the hypocritical "wall-street-vs-main-street" double-talk and

'nasty' laughing and smirking last night made the ex-PM angry. Impressed

at Ryan's calm, Kaminsky sums it all up, about Biden: "I would have punched the guy in the face!" - the truth.Charts Of The Day: Why America Needs To Embrace The Fiscal Cliff Instead Of Kicking The Can Once Again

To quote David Rosenberg: "there is no good time, but better now than waiting to be shocked into the retrenchment later on. If left unchecked, the Federal debt/GDP ratio will breach 100% within the next two or three years. Do we really need to turn European? And more importantly, even under a sustained low interest rate policy, debt service costs will continue to bite into the revenue base - so much so that they will soon begin to absorb more than 20% of total tax receipts. At a time when grim demographic realities will push dependency ratios higher and with that ever-spiralling entitlement spending, the power of compound interest on a continued mountain of debt even assuming years of low rates will ensnare fiscal finances and seriously limit our policy flexibility in the future."

Is This Why Gold Is Selling Off?

From

the morning of Draghi's press-conference on 9/6, Treasury bond prices

and Gold have danced an interesting waltz around one another. After

recoupling on 9/26, they once again divorced for two weeks, only to

reconcile their differences once again today. Is the toing-and -froing

of inflation views driving gold and bonds - and does that mean Gold is

almost done with its drop here as Both the Long-Bond and Gold are now

both up 1.22% from QEternity.

From

the morning of Draghi's press-conference on 9/6, Treasury bond prices

and Gold have danced an interesting waltz around one another. After

recoupling on 9/26, they once again divorced for two weeks, only to

reconcile their differences once again today. Is the toing-and -froing

of inflation views driving gold and bonds - and does that mean Gold is

almost done with its drop here as Both the Long-Bond and Gold are now

both up 1.22% from QEternity.From Presidential Election To Popular Insurrection In One Easy Step: Art Cashin Explains

While last night's VeeP debate was all feces and frolics,

UBS' Art Cashin and his 'Friends of Fermentation' recently drifted

onto the topic of the Presidential Election - and the conversation was

not what he calls "reassuring" as they move from margins of victory to

result-challenges and banana-republic like street demonstrations and

riots. The heart of this discussion is the acrimonious tone that has

evolved and grown in our political exchanges. All the "us and them" and class warfare posturing sets a dangerous backdrop to a close election.

While last night's VeeP debate was all feces and frolics,

UBS' Art Cashin and his 'Friends of Fermentation' recently drifted

onto the topic of the Presidential Election - and the conversation was

not what he calls "reassuring" as they move from margins of victory to

result-challenges and banana-republic like street demonstrations and

riots. The heart of this discussion is the acrimonious tone that has

evolved and grown in our political exchanges. All the "us and them" and class warfare posturing sets a dangerous backdrop to a close election.I Name The New Baby: "Intervention"

There has been the thought, in place for decades, that the greatest danger lay in rapidly escalating Inflation

and that governments could ruin the populace and devastate the purses

of everyone if Inflation was allowed to run rampant. This was counterbalanced by the fear of Deflation which may have an even worse effect.

These two twin evils have been viewed as the mainstay of things that

could go wrong and they have each been battled in various ways for the

last hundred years. Some missions were successful, some not, but the

battle raged on from one administration to another. Now I wonder if some new infant has not been born to join them. This morning I will name this new baby; "Intervention." We find ourselves in unchartered territory and without a decent compass.

There has been the thought, in place for decades, that the greatest danger lay in rapidly escalating Inflation

and that governments could ruin the populace and devastate the purses

of everyone if Inflation was allowed to run rampant. This was counterbalanced by the fear of Deflation which may have an even worse effect.

These two twin evils have been viewed as the mainstay of things that

could go wrong and they have each been battled in various ways for the

last hundred years. Some missions were successful, some not, but the

battle raged on from one administration to another. Now I wonder if some new infant has not been born to join them. This morning I will name this new baby; "Intervention." We find ourselves in unchartered territory and without a decent compass.S&P Futures Break 50DMA

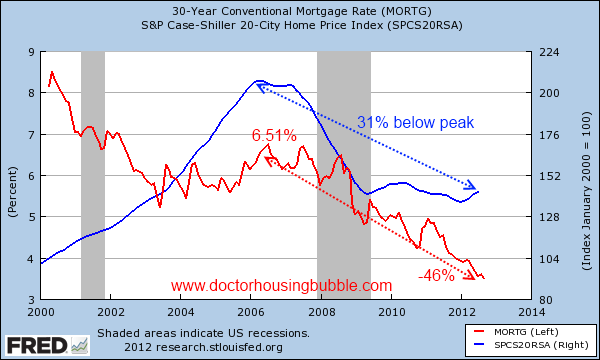

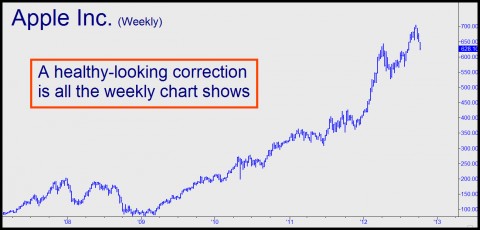

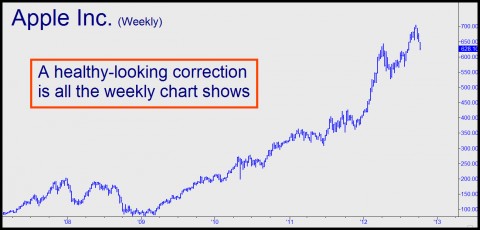

With AAPL sat just above its 100DMA, unable to hold gains this morning, the S&P 500 futures have just broken below their 50DMA for the first time since July 25th.

The Bernanke-Spike has gone and now the Draghi-Dagger comes into

focus... as financial earnings fail to spark another hope-driven rally.

From the day before Draghi's spike, the VWAP (volume-weighted average

price) for S&P 500 futures is 1444.5 - so on average in aggregate

buyers are now losers.

With AAPL sat just above its 100DMA, unable to hold gains this morning, the S&P 500 futures have just broken below their 50DMA for the first time since July 25th.

The Bernanke-Spike has gone and now the Draghi-Dagger comes into

focus... as financial earnings fail to spark another hope-driven rally.

From the day before Draghi's spike, the VWAP (volume-weighted average

price) for S&P 500 futures is 1444.5 - so on average in aggregate

buyers are now losers.European Equities End Ugly Week With Credit Unchanged

The

exuberant OMT-driven froth of the European equity markets appears to

be fading. All major stock indices across the region ended the week red

- with Spain worst down 3.3% and Italy down 2.2%

(though as CNBC would say - off their lows). This looks like

catching-down to European sovereign's less sanguine view of the world as

Italy and Spain sovereign bond spreads end almost perfectly unchanged

(having been up 15bps and 25bps respectively mid-week). Corporate and

financial credit spreads outperformed equities on the week - ending

unchanged also - with most of the move occurring today. Interestingly,

the LTRO stigma is rising once again - as non-LTRO-encumbered bank credit spreads hit a 14-month low this week and the spread to LTRO-banks widens. Europe's VIX ended the week unchanged at 21.9% - thanks to a significant spike into today's close.

The

exuberant OMT-driven froth of the European equity markets appears to

be fading. All major stock indices across the region ended the week red

- with Spain worst down 3.3% and Italy down 2.2%

(though as CNBC would say - off their lows). This looks like

catching-down to European sovereign's less sanguine view of the world as

Italy and Spain sovereign bond spreads end almost perfectly unchanged

(having been up 15bps and 25bps respectively mid-week). Corporate and

financial credit spreads outperformed equities on the week - ending

unchanged also - with most of the move occurring today. Interestingly,

the LTRO stigma is rising once again - as non-LTRO-encumbered bank credit spreads hit a 14-month low this week and the spread to LTRO-banks widens. Europe's VIX ended the week unchanged at 21.9% - thanks to a significant spike into today's close.The Debt Drugs Don’t Work

by Bill Bonner, Daily Reckoning.com.au:

First, here’s Nobel Prize-winning Joseph Stiglitz calling for more spending by the feds:

‘For both Europe and America, the danger now is that politicians and markets believe that monetary policy can revive the economy. Unfortunately, its main impact at this point is to distract attention from measures that would truly stimulate growth, including an expansionary fiscal policy and financial-sector reforms that boost lending.’

Yes, get them to spend more money…use more resources on crackpot schemes. Give more money to zombies.

Why not? The whole idea is to boost spending. Or as Stiglitz would say, to ‘increase demand’. Well, nobody is more demanding than a zombie…especially when he’s got a gun in his hand and someone else’s money in his pocket.

Read More @ DailyReckoning.com.au

We love technology. We wouldn’t invest so much of our time and money in

all things tech – particularly the companies that we invest in and

recommend in our Casey Extraordinary Technology

service – if we didn’t. And while firmly established publicly traded

companies garner the bulk of our investment dollars, it’s important to

keep in mind where these entities got their start. Most successful tech

ventures began in a garage, the back room at a university lab, or on

some secret skunkworks project.

Think Google (a computer lab), Microsoft (a dorm room), and Apple (a

garage). So it behooves us – and all investors in the tech sector – to

stay abreast of the latest developments coming out of these venues in

hopes of stumbling upon the next billion-dollar idea.

In this vein (and in the interest of entertainment) we regularly scour the tech world in search of the most promising, cool, or just plain odd things that have been hacked up in the basements of our fellow geeks. Here are some of our favorites that we’ve come across over the past year:

Eyegaze Computing

This first hack is an excellent illustration of the ease with which modern tech allows some unlikely people to reach a very sophisticated level of innovation.

Read More @ CaseyResearch.com

In this vein (and in the interest of entertainment) we regularly scour the tech world in search of the most promising, cool, or just plain odd things that have been hacked up in the basements of our fellow geeks. Here are some of our favorites that we’ve come across over the past year:

Eyegaze Computing

This first hack is an excellent illustration of the ease with which modern tech allows some unlikely people to reach a very sophisticated level of innovation.

Read More @ CaseyResearch.com

by Justin O’Connell, Dollar Vigilante:

Some call it bootlegging. Some call it racketeering. I call it a business.” – Al Capone

Some call it bootlegging. Some call it racketeering. I call it a business.” – Al Capone

The State Versus Al Capone

When Al Capone rushed back to the court room from his hotel headquarters just in time to hear the jury’s verdict, his bald head was sweating as he put on his loud, green suit jacket to accompany his green suit (one of the $135 ones, a New York Times journalist wrote at the time, worth about $2,000 in today’s terms). Judge Wilkerson walked gallantly to his seat and faced the jury.

“Gentlemen,” he said, “have you reached a verdict?”

“Yes, sir,” said the foreman in a hardly audible voice.

The verdict, written on a court form, was handed across the bench. The clerk cleared his voice quietly and read:

Read More @ DollarVigilante.com

from visionvictory Some call it bootlegging. Some call it racketeering. I call it a business.” – Al Capone

Some call it bootlegging. Some call it racketeering. I call it a business.” – Al CaponeThe State Versus Al Capone

When Al Capone rushed back to the court room from his hotel headquarters just in time to hear the jury’s verdict, his bald head was sweating as he put on his loud, green suit jacket to accompany his green suit (one of the $135 ones, a New York Times journalist wrote at the time, worth about $2,000 in today’s terms). Judge Wilkerson walked gallantly to his seat and faced the jury.

“Gentlemen,” he said, “have you reached a verdict?”

“Yes, sir,” said the foreman in a hardly audible voice.

The verdict, written on a court form, was handed across the bench. The clerk cleared his voice quietly and read:

Read More @ DollarVigilante.com

by Prof. James Petras, Global Research:

Whenever

financial swindlers prosper at the expense of investors or a bank

jiggers interest rates to bugger their competitors or tax evaders flee

fiscal crises or rent gouging petrol monarchies recycle profits or

oligarchs pillage economies and drive millions to drink, drugs and

destitution they find a suitable secure sanctuary in London. They are

wooed and pursued by big British realtors eager to sell them

multi-million dollar estates, trophy properties and landmark mansions.

Whenever

financial swindlers prosper at the expense of investors or a bank

jiggers interest rates to bugger their competitors or tax evaders flee

fiscal crises or rent gouging petrol monarchies recycle profits or

oligarchs pillage economies and drive millions to drink, drugs and

destitution they find a suitable secure sanctuary in London. They are

wooed and pursued by big British realtors eager to sell them

multi-million dollar estates, trophy properties and landmark mansions.

Pompous and pretentious British academics convince them to send their progeny to six digit private schools, promising them that when they graduate they will be speaking English through their nasal cavities, rolling their r’s and mastering the art of eloquent but vacuous elocution. British governments, Labor, Liberal, and Conservative, in the best and most hypocritical legal traditions, fashion the legal loopholes to attract the biggest and wealthiest parasites of the world.

Read More @ GlobalResearch.ca

Your support is needed...

Thank You

I'm PayPal Verified

Whenever

financial swindlers prosper at the expense of investors or a bank

jiggers interest rates to bugger their competitors or tax evaders flee

fiscal crises or rent gouging petrol monarchies recycle profits or

oligarchs pillage economies and drive millions to drink, drugs and

destitution they find a suitable secure sanctuary in London. They are

wooed and pursued by big British realtors eager to sell them

multi-million dollar estates, trophy properties and landmark mansions.

Whenever

financial swindlers prosper at the expense of investors or a bank

jiggers interest rates to bugger their competitors or tax evaders flee

fiscal crises or rent gouging petrol monarchies recycle profits or

oligarchs pillage economies and drive millions to drink, drugs and

destitution they find a suitable secure sanctuary in London. They are

wooed and pursued by big British realtors eager to sell them

multi-million dollar estates, trophy properties and landmark mansions.Pompous and pretentious British academics convince them to send their progeny to six digit private schools, promising them that when they graduate they will be speaking English through their nasal cavities, rolling their r’s and mastering the art of eloquent but vacuous elocution. British governments, Labor, Liberal, and Conservative, in the best and most hypocritical legal traditions, fashion the legal loopholes to attract the biggest and wealthiest parasites of the world.

Read More @ GlobalResearch.ca

Your support is needed...

Thank You

I'm PayPal Verified

by Ben Traynor, Gold Seek:

SPOT MARKET gold bullion prices climbed back above $1770 an ounce

during Thursday morning’s London trading – still a few Dollars below

where it started the week – as the Euro also recovered ground following

falls overnight after Spain had its credit rating cut.

SPOT MARKET gold bullion prices climbed back above $1770 an ounce

during Thursday morning’s London trading – still a few Dollars below

where it started the week – as the Euro also recovered ground following

falls overnight after Spain had its credit rating cut.

Stock markets edged higher this morning, as did most industrial commodities, while US Treasury bonds fell and German bund prices gained.

Silver bullion climbed as high as $34.33 an ounce, also slightly down on the week.

“We are watching support [for silver] at $33.37,” says bullion bank Scotia Mocatta’s latest technical analysis.

Read More @ GoldSeek.com

SPOT MARKET gold bullion prices climbed back above $1770 an ounce

during Thursday morning’s London trading – still a few Dollars below

where it started the week – as the Euro also recovered ground following

falls overnight after Spain had its credit rating cut.

SPOT MARKET gold bullion prices climbed back above $1770 an ounce

during Thursday morning’s London trading – still a few Dollars below

where it started the week – as the Euro also recovered ground following

falls overnight after Spain had its credit rating cut.Stock markets edged higher this morning, as did most industrial commodities, while US Treasury bonds fell and German bund prices gained.

Silver bullion climbed as high as $34.33 an ounce, also slightly down on the week.

“We are watching support [for silver] at $33.37,” says bullion bank Scotia Mocatta’s latest technical analysis.

Read More @ GoldSeek.com

Employees

who belong to the National Union of Mineworkers didn’t accept the

offer, spokesman Lesiba Seshoka said in a text message in response to a

Bloomberg query today.

by Paul Burkhardt, MineWeb.com

Members of South Africa’s biggest union rejected a proposal by the

nation’s largest gold companies to raise wages and end strikes that have

crippled the industry.

Members of South Africa’s biggest union rejected a proposal by the

nation’s largest gold companies to raise wages and end strikes that have

crippled the industry.

Employees who belong to the National Union of Mineworkers didn’t accept the offer, spokesman Lesiba Seshoka said in a text message in response to a query today.

AngloGold Ashanti Ltd., Gold Fields Ltd. and Harmony Gold Mining Co. had offered an additional 2 percent raise and Harmony 1.5 percent in categories four through eight this year, Elize Strydom, the chief negotiator at the Chamber of Mines, an industry body that represents the companies in wage talks, said yesterday. Category three, the entry level, would be eliminated in the proposal, meaning the lowest-paid workers would get a wage at the higher category.

Read More @ MineWeb.com

by Paul Burkhardt, MineWeb.com

Members of South Africa’s biggest union rejected a proposal by the

nation’s largest gold companies to raise wages and end strikes that have

crippled the industry.

Members of South Africa’s biggest union rejected a proposal by the

nation’s largest gold companies to raise wages and end strikes that have

crippled the industry.Employees who belong to the National Union of Mineworkers didn’t accept the offer, spokesman Lesiba Seshoka said in a text message in response to a query today.

AngloGold Ashanti Ltd., Gold Fields Ltd. and Harmony Gold Mining Co. had offered an additional 2 percent raise and Harmony 1.5 percent in categories four through eight this year, Elize Strydom, the chief negotiator at the Chamber of Mines, an industry body that represents the companies in wage talks, said yesterday. Category three, the entry level, would be eliminated in the proposal, meaning the lowest-paid workers would get a wage at the higher category.

Read More @ MineWeb.com

By Peter Michaelson, Op Ed News:

Political scientists and other experts say there’s no simple cause of

war. Human nature, they say, is just another ingredient in the recipe

for war, along with varying portions of racism and religion, geography

and language, and economics and culture. If so, is war too complex a

problem for us simple people to understand or prevent?

Political scientists and other experts say there’s no simple cause of

war. Human nature, they say, is just another ingredient in the recipe

for war, along with varying portions of racism and religion, geography

and language, and economics and culture. If so, is war too complex a

problem for us simple people to understand or prevent?

Does war, to put it in the guilt-free passive tense, just happen? Or can war be understood in a way that enables us to take responsibility for this continuing shame upon our species?

Most people cite aggression as a primary cause of war. However, underneath the aggression, deep in our unconscious mind, resides the passivity that enables war to happen. This inner passivity largely takes the form of self-doubt about one’s value and significance. This self-doubt is a void–our heart of darkness–that strands us in the shadows of our better nature. The main cause of war is our difficulty in recognizing this grave liability, this wasteland in our psyche where our humanity has not yet penetrated.

Read More @ OpedNews.com

Augason Farms Hard Red Wheat - 45 lb. Pail - Emergency Preparedness (Google Affiliate Ad)

from RonPaulCC2012 :

Political scientists and other experts say there’s no simple cause of

war. Human nature, they say, is just another ingredient in the recipe

for war, along with varying portions of racism and religion, geography

and language, and economics and culture. If so, is war too complex a

problem for us simple people to understand or prevent?

Political scientists and other experts say there’s no simple cause of

war. Human nature, they say, is just another ingredient in the recipe

for war, along with varying portions of racism and religion, geography

and language, and economics and culture. If so, is war too complex a

problem for us simple people to understand or prevent?Does war, to put it in the guilt-free passive tense, just happen? Or can war be understood in a way that enables us to take responsibility for this continuing shame upon our species?

Most people cite aggression as a primary cause of war. However, underneath the aggression, deep in our unconscious mind, resides the passivity that enables war to happen. This inner passivity largely takes the form of self-doubt about one’s value and significance. This self-doubt is a void–our heart of darkness–that strands us in the shadows of our better nature. The main cause of war is our difficulty in recognizing this grave liability, this wasteland in our psyche where our humanity has not yet penetrated.

Read More @ OpedNews.com

Augason Farms Hard Red Wheat - 45 lb. Pail - Emergency Preparedness (Google Affiliate Ad)

from RonPaulCC2012 :

by Paul Kiel, Pro Publica:

Late last year, the country’s bank regulators launched a massive

program to evaluate millions of foreclosure cases and compensate

homeowners who fell victim to the banks’ flawed or illegal practices.

Regulators dubbed it the “Independent Foreclosure Review” to emphasize

that the banks would not be making key decisions about loans they had

made or serviced.

Late last year, the country’s bank regulators launched a massive

program to evaluate millions of foreclosure cases and compensate

homeowners who fell victim to the banks’ flawed or illegal practices.

Regulators dubbed it the “Independent Foreclosure Review” to emphasize

that the banks would not be making key decisions about loans they had

made or serviced.

But a raft of evidence — internal [1] Bank of America memos [2] and emails obtained by ProPublica, interviews with two bank staff members who have worked on the review, and little-noticed documents released late last year by a federal banking regulator — throw the independence of the review into serious doubt. Together, they indicate that Bank of America — the financial giant with the largest number of homeowners eligible for the program — is performing much of the work itself.

The ultimate decision as to whether and how much a homeowner will be compensated is not made by Bank of America, the evidence shows, but is based largely on work that the bank itself performs. One current employee called that crucial judgment “only a matter of double checking” the bank’s work.

Read More @ ProPublica.org

BTFD...

Late last year, the country’s bank regulators launched a massive

program to evaluate millions of foreclosure cases and compensate

homeowners who fell victim to the banks’ flawed or illegal practices.

Regulators dubbed it the “Independent Foreclosure Review” to emphasize

that the banks would not be making key decisions about loans they had

made or serviced.

Late last year, the country’s bank regulators launched a massive

program to evaluate millions of foreclosure cases and compensate

homeowners who fell victim to the banks’ flawed or illegal practices.

Regulators dubbed it the “Independent Foreclosure Review” to emphasize

that the banks would not be making key decisions about loans they had

made or serviced.

But a raft of evidence — internal [1] Bank of America memos [2] and emails obtained by ProPublica, interviews with two bank staff members who have worked on the review, and little-noticed documents released late last year by a federal banking regulator — throw the independence of the review into serious doubt. Together, they indicate that Bank of America — the financial giant with the largest number of homeowners eligible for the program — is performing much of the work itself.

The ultimate decision as to whether and how much a homeowner will be compensated is not made by Bank of America, the evidence shows, but is based largely on work that the bank itself performs. One current employee called that crucial judgment “only a matter of double checking” the bank’s work.

Read More @ ProPublica.org

BTFD...

from Gold Core:

Gold remains robust in euro terms at €1,364.50/oz and remains less

than only 1% away from new record highs in the single currency (see

chart).

Gold remains robust in euro terms at €1,364.50/oz and remains less

than only 1% away from new record highs in the single currency (see

chart).

India and China are embarking on their peak consumption season which may create a boost to the physical market.

The far from resolved debt crisis in Greece, Spain and most countries in the western world means that this is another correction and investors and store of wealth buyers should continue to accumulate on the dip.

Prices may remain contained until after the U.S. election but we expect that soon after the election (we expect Obama to be re-elected), precious metal prices will again surge. Indeed, from November into the early months of 2013, we could see one of the largest upward price movements in gold and silver so far in their bull markets.

U.S. election years tend to see gold underperform vis-à-vis other years and this was seen in 2004 (+4.7%) and 2008 (+5%) when gold saw only marginal gains compared to the 17% annualised dollar returns seen in that decade.

Post election years saw stronger gains – with a 22% in 2005 and a 25% return in 2009.

Read More @ GoldCore.com

Gold remains robust in euro terms at €1,364.50/oz and remains less

than only 1% away from new record highs in the single currency (see

chart).

Gold remains robust in euro terms at €1,364.50/oz and remains less

than only 1% away from new record highs in the single currency (see

chart). India and China are embarking on their peak consumption season which may create a boost to the physical market.

The far from resolved debt crisis in Greece, Spain and most countries in the western world means that this is another correction and investors and store of wealth buyers should continue to accumulate on the dip.

Prices may remain contained until after the U.S. election but we expect that soon after the election (we expect Obama to be re-elected), precious metal prices will again surge. Indeed, from November into the early months of 2013, we could see one of the largest upward price movements in gold and silver so far in their bull markets.

U.S. election years tend to see gold underperform vis-à-vis other years and this was seen in 2004 (+4.7%) and 2008 (+5%) when gold saw only marginal gains compared to the 17% annualised dollar returns seen in that decade.

Post election years saw stronger gains – with a 22% in 2005 and a 25% return in 2009.

Read More @ GoldCore.com

from KingWorldNews:

Today John Embry told King World News, “We

are literally witnessing a war between the physical buyers (Eastern

central banks), and the paper manipulators (commercials or bullion

banks), and that is why there is such a fierce battle being waged in

gold between $1,735 and $1,800.” Embry also stated, “If

the commercials run into trouble (with their massive short positions),

KWN readers will see a move in gold that will leave them breathless.”

Today John Embry told King World News, “We

are literally witnessing a war between the physical buyers (Eastern

central banks), and the paper manipulators (commercials or bullion

banks), and that is why there is such a fierce battle being waged in

gold between $1,735 and $1,800.” Embry also stated, “If

the commercials run into trouble (with their massive short positions),

KWN readers will see a move in gold that will leave them breathless.”

Here is what Embry, who is Chief Investment Strategist at Sprott Asset Management, had to say: “This is one of those moments in the gold market where there is a distinct possibility that we will see a commercial signal failure. A commercial signal failure is an extremely rare event, but we could well be setting up for just such an occurrence right now.”

John Embry continues @ KingWorldNews.com

Today John Embry told King World News, “We

are literally witnessing a war between the physical buyers (Eastern

central banks), and the paper manipulators (commercials or bullion

banks), and that is why there is such a fierce battle being waged in

gold between $1,735 and $1,800.” Embry also stated, “If

the commercials run into trouble (with their massive short positions),

KWN readers will see a move in gold that will leave them breathless.”

Today John Embry told King World News, “We

are literally witnessing a war between the physical buyers (Eastern

central banks), and the paper manipulators (commercials or bullion

banks), and that is why there is such a fierce battle being waged in

gold between $1,735 and $1,800.” Embry also stated, “If

the commercials run into trouble (with their massive short positions),

KWN readers will see a move in gold that will leave them breathless.”Here is what Embry, who is Chief Investment Strategist at Sprott Asset Management, had to say: “This is one of those moments in the gold market where there is a distinct possibility that we will see a commercial signal failure. A commercial signal failure is an extremely rare event, but we could well be setting up for just such an occurrence right now.”

John Embry continues @ KingWorldNews.com

How's that Hopey Changey thing working out for you?...

by Mac Slavo, SHTFPlan:

One key measure of global economic health is how much freight – raw

materials and manufactured goods – is being shipped around the world and

in the United States. In July of this year the Balctic Dry Index, a

measure of the price to pay for the movement of raw materials by sea, hit a record breaking low and signaled a steep decline in global manufacturing and consumption.

One key measure of global economic health is how much freight – raw

materials and manufactured goods – is being shipped around the world and

in the United States. In July of this year the Balctic Dry Index, a

measure of the price to pay for the movement of raw materials by sea, hit a record breaking low and signaled a steep decline in global manufacturing and consumption.

This was a key indicator for where the economy was headed on a global scale.

Just a few months later we’ve received confirmation of this trend from FedEx, one of the largest shipping companies in the world.

Yes, Americans are still shopping, but they aren’t shopping at the same pace they were five years ago. Their jobs have been eliminated, wages reduced and credit has been restricted. FedEx’s latest earnings report is proof positive of this:

Read More @ SHTFPlan.com

Thank You

I'm PayPal Verified

One key measure of global economic health is how much freight – raw

materials and manufactured goods – is being shipped around the world and

in the United States. In July of this year the Balctic Dry Index, a

measure of the price to pay for the movement of raw materials by sea, hit a record breaking low and signaled a steep decline in global manufacturing and consumption.

One key measure of global economic health is how much freight – raw

materials and manufactured goods – is being shipped around the world and

in the United States. In July of this year the Balctic Dry Index, a

measure of the price to pay for the movement of raw materials by sea, hit a record breaking low and signaled a steep decline in global manufacturing and consumption.This was a key indicator for where the economy was headed on a global scale.

Just a few months later we’ve received confirmation of this trend from FedEx, one of the largest shipping companies in the world.

Yes, Americans are still shopping, but they aren’t shopping at the same pace they were five years ago. Their jobs have been eliminated, wages reduced and credit has been restricted. FedEx’s latest earnings report is proof positive of this:

Read More @ SHTFPlan.com

from Testosterone Pit.com:

It’s been a phenomenal circus, the screaming and hollering on all sides

about the “fiscal cliff,” in the media, from lawmakers, from chieftains

of our industries, particularly those that feed at the government’s big

trough, such as defense contractors, which include some of the largest

global corporations. Even NPR this morning postulated that it would

cause a million job losses. Hysteria comes to mind.

It’s been a phenomenal circus, the screaming and hollering on all sides

about the “fiscal cliff,” in the media, from lawmakers, from chieftains

of our industries, particularly those that feed at the government’s big

trough, such as defense contractors, which include some of the largest

global corporations. Even NPR this morning postulated that it would

cause a million job losses. Hysteria comes to mind.

The fiscal cliff is to the US what the Troika is to Greece: an unwelcome dose of self-imposed half-assed discipline. Self-imposed in Greece because they could send the Troika packing, default on the rest of their euro debt, revert to the drachma, and print themselves into poverty [Greece, Tell Brussels “To Take A Hike” And Let The Troika Bail Out The ECB Instead]. Self-imposed in the US because Congress passed, and the President signed, the laws that make up the fiscal cliff. And half-assed because it doesn’t mean that either country will ever live within its means.

According to the fear mongers out there, the US would fall off that fiscal cliff if (most notably):

- the Bush tax cuts are allowed to expire, sending us back to where we were before.

Read More @ TestosteronePit.com

Your support is needed... It’s been a phenomenal circus, the screaming and hollering on all sides

about the “fiscal cliff,” in the media, from lawmakers, from chieftains

of our industries, particularly those that feed at the government’s big

trough, such as defense contractors, which include some of the largest

global corporations. Even NPR this morning postulated that it would

cause a million job losses. Hysteria comes to mind.

It’s been a phenomenal circus, the screaming and hollering on all sides

about the “fiscal cliff,” in the media, from lawmakers, from chieftains

of our industries, particularly those that feed at the government’s big

trough, such as defense contractors, which include some of the largest

global corporations. Even NPR this morning postulated that it would

cause a million job losses. Hysteria comes to mind.The fiscal cliff is to the US what the Troika is to Greece: an unwelcome dose of self-imposed half-assed discipline. Self-imposed in Greece because they could send the Troika packing, default on the rest of their euro debt, revert to the drachma, and print themselves into poverty [Greece, Tell Brussels “To Take A Hike” And Let The Troika Bail Out The ECB Instead]. Self-imposed in the US because Congress passed, and the President signed, the laws that make up the fiscal cliff. And half-assed because it doesn’t mean that either country will ever live within its means.

According to the fear mongers out there, the US would fall off that fiscal cliff if (most notably):

- the Bush tax cuts are allowed to expire, sending us back to where we were before.

Read More @ TestosteronePit.com

from, via Wealth Wire:

It is still amazing how few people realize how subsidized the housing market really is…

I have talked to people that walked into a too big to fail bank, received a government-backed mortgage yet assume this is somehow the “free market” at work. Even after pulling up their loan on a public Fannie Mae database they still want to believe they are participating in a free-market. Why? Ultimately it is a direct benefit to their bottom line. The housing market lost any free-market label post-Great Depression. Plus, that bank is only able to function courtesy of rewriting accounting rules and trillions of dollars in emergency loans.

For over a generation the loans that were made were conservative, required a large down payment, and came at a time when household incomes were rising. We can argue the merits of government-banking intervention (i.e., the Fed with QE3, mortgage interest deduction, etc) yet the market is now fully addicted on all these external factors. A Pandora’s Box has been opened and now every action that is taken is more extreme and more permanent. Yet the housing market of today is nothing like the one many baby boomers grew up in and eventually purchased. Demographics and stagnant incomes will create different variables for the housing market going forward.

Read More @ WealthWire.com

Beneath a façade of tedious price action, U.S. stocks appear to be

weakening by the hour. Yesterday, for instance, the Dow couldn’t even

muster a 100-point boost on news that jobless claims had fallen by

30,000 in the week ended October 6. Earlier this year, before our

perennially recovering economy encountered some stiff recessionary

headwinds, that stat would have been worth at least 150 Dow points on

the opening. This time around, though, DaBoyz could milk only a paltry

84-point gain from it. When a second-wind flurry of buying failed to

drive the blue chip average any higher, it was time to unload. We said

so in the Rick’s Picks chat room at the time, noting that the rally felt

“doomed,” as it indeed was. Have investors finally figured out that

virtually all employment-related statistics, especially so close to the

election, are economically meaningless at best and brazen lies at worst?

Even if they have, it would hardly have mattered. Since early in 2009,

and up until recently, any item from the Labor Department that was

other than catastrophic has been seized upon by institutional traders to

stampede bears into short-covering. As we’ve pointed out here many

times before, that’s the only kind of buying powerful enough to push

stocks through levels of supply or to jolt shares from doldrums. Now,

this effect appears to be dead, or at least dying.

Beneath a façade of tedious price action, U.S. stocks appear to be

weakening by the hour. Yesterday, for instance, the Dow couldn’t even

muster a 100-point boost on news that jobless claims had fallen by

30,000 in the week ended October 6. Earlier this year, before our

perennially recovering economy encountered some stiff recessionary

headwinds, that stat would have been worth at least 150 Dow points on

the opening. This time around, though, DaBoyz could milk only a paltry

84-point gain from it. When a second-wind flurry of buying failed to

drive the blue chip average any higher, it was time to unload. We said

so in the Rick’s Picks chat room at the time, noting that the rally felt

“doomed,” as it indeed was. Have investors finally figured out that

virtually all employment-related statistics, especially so close to the

election, are economically meaningless at best and brazen lies at worst?

Even if they have, it would hardly have mattered. Since early in 2009,

and up until recently, any item from the Labor Department that was

other than catastrophic has been seized upon by institutional traders to

stampede bears into short-covering. As we’ve pointed out here many

times before, that’s the only kind of buying powerful enough to push

stocks through levels of supply or to jolt shares from doldrums. Now,

this effect appears to be dead, or at least dying.

Read More @ RickAckerman.com

It is still amazing how few people realize how subsidized the housing market really is…

I have talked to people that walked into a too big to fail bank, received a government-backed mortgage yet assume this is somehow the “free market” at work. Even after pulling up their loan on a public Fannie Mae database they still want to believe they are participating in a free-market. Why? Ultimately it is a direct benefit to their bottom line. The housing market lost any free-market label post-Great Depression. Plus, that bank is only able to function courtesy of rewriting accounting rules and trillions of dollars in emergency loans.

For over a generation the loans that were made were conservative, required a large down payment, and came at a time when household incomes were rising. We can argue the merits of government-banking intervention (i.e., the Fed with QE3, mortgage interest deduction, etc) yet the market is now fully addicted on all these external factors. A Pandora’s Box has been opened and now every action that is taken is more extreme and more permanent. Yet the housing market of today is nothing like the one many baby boomers grew up in and eventually purchased. Demographics and stagnant incomes will create different variables for the housing market going forward.

Read More @ WealthWire.com

Ignore Signs of Distribution at Your Peril

by Rick Ackerman, Rick Ackerman.com:

Beneath a façade of tedious price action, U.S. stocks appear to be

weakening by the hour. Yesterday, for instance, the Dow couldn’t even

muster a 100-point boost on news that jobless claims had fallen by

30,000 in the week ended October 6. Earlier this year, before our

perennially recovering economy encountered some stiff recessionary

headwinds, that stat would have been worth at least 150 Dow points on

the opening. This time around, though, DaBoyz could milk only a paltry

84-point gain from it. When a second-wind flurry of buying failed to

drive the blue chip average any higher, it was time to unload. We said

so in the Rick’s Picks chat room at the time, noting that the rally felt

“doomed,” as it indeed was. Have investors finally figured out that

virtually all employment-related statistics, especially so close to the

election, are economically meaningless at best and brazen lies at worst?

Even if they have, it would hardly have mattered. Since early in 2009,

and up until recently, any item from the Labor Department that was

other than catastrophic has been seized upon by institutional traders to

stampede bears into short-covering. As we’ve pointed out here many

times before, that’s the only kind of buying powerful enough to push

stocks through levels of supply or to jolt shares from doldrums. Now,

this effect appears to be dead, or at least dying.

Beneath a façade of tedious price action, U.S. stocks appear to be

weakening by the hour. Yesterday, for instance, the Dow couldn’t even

muster a 100-point boost on news that jobless claims had fallen by

30,000 in the week ended October 6. Earlier this year, before our

perennially recovering economy encountered some stiff recessionary

headwinds, that stat would have been worth at least 150 Dow points on

the opening. This time around, though, DaBoyz could milk only a paltry

84-point gain from it. When a second-wind flurry of buying failed to

drive the blue chip average any higher, it was time to unload. We said

so in the Rick’s Picks chat room at the time, noting that the rally felt

“doomed,” as it indeed was. Have investors finally figured out that

virtually all employment-related statistics, especially so close to the

election, are economically meaningless at best and brazen lies at worst?

Even if they have, it would hardly have mattered. Since early in 2009,

and up until recently, any item from the Labor Department that was

other than catastrophic has been seized upon by institutional traders to

stampede bears into short-covering. As we’ve pointed out here many

times before, that’s the only kind of buying powerful enough to push

stocks through levels of supply or to jolt shares from doldrums. Now,

this effect appears to be dead, or at least dying.Read More @ RickAckerman.com

We last reported on widespread drought the United States Department of Agriculture (USDA) called “the biggest disaster in history,” in a July 31 piece called Food Prices – It’s Lights Out for Agriculture.

Today we update the situation in the context of a new QE printing

program and the outlook for the coming months. Of course, we develop our

long-held position that quickly rising food prices will trigger a

search for money of stable value.

In conjunction with the chart above, the drought is best observed in the average yield–how many bushels of corn are produced per acre. Average yield is estimated to be the smallest since 1995 at 122.0, bushels per acre, compared to estimates of 122.8 last month, averaging 147.2 last year.

Corn supply is hovering near historic lows, while this year’s crop, according to the newest USDA estimates, will be 13% less than 2011, 21 million bushels less than the September estimate. This has pushed prices closer to recent highs today, pulling wheat prices along for the ride.

Read More @ WealthCycles.com

In conjunction with the chart above, the drought is best observed in the average yield–how many bushels of corn are produced per acre. Average yield is estimated to be the smallest since 1995 at 122.0, bushels per acre, compared to estimates of 122.8 last month, averaging 147.2 last year.

Corn supply is hovering near historic lows, while this year’s crop, according to the newest USDA estimates, will be 13% less than 2011, 21 million bushels less than the September estimate. This has pushed prices closer to recent highs today, pulling wheat prices along for the ride.

Read More @ WealthCycles.com

by Greg Hunter, USAWatchdog:

The Vice Presidential debate was this week, and it was supposed to get into the real down and dirty numbers. Vice Presidents rarely make a difference in the outcome of a Presidential election, so who cares who won. I am focusing on what is not said, and both parties conveniently leave out the $85 billion a month the Fed is printing to bail out bankers and suppress interest rates. Both parties get plenty of help from the mainstream media not talking about the real issues. For example, yesterday’s USA Today ran a piece titled “Analysis: Recovery begins to look normal.” This is analysis? You’ve got to be kidding me. What is “normal” about unprecedented money printing that will total more than $1 trillion a year and interest rates frozen to near 0% until 2015? If the U.S. was in a real so-called “recovery,” the Fed would not be printing $85 billion a month in “open-ended” (unlimited) QE, or what most people simply call money printing. By the way, the IMF said this week it sees an “alarmingly high” risk of a much deeper worldwide downturn. I guess the IMF doesn’t see a recovery either.

Read More @ USAWatchdog.com

The Vice Presidential debate was this week, and it was supposed to get into the real down and dirty numbers. Vice Presidents rarely make a difference in the outcome of a Presidential election, so who cares who won. I am focusing on what is not said, and both parties conveniently leave out the $85 billion a month the Fed is printing to bail out bankers and suppress interest rates. Both parties get plenty of help from the mainstream media not talking about the real issues. For example, yesterday’s USA Today ran a piece titled “Analysis: Recovery begins to look normal.” This is analysis? You’ve got to be kidding me. What is “normal” about unprecedented money printing that will total more than $1 trillion a year and interest rates frozen to near 0% until 2015? If the U.S. was in a real so-called “recovery,” the Fed would not be printing $85 billion a month in “open-ended” (unlimited) QE, or what most people simply call money printing. By the way, the IMF said this week it sees an “alarmingly high” risk of a much deeper worldwide downturn. I guess the IMF doesn’t see a recovery either.

Read More @ USAWatchdog.com

Thank You

I'm PayPal Verified

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment