by Angela Monaghan, The Telegraph:

Greece could leave the eurozone within the next six months, the Swedish finance minister Anders Borg has warned.

Greece could leave the eurozone within the next six months, the Swedish finance minister Anders Borg has warned.“It’s most probable that they will leave,” Mr Borg said, speaking from the annual meetings of the International Monetary Fund in Tokyo.

“We shouldn’t rule out this happening in the next half-year.”

His comments came before a meeting of European Union leaders in Brussels on October 18-19, to discuss strengthening economic and monetary ties in a bid to restore confidence in the single currency.

Mr Borg said a Greek exit was unlikely to have a major impact on markets because “in practice everyone already understands which way the wind is blowing.”

Read More @ Telegraph.co.uk

King World News received the following communication from the largest bullion dealer in Norway. The source wrote to KWN, “Today was not a good day being a Norwegian and believer in personal freedom. Attached are some thoughts from Norway.” This King World News exclusive piece was written by Martin Mesicek of Gold Source, and he concludes the report by discussing what citizens of the EU are doing right now in the gold and silver markets.

October 13, 2012 (King World News) – This is further evidence of how disconnected the political elite has become from the people. I wonder what the citizens of troubled EU countries feel about a peace prize being awarded to a technocratic elitist project that has practically tied the hands and feet of any sovereign fiscal response to the ongoing crises by governments in countries such as those of Greece and Spain. I can only hope they are laughing. The troika’s demand for cuts and slow and painful structural reforms, in exchange for further indebtedness, does not create peace in Europe — quite the opposite. This is evident in the streets, where riots and protests are growing in intensity.

Read More @ KingWorldNews.com

from MyBudget360.com:

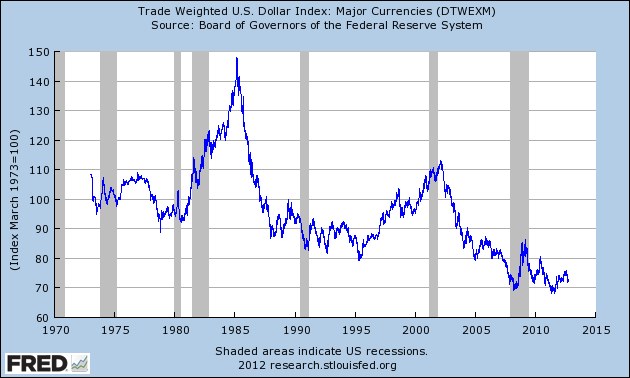

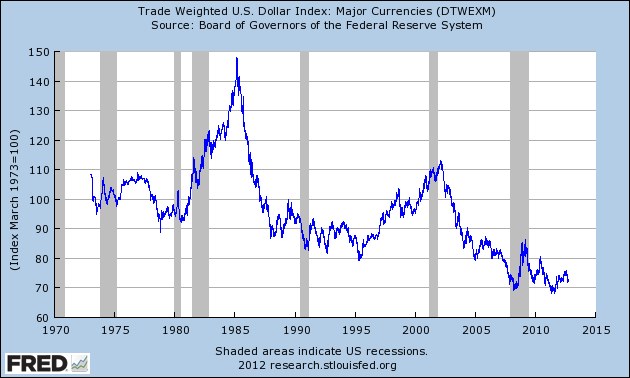

There is certainly a cost to a falling US dollar.

Many Americans are living the consequences of this multi-decade long

trend. The Federal Reserve has only added fuel to this trend but many

families are now realizing that there does come a cost to unrelenting

debt based solutions to fiscal problems. Shopping at the local grocery

store I’ve noticed that some items have doubled in the last few years.

Fueling up is also more expensive. The issue with living on a low

dollar policy is that eventually, you end up in a low wage capitalist

system. The easy money slowly inflates away especially on global

items. We are seeing this in the US in various arenas especially with higher education.

The end result is that the standard of living for the vast majority of

Americans has fallen dramatically in the last few decades.

There is certainly a cost to a falling US dollar.

Many Americans are living the consequences of this multi-decade long

trend. The Federal Reserve has only added fuel to this trend but many

families are now realizing that there does come a cost to unrelenting

debt based solutions to fiscal problems. Shopping at the local grocery

store I’ve noticed that some items have doubled in the last few years.

Fueling up is also more expensive. The issue with living on a low

dollar policy is that eventually, you end up in a low wage capitalist

system. The easy money slowly inflates away especially on global

items. We are seeing this in the US in various arenas especially with higher education.

The end result is that the standard of living for the vast majority of

Americans has fallen dramatically in the last few decades.

Read More @ MyBudget360.com

There is certainly a cost to a falling US dollar.

Many Americans are living the consequences of this multi-decade long

trend. The Federal Reserve has only added fuel to this trend but many

families are now realizing that there does come a cost to unrelenting

debt based solutions to fiscal problems. Shopping at the local grocery

store I’ve noticed that some items have doubled in the last few years.

Fueling up is also more expensive. The issue with living on a low

dollar policy is that eventually, you end up in a low wage capitalist

system. The easy money slowly inflates away especially on global

items. We are seeing this in the US in various arenas especially with higher education.

The end result is that the standard of living for the vast majority of

Americans has fallen dramatically in the last few decades.

There is certainly a cost to a falling US dollar.

Many Americans are living the consequences of this multi-decade long

trend. The Federal Reserve has only added fuel to this trend but many

families are now realizing that there does come a cost to unrelenting

debt based solutions to fiscal problems. Shopping at the local grocery

store I’ve noticed that some items have doubled in the last few years.

Fueling up is also more expensive. The issue with living on a low

dollar policy is that eventually, you end up in a low wage capitalist

system. The easy money slowly inflates away especially on global

items. We are seeing this in the US in various arenas especially with higher education.

The end result is that the standard of living for the vast majority of

Americans has fallen dramatically in the last few decades.Read More @ MyBudget360.com

US budget deficit dips $207 billion but still tops $1 trillion for a fourth straight year

by Martin Crutsinger, Yahoo Finance:

The United States has now spent $1 trillion more than it’s taken in for four straight years.

The United States has now spent $1 trillion more than it’s taken in for four straight years.

The Treasury Department confirmed Friday what was widely expected: The deficit for the just-ended 2012 budget year — the gap between the government’s tax revenue and its spending — totaled $1.1 trillion. Put simply, that’s how much the government had to borrow.

It wasn’t quite as ugly as last year. Tax revenue rose 6.4 percent from 2011 to $2.45 trillion. And spending fell 1.7 percent to $3.5 trillion. As a result, the deficit shrank 16 percent, or $207 billion.

A stronger economy meant more people had jobs and income that generated tax revenue. Corporations also contributed more to federal revenue than in 2011.

The government spent less on Medicaid and on defense as U.S. military involvement in Iraq was winding down.

Read More @ Finance.Yahoo.com

Your support is needed...

Thank You

I'm PayPal Verified

by Martin Crutsinger, Yahoo Finance:

The United States has now spent $1 trillion more than it’s taken in for four straight years.

The United States has now spent $1 trillion more than it’s taken in for four straight years.The Treasury Department confirmed Friday what was widely expected: The deficit for the just-ended 2012 budget year — the gap between the government’s tax revenue and its spending — totaled $1.1 trillion. Put simply, that’s how much the government had to borrow.

It wasn’t quite as ugly as last year. Tax revenue rose 6.4 percent from 2011 to $2.45 trillion. And spending fell 1.7 percent to $3.5 trillion. As a result, the deficit shrank 16 percent, or $207 billion.

A stronger economy meant more people had jobs and income that generated tax revenue. Corporations also contributed more to federal revenue than in 2011.

The government spent less on Medicaid and on defense as U.S. military involvement in Iraq was winding down.

Read More @ Finance.Yahoo.com

Your support is needed...

Thank You

I'm PayPal Verified

The 21st Century Monolith

For all intents and purposes, there have been two US Presidents thus far in the 21st century - George Bush (the younger) and Barack Obama. If we take Mr Bush’s two terms to cover fiscal 2001 to fiscal 2008, the total rise in official Treasury funded debt over that period was $US 4.350 TRILLION. If we take Mr Obama’s first term to cover fiscal 2009 to fiscal 2012, the rise over four years was $US 6.050 TRILLION. Add the two together and you get a grand total of $US 10.4 TRILLION. That’s almost two thirds (65 percent) of the total funded debt of $US 16.066 TRILLION as of September 28, 2012.Beta Testing QE 4 - "Large Amount" Of $100 Bills Stolen From Federal Reserve

A month ago,

just before the launch of QEternity, we caught a rare glimpse of what

may be the beta test of one of the Fed's latest ploys in

"unconventional monetary easing" when bank robbers decided to throw

money out of their car in central LA during a police pursuit. Today, a

month later, and 4 weeks after Bernanke's latest open-ended monetary

easing, incorrectly reference virtually everywhere as QE3 (as Twist has

had more flow impact on the market than QE 1 and 2 combined) has

proven to be, at least so far, an absolute failure, we learn what

perhaps may be an even more "effective" approach to juicing the

monetary supply with quite literally brand new, freshly printed

Benjamins (the Franklin varietal; the Bernanke will

have one or more separator commas). From AP: "Federal authorities are

warning merchants to be on the lookout for stolen $100 bills that aren't

supposed to go into circulation until next year. The bills were stolen from an airplane that landed in Philadelphia from Dallas Thursday morning. The plane had been transporting money from the Federal Reserve facility in Dallas."

A month ago,

just before the launch of QEternity, we caught a rare glimpse of what

may be the beta test of one of the Fed's latest ploys in

"unconventional monetary easing" when bank robbers decided to throw

money out of their car in central LA during a police pursuit. Today, a

month later, and 4 weeks after Bernanke's latest open-ended monetary

easing, incorrectly reference virtually everywhere as QE3 (as Twist has

had more flow impact on the market than QE 1 and 2 combined) has

proven to be, at least so far, an absolute failure, we learn what

perhaps may be an even more "effective" approach to juicing the

monetary supply with quite literally brand new, freshly printed

Benjamins (the Franklin varietal; the Bernanke will

have one or more separator commas). From AP: "Federal authorities are

warning merchants to be on the lookout for stolen $100 bills that aren't

supposed to go into circulation until next year. The bills were stolen from an airplane that landed in Philadelphia from Dallas Thursday morning. The plane had been transporting money from the Federal Reserve facility in Dallas."The US Fiscal 'Moment': Cliff, Slope, Or Wile E. Coyote?

The overhwelming majority of investors seem to believe that some compromise will be reached to resolve the looming fiscal drag, and as we noted here,

this fact is more than priced into markets. As Barclays notes however,

a big deal that encompasses entitlement and tax reform is very

unlikely before year-end. Hence, if the ‘cliff’ is avoided, it will be

because Congress extends all expiring provisions for some time while it

works on a bigger deal. Such an 'extension/compromise' move would not reduce investor uncertainty if it were only for a few months; bond markets would simply start counting down to the new date. More importantly, the discussion about the fiscal cliff misses a broader point: the US will probably have significant fiscal tightening over the next decade that is a drag on medium-term growth.

Yet more investors dismiss last year's reaction to the debt-ceiling

debate - a 17% decline in 2 weeks - as any kind of precedent, claiming

(falsely) that this was more due to European financial difficulties. We

expect fiscal issues to be the defining drivers of the next several

quarters and as BofAML notes, Washington's view of this 'process' as a

'slope' combined with the dangerously negative election campaign (which

will need a 180-degree reversal for any compromise) means the likelihood of a Wile E. Coyote Moment is considerably higher than most expect.

The overhwelming majority of investors seem to believe that some compromise will be reached to resolve the looming fiscal drag, and as we noted here,

this fact is more than priced into markets. As Barclays notes however,

a big deal that encompasses entitlement and tax reform is very

unlikely before year-end. Hence, if the ‘cliff’ is avoided, it will be

because Congress extends all expiring provisions for some time while it

works on a bigger deal. Such an 'extension/compromise' move would not reduce investor uncertainty if it were only for a few months; bond markets would simply start counting down to the new date. More importantly, the discussion about the fiscal cliff misses a broader point: the US will probably have significant fiscal tightening over the next decade that is a drag on medium-term growth.

Yet more investors dismiss last year's reaction to the debt-ceiling

debate - a 17% decline in 2 weeks - as any kind of precedent, claiming

(falsely) that this was more due to European financial difficulties. We

expect fiscal issues to be the defining drivers of the next several

quarters and as BofAML notes, Washington's view of this 'process' as a

'slope' combined with the dangerously negative election campaign (which

will need a 180-degree reversal for any compromise) means the likelihood of a Wile E. Coyote Moment is considerably higher than most expect.The Problem With Centralization

"The European Union is a horrible, stupid project. The idea that unification would create an economy that could compete with China and be more like the United States is pure garbage. What ruined China, throughout history, is the top-down state. What made Europe great was the diversity: political and economic. Having the same currency, the euro, was a terrible idea. It encouraged everyone to borrow to the hilt. The most stable country in the history of mankind, and probably the most boring, by the way, is Switzerland. It’s not even a city-state environment; it’s a municipal state. Most decisions are made at the local level, which allows for distributed errors that don’t adversely affect the wider system. Meanwhile, people want a united Europe, more alignment, and look at the problems. The solution is right in the middle of Europe — Switzerland. It’s not united! It doesn’t have a Brussels! It doesn’t need one."from TruthNeverTold :

US ambassador: Internet fee proposal gaining momentum

by Brendan Sasso, The Hill:

U.S. Ambassador Terry Kramer warned on Friday that a proposal to give a

United Nations agency more control over the Internet is gaining

momentum in other countries.

U.S. Ambassador Terry Kramer warned on Friday that a proposal to give a

United Nations agency more control over the Internet is gaining

momentum in other countries.

Proposals to expand the U.N.’s International Telecommunications Union’s (ITU) authority over the Internet could come up at a treaty conference in Dubai in December. European telecommunications companies are pushing a plan that would create new rules that would allow them to charge more to carry international traffic.

The proposal by the European Telecommunications Network Operators’ Association could force websites like Google, Facebook and Netflix to pay fees to network operators around the world.

Kramer said the idea of an international Internet fee is “gaining more interest in the African states and also in the Arab states.”

He said the United States delegation to the conference will have to redouble its efforts to convince other countries that the proposal would only stifle innovation and economic growth.

Read More @ TheHill.com

by Brendan Sasso, The Hill:

U.S. Ambassador Terry Kramer warned on Friday that a proposal to give a

United Nations agency more control over the Internet is gaining

momentum in other countries.

U.S. Ambassador Terry Kramer warned on Friday that a proposal to give a

United Nations agency more control over the Internet is gaining

momentum in other countries. Proposals to expand the U.N.’s International Telecommunications Union’s (ITU) authority over the Internet could come up at a treaty conference in Dubai in December. European telecommunications companies are pushing a plan that would create new rules that would allow them to charge more to carry international traffic.

The proposal by the European Telecommunications Network Operators’ Association could force websites like Google, Facebook and Netflix to pay fees to network operators around the world.

Kramer said the idea of an international Internet fee is “gaining more interest in the African states and also in the Arab states.”

He said the United States delegation to the conference will have to redouble its efforts to convince other countries that the proposal would only stifle innovation and economic growth.

Read More @ TheHill.com

by Katie Pavlich, Town Hall:

Special Agent Vince Cefalu has worked for the Bureau of Alcohol Tobacco and Firearms for more than 25 years. On top of successfully placing dozens of hard criminals behind bars throughout his career, Cefalu has received promotions and consistently positive evaluations. When he started raising his voice about ATF corruption and illegal wiretapping in 2005, things changed. Tuesday evening, Cefalu was asked to meet Special Agent in Charge of the San Francisco Field Division Joseph Riehl at a Denny’s Restaurant near Lake Tahoe. When he arrived, he was served termination papers in the parking lot. Classy move. The exchange was secretly recorded by a confidential source. David Codrea has more:

The video, shaky at times from being handheld, and with color imbalance streaking happening inadvertently in the uploading to YouTube, was recorded by a confidential source and shows Cefalu approached by two ATF management representatives including Joseph M. Riehl, Special Agent in Charge of the San Francisco Field Division, which encompasses Northern California and Nevada field offices.

Riehl, seen talking to Cefalu through his Jeep window and reportedly telling him he couldn’t leave because he had to sign papers, had been criticized on the CUATF forum, and Gun Rights Examiner is attempting to track down audit reports to determine what an independent assessment reveals about the allegations there. But the bottom line is, an employee with over 25 years of service who has been a leading spokesman for whistleblowers was unceremoniously canned in a public parking lot by senior division management.

Read More @ TownHall.com

Special Agent Vince Cefalu has worked for the Bureau of Alcohol Tobacco and Firearms for more than 25 years. On top of successfully placing dozens of hard criminals behind bars throughout his career, Cefalu has received promotions and consistently positive evaluations. When he started raising his voice about ATF corruption and illegal wiretapping in 2005, things changed. Tuesday evening, Cefalu was asked to meet Special Agent in Charge of the San Francisco Field Division Joseph Riehl at a Denny’s Restaurant near Lake Tahoe. When he arrived, he was served termination papers in the parking lot. Classy move. The exchange was secretly recorded by a confidential source. David Codrea has more:

The video, shaky at times from being handheld, and with color imbalance streaking happening inadvertently in the uploading to YouTube, was recorded by a confidential source and shows Cefalu approached by two ATF management representatives including Joseph M. Riehl, Special Agent in Charge of the San Francisco Field Division, which encompasses Northern California and Nevada field offices.

Riehl, seen talking to Cefalu through his Jeep window and reportedly telling him he couldn’t leave because he had to sign papers, had been criticized on the CUATF forum, and Gun Rights Examiner is attempting to track down audit reports to determine what an independent assessment reveals about the allegations there. But the bottom line is, an employee with over 25 years of service who has been a leading spokesman for whistleblowers was unceremoniously canned in a public parking lot by senior division management.

Read More @ TownHall.com

by Christina Rexrode, Yahoo:

JPMorgan Chase, the country’s biggest bank, reported a record quarterly

profit Friday, helped by a surge in mortgage refinancing. CEO Jamie

Dimon said he believed the housing market “has turned a corner.”

JPMorgan Chase, the country’s biggest bank, reported a record quarterly

profit Friday, helped by a surge in mortgage refinancing. CEO Jamie

Dimon said he believed the housing market “has turned a corner.”

The bank made $5.3 billion from July through September, up 36 percent from the same period a year ago. It worked out to $1.40 per share, blowing away the $1.21 predicted by analysts polled by FactSet, a provider of financial data.

Revenue rose 6 percent to $25.9 billion, beating expectations of $24.4 billion. Earnings were also helped because the bank set aside less money for bad loans — $1.8 billion, down 26 percent from a year ago.

Revenue from mortgage loans shot up 29 percent. About three-quarters of that was from people refinancing, rather than buying new homes. Low interest rates and government help encouraged homeowners to refinance.

Read More @ News.Yahoo.com

JPMorgan Chase, the country’s biggest bank, reported a record quarterly

profit Friday, helped by a surge in mortgage refinancing. CEO Jamie

Dimon said he believed the housing market “has turned a corner.”

JPMorgan Chase, the country’s biggest bank, reported a record quarterly

profit Friday, helped by a surge in mortgage refinancing. CEO Jamie

Dimon said he believed the housing market “has turned a corner.”The bank made $5.3 billion from July through September, up 36 percent from the same period a year ago. It worked out to $1.40 per share, blowing away the $1.21 predicted by analysts polled by FactSet, a provider of financial data.

Revenue rose 6 percent to $25.9 billion, beating expectations of $24.4 billion. Earnings were also helped because the bank set aside less money for bad loans — $1.8 billion, down 26 percent from a year ago.

Revenue from mortgage loans shot up 29 percent. About three-quarters of that was from people refinancing, rather than buying new homes. Low interest rates and government help encouraged homeowners to refinance.

Read More @ News.Yahoo.com

by Brandon Turbeville, Activist Post

Early in 2012, I wrote an article regarding India’s implementation of the Unique Identification (UID) Program for all of its 1.2 billion residents entitled, “Cashless Society: India Implements First Biometric ID Program Despite Growing Concern,” where I detailed the history, mechanisms and ultimate goals of the program. I followed this report by an article entitled, “Japan Proposes Next Phase of Centralized Surveillance,” dealing with the new Japanese UID with a similar analysis. But, while news of India and Japan’s massive National ID program was met with much surprise by many even in the alternative media, it may once again come as a surprise that yet another push for a National ID push is on the way – this time, in the UK.

Like the Indian and Japanese ice-breaker, the UK program is being developed in concert and collusion between the UK government and international corporations.

Read More @ Activist Post

Early in 2012, I wrote an article regarding India’s implementation of the Unique Identification (UID) Program for all of its 1.2 billion residents entitled, “Cashless Society: India Implements First Biometric ID Program Despite Growing Concern,” where I detailed the history, mechanisms and ultimate goals of the program. I followed this report by an article entitled, “Japan Proposes Next Phase of Centralized Surveillance,” dealing with the new Japanese UID with a similar analysis. But, while news of India and Japan’s massive National ID program was met with much surprise by many even in the alternative media, it may once again come as a surprise that yet another push for a National ID push is on the way – this time, in the UK.

Like the Indian and Japanese ice-breaker, the UK program is being developed in concert and collusion between the UK government and international corporations.

Read More @ Activist Post

from matlarson10:

My Dear Friends,

You have to consider the possibility that not only are economic indicators being skewed for election, but so are key markets.

Crude’s multi dollar flop around $100 looked quite professionally induced. The 18 days of body blocks in gold at primarily $1775 cash was not an accident nor did it occur in the cash market. It was an induced reaction to the paper market. We live in an illusionary world of MSM as a tool to create market short term for political purposes. However, every time they pull this off the market loses both participants and confidence. In gold, working against that illusion is huge reserves of private money and many central banks.

They stand as demand for gold now is between $1670 and $1750. This reaction in gold is politically motivated and meaningless drama with short legs.

Regards,

Jim

Jim Sinclair’s Commentary

China bashing has been a habit of western MSM. Comparatively, that is a mistake.

China exports grow much more than expected October 13, 2012 4:16 pm

China’s exports grew at roughly twice the rate expected in September while imports returned to the path of expansion, suggesting government measures to prop up economic growth are working and additional policy action may not be needed for now.

Customs data showed exports in September grew 9.9 per cent from a year earlier, roughly twice the 5 per cent rate expected by investors and up sharply from the 2.7 per cent annual rise recorded in August.

Imports rose 2.4 per cent year-on-year in September, in line with findings in the benchmark Reuters poll that had forecast a recovery from August’s surprise 2.6 per cent annual decline.

The trade surplus was $27.7bn in September, compared with a forecast of $20.7bn and August’s $26.7bn.

“The export data are much stronger than expected, signalling that overseas markets have recovered,” said Xiao Bo, economist at Huarong Securities in Beijing.

Mr Xiao said a trade recovery implied a slide in China’s economic growth was likely to have been arrested, boding well for a recovery to take hold in the fourth quarter to brighten the jobs outlook – a key factor for Beijing as a November leadership transition for the ruling Communist Party looms.

More…

GOLD – The Simple Facts

Nicholas J. Johnson, Mihir P. Worah

For more than a millennium, gold has broadly managed to maintain its real value, even as various currency regimes have come and gone.

The supply of gold is constrained, and we see demand increasing consistent with global economic growth on a per capita basis.

Given current valuations and central bank policies, we believe investors should consider including gold and other precious metals in a diversified investment portfolio.

When it comes to investing in gold, investors often see the world in black and white. Some people have a deep, almost religious conviction that gold is a useless, barbarous relic with no yield; it’s an asset no rational investor would ever want. Others love it, seeing it as the only asset that can offer protection from the coming financial catastrophe, which is always just around the corner.

Our views are more nuanced and, we believe, provide a balanced framework for assessing value. Our bottom line: given current valuations and central bank policies, we see gold as a compelling inflation hedge and store of value that is potentially superior to fiat currencies.

We believe investors should consider allocating gold and other precious metals to a diversified investment portfolio. The supply of gold is constrained, and we see demand increasing consistent with global economic growth on a per capita basis. Regarding inflation in particular, we feel that the Federal Reserve’s decision to begin a third round of quantitative easing makes gold even more attractive.

We see the Fed’s actions in the wake of the financial crisis as a paradigm shift whereby the Fed is attempting to ease financial conditions and encourage risk-taking by increasing inflation expectations. Its policies will likely result in continuous negative real interest rates because nominal rates will be fixed at close to 0% for the foreseeable future.

To be sure, gold isn’t the only asset with the potential to hold its value in inflationary times. For U.S. investors, at least, Treasury Inflation-Protected Securities (TIPS) offer an explicit inflation hedge. What’s more, TIPS tend to be less volatile than gold and, if held to maturity, are guaranteed to receive their principal back – barring a U.S. government default (which we see as incredibly improbable). Still, history shows that gold is highly correlated to inflation and has unique supply and demand characteristics that potentially lead to attractive valuations.

A unique store of value

For more than a millennium, gold has served as a store of value and a medium of exchange. It has broadly managed to maintain its real value, even as various currency regimes have come and gone. The reason is that the supply of gold is not at the whim of any governmental power; it is fundamentally supply constrained. Total outstanding above-ground gold stocks – the amount that has been extracted over the past few millennia – are roughly 155,000 metric tons. Each year mines supply roughly 2,600 additional metric tons, or 1.7% of the outstanding total. This is why gold can be thought of as the currency without a printing press.

The downside of gold is that it generates no interest. One ounce of gold today will still be only one ounce next year and the year after that. Because of this, gold is sometimes referred to as a non-productive financial asset, but we feel this characterization is misleading. Rather, we believe gold should not be thought of as a substitute for equities or corporate bonds. These have equity or default risk and therefore convey risk premiums.

Instead, gold should be thought of as a currency, one which pays no interest. Dollars, euro, yen and other currencies can be deposited to receive interest, and this rate of interest is meant to compensate for the decline in the value of paper currencies via inflation. Gold, in contrast, maintains its real value over time so no interest is necessary.

More…

Your support is needed...

Thank You

I'm PayPal Verified

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment