from KingWorldNews:

On July 20th, the ‘London Trader’ told King World News, “The LBMA’s price fixing scheme is coming to an end.” Gold quickly rose $200 after that interview. Today the source now tells KWN the LBMA has, “… incredibly large quantities of paper silver and gold being traded each day, but the real problem here is there is virtually nothing to back this up.” The source also said, “This is all part of the LBMA Ponzi scheme.”

King World News has now released a total of three written interviews with the London Trader. This is the third in a series of blockbuster interviews which uncovers what is happening behind the scenes in the gold and silver markets. The source also discussed the incredible tightness in the physical silver market.

Robert Fitzwilson continues @ KingWorldNews.com

On July 20th, the ‘London Trader’ told King World News, “The LBMA’s price fixing scheme is coming to an end.” Gold quickly rose $200 after that interview. Today the source now tells KWN the LBMA has, “… incredibly large quantities of paper silver and gold being traded each day, but the real problem here is there is virtually nothing to back this up.” The source also said, “This is all part of the LBMA Ponzi scheme.”

King World News has now released a total of three written interviews with the London Trader. This is the third in a series of blockbuster interviews which uncovers what is happening behind the scenes in the gold and silver markets. The source also discussed the incredible tightness in the physical silver market.

Robert Fitzwilson continues @ KingWorldNews.com

from Blacklisted News:

The

frightening prospects from a derivative meltdown, well known for years,

seem to deepen with every measure to prop up a failing international

financial system. The essay Greed is Good, but Derivatives are Better, characterizes the gamble game in this fashion:

The

frightening prospects from a derivative meltdown, well known for years,

seem to deepen with every measure to prop up a failing international

financial system. The essay Greed is Good, but Derivatives are Better, characterizes the gamble game in this fashion: “The elegance of derivatives is that the rules that defy nature are not involved in intangible swaps. The basic value in the payment from the risk is always dumped on the back of the taxpayer. Ponzi schemes are legal when government croupiers spin loaded balls on their fudged roulette tables.”

Under conventional

international trading settlement, the world reserve currency is the

Dollar. The loss of confidence in the Federal Reserve System causes a

corresponding decline in value in U. S Treasury obligations. Add into

this risk equation, derivative instruments that are deadly threats that

can well destroy national currencies. One such response to this

unchecked danger can be found in a Bloomberg Businessweek perceptive

article, A Shortage of Bonds to Back Derivatives Bets, makes a stark forecast.

Read More @ BlacklistedNews.com

from Silver Vigilante:

Gold Bugs get some reassurance from the past that hoarding precious

metals is the only way to protect against the eroding effects of

hyperinflation on wealth .The BBC is reporting a “nationally

significant” hoard of Roman gold coins has been found by a metal

detectorist in Hertfordshire, UK. Chances are, judging on the sporadic

nature of his bury, this gold bug from the 5th century, was totally

freaking out about currency devaluation and government taxation. It is

likely that he didn’t have very many friends, as his monetary doom-talk

probably turned his friends and family off, as they desired to believe –

however falsely – the Roman Empire would last forever.

Gold Bugs get some reassurance from the past that hoarding precious

metals is the only way to protect against the eroding effects of

hyperinflation on wealth .The BBC is reporting a “nationally

significant” hoard of Roman gold coins has been found by a metal

detectorist in Hertfordshire, UK. Chances are, judging on the sporadic

nature of his bury, this gold bug from the 5th century, was totally

freaking out about currency devaluation and government taxation. It is

likely that he didn’t have very many friends, as his monetary doom-talk

probably turned his friends and family off, as they desired to believe –

however falsely – the Roman Empire would last forever.

This gold bug from antiquity, whose stash was found on private land north of Saint Albans managed to acquire the largest know Roman gold coin accumulation in UK history. He must’ve been freaking out. Since he never recovered his gold, SV suspects that he was executed for his wild conspiracy theories by the praetorian class of the Roman Empire. Or, perhaps this is the stash of an individual who lived far away, who wished to get his stash far away from the Roman epicenter. An ancient “Get Your Gold Out of Dodge” attempt.

Read More @ Silver Vigilante

Your support is needed...

Thank You

I'm PayPal Verified

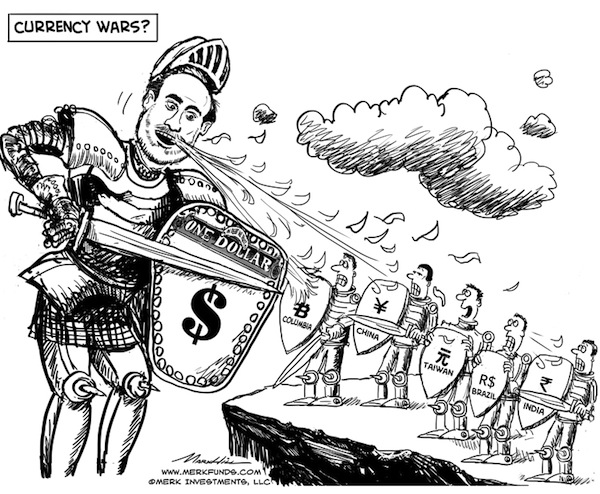

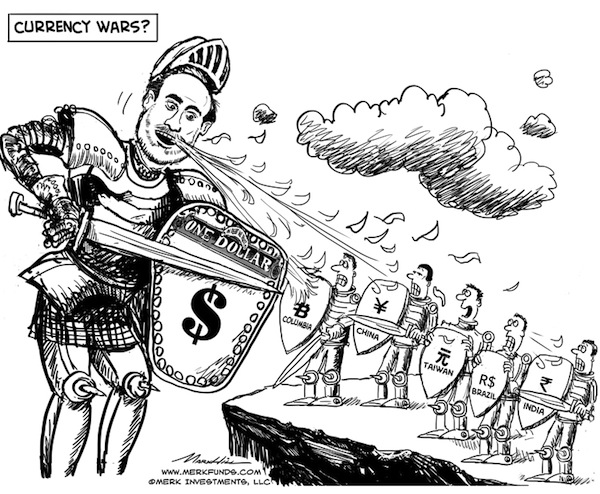

by Axel Merk, Merk Funds:

The cheapest Fed policy is one where a Fed official utters a few words

and the markets move. Rate cuts are more expensive; even more so are

emergency rate cuts and the printing of billions, then trillions of

dollars. As such, the Fed’s communication strategy may be considered

part of a war of words. Indeed, the commitment to keep interest rates

low through mid 2015 may be part of that category. But quantitative

easing goes beyond words: QE3, as it was announced last month, is the

Fed’s third round of quantitative easing, a program in which the Fed is

engaging in an open-ended program to purchase Mortgage Backed Securities

(MBS). To pay for such purchases, money is created through the strokes

of a keyboard: the Fed credits banks with “cash” in payment for MBS,

replacing MBS on bank balance sheets with Fed checking accounts. Through

the rules of fractional reserve banking, this cash can be multiplied on

to create new loans and expand the broader money supply. The money used

for the QE purchases is created out of thin air, not literally printed,

although even Bernanke has referred to this process as printing money

to illustrate the mechanics.

The cheapest Fed policy is one where a Fed official utters a few words

and the markets move. Rate cuts are more expensive; even more so are

emergency rate cuts and the printing of billions, then trillions of

dollars. As such, the Fed’s communication strategy may be considered

part of a war of words. Indeed, the commitment to keep interest rates

low through mid 2015 may be part of that category. But quantitative

easing goes beyond words: QE3, as it was announced last month, is the

Fed’s third round of quantitative easing, a program in which the Fed is

engaging in an open-ended program to purchase Mortgage Backed Securities

(MBS). To pay for such purchases, money is created through the strokes

of a keyboard: the Fed credits banks with “cash” in payment for MBS,

replacing MBS on bank balance sheets with Fed checking accounts. Through

the rules of fractional reserve banking, this cash can be multiplied on

to create new loans and expand the broader money supply. The money used

for the QE purchases is created out of thin air, not literally printed,

although even Bernanke has referred to this process as printing money

to illustrate the mechanics.

Read More @ MerkFunds.com

Gold Bugs get some reassurance from the past that hoarding precious

metals is the only way to protect against the eroding effects of

hyperinflation on wealth .The BBC is reporting a “nationally

significant” hoard of Roman gold coins has been found by a metal

detectorist in Hertfordshire, UK. Chances are, judging on the sporadic

nature of his bury, this gold bug from the 5th century, was totally

freaking out about currency devaluation and government taxation. It is

likely that he didn’t have very many friends, as his monetary doom-talk

probably turned his friends and family off, as they desired to believe –

however falsely – the Roman Empire would last forever.

Gold Bugs get some reassurance from the past that hoarding precious

metals is the only way to protect against the eroding effects of

hyperinflation on wealth .The BBC is reporting a “nationally

significant” hoard of Roman gold coins has been found by a metal

detectorist in Hertfordshire, UK. Chances are, judging on the sporadic

nature of his bury, this gold bug from the 5th century, was totally

freaking out about currency devaluation and government taxation. It is

likely that he didn’t have very many friends, as his monetary doom-talk

probably turned his friends and family off, as they desired to believe –

however falsely – the Roman Empire would last forever.This gold bug from antiquity, whose stash was found on private land north of Saint Albans managed to acquire the largest know Roman gold coin accumulation in UK history. He must’ve been freaking out. Since he never recovered his gold, SV suspects that he was executed for his wild conspiracy theories by the praetorian class of the Roman Empire. Or, perhaps this is the stash of an individual who lived far away, who wished to get his stash far away from the Roman epicenter. An ancient “Get Your Gold Out of Dodge” attempt.

Read More @ Silver Vigilante

Your support is needed...

Thank You

I'm PayPal Verified

The cheapest Fed policy is one where a Fed official utters a few words

and the markets move. Rate cuts are more expensive; even more so are

emergency rate cuts and the printing of billions, then trillions of

dollars. As such, the Fed’s communication strategy may be considered

part of a war of words. Indeed, the commitment to keep interest rates

low through mid 2015 may be part of that category. But quantitative

easing goes beyond words: QE3, as it was announced last month, is the

Fed’s third round of quantitative easing, a program in which the Fed is

engaging in an open-ended program to purchase Mortgage Backed Securities

(MBS). To pay for such purchases, money is created through the strokes

of a keyboard: the Fed credits banks with “cash” in payment for MBS,

replacing MBS on bank balance sheets with Fed checking accounts. Through

the rules of fractional reserve banking, this cash can be multiplied on

to create new loans and expand the broader money supply. The money used

for the QE purchases is created out of thin air, not literally printed,

although even Bernanke has referred to this process as printing money

to illustrate the mechanics.

The cheapest Fed policy is one where a Fed official utters a few words

and the markets move. Rate cuts are more expensive; even more so are

emergency rate cuts and the printing of billions, then trillions of

dollars. As such, the Fed’s communication strategy may be considered

part of a war of words. Indeed, the commitment to keep interest rates

low through mid 2015 may be part of that category. But quantitative

easing goes beyond words: QE3, as it was announced last month, is the

Fed’s third round of quantitative easing, a program in which the Fed is

engaging in an open-ended program to purchase Mortgage Backed Securities

(MBS). To pay for such purchases, money is created through the strokes

of a keyboard: the Fed credits banks with “cash” in payment for MBS,

replacing MBS on bank balance sheets with Fed checking accounts. Through

the rules of fractional reserve banking, this cash can be multiplied on

to create new loans and expand the broader money supply. The money used

for the QE purchases is created out of thin air, not literally printed,

although even Bernanke has referred to this process as printing money

to illustrate the mechanics.Read More @ MerkFunds.com

by Graham Summers, Gains Pains & Capital:

While the media world is abuzz with last night’s Presidential debate, I’d like to cut through the noise and present you with two truly staggering facts that need to be kept in mind as the backdrop for the US Presidential Election

Fact #1: EU leaders have stated point blank that they were asked to keep things quiet until after the election.

Regardless of your party affiliation, social views or the like, we have to ask ourselves “what was promised in return?”

If you’ve been reading me for some time, you know by now that the EU is in massive trouble. Spain is currently drawing over €400 billion from the ECB.

Read More @ GainsPainsCapital.com

While the media world is abuzz with last night’s Presidential debate, I’d like to cut through the noise and present you with two truly staggering facts that need to be kept in mind as the backdrop for the US Presidential Election

Fact #1: EU leaders have stated point blank that they were asked to keep things quiet until after the election.

Regardless of your party affiliation, social views or the like, we have to ask ourselves “what was promised in return?”

If you’ve been reading me for some time, you know by now that the EU is in massive trouble. Spain is currently drawing over €400 billion from the ECB.

Read More @ GainsPainsCapital.com

Clive Boddy: Two Papers on the Destructiveness of Psychopathy in Business and Government

[Ed. Note: Of course, just like EVERY other domestic "terror" operation, the FBI supplied the "bomb", and then "saved the day". Does this storyline EVER get old?]

The plot was a sting operation monitored by the FBI and NYPD

from NBC New York:

New York has learned that federal authorities have arrested a man they

say was plotting to attack the Federal Reserve building in Lower

Manhattan, just blocks from the World Trade Center site.

New York has learned that federal authorities have arrested a man they

say was plotting to attack the Federal Reserve building in Lower

Manhattan, just blocks from the World Trade Center site.

The man is in custody in New York. Sources tell NBC 4 New York that the suspect lives in Jamaica, Queens and was arrested Wednesday morning after he drove a van that he believed to be loaded with explosives from Long Island to Lower Manhattan. The man left the van near the Federal Reserve building and was then arrested by the FBI and NYPD.

Law enforcement officials stress that the plot was a sting operation monitored by the FBI and NYPD and the public was never at risk. The “explosives” in the van were inert, officials said.

Sources say the suspect was acting alone in the plot against the Fed, which is located at 33 Liberty St., three and 1/2 blocks from ground zero.

Read More @ NBCNewYork.com

In recent decades politicians have increasingly followed the Keynesian prescription of economic growth through continued government borrowing and the creation of undreamt of amounts of fiat money by central banks. To facilitate this process, the larger commercial banks have acted as the central banks’ de facto distribution system, and as a result have grown ever larger while accepting progressively greater risks.

In 2008, potential catastrophe loomed as the entire international financial system was challenged with collapse. But, as the ‘darlings’ of the central banks, the “too big to fail” banks were saved by taxpayer bailouts so that they could continue to play their role in the stimulus engine. But as a result of these distortions, the environment for those banks outside of the exclusive “too big to fail club” has been increasingly challenging. In the United States, the financial services industry is changing radically and many fear that the days of U.S. dominance will be coming to an end.

Read More @ EuroPacificCapital.com

This morning's New Home Starts and Building Permits was called by some 'The Most Bullish Development On The Entire Earth'. That is indeed a very bullish statement about a sector of the economy that is still running at very recessionary levels of activity. However, let's analyze the data beyond the headline to determine what is really occurring. Among the various 'surprises' are seasonal adjustments, as we saw with the retail sales, were exceptionally large in September; the underlying fundamentals, especially in the 25-35 cohorts, are simply not in place to create a sustainable upturn in housing; and the disconnect between the housing data and the real demand for construction workers. The current activity falls well within the bounds of normal volatility, and we will likely see revisions lower in the coming months ahead, as seasonal variations began to negatively impact the data towards year end. The important point, however, is that while the housing data on the surface is showing improvement the more important components to sustainability from employment to lending are not.

While patriotically buying US equities, or Intrade contracts, is 'believed' to reflexively improve the odds of the incumbent reaching a second term, the correlation between Obama's lead over Romney and stocks is actually not that high. The most highly correlated 'vehicle' for 'impacting' the odds of an Obama victory is, according to empirical data, the CRB Index.

While it is easier to listen to the narrative from world leaders and feel numb to the reality of it all, The Economist has decided enough is enough. Just as we earlier explained in simple bullet points the reality of the last few years in Europe (here), so The Economist provides this handy 'be your own global macro strategist' tool

to comprehend just what magic the markets believe will occur going

forward to keep debt levels under control across the world's

governments... (e.g. all things equal, the country would need to

grow by 7.7% a year, or nominal bond yields to fall to a Teutonic 0.5%

to stabilize government gross debt at its 2011 level of 70% of GDP).

While it is easier to listen to the narrative from world leaders and feel numb to the reality of it all, The Economist has decided enough is enough. Just as we earlier explained in simple bullet points the reality of the last few years in Europe (here), so The Economist provides this handy 'be your own global macro strategist' tool

to comprehend just what magic the markets believe will occur going

forward to keep debt levels under control across the world's

governments... (e.g. all things equal, the country would need to

grow by 7.7% a year, or nominal bond yields to fall to a Teutonic 0.5%

to stabilize government gross debt at its 2011 level of 70% of GDP).

Quazi

Mohammad Rezwanul Ahsan Nafis (Nafis), 21, was arrested this morning

in downtown Manhattan after he allegedly attempted to detonate what he

believed to be a 1,000-pound bomb at the New York Federal Reserve Bank

on Liberty Street in lower Manhattan’s financial district. The

defendant faces charges of attempting to use a weapon of mass

destruction and attempting to provide material support to al Qaeda. The

arrest of Nafis was the culmination of an undercover operation during

which he was closely monitored by the FBI New York Field Office’s Joint

Terrorism Task Force (JTTF). The explosives that he allegedly sought

and attempted to use had been rendered inoperable by law enforcement

and posed no threat to the public. The charges were announced by Loretta

E. Lynch, United States Attorney for the Eastern District of New York;

Lisa Monaco, Assistant Attorney General for National Security; Mary E.

Galligan, Acting Assistant Director in Charge, Federal Bureau of

Investigation, New York Field Office (FBI); and Raymond W. Kelly,

Commissioner, New York City Police Department (NYPD).

Quazi

Mohammad Rezwanul Ahsan Nafis (Nafis), 21, was arrested this morning

in downtown Manhattan after he allegedly attempted to detonate what he

believed to be a 1,000-pound bomb at the New York Federal Reserve Bank

on Liberty Street in lower Manhattan’s financial district. The

defendant faces charges of attempting to use a weapon of mass

destruction and attempting to provide material support to al Qaeda. The

arrest of Nafis was the culmination of an undercover operation during

which he was closely monitored by the FBI New York Field Office’s Joint

Terrorism Task Force (JTTF). The explosives that he allegedly sought

and attempted to use had been rendered inoperable by law enforcement

and posed no threat to the public. The charges were announced by Loretta

E. Lynch, United States Attorney for the Eastern District of New York;

Lisa Monaco, Assistant Attorney General for National Security; Mary E.

Galligan, Acting Assistant Director in Charge, Federal Bureau of

Investigation, New York Field Office (FBI); and Raymond W. Kelly,

Commissioner, New York City Police Department (NYPD).

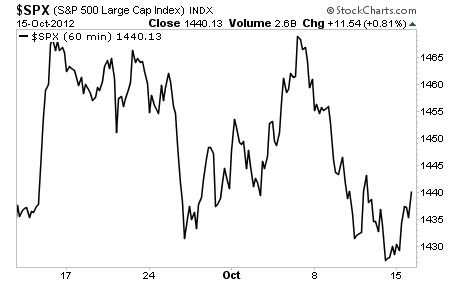

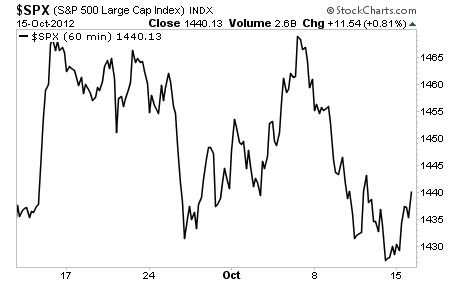

IBM

weighed on the Dow - much to the chagrin of the mainstream media - but

if they'd replaced IBM with AAPL things would have been just as ugly

(if not worse). The tech-darling dumped after trying to ramp in the

last hour and once again failing at VWAP on heavy volume as the big boys

exited. S&P futures auctioned up to QEtc. spike levels and were

unable to get through but still had a solid day. Interestingly, while

today was an 'uncorrelated' day across risk assets, the rise in

Treasury yields, rise in stocks, drop in Gold, and drop in USD has

brought them all back together in sync post-QEtc. - from here who knows? Credit markets tracked equities generally - but HYG and LQD saw major volume spikes early on this morning (looked like HYG sells and LQD buys). VIX limped sideways

most of the day - falling 0.14vols to 15.08% (though for the year

remains on average at a high premium to realized). The USD is down 0.85%

for the week with EUR back above 1.31 and only JPY weaker vs USD among the majors.

IBM

weighed on the Dow - much to the chagrin of the mainstream media - but

if they'd replaced IBM with AAPL things would have been just as ugly

(if not worse). The tech-darling dumped after trying to ramp in the

last hour and once again failing at VWAP on heavy volume as the big boys

exited. S&P futures auctioned up to QEtc. spike levels and were

unable to get through but still had a solid day. Interestingly, while

today was an 'uncorrelated' day across risk assets, the rise in

Treasury yields, rise in stocks, drop in Gold, and drop in USD has

brought them all back together in sync post-QEtc. - from here who knows? Credit markets tracked equities generally - but HYG and LQD saw major volume spikes early on this morning (looked like HYG sells and LQD buys). VIX limped sideways

most of the day - falling 0.14vols to 15.08% (though for the year

remains on average at a high premium to realized). The USD is down 0.85%

for the week with EUR back above 1.31 and only JPY weaker vs USD among the majors.

The plot was a sting operation monitored by the FBI and NYPD

from NBC New York:

New York has learned that federal authorities have arrested a man they

say was plotting to attack the Federal Reserve building in Lower

Manhattan, just blocks from the World Trade Center site.

New York has learned that federal authorities have arrested a man they

say was plotting to attack the Federal Reserve building in Lower

Manhattan, just blocks from the World Trade Center site.The man is in custody in New York. Sources tell NBC 4 New York that the suspect lives in Jamaica, Queens and was arrested Wednesday morning after he drove a van that he believed to be loaded with explosives from Long Island to Lower Manhattan. The man left the van near the Federal Reserve building and was then arrested by the FBI and NYPD.

Law enforcement officials stress that the plot was a sting operation monitored by the FBI and NYPD and the public was never at risk. The “explosives” in the van were inert, officials said.

Sources say the suspect was acting alone in the plot against the Fed, which is located at 33 Liberty St., three and 1/2 blocks from ground zero.

Read More @ NBCNewYork.com

Banks Punished For Central Bank and Political Errors

by John Browne, Euro Pacific Capital:

In recent decades politicians have increasingly followed the Keynesian prescription of economic growth through continued government borrowing and the creation of undreamt of amounts of fiat money by central banks. To facilitate this process, the larger commercial banks have acted as the central banks’ de facto distribution system, and as a result have grown ever larger while accepting progressively greater risks.

In 2008, potential catastrophe loomed as the entire international financial system was challenged with collapse. But, as the ‘darlings’ of the central banks, the “too big to fail” banks were saved by taxpayer bailouts so that they could continue to play their role in the stimulus engine. But as a result of these distortions, the environment for those banks outside of the exclusive “too big to fail club” has been increasingly challenging. In the United States, the financial services industry is changing radically and many fear that the days of U.S. dominance will be coming to an end.

Read More @ EuroPacificCapital.com

Och-Ziff Calls Top Of "REO-To-Rental", And Distressed Housing Demand, With Exit Of Landlord Business

The primary, if not only, reason there has been a brief spike in subsidized demand for housing in recent months, has been the GSE/FHFA endorsed REO-To-Rental plan, and associated securitization conduits, in which large asset managers have been encouraged to take advantage of government funded, risk-free financing (and entirely bypassing banks who have given up on loan origination due to legacy liability issues which have every bank tied up in litigation from now until Feddom come - just see today's Bank of America results) and purchase foreclosed properties in bulk, with the intention of converting them into rental properties. Needless to say, the subsidization of this wholesale purchasing of foreclosures, coupled with the ongoing "foreclosure stuffing" pursued by the big banks (as a reminder days to foreclose in California just hit a record 1,072 per RealtyTrac as banks simply refuse to clear housing inventory faster knowing full well withheld inventory is an additional clearing price subsidy) is the main reason why the punditry has been confused into believing there is a housing rebound. That this "rebound" is merely a subsidized demand pull phenomenon a la the "cash for clunkers" auto sales program is patently clear to most. Nonetheless what little confusion is left, is finally coming to an end, thanks to none other than one of the first entrants in the REO-To-Rental space, $31 billion hedge fund Och Ziff, which a year after entering the program with hopes of quick riches, is now looking to cash out.Housing Starts And Permits: Euphoria May Be Premature

This morning's New Home Starts and Building Permits was called by some 'The Most Bullish Development On The Entire Earth'. That is indeed a very bullish statement about a sector of the economy that is still running at very recessionary levels of activity. However, let's analyze the data beyond the headline to determine what is really occurring. Among the various 'surprises' are seasonal adjustments, as we saw with the retail sales, were exceptionally large in September; the underlying fundamentals, especially in the 25-35 cohorts, are simply not in place to create a sustainable upturn in housing; and the disconnect between the housing data and the real demand for construction workers. The current activity falls well within the bounds of normal volatility, and we will likely see revisions lower in the coming months ahead, as seasonal variations began to negatively impact the data towards year end. The important point, however, is that while the housing data on the surface is showing improvement the more important components to sustainability from employment to lending are not.

Why Obama Supporters Should Buy Commodities, Not Stocks

While patriotically buying US equities, or Intrade contracts, is 'believed' to reflexively improve the odds of the incumbent reaching a second term, the correlation between Obama's lead over Romney and stocks is actually not that high. The most highly correlated 'vehicle' for 'impacting' the odds of an Obama victory is, according to empirical data, the CRB Index.

Be Your Own Global Macro Strategist

While it is easier to listen to the narrative from world leaders and feel numb to the reality of it all, The Economist has decided enough is enough. Just as we earlier explained in simple bullet points the reality of the last few years in Europe (here), so The Economist provides this handy 'be your own global macro strategist' tool

to comprehend just what magic the markets believe will occur going

forward to keep debt levels under control across the world's

governments... (e.g. all things equal, the country would need to

grow by 7.7% a year, or nominal bond yields to fall to a Teutonic 0.5%

to stabilize government gross debt at its 2011 level of 70% of GDP).

While it is easier to listen to the narrative from world leaders and feel numb to the reality of it all, The Economist has decided enough is enough. Just as we earlier explained in simple bullet points the reality of the last few years in Europe (here), so The Economist provides this handy 'be your own global macro strategist' tool

to comprehend just what magic the markets believe will occur going

forward to keep debt levels under control across the world's

governments... (e.g. all things equal, the country would need to

grow by 7.7% a year, or nominal bond yields to fall to a Teutonic 0.5%

to stabilize government gross debt at its 2011 level of 70% of GDP).Full FBI Statement On Arrest Of Fed-a-Bomber Suspect Quazi Nafis, Who Worked "On Behalf Of al Qaeda"

Quazi

Mohammad Rezwanul Ahsan Nafis (Nafis), 21, was arrested this morning

in downtown Manhattan after he allegedly attempted to detonate what he

believed to be a 1,000-pound bomb at the New York Federal Reserve Bank

on Liberty Street in lower Manhattan’s financial district. The

defendant faces charges of attempting to use a weapon of mass

destruction and attempting to provide material support to al Qaeda. The

arrest of Nafis was the culmination of an undercover operation during

which he was closely monitored by the FBI New York Field Office’s Joint

Terrorism Task Force (JTTF). The explosives that he allegedly sought

and attempted to use had been rendered inoperable by law enforcement

and posed no threat to the public. The charges were announced by Loretta

E. Lynch, United States Attorney for the Eastern District of New York;

Lisa Monaco, Assistant Attorney General for National Security; Mary E.

Galligan, Acting Assistant Director in Charge, Federal Bureau of

Investigation, New York Field Office (FBI); and Raymond W. Kelly,

Commissioner, New York City Police Department (NYPD).

Quazi

Mohammad Rezwanul Ahsan Nafis (Nafis), 21, was arrested this morning

in downtown Manhattan after he allegedly attempted to detonate what he

believed to be a 1,000-pound bomb at the New York Federal Reserve Bank

on Liberty Street in lower Manhattan’s financial district. The

defendant faces charges of attempting to use a weapon of mass

destruction and attempting to provide material support to al Qaeda. The

arrest of Nafis was the culmination of an undercover operation during

which he was closely monitored by the FBI New York Field Office’s Joint

Terrorism Task Force (JTTF). The explosives that he allegedly sought

and attempted to use had been rendered inoperable by law enforcement

and posed no threat to the public. The charges were announced by Loretta

E. Lynch, United States Attorney for the Eastern District of New York;

Lisa Monaco, Assistant Attorney General for National Security; Mary E.

Galligan, Acting Assistant Director in Charge, Federal Bureau of

Investigation, New York Field Office (FBI); and Raymond W. Kelly,

Commissioner, New York City Police Department (NYPD).AAPL At Lows, S&P At Highs And Bonds Catch Up To Stocks

IBM

weighed on the Dow - much to the chagrin of the mainstream media - but

if they'd replaced IBM with AAPL things would have been just as ugly

(if not worse). The tech-darling dumped after trying to ramp in the

last hour and once again failing at VWAP on heavy volume as the big boys

exited. S&P futures auctioned up to QEtc. spike levels and were

unable to get through but still had a solid day. Interestingly, while

today was an 'uncorrelated' day across risk assets, the rise in

Treasury yields, rise in stocks, drop in Gold, and drop in USD has

brought them all back together in sync post-QEtc. - from here who knows? Credit markets tracked equities generally - but HYG and LQD saw major volume spikes early on this morning (looked like HYG sells and LQD buys). VIX limped sideways

most of the day - falling 0.14vols to 15.08% (though for the year

remains on average at a high premium to realized). The USD is down 0.85%

for the week with EUR back above 1.31 and only JPY weaker vs USD among the majors.

IBM

weighed on the Dow - much to the chagrin of the mainstream media - but

if they'd replaced IBM with AAPL things would have been just as ugly

(if not worse). The tech-darling dumped after trying to ramp in the

last hour and once again failing at VWAP on heavy volume as the big boys

exited. S&P futures auctioned up to QEtc. spike levels and were

unable to get through but still had a solid day. Interestingly, while

today was an 'uncorrelated' day across risk assets, the rise in

Treasury yields, rise in stocks, drop in Gold, and drop in USD has

brought them all back together in sync post-QEtc. - from here who knows? Credit markets tracked equities generally - but HYG and LQD saw major volume spikes early on this morning (looked like HYG sells and LQD buys). VIX limped sideways

most of the day - falling 0.14vols to 15.08% (though for the year

remains on average at a high premium to realized). The USD is down 0.85%

for the week with EUR back above 1.31 and only JPY weaker vs USD among the majors.

by Mac Slavo, SHTFPlan:

Up until recently the existence of a national “red list” of domestic dissidents and potential terrorists existed only within the realm of conspiracy theory and Hollywood story lines.

But what if such a red list did exist?

What if all of those tracking and monitoring mechanisms being put into place by the Department of Homeland Security, the National Security Administration and the Central Intelligence Agency are now being utilized to identify and take action against American citizens who may pose a perceived threat to the security and stability of the United States government?

Yes, it sounds like something out of a science fiction novel, but you’d better believe that it’s happening, and it’s happening right here and now.

Read More @ SHTFPlan.com

Up until recently the existence of a national “red list” of domestic dissidents and potential terrorists existed only within the realm of conspiracy theory and Hollywood story lines.

But what if such a red list did exist?

What if all of those tracking and monitoring mechanisms being put into place by the Department of Homeland Security, the National Security Administration and the Central Intelligence Agency are now being utilized to identify and take action against American citizens who may pose a perceived threat to the security and stability of the United States government?

Yes, it sounds like something out of a science fiction novel, but you’d better believe that it’s happening, and it’s happening right here and now.

Read More @ SHTFPlan.com

from Testosterone Pit.com:

Softbank’s announcement to buy 70% of Sprint Nextel Corp. for $20.1

billion caused its stock to plunge 17% in Japan that day. Investors had

been through it before: a company pays way too much to accomplish its

CEO’s megalomaniac goals, only to get mired in a corporate culture

clash, faulty execution, and other overseas nightmares. Past performance

isn’t exactly an endorsement: from 2000 to 2011, the net amount of

market value lost by Japanese acquirers a year after deal announcement

was $330 billion—a “terrible” track record.

Softbank’s announcement to buy 70% of Sprint Nextel Corp. for $20.1

billion caused its stock to plunge 17% in Japan that day. Investors had

been through it before: a company pays way too much to accomplish its

CEO’s megalomaniac goals, only to get mired in a corporate culture

clash, faulty execution, and other overseas nightmares. Past performance

isn’t exactly an endorsement: from 2000 to 2011, the net amount of

market value lost by Japanese acquirers a year after deal announcement

was $330 billion—a “terrible” track record.

The Softbank announcement was the most visible part of Japan Inc.’s pursuit of foreign interests. But in its shadow, Japanese companies are quietly heading hand-in-hand with the Japanese government into iffier areas, like Bangladesh, where they struggle with the most basic impediments to investment.

Read More @ TestosteronePit.com

Softbank’s announcement to buy 70% of Sprint Nextel Corp. for $20.1

billion caused its stock to plunge 17% in Japan that day. Investors had

been through it before: a company pays way too much to accomplish its

CEO’s megalomaniac goals, only to get mired in a corporate culture

clash, faulty execution, and other overseas nightmares. Past performance

isn’t exactly an endorsement: from 2000 to 2011, the net amount of

market value lost by Japanese acquirers a year after deal announcement

was $330 billion—a “terrible” track record.

Softbank’s announcement to buy 70% of Sprint Nextel Corp. for $20.1

billion caused its stock to plunge 17% in Japan that day. Investors had

been through it before: a company pays way too much to accomplish its

CEO’s megalomaniac goals, only to get mired in a corporate culture

clash, faulty execution, and other overseas nightmares. Past performance

isn’t exactly an endorsement: from 2000 to 2011, the net amount of

market value lost by Japanese acquirers a year after deal announcement

was $330 billion—a “terrible” track record.The Softbank announcement was the most visible part of Japan Inc.’s pursuit of foreign interests. But in its shadow, Japanese companies are quietly heading hand-in-hand with the Japanese government into iffier areas, like Bangladesh, where they struggle with the most basic impediments to investment.

Read More @ TestosteronePit.com

Leftist media denial fails to stem DELUGE of offensive Tweets

by Paul Joseph Watson, InfoWars:

by Paul Joseph Watson, InfoWars:

Despite Obama front groups like Think Progress

desperately attempting to deny the legitimacy of the issue, Twitter

continues to be flooded with threats by Obama supporters to riot if Mitt

Romney wins the election.

As we reported earlier,

not only are Obama supporters threatening to cause mayhem in American

cities if Obama loses, they are also making direct death threats against

Mitt Romney.

A talking point floated by Obama campaign fronts like Think Progress has attempted to characterize the story as

a non-issue driven by racism, and yet such denials have failed to stem

the deluge of threats to cause chaos which continue to pour forth from

Obama supporters.

Read More @ InfoWars.com

by Mike Shedlock, Global Economic Analysis:

I wish I was making this up, and it certainly sounds like it’s

something straight out of The Onion, yet here it is, on a Washington

Post headline: French president pushing homework ban as part of ed

reforms.

I wish I was making this up, and it certainly sounds like it’s

something straight out of The Onion, yet here it is, on a Washington

Post headline: French president pushing homework ban as part of ed

reforms.

Reason for the homework ban?

Francois Hollande doesn’t think it is fair that some kids get homework help from their parents while children who come from disadvantaged families don’t.

Instead, Hollande wants to hire more teachers without saying where the money will come from (but you know the answer is tax hikes).

He also wants to increase the length of the school week from four days to four-and-a-half days. Note that school days in France start at 8:30 a.m. and end at 4:30 p.m.

Read More @ GlobalEconomicAnalysis.blogspot.com

I wish I was making this up, and it certainly sounds like it’s

something straight out of The Onion, yet here it is, on a Washington

Post headline: French president pushing homework ban as part of ed

reforms.

I wish I was making this up, and it certainly sounds like it’s

something straight out of The Onion, yet here it is, on a Washington

Post headline: French president pushing homework ban as part of ed

reforms.Reason for the homework ban?

Francois Hollande doesn’t think it is fair that some kids get homework help from their parents while children who come from disadvantaged families don’t.

Instead, Hollande wants to hire more teachers without saying where the money will come from (but you know the answer is tax hikes).

He also wants to increase the length of the school week from four days to four-and-a-half days. Note that school days in France start at 8:30 a.m. and end at 4:30 p.m.

Read More @ GlobalEconomicAnalysis.blogspot.com

from Blacklisted News:

What a fascinating thing! Total control of a living organism! — psychologist B.F. Skinner

What a fascinating thing! Total control of a living organism! — psychologist B.F. Skinner

The corporatization of society requires a population that accepts control by authorities, and so when psychologists and psychiatrists began providing techniques that could control people, the corporatocracy embraced mental health professionals.

In psychologist B.F. Skinner’s best-selling book Beyond Freedom and Dignity (1971), he argued that freedom and dignity are illusions that hinder the science of behavior modification, which he claimed could create a better-organized and happier society.

During the height of Skinner’s fame in the 1970s, it was obvious to anti-authoritarians such as Noam Chomsky (“The Case Against B.F. Skinner”) and Lewis Mumord that Skinner’s worldview—a society ruled by benevolent control freaks—was antithetical to democracy. In Skinner’s novel Walden Two (1948), his behaviorist hero states, “We do not take history seriously,” to which Lewis Mumford retorted, “And no wonder: if man knew no history, the Skinners would govern the world, as Skinner himself has modestly proposed in his behaviorist utopia.”

Read More @ BlacklistedNews.com

Your support is needed...

Thank You

I'm PayPal Verified

What a fascinating thing! Total control of a living organism! — psychologist B.F. Skinner

What a fascinating thing! Total control of a living organism! — psychologist B.F. Skinner

The corporatization of society requires a population that accepts control by authorities, and so when psychologists and psychiatrists began providing techniques that could control people, the corporatocracy embraced mental health professionals.

In psychologist B.F. Skinner’s best-selling book Beyond Freedom and Dignity (1971), he argued that freedom and dignity are illusions that hinder the science of behavior modification, which he claimed could create a better-organized and happier society.

During the height of Skinner’s fame in the 1970s, it was obvious to anti-authoritarians such as Noam Chomsky (“The Case Against B.F. Skinner”) and Lewis Mumord that Skinner’s worldview—a society ruled by benevolent control freaks—was antithetical to democracy. In Skinner’s novel Walden Two (1948), his behaviorist hero states, “We do not take history seriously,” to which Lewis Mumford retorted, “And no wonder: if man knew no history, the Skinners would govern the world, as Skinner himself has modestly proposed in his behaviorist utopia.”

Read More @ BlacklistedNews.com

Your support is needed...

Thank You

I'm PayPal Verified

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment