My Dear Friends,

Please note that even with the dollar up and the euro down some, the respective moves do not support a minus 11 opening in gold.

This is a pre-election operation and the MSM story helping it is that Romney will be our next president. Romney and Obama as far as gold goes are the same.

Romney said he would fire Bernanke. If the Bernanke approach is changed, national bankruptcies will follow within weeks.

I assure you the election of Romney, if it was to occur, will not change anything in the story of gold other than adding more drama.

Regards,

Jim

from Zero Hedge:

On a regular basis we are placated by commercials to satisfy our craving to know which bathroom tissue is the most absorbent; debates ‘infomercials’ assuaging our fears over which vice-presidential candidate has the best dentist; and reality-shows that comfort our ‘at least I am not as bad as…’ need; there is an inescapable reality occurring right under our propagandized nose (as we noted here). Economic Reason has gathered together the Top 15 ‘reality’ economic documentaries – so turn-on, tune-in, and drop-out of the mainstream for a few hours…

Originally posted at Economic Reason blog,

Top 15 Economic Documentaries

Posted on 09 September 2012.

1. Overdose: The Next Financial Crisis – Directed by Martin Borgs

Based on the book “Financial Fiasco”

by Johan Norberg this documentary depicts When the world’s financial

bubble blew, the solution was to lower interest rates and pump trillions

of dollars into the sick banking system. The solution is the problem,

that’s why we had a problem in the first place. Featured guests; Peter

Schiff, Gerald Celente, Dennis Hannon. ~46 min.

See the Remaining 14 @ Zero Hedge

See the Remaining 14 @ Zero Hedge

from Silver Doctors:

The cartel wasted no time on light Globex trading Sunday night, attacking both gold and silver. Both metals were treated to waterfall declines on the open, with silver smashed UNDER $33 in seconds, smashed from $33.58 to $32.98.

Read More @ Silver Doctors

The cartel wasted no time on light Globex trading Sunday night, attacking both gold and silver. Both metals were treated to waterfall declines on the open, with silver smashed UNDER $33 in seconds, smashed from $33.58 to $32.98.

Read More @ Silver Doctors

John Taylor On Poor Policy And This Recovery's Broken 'Plucking' Model

It feels different this time. It also 'looks' different this time in that our 'recovery' just is not bouncing back from its Friedman-ite 'plucked' level

to rise phoenix-like back to Potential GDP - as it is 'supposed' to. In

an excellent two-part animated series, Stanford's John 'Rule' Taylor

and Russ Roberts discuss this recovery's differences along many

variables including GDP trend reversion, percent of the population that

is working and, economic growth overall. They then go on to discuss

potential reasons for this sluggish recovery; the ongoing slump in

construction employment, the effect of housing prices on saving and

spending decisions by households, and this recovery's having been

preceded by a financial crisis. Taylor rejects these

arguments, arguing instead that the sluggish recovery can be explained

by poor economic policy decisions made by the Bush and the Obama

administrations. Simple, clear, 20 minutes of Sunday evening preparation for the week.

It feels different this time. It also 'looks' different this time in that our 'recovery' just is not bouncing back from its Friedman-ite 'plucked' level

to rise phoenix-like back to Potential GDP - as it is 'supposed' to. In

an excellent two-part animated series, Stanford's John 'Rule' Taylor

and Russ Roberts discuss this recovery's differences along many

variables including GDP trend reversion, percent of the population that

is working and, economic growth overall. They then go on to discuss

potential reasons for this sluggish recovery; the ongoing slump in

construction employment, the effect of housing prices on saving and

spending decisions by households, and this recovery's having been

preceded by a financial crisis. Taylor rejects these

arguments, arguing instead that the sluggish recovery can be explained

by poor economic policy decisions made by the Bush and the Obama

administrations. Simple, clear, 20 minutes of Sunday evening preparation for the week.ECB's Weidmann On Gold: "Money Is A Social Convention"

A few weeks ago we noted

Bundesbank president and ECB governing council member Jens Weidmann's

analogy between the Faustian bargain offered by a money-printing

Mephistopheles in Goethe's classic prose and today's ubiquitous

oh-so-tempting short-term solution to everyone's pain. His full speech

(below), while a little dramatic, should indeed strike fear into many

with its clarity. The financial power of a central bank is unlimited in principle;

it does not have to acquire beforehand the money it lends or uses for

payments. Many believe Goethe was portraying the modern economy with

its creation of paper money as a continuation of alchemy by other

means. While traditional alchemists attempted to turn lead into gold, in the modern economy, paper was made into money. Indeed, the fact that central banks can create money out of thin air, so to speak, is something that many observers are likely to find surprising and strange, perhaps mystical and dreamlike, too – or even nightmarish.

Of course, Weidmann concludes, it is important that central bankers,

who are in charge of a public good – in this case, stable money –

bolster public confidence by explaining their policies. The best protection against temptation in monetary policy is an enlightened and stability-oriented society. [and Gold!]

A few weeks ago we noted

Bundesbank president and ECB governing council member Jens Weidmann's

analogy between the Faustian bargain offered by a money-printing

Mephistopheles in Goethe's classic prose and today's ubiquitous

oh-so-tempting short-term solution to everyone's pain. His full speech

(below), while a little dramatic, should indeed strike fear into many

with its clarity. The financial power of a central bank is unlimited in principle;

it does not have to acquire beforehand the money it lends or uses for

payments. Many believe Goethe was portraying the modern economy with

its creation of paper money as a continuation of alchemy by other

means. While traditional alchemists attempted to turn lead into gold, in the modern economy, paper was made into money. Indeed, the fact that central banks can create money out of thin air, so to speak, is something that many observers are likely to find surprising and strange, perhaps mystical and dreamlike, too – or even nightmarish.

Of course, Weidmann concludes, it is important that central bankers,

who are in charge of a public good – in this case, stable money –

bolster public confidence by explaining their policies. The best protection against temptation in monetary policy is an enlightened and stability-oriented society. [and Gold!]The Meaning of "Earthquake Reading" Changes With Phases

Eric De Groot at Eric De Groot - 2 hours ago

Amir, Earthquakes or warnings before a significant trend change occur

only during D-wave declines and late stage C-wave advances at times. The

earthquake tool's bearish setups produced during A-wave advances (usually

at critical resistance) picks up the paper supply intended to delay and

reorganize the trend before the powerful C-wave rally. Do...

[[ This is a content summary only. Visit my website for full links, other

content, and more! ]]Out Of The 'Liquidity Trap' Frying Pan And Into The 'Liquidity Lure' Fire

"Liquidity trap" was a term coined by John Maynard Keynes in the aftermath of the Great Depression. He argued that when yields are low enough, expanding money supply won't stimulate growth

because bonds and cash are already near-equivalents when bonds pay

(almost) no interest. Some, like Citi's credit strategy team, would say

that it is a pretty apt description of the state of play these days.

To their minds (and ours), there is very little doubt that central banks

have played an absolutely crucial role in propping up asset prices in

recent years, Why have markets responded so resolutely when growth hasn't? The answer, we think, is that in

their attempts to free markets from the liquidity trap, central banks

are ensnaring markets in what we'll call a "liquidity lure". That lure is three pronged... but tail risks are bound to re-appear and from this position, there is no painless escape.

"Liquidity trap" was a term coined by John Maynard Keynes in the aftermath of the Great Depression. He argued that when yields are low enough, expanding money supply won't stimulate growth

because bonds and cash are already near-equivalents when bonds pay

(almost) no interest. Some, like Citi's credit strategy team, would say

that it is a pretty apt description of the state of play these days.

To their minds (and ours), there is very little doubt that central banks

have played an absolutely crucial role in propping up asset prices in

recent years, Why have markets responded so resolutely when growth hasn't? The answer, we think, is that in

their attempts to free markets from the liquidity trap, central banks

are ensnaring markets in what we'll call a "liquidity lure". That lure is three pronged... but tail risks are bound to re-appear and from this position, there is no painless escape.S&P Futures Are Testing Draghi's Dream

EURUSD

meandered for the first few hours this afternoon but as Asia opens EUR

(and AUD) weakness, USD strength and risk-off has come to pass. While

not earth-shatteringly devastating, S&P 500 futures are trading down 5 points

(8 points from opening high this evening) - their lowest in a month -

and testing critical support from the Draghi 'believe' speech spike. AUD weakness is especially notable

after opening rather strong (swing from a 0.3% gain to a 0.3% loss now

against the USD). Treasuries are still waking up (down 1bps).

EURUSD

meandered for the first few hours this afternoon but as Asia opens EUR

(and AUD) weakness, USD strength and risk-off has come to pass. While

not earth-shatteringly devastating, S&P 500 futures are trading down 5 points

(8 points from opening high this evening) - their lowest in a month -

and testing critical support from the Draghi 'believe' speech spike. AUD weakness is especially notable

after opening rather strong (swing from a 0.3% gain to a 0.3% loss now

against the USD). Treasuries are still waking up (down 1bps).About QEternity's Mortgage-Based Housing Boost?

We

know its 'early' and we should not be judging yet another QE-book by

its front-running cover; but the following four charts might give all

those hopeful that this time its different some pause for thought on the

Fed's actions being anything other than by the banks, for the banks,

and of the banks. With refi activity's burst fading, retail mortgage

rates having not budged, residential delinquencies rising once again,

and average 'approved mortgage loan' FICO score at 750, it

would seem the Fed could throw another cajillion dollars at the banks

and reserves would just inflate further (along with everything we eat,

use, and need), leaving the economy muddling through at best.

We

know its 'early' and we should not be judging yet another QE-book by

its front-running cover; but the following four charts might give all

those hopeful that this time its different some pause for thought on the

Fed's actions being anything other than by the banks, for the banks,

and of the banks. With refi activity's burst fading, retail mortgage

rates having not budged, residential delinquencies rising once again,

and average 'approved mortgage loan' FICO score at 750, it

would seem the Fed could throw another cajillion dollars at the banks

and reserves would just inflate further (along with everything we eat,

use, and need), leaving the economy muddling through at best.Can Government Create Opportunity?

The

percentage of Americans who reside in the lowest income quintile and

move up either to the middle quintile or higher has been in decline

over the past three decades. This statistic should be alarming

as it is indicative of stagnation within an economy that supposedly

fosters the entrepreneurial spirit. In a world of scarcity, opportunity

for a better life is an ever-present reality. In the marketplace,

success is achieved by making others better off. Achievement for the

state means trampling on the rights of others. One embodies the

elements of peace and cooperation which give way to fostering

incalculable opportunities to thrive. The other results in a perpetual state of conflict between those who “pay the taxes” and “those who are the recipients of their proceeds.” The state creates opportunity for latter and decimates it for the former. The

only way to set free the innovative minds who build wealth and

opportunity is to scale back this exploitive state of affairs.

The

percentage of Americans who reside in the lowest income quintile and

move up either to the middle quintile or higher has been in decline

over the past three decades. This statistic should be alarming

as it is indicative of stagnation within an economy that supposedly

fosters the entrepreneurial spirit. In a world of scarcity, opportunity

for a better life is an ever-present reality. In the marketplace,

success is achieved by making others better off. Achievement for the

state means trampling on the rights of others. One embodies the

elements of peace and cooperation which give way to fostering

incalculable opportunities to thrive. The other results in a perpetual state of conflict between those who “pay the taxes” and “those who are the recipients of their proceeds.” The state creates opportunity for latter and decimates it for the former. The

only way to set free the innovative minds who build wealth and

opportunity is to scale back this exploitive state of affairs.Did Central Bankers Kill The Single-Name CDS Market (For Now)?

The fact that the major credit indices have had to resort to 'imaginary credit' in order to generate an actionable market is perhaps the final nail in the coffin of the single-name CDS market in this cycle. An artificially low spread environment,

forced their by massive technical flows thanks to central-bankers'

financial repression has removed a natural buyer- and seller- from the

market - reducing liquidity; and combined with Dodd-Frank and more regulation (higher capital reqs), dealers are also forced to delever risk books (reducing liquidity). But, there is one glaring reason why the single-name CDS market is dying; extremely high correlation.

As Barclays notes, in a market where investors’ ears are, more than

ever, finely tuned to the statements of politicians and central banks

and the tail outcomes for the market, it makes sense for correlation to

be high – at this stage, there should be little distinction between

individual names – trading the level of systemic risk premia is the

focus. And sure enough, index (systemic) volumes is rising as

single-name (idiosyncratic risk) trading volumes and exposures are

fading fast. So what brings it back?

The fact that the major credit indices have had to resort to 'imaginary credit' in order to generate an actionable market is perhaps the final nail in the coffin of the single-name CDS market in this cycle. An artificially low spread environment,

forced their by massive technical flows thanks to central-bankers'

financial repression has removed a natural buyer- and seller- from the

market - reducing liquidity; and combined with Dodd-Frank and more regulation (higher capital reqs), dealers are also forced to delever risk books (reducing liquidity). But, there is one glaring reason why the single-name CDS market is dying; extremely high correlation.

As Barclays notes, in a market where investors’ ears are, more than

ever, finely tuned to the statements of politicians and central banks

and the tail outcomes for the market, it makes sense for correlation to

be high – at this stage, there should be little distinction between

individual names – trading the level of systemic risk premia is the

focus. And sure enough, index (systemic) volumes is rising as

single-name (idiosyncratic risk) trading volumes and exposures are

fading fast. So what brings it back?Your support is needed...

Thank You

I'm PayPal Verified

NeoCon Lindsey Graham To Introduce Bill to Arm and Finance Israel For WW III

by Susanne Posel, Occupy Corporatism:

In November, Senator Lindsey Graham will implore Congress to pledge US troops, defense and unlimited money to Israeli Prime Minister Benjamin Netanyahu should he announce a preemptive strike against Iran. In effect, Lindsey is anticipating that the UN will dissolve the sanctions against Iran and pave the way for the US to have purpose against Iran in a military threat.

Graham is working with Senator Mike Johanna to write the resolution that will be introduced to the Senate next month. He is becoming an integral influence for the Zionist agenda in his endorsement of Netanyahu’s “red line” that is meant to demonstrate rejection of Iran’s nuclear endeavors.

There is a clear division in the US Armed Forces as to what is designated a “credible threat” and what is a politically motivated attack on a sovereign nation. General Martin Dempsey, chairman of the Joint Chiefs of Staff, is one of these military professionals who do not want to comply with an order from the executive branch to strike Iran.

Read More @ OccupyCorporatism.com

from matlarson10:

from TruthNeverTold :

from The Economic Policy Journal:

Two teenagers were killed and 24 others were wounded during a city night filled with gun violence.

The youngest victim, Richard Modell, 17, died from his wounds after being shot along with a friend as the two went to meet a girl in the West Woodlawn neighborhood on the South Side Saturday night.

Richard Modell, 17, may have been targeted due to a feud between two rival gangs, one of which police say he belonged to. He and the 18-year-old were on their way to meet a girl when someone walked up and opened fire in the 6300 block of South Rhodes Avenue just before 9:30 p.m., according to police.

Read More @ The Economic Policy Journal

Two teenagers were killed and 24 others were wounded during a city night filled with gun violence.

The youngest victim, Richard Modell, 17, died from his wounds after being shot along with a friend as the two went to meet a girl in the West Woodlawn neighborhood on the South Side Saturday night.

Richard Modell, 17, may have been targeted due to a feud between two rival gangs, one of which police say he belonged to. He and the 18-year-old were on their way to meet a girl when someone walked up and opened fire in the 6300 block of South Rhodes Avenue just before 9:30 p.m., according to police.

Read More @ The Economic Policy Journal

by Zen Gardner, ZenGardner.com

This cyber false flag sabre rattling has been going on for some time.

The alternative research community is all over the various possibilities

for what the PTBs might use next to get humanity scurrying into their

next stage of control.

This cyber false flag sabre rattling has been going on for some time.

The alternative research community is all over the various possibilities

for what the PTBs might use next to get humanity scurrying into their

next stage of control.

They also probably get a sadistic kick out of all the things we try to second guess.

We don’t want to be guilty of bringing things into our reality by visualization and intention, but I maintain it’s been smart to be aware and even envision different scenarios to keep ourselves alert and prepared.

Who knows. It may just push them back and keep them from absolute total abandon in the execution of their obvious Machiavellian plans.

The Latest Never-So-Subtle Outburst: Leon Panetta looks the perfect stooge. I mean perfect. The spiritual plastic surgery on his brow to give him the “perma-cern” look even outdoes Joe Lieberman’s “I’m just a helpless Zionist protecting my persecuted people” look. Disgusting people.

Read More @ ZenGardner.com

This cyber false flag sabre rattling has been going on for some time.

The alternative research community is all over the various possibilities

for what the PTBs might use next to get humanity scurrying into their

next stage of control.

This cyber false flag sabre rattling has been going on for some time.

The alternative research community is all over the various possibilities

for what the PTBs might use next to get humanity scurrying into their

next stage of control.They also probably get a sadistic kick out of all the things we try to second guess.

We don’t want to be guilty of bringing things into our reality by visualization and intention, but I maintain it’s been smart to be aware and even envision different scenarios to keep ourselves alert and prepared.

Who knows. It may just push them back and keep them from absolute total abandon in the execution of their obvious Machiavellian plans.

The Latest Never-So-Subtle Outburst: Leon Panetta looks the perfect stooge. I mean perfect. The spiritual plastic surgery on his brow to give him the “perma-cern” look even outdoes Joe Lieberman’s “I’m just a helpless Zionist protecting my persecuted people” look. Disgusting people.

Read More @ ZenGardner.com

A

clash over the knock-on effects of monetary easing policies in the US,

Britain and other European countries led to sharp exchanges in Tokyo

among bankers and finance ministers.

by Roland Gribben, The Telegraph:

Christine Lagarde, IMF managing director, expressed concern about the

impact of the measures on developing countries, but was quickly taken to

task by Ben Bernanke, head of the US Federal Reserve.

Christine Lagarde, IMF managing director, expressed concern about the

impact of the measures on developing countries, but was quickly taken to

task by Ben Bernanke, head of the US Federal Reserve.

She told the closing session of the IMF and World Bank annual meetings that accommodating monetary policies could strain the capacity of emerging nations to absorb potentially large flows of capital and could lead to overheating and asset bubbles.

Mr Bernanke issued a statement defending the US action, rejected claims that rich countries were to blame for the huge waves of capital and maintained that the monetary easing policy had helped exports from the developing world as well as benefiting the US economy.

US policy was already under attack from emerging nations before Ms Lagarde’s intervention. Guido Mantaega, Brazil’s finance minister, said: “Advanced countries cannot count on exporting their way out of the crisis at the expense of emerging market economies. Currency wars will only compound the world’s economic difficulties.”

Read More @ Telegraph.co.uk

by Roland Gribben, The Telegraph:

Christine Lagarde, IMF managing director, expressed concern about the

impact of the measures on developing countries, but was quickly taken to

task by Ben Bernanke, head of the US Federal Reserve.

Christine Lagarde, IMF managing director, expressed concern about the

impact of the measures on developing countries, but was quickly taken to

task by Ben Bernanke, head of the US Federal Reserve.She told the closing session of the IMF and World Bank annual meetings that accommodating monetary policies could strain the capacity of emerging nations to absorb potentially large flows of capital and could lead to overheating and asset bubbles.

Mr Bernanke issued a statement defending the US action, rejected claims that rich countries were to blame for the huge waves of capital and maintained that the monetary easing policy had helped exports from the developing world as well as benefiting the US economy.

US policy was already under attack from emerging nations before Ms Lagarde’s intervention. Guido Mantaega, Brazil’s finance minister, said: “Advanced countries cannot count on exporting their way out of the crisis at the expense of emerging market economies. Currency wars will only compound the world’s economic difficulties.”

Read More @ Telegraph.co.uk

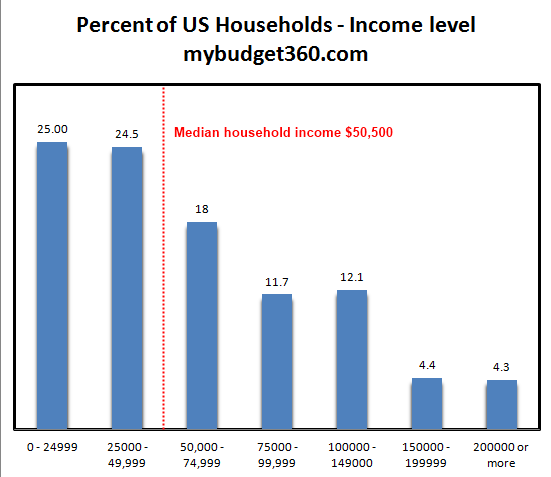

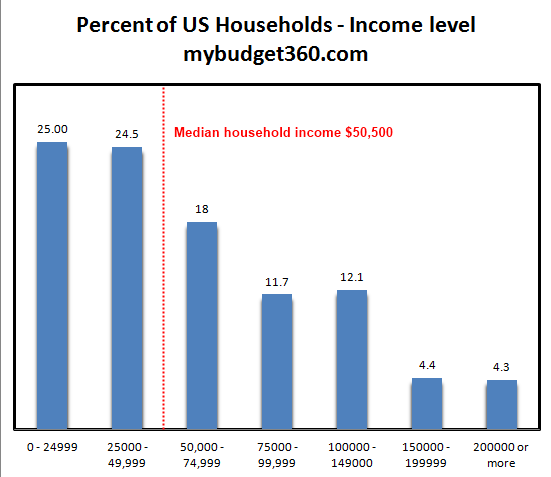

If

you call something the middle make sure you are using math. The

surprising details on median household income and per capita wages.

from MyBudget360.com:

People have a hard time wrapping their minds around household and

personal income. It is an easy enough concept to understand but some

throw around terminology that confuses the facts. For example $250,000

is not middle class income if we define it from a strictly mathematical

model. The median household income in the US is $50,500. In other words,

half make more than $50,000 and half make less. If you as an individual

made more than $250,000 that would put you in the top one percent of

all earners in the US. For households making more than $250,000 per year

this would put you in the top two percent of US households. Let us look

at the income data carefully.

People have a hard time wrapping their minds around household and

personal income. It is an easy enough concept to understand but some

throw around terminology that confuses the facts. For example $250,000

is not middle class income if we define it from a strictly mathematical

model. The median household income in the US is $50,500. In other words,

half make more than $50,000 and half make less. If you as an individual

made more than $250,000 that would put you in the top one percent of

all earners in the US. For households making more than $250,000 per year

this would put you in the top two percent of US households. Let us look

at the income data carefully.

Read More @ MyBudget360.com

from MyBudget360.com:

People have a hard time wrapping their minds around household and

personal income. It is an easy enough concept to understand but some

throw around terminology that confuses the facts. For example $250,000

is not middle class income if we define it from a strictly mathematical

model. The median household income in the US is $50,500. In other words,

half make more than $50,000 and half make less. If you as an individual

made more than $250,000 that would put you in the top one percent of

all earners in the US. For households making more than $250,000 per year

this would put you in the top two percent of US households. Let us look

at the income data carefully.

People have a hard time wrapping their minds around household and

personal income. It is an easy enough concept to understand but some

throw around terminology that confuses the facts. For example $250,000

is not middle class income if we define it from a strictly mathematical

model. The median household income in the US is $50,500. In other words,

half make more than $50,000 and half make less. If you as an individual

made more than $250,000 that would put you in the top one percent of

all earners in the US. For households making more than $250,000 per year

this would put you in the top two percent of US households. Let us look

at the income data carefully.Read More @ MyBudget360.com

by Alasdair Macleod, Gold Money:

Last Monday GoldMoney published my article showing the frightening growth in money-quantities for the US dollar.

In that article I stated that the hyperbolic rate of increase, if the

established trend is maintained, is now running at over $300bn monthly,

while the Federal Reserve is officially expanding money at only $85bn.

Last Monday GoldMoney published my article showing the frightening growth in money-quantities for the US dollar.

In that article I stated that the hyperbolic rate of increase, if the

established trend is maintained, is now running at over $300bn monthly,

while the Federal Reserve is officially expanding money at only $85bn.

The first thing to note is that the Fed issues money because it deems it necessary. The hyperbolic trend increase in the quantity of money is a reflection of this necessity, implying that if the Fed’s money issuance is at a slower rate than required, then strains will appear in the financial system. There are a number of reasons behind this monetary acceleration, not least the need to perpetuate bubbles in securities markets, but there are three major underlying problems.

Government spending

Federal government spending is accelerating, due to rapidly escalating welfare commitments, not all of which are reflected in the budget. Demographics, particularly the retirement of baby-boomers, government-sponsored healthcare, and unemployment benefits are increasing all the time; yet the tax base is contracting because of poor economic performance and tax avoidance. Furthermore, state and municipal finances are dire.

Read More @ GoldMoney.com

Last Monday GoldMoney published my article showing the frightening growth in money-quantities for the US dollar.

In that article I stated that the hyperbolic rate of increase, if the

established trend is maintained, is now running at over $300bn monthly,

while the Federal Reserve is officially expanding money at only $85bn.

Last Monday GoldMoney published my article showing the frightening growth in money-quantities for the US dollar.

In that article I stated that the hyperbolic rate of increase, if the

established trend is maintained, is now running at over $300bn monthly,

while the Federal Reserve is officially expanding money at only $85bn.The first thing to note is that the Fed issues money because it deems it necessary. The hyperbolic trend increase in the quantity of money is a reflection of this necessity, implying that if the Fed’s money issuance is at a slower rate than required, then strains will appear in the financial system. There are a number of reasons behind this monetary acceleration, not least the need to perpetuate bubbles in securities markets, but there are three major underlying problems.

Government spending

Federal government spending is accelerating, due to rapidly escalating welfare commitments, not all of which are reflected in the budget. Demographics, particularly the retirement of baby-boomers, government-sponsored healthcare, and unemployment benefits are increasing all the time; yet the tax base is contracting because of poor economic performance and tax avoidance. Furthermore, state and municipal finances are dire.

Read More @ GoldMoney.com

My Dear Friends,

Admitting reality is a prerequisite for understanding markets.

Exchanges that are public gain their value from the volume of trading. Therefore they will protect volume makers at whatever cost, even the cost of a viable future for the exchange is ignored by management and regulators in order to provide an exchange higher quoted value.

Regards,

Jim

Nanex: Investors Need to Realize The Machines Have Taken Over

The blink of an eye is a lifetime for HFT algos by Adam Taggart

Saturday, October 6, 2012, 2:24 PM

High Frequency Trading (HFT) deeply concerns Eric Hunsader, founder of Nanex. He worries that today’s investors, our regulators, — heck, even the HFT algorithms themselves — don’t fully understand the risks market prices face in the brave new era of bot-dominated trading.

For instance, Hunsader estimates that HFT algorithms are responsible for 70%(!) of all completed transactions on our exchanges, and for 99.9%(!!!) of all exchange quotes.

The pictures of trading floors you see on TV, where the people in bright jackets appear frantically busy in making their trades, have no bearing — claims Hunsader — on the actual trading action. The real action happens across fiber-optic cables, on racks of servers in cooled rooms; where an arms race defined by cable length and switching speeds is being waged

The reality is that the machines have taken over. When you buy or sell a security, the odds are extremely high the other side of the trade is being placed by an algorithm — one that cares nothing for the fundamentals of the underlying instrument. It simply is looking to make a quick profit, oftentimes measured in fractions of pennies. And this has vast repercussions for the stability and the fairness of our financial markets.

Because of speed advantages, HFT algos can see and react to prices faster than you can. Ridiculously faster. A second on the clock, to an HFT algo, is an eternity.

The deep pockets of the firms emplying HFT algos combine with this speed to move asset prices around, sometimes wildly so, faster than most of us can comprehend. In the time it takes for your "real-time" quote system to refresh, an individual stock could have traded many percetages up and/or down — and you would have no idea.

More…

Jim Sinclair’s Commentary

Now you know the inspiration for our present money. Someone was trying to tell the sheeple something.

Jim Sinclair’s Commentary

Whatever is required will be provided both in time and in cash.

IMF’s Christine Lagarde backs more time for Greece 12 October 2012 Last updated at 12:30 ET

The International Monetary Fund (IMF) head, Christine Lagarde, has backed calls for Greece to have more time to meet the targets of its bailout.

She said in a BBC debate held in Tokyo that this might be better than "frontloading heavily", or making Greece pay the most upfront.

But the biggest contributor to Greece’s bailouts, Germany, rebuffed the idea.

"We have to stick to what we announced," Germany’s Finance Minister Wolfgang Schaeuble replied.

Greece has asked for two more years to meet the spending cuts demanded by its lenders, which include the eurozone countries through its bailout funds and also the IMF.

Ms Lagarde backed the calls, but Mr Schaeuble stuck to Germany’s previous line that on the terms of the 130bn-euro (£105bn; $168bn) bailout – Greece’s second since 2010 – Athens must be held to what it agreed.

More…

Jim Sinclair’s Commentary

There was no defense force able to stave off the organized attack of the US embassy. MSM reports on the attack were brazen lies.

Why should you be surprised by the pre-election employment figures of either the pre-election crude and gold markets?

Notes From Underground

Dear Friends,

You know my position. Whatever is required will be provided in Euroland with the Fed as the swapper of last resort.

Regards,

Jim

Notes From Underground: Christine Lagarde Is Quietly Raising Her Voice Yra Harris

Click here to visit Yra’s blog…

The IMF took center stage during the last four days as its meeting in Tokyo became the central focus of the global macro world. As usual, the IMF communique promised much via the usual platitudes but as investors and traders we are left in the lurch as much is promised but no real substance is revealed. Probably the most important element in the communique is the line, “WE NEED TO ACT DECISIVELY TO BREAK NEGATIVE FEEDBACK LOOPS AND RESTORE THE GLOBAL ECONOMY TO A PATH OF STRONG,SUSTAINABLE AND BALANCED GROWTH.” Why is this simple statement so critical? In last week’s IMF-produced “World Economic Outlook,” it revealed that the IMF‘s model is probably flawed when measuring the impact of fiscal policy on economic growth.

This quote from the text is extremely important and a giant hat tip to JA for pointing me in the direction. “THE main finding, based on data for 28 economies, is that multipliers used in generating growth forecasts have been systematically too low since the Great Recession, by 0.4 to 1.2, depending on the forecast source and the specifics of the estimation approach. Informal evidence suggests that the multipliers implicitly used to generate these forecasts are about 0.5. So actual multipliers may be higher, in the range of 0.9 to 1.7.” This is a very critical statement for it is setting the rationale for the TROIKA to be able to suspend the implementation of the austerity budgets that is the basis of ESM “CONDITIONALITY” mandated by the Bundesbank. It also provides the basis for the communique’s reference to breaking negative feedback loops.

The IMF‘s work builds upon the work of the Obama administration’s best economist, Christina Romer, who unfortunately departed Washington for academia (Berkley) and left behind much mediocrity. The IMF research work is reviewed in Saturday’s Financial Times and shows the scatter graph of the 28 economies used in the study. While there is a great deal of discussion about the credibility of the study’s results, I don’t care about the academic arguments at this time. What concerns me as a trader is how the Lagarde-led IMF is going to utilize the results as push back against the German-led argument about fiscal austerity. In an October 11 AFP article, Claire Jones and Peter Spiegel reported Lagarde and Schaueble clashed over plans on European austerity. IMF Director Lagarde was pushing for increased time for Greece and Spain in meeting their promised budget numbers.

Schaeuble was openly opposed to allowing Greece or Spain more time and was not happy that Lagarde was muddying the waters, but if Merkel and Schaueble are going to desire IMF money to aid the European cause then Lagarde is going to demand some input. Ms. Lagarde said world leaders are going to have to end the programs that are “prolonging terrifying and unacceptable” levels of unemployment. Lagarde added “…. governments should no longer pursue specific debt reduction targets but focus on implementing reforms.”

The FT piece on Saturday has a sidebar that attempted to temper the dispute between Lagarde and Schaueble but the final quote can be tossed in the trash bin of European credibility: “When asked whether Greece should be acting on the prescription of the IMF, or Germany, Mr. Schaeuble said: ‘There is no difference, never. It is impossible. We always agree.’” This is more crap strewn about by the Euro politicians and certainly represents the classic rebuttal that oral contracts are not worth the paper they are printed on.

If the Lagarde position gains ascendancy over the Germans, especially as the IMF paper provides the needed cover, the Draghi policy will become much more powerful. In the near term the Outright Monetary Transaction will have a much greater impact on the near-term money and the 2-YEAR NOTES of the EU sovereigns are the key to what is to take place in determining the outcome for the debt stressed. Ten-year notes will be a trading issue but the short-term notes will be the best barometer.

***In a post-IMF conference statement, Chinese and Japanese officials say they will support the ESM. Tachiko Nakao, Japan’s Vice Finance Minister, said Japan will “positively consider” buying bonds issued by the ESM. The Chinese PBOC Deputy Governor Yi Gang also stated that China will ‘cooperate’ with the ESM. Longtime readers of NOTES know that in December 2009, it was the Chinese reneging on a promise to buy Greek 10-year notes that set into motion the drastic rise in the debt of Greece and the other Peripherals (PIIGS). China has made other promises to the Europeans about purchasing the debt of Portugal and Spain and failed to deliver.

I find the Japanese statement to be of greater interest as I wonder if the Japanese receive the support of the IMF and Europeans to weaken the YEN a quid pro quo. It was reported in a Bloomberg article on October 11 that Prime Minister Noda said in an interview that the “… Yen is a ‘serious problem’ out of step with Japan’s economic performance and ‘when necessary, we will take decisive action.’” Japanese purchases of ESM bonds and support for increased IMF funding for Europe=SERIOUS YEN INTERVENTION? Something about which to be alert so the YEN 200-day moving average and all of the YEN crosses will need to be closely watched.

***In a further comment on the IMF‘s recent World Economic Outlook, Paul Krugman added a little bit of Schadenfreude by calling the research report “… An extensive document in hand wringing.” In a Reuters article by Antoni Slodkowski and Julien Toyer, Krugman added, “kudos to the Fund for having the courage to say this, which means bucking some powerful players as well as admitting that its own analysis was flawed.” Now I await the economic voice of record to challenge the predictive models of the FED. The importance of Krugman raising his voice in support of the IMF actions is to give Lagarde further cover for action in her coming battles with the Germans and of course Jens Weidmann.

Your support is needed...

Thank You

I'm PayPal Verified

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment