The majority

of Americans seem OK with just waddling through life, accepting the

lies and misinformation blasted from the boob tube and their various

iGadgets by their owners, gorging themselves to death on

Twinkies and Cheetos, paying 15% interest on their $10,000 rolling

credit card balance, and growing ever more dependent on the

welfare/warfare state to provide and protect them from accepting

personal responsibility for their lives. A minority of critical

thinking people have chosen to question everything they see and hear

being spewed at us by the propagandist mainstream media. What do 'we, the people' want? As it seems the entitlement “free shit” mentality permeates our culture. The question is whether we will stand idly by, fiddling with our gadgets, tweeting about Honey Boo Boo, or will we regain our sense of duty to the future generations of this country.

The majority

of Americans seem OK with just waddling through life, accepting the

lies and misinformation blasted from the boob tube and their various

iGadgets by their owners, gorging themselves to death on

Twinkies and Cheetos, paying 15% interest on their $10,000 rolling

credit card balance, and growing ever more dependent on the

welfare/warfare state to provide and protect them from accepting

personal responsibility for their lives. A minority of critical

thinking people have chosen to question everything they see and hear

being spewed at us by the propagandist mainstream media. What do 'we, the people' want? As it seems the entitlement “free shit” mentality permeates our culture. The question is whether we will stand idly by, fiddling with our gadgets, tweeting about Honey Boo Boo, or will we regain our sense of duty to the future generations of this country. Lemmings… At the precipice of WWIII

A well-connected source just secreted me a copy of the script, and if it plays out as currently written, it’s guaranteed to be a horrible, horrible ending… for the Lemmings.

Spain’s police state has spiraled out of control as riot

police are now running throughout the streets beating everyone in sight,

men and woman, young and old.

by Alexander Higgins, InfoWars:

When the people demand democracy from an oligarchy that rules their subjects trough the strong-arm of a totalitarian police state the streets fill with the madness and mayhem seen in this video.

Since September 25th the masses of Spain, no longer being able to feed themselves or their families, have risen up against the oligarchy to protest further budget cuts and massive tax increases a situation so dire it threatens their very survival. While the masses suffer those the poor are being robbed yet again to bail out the rich.

The overlords have no sympathy for the less fortunate and instead of forcing the bankers to take the loses on their investments the ruling class remains disconnected from the reality of millions.

The unrest has spans across Europe into several nations being forced the pinch out the masses by globalist regulatory bodies claiming nations need to get their fiscal house in order. But as we have seen in every previous past crash situations such as these are used as nothing more than excuse to help the rich reduce their own tax burden and the operating costs of the corporations they run.

Yet this time around the downward spiral only continues to self-perpetuate and deepen as the funds collected with each passing austerity cut are spent funding yet another banker bailout which acts as nothing more than a band-aid on a hemorrhaging gashes of a collapsing economic system that has struck with a self-inflicted mortal wound delivered by a trifecta of rapacious greed, rampant fraud and unbearable corruption.

Read More @ InfoWars.com

by Alexander Higgins, InfoWars:

When the people demand democracy from an oligarchy that rules their subjects trough the strong-arm of a totalitarian police state the streets fill with the madness and mayhem seen in this video.

Since September 25th the masses of Spain, no longer being able to feed themselves or their families, have risen up against the oligarchy to protest further budget cuts and massive tax increases a situation so dire it threatens their very survival. While the masses suffer those the poor are being robbed yet again to bail out the rich.

The overlords have no sympathy for the less fortunate and instead of forcing the bankers to take the loses on their investments the ruling class remains disconnected from the reality of millions.

The unrest has spans across Europe into several nations being forced the pinch out the masses by globalist regulatory bodies claiming nations need to get their fiscal house in order. But as we have seen in every previous past crash situations such as these are used as nothing more than excuse to help the rich reduce their own tax burden and the operating costs of the corporations they run.

Yet this time around the downward spiral only continues to self-perpetuate and deepen as the funds collected with each passing austerity cut are spent funding yet another banker bailout which acts as nothing more than a band-aid on a hemorrhaging gashes of a collapsing economic system that has struck with a self-inflicted mortal wound delivered by a trifecta of rapacious greed, rampant fraud and unbearable corruption.

Read More @ InfoWars.com

Rebellion to tyrants is obedience to God. -Benjamin Franklin

from TNSONSOFLIBERTY:

from WallStForMainSt:

In this 15 minute interview Wall St for Main St Co-Founder Jason Burack interviews investor and Austrian School economist Michael Pento about the impact of the Federal Reserve’s QE announcement.

In this 15 minute interview Wall St for Main St Co-Founder Jason Burack interviews investor and Austrian School economist Michael Pento about the impact of the Federal Reserve’s QE announcement.

The Underlying Problem, More Often Than Not, Is Rooted In Its Economy

Admin at Jim Rogers Blog - 2 hours ago

The capitalist knows that whatever the problem a country exhibits, the

underlying problem, more often than not, is rooted in its economy. It may

pass for a religious or racial problem, but is basically economic. - *in

Adventure Capitalist*

*Jim Rogers is an author, financial commentator and successful

international investor. He has been frequently featured in Time, The New

York Times, Barron’s, Forbes, Fortune, The Wall Street Journal, The

Financial Times and is a regular guest on Bloomberg and CNBC.*Why It's Different This Time With AAPL's iCorrection

We

have seen bigger drops in AAPL's share price and each time that dip

has been bought. Critically though, not just nibbled on but

backed-up-the-truck volume surges as AAPL's price fell as what seemed

like institutional buyers using any dip to grab some high-beta meth into

this trend. The current almost-10% drop is missing this volume surge - where are the BTFD'ers? But, but, but what about iTV, the mini-iPad, and the pending vendor-financing corporate spin-off?

We

have seen bigger drops in AAPL's share price and each time that dip

has been bought. Critically though, not just nibbled on but

backed-up-the-truck volume surges as AAPL's price fell as what seemed

like institutional buyers using any dip to grab some high-beta meth into

this trend. The current almost-10% drop is missing this volume surge - where are the BTFD'ers? But, but, but what about iTV, the mini-iPad, and the pending vendor-financing corporate spin-off?The ESM Has Been Inaugurated: Spain's €3.8 Billion Invoice Is In The Mail

Now that the ESM has been officially inaugurated, to much pomp and fanfare out of Europe this morning, many are wondering not so much where the full debt backstop funding of the instrument will come from (it is clear that in a closed-loop Ponzi system, any joint and severally liable instrument will need to get funding from its joint and severally liable members), as much as where the equity "paid-in" capital will originate, since in Europe all but the AAA-rated countries are insolvent, and current recipients of equity-level bailouts from the "core." As a reminder, as part of the ESM's synthetic structure, the 17 member countries have to fund €80 billion of paid-in capital (i.e. equity buffer) which in turn serves as a 11.4% first loss backstop for the remainder of the €620 billion callable capital (we have described the CDO-like nature of the ESM before on many occasions in the past). The irony of a country like Greece precommiting to a €19.7 billion capital call, or Spain to €83.3 billion, or Italy to €125.4 billion, is simply beyond commentary. Obviously by the time the situation gets to the point where the Greek subscription of €20 billion is the marginal European rescue cash, it will be game over. The hope is that it never gets to that point. There is, however, some capital that inevitably has to be funded, which even if nominal, may prove to be a headache for the "subscriber" countries. The payment schedule of that capital "invoicing" has been transformed from the original ESM document, and instead of 5 equal pro rata annual payments has been accelerated to a 40%, 40%, 20% schedule. And more importantly, "The first two instalments (€32 billion) will be paid in within 15 days of ESM inauguration." In other words, October 23 is the deadline by which an already cash-strapped Spain, has to pay-in the 40% of its €9.5 billion, or €3.8 billion, contribution, or else.

Why The Market Should Not Expect A Bounce If A Fiscal Cliff 'Compromise' Is Reached

As

earnings season is upon us, we will no doubt hear that expectations

are so low that the market has it all priced in and upside is the only

way to go (apart from the fact that Q4 expectations remain in the land of faeries and unicorns). Of course Q4's hockey-stick is critically going to depend on the fiscal-cliff - post-election. As we noted here,

there are few positive outcomes from the fiscal cliff 'negotiations'

with even a best-case 'possibility' of a 0.9% fiscal drag in the first

half of 2013. Using trend growth of 3%, and Goldman's estimate of around

a 4% drag (lower than the 6-plus% drag the CBO estimates), we can work

back from the consensus 2.05% GDP growth for 2013 to figure what the market's priced in probability of a fiscal-cliff resolution is. It would seem the market is more than happy to almost entirely dismiss the fiscal cliff. Back of the envelope math implies only a 1.5% probability of the full fiscal cliff impact and therefore any expectation of an equity market rally on hopes of a compromise seem far-fetched with well over 95% priced in currently.

As

earnings season is upon us, we will no doubt hear that expectations

are so low that the market has it all priced in and upside is the only

way to go (apart from the fact that Q4 expectations remain in the land of faeries and unicorns). Of course Q4's hockey-stick is critically going to depend on the fiscal-cliff - post-election. As we noted here,

there are few positive outcomes from the fiscal cliff 'negotiations'

with even a best-case 'possibility' of a 0.9% fiscal drag in the first

half of 2013. Using trend growth of 3%, and Goldman's estimate of around

a 4% drag (lower than the 6-plus% drag the CBO estimates), we can work

back from the consensus 2.05% GDP growth for 2013 to figure what the market's priced in probability of a fiscal-cliff resolution is. It would seem the market is more than happy to almost entirely dismiss the fiscal cliff. Back of the envelope math implies only a 1.5% probability of the full fiscal cliff impact and therefore any expectation of an equity market rally on hopes of a compromise seem far-fetched with well over 95% priced in currently.European Equities Give Back Friday's Gains As EUR Tumbles Most In Almost 3 Months

Friday's ramp-fest in European stocks - which did not appear to be correspondingly followed by European sovereign debt - was largely retraced today.

Extended by the bullish bias from the US NFP data (and closed before

the US data BLShit sunk in), it seems that not just the catch down drove

stocks in Europe (and Europe's VIX) but anxiety ahead of the expected

wall of noise from European leaders ahead of their meetings (which we

have already suffered today). European government bonds leaked lower

(yields/spreads higher) and Swiss 2Y rates dropped to their lowest in a month (though still well above the mid-crisis safety panic levels of a few months ago). European credit also slid - tending to follow equities this time.

Friday's ramp-fest in European stocks - which did not appear to be correspondingly followed by European sovereign debt - was largely retraced today.

Extended by the bullish bias from the US NFP data (and closed before

the US data BLShit sunk in), it seems that not just the catch down drove

stocks in Europe (and Europe's VIX) but anxiety ahead of the expected

wall of noise from European leaders ahead of their meetings (which we

have already suffered today). European government bonds leaked lower

(yields/spreads higher) and Swiss 2Y rates dropped to their lowest in a month (though still well above the mid-crisis safety panic levels of a few months ago). European credit also slid - tending to follow equities this time.From Zero Interest Rate To Zero Retirement: How The Fed Doomed Elderly Americans To Endless Work

Given the Fed's ZIRP impact on expected returns, PIMCO notes that those approaching retirement have three choices: a) save more, b) work longer, or c) tighten their belts in retirement.

If everyone saves more, we consume less, and therefore GDP growth slows

down. Anemic growth leads to a Fed on hold for a prolonged period - and

even further lowered return expectations in an ugly

paradox-of-thrift-like feedback loop. PIMCO has found a concerning

empirical link between lower rates and longer periods in the workforce as a higher fraction of older Americans remain employed.

This has the structurally dismal impact of reducing (implicitly) the

level of 'prime working age' employment and has 'convexity' - in other

words, the lower rates go, the greater the inertia of the elderly to stay in the workforce.

Intuitively, low rates leading to longer work lives just makes sense –

especially in an era where fewer retirees will draw defined benefit

pensions. This is why some of us are wondering if the Fed is spinning its wheels by sticking to the old model of trying to stimulate growth. So expect lower-rates and longer working years or go all-in on HY CCC debt with 20% of your savings.

Given the Fed's ZIRP impact on expected returns, PIMCO notes that those approaching retirement have three choices: a) save more, b) work longer, or c) tighten their belts in retirement.

If everyone saves more, we consume less, and therefore GDP growth slows

down. Anemic growth leads to a Fed on hold for a prolonged period - and

even further lowered return expectations in an ugly

paradox-of-thrift-like feedback loop. PIMCO has found a concerning

empirical link between lower rates and longer periods in the workforce as a higher fraction of older Americans remain employed.

This has the structurally dismal impact of reducing (implicitly) the

level of 'prime working age' employment and has 'convexity' - in other

words, the lower rates go, the greater the inertia of the elderly to stay in the workforce.

Intuitively, low rates leading to longer work lives just makes sense –

especially in an era where fewer retirees will draw defined benefit

pensions. This is why some of us are wondering if the Fed is spinning its wheels by sticking to the old model of trying to stimulate growth. So expect lower-rates and longer working years or go all-in on HY CCC debt with 20% of your savings.

by Ira Katz, Lew Rockwell:

The Ghost Writer begins with a ferry arriving on the Massachusetts coast from an offshore island (a fictional version of Martha’s Vineyard) with vehicles passing around an apparently abandoned SUV. The next image is of a body washed up on the island. The corpse was of the ghost writer for the memoirs of an ex-Prime Minister of the U.K. After this accident/suicide another ghost writer is recruited. The trouble begins even before the new writer arrives back at his apartment in London after receiving a copy of the manuscript, as it is purposely stolen. Polanski builds the suspense as the writer goes to the island compound to work on the book. The Blair-like ex-Prime Minister is holed up in the U.S. because he is being accused of war crimes associated with torturing suspected terrorists.

Read More @ LewRockwell.com

Still Think Your Vote Counts?...

While pretty much everyone reading this already understands that the elections are a joke run by the Two Party Dictatorship, this video explains exactly how the debates are rigged to ensure no Third Party candidate can ever participate and to ensure that neither of the cronies on stage ever gets hit by a difficult question. How is this achieved? A “secret debate contract.” Yep, just another conspiracy FACT.

Read More @ LibertyBlitzkreig.com

By: Clive Maund, The Market Oracle:

It has been widely assumed across the markets that the forces of

deflation have been vanquished by the Fed’s making it plain a couple of

weeks ago that it is going to throw all of its firepower into the battle

to defeat it. So let’s make this as clear as possible – the forces of

deflation will not be defeated by anything until they done their work of

expunging the massive overhang of debt from the system. The Fed’s

latest stated policy is merely a display of desperation and a symptom of

intellectual bankruptcy in that they seem to think that more of what

created the problems in the first place is now going to somehow fix

them. We are going into a depression anyway, and they have made it plain

that for good measure they are going to destroy the currency into the

bargain. In reality, all they are trying to do is buy as much time as

possible – they know they are cornered and that the system is doomed and

procrastination is all that is left to them.

It has been widely assumed across the markets that the forces of

deflation have been vanquished by the Fed’s making it plain a couple of

weeks ago that it is going to throw all of its firepower into the battle

to defeat it. So let’s make this as clear as possible – the forces of

deflation will not be defeated by anything until they done their work of

expunging the massive overhang of debt from the system. The Fed’s

latest stated policy is merely a display of desperation and a symptom of

intellectual bankruptcy in that they seem to think that more of what

created the problems in the first place is now going to somehow fix

them. We are going into a depression anyway, and they have made it plain

that for good measure they are going to destroy the currency into the

bargain. In reality, all they are trying to do is buy as much time as

possible – they know they are cornered and that the system is doomed and

procrastination is all that is left to them.

Read More @ TheMarketOracle.co.uk

from weavingspider:

It has been widely assumed across the markets that the forces of

deflation have been vanquished by the Fed’s making it plain a couple of

weeks ago that it is going to throw all of its firepower into the battle

to defeat it. So let’s make this as clear as possible – the forces of

deflation will not be defeated by anything until they done their work of

expunging the massive overhang of debt from the system. The Fed’s

latest stated policy is merely a display of desperation and a symptom of

intellectual bankruptcy in that they seem to think that more of what

created the problems in the first place is now going to somehow fix

them. We are going into a depression anyway, and they have made it plain

that for good measure they are going to destroy the currency into the

bargain. In reality, all they are trying to do is buy as much time as

possible – they know they are cornered and that the system is doomed and

procrastination is all that is left to them.

It has been widely assumed across the markets that the forces of

deflation have been vanquished by the Fed’s making it plain a couple of

weeks ago that it is going to throw all of its firepower into the battle

to defeat it. So let’s make this as clear as possible – the forces of

deflation will not be defeated by anything until they done their work of

expunging the massive overhang of debt from the system. The Fed’s

latest stated policy is merely a display of desperation and a symptom of

intellectual bankruptcy in that they seem to think that more of what

created the problems in the first place is now going to somehow fix

them. We are going into a depression anyway, and they have made it plain

that for good measure they are going to destroy the currency into the

bargain. In reality, all they are trying to do is buy as much time as

possible – they know they are cornered and that the system is doomed and

procrastination is all that is left to them.Read More @ TheMarketOracle.co.uk

from weavingspider:

Total global needs to grow to $213 trillion by 2020 just to sustain current growth

from MyBudget360.com

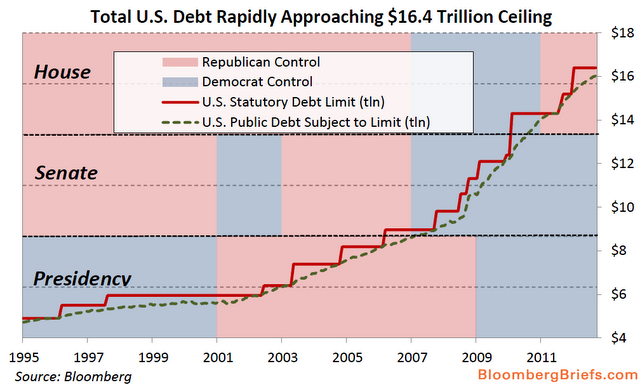

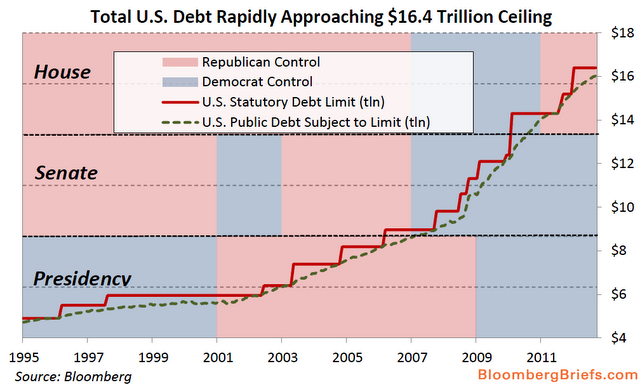

Every so often markets forget that too much debt is a bad thing. We are already seeing inflation in many items

and the standard of living being pushed lower for many Americans thanks

to policies that crush the US dollar and allow the Fed to expand its

balance sheet without congressional approval. There are consequences to

all these actions. We are also quickly approaching the debt ceiling,

again. Does anyone think that $16 trillion will ever be paid off?

Total global debt is at a silly number no matter how you slice it. The

problem is you get a diminishing level of return and you can see this in

places like the Euro-zone that is bailing out banks and countries left

and right. Then you have economies like China were they are having internal bubbles in real estate because hot money is flowing too quickly. Is there a tipping point for global debt?

Every so often markets forget that too much debt is a bad thing. We are already seeing inflation in many items

and the standard of living being pushed lower for many Americans thanks

to policies that crush the US dollar and allow the Fed to expand its

balance sheet without congressional approval. There are consequences to

all these actions. We are also quickly approaching the debt ceiling,

again. Does anyone think that $16 trillion will ever be paid off?

Total global debt is at a silly number no matter how you slice it. The

problem is you get a diminishing level of return and you can see this in

places like the Euro-zone that is bailing out banks and countries left

and right. Then you have economies like China were they are having internal bubbles in real estate because hot money is flowing too quickly. Is there a tipping point for global debt?

Read More @ MyBudget360.com

from MyBudget360.com

Every so often markets forget that too much debt is a bad thing. We are already seeing inflation in many items

and the standard of living being pushed lower for many Americans thanks

to policies that crush the US dollar and allow the Fed to expand its

balance sheet without congressional approval. There are consequences to

all these actions. We are also quickly approaching the debt ceiling,

again. Does anyone think that $16 trillion will ever be paid off?

Total global debt is at a silly number no matter how you slice it. The

problem is you get a diminishing level of return and you can see this in

places like the Euro-zone that is bailing out banks and countries left

and right. Then you have economies like China were they are having internal bubbles in real estate because hot money is flowing too quickly. Is there a tipping point for global debt?

Every so often markets forget that too much debt is a bad thing. We are already seeing inflation in many items

and the standard of living being pushed lower for many Americans thanks

to policies that crush the US dollar and allow the Fed to expand its

balance sheet without congressional approval. There are consequences to

all these actions. We are also quickly approaching the debt ceiling,

again. Does anyone think that $16 trillion will ever be paid off?

Total global debt is at a silly number no matter how you slice it. The

problem is you get a diminishing level of return and you can see this in

places like the Euro-zone that is bailing out banks and countries left

and right. Then you have economies like China were they are having internal bubbles in real estate because hot money is flowing too quickly. Is there a tipping point for global debt?Read More @ MyBudget360.com

by Peter Cooper, Silver Seek:

What would the market for precious metals look like if we were

approaching the top of this decade-long bull market? You would almost

certainly see a price spike of some significance, say a doubling of

prices in 12 months.

What would the market for precious metals look like if we were

approaching the top of this decade-long bull market? You would almost

certainly see a price spike of some significance, say a doubling of

prices in 12 months.

Have we seen anything like that? The surge in silver to almost $50 an ounce some 18 months ago is the closest we have come to it, and the silver price has not collapsed since then. Far from it, the price chart is one of consolidation for another surge.

Ruff timing

Gold topped out at $1,923 almost a year ago and just tip-toed above $1,800 for the first time since then last week. It is hardly a blow-off, although prices are now up three-fold on seven years ago when Howard Ruff published his ‘Little Book of Big Fortunes in Gold & Silver’ with $2,000 then predicted as the market top. Gold was $600 an ounce and silver $10.

Read More @ SilverSeek.com

What would the market for precious metals look like if we were

approaching the top of this decade-long bull market? You would almost

certainly see a price spike of some significance, say a doubling of

prices in 12 months.

What would the market for precious metals look like if we were

approaching the top of this decade-long bull market? You would almost

certainly see a price spike of some significance, say a doubling of

prices in 12 months.Have we seen anything like that? The surge in silver to almost $50 an ounce some 18 months ago is the closest we have come to it, and the silver price has not collapsed since then. Far from it, the price chart is one of consolidation for another surge.

Ruff timing

Gold topped out at $1,923 almost a year ago and just tip-toed above $1,800 for the first time since then last week. It is hardly a blow-off, although prices are now up three-fold on seven years ago when Howard Ruff published his ‘Little Book of Big Fortunes in Gold & Silver’ with $2,000 then predicted as the market top. Gold was $600 an ounce and silver $10.

Read More @ SilverSeek.com

from Silver Vigilante:

Anglo American Platinum fired 12,000 wildcat strikers over labor strife

sweeping South Africa, Africa’s largest economy. Since the strikes

began in the critical mining sector, nearly 50 people have been killed.

President Jacob Zuma’s ruling ANC is struggling to keep control of the

region as the worst social unrest since the apartheid continues to grow.

The termination noticed, delivered to many SMS, was surprising, despite

threats by Amplats that it planned to discipline strikers. In a

related move, Atlatsa Resources also fired 2,500 workers who went on

wildcat strike this week at its Bokoni platinum mine in South Africa,

according to a company official.

Anglo American Platinum fired 12,000 wildcat strikers over labor strife

sweeping South Africa, Africa’s largest economy. Since the strikes

began in the critical mining sector, nearly 50 people have been killed.

President Jacob Zuma’s ruling ANC is struggling to keep control of the

region as the worst social unrest since the apartheid continues to grow.

The termination noticed, delivered to many SMS, was surprising, despite

threats by Amplats that it planned to discipline strikers. In a

related move, Atlatsa Resources also fired 2,500 workers who went on

wildcat strike this week at its Bokoni platinum mine in South Africa,

according to a company official.

On Saturday, several hundred workers held a two-hour rally in the vicinity of a soccer stadium near the platinum city of Rustenburg as police in armored vehicles and a helicopter watched. The rally took place about 70 miles northwest of Johannesburg.

The rally was calmer than the protests of recent weeks.

Read More @ Silver Vigilante

Please Donate Donations will help defray the operational costs. Paypal, a leading provider of secure online money transfers, will handle the donations. Thank you for your contribution.

Anglo American Platinum fired 12,000 wildcat strikers over labor strife

sweeping South Africa, Africa’s largest economy. Since the strikes

began in the critical mining sector, nearly 50 people have been killed.

President Jacob Zuma’s ruling ANC is struggling to keep control of the

region as the worst social unrest since the apartheid continues to grow.

The termination noticed, delivered to many SMS, was surprising, despite

threats by Amplats that it planned to discipline strikers. In a

related move, Atlatsa Resources also fired 2,500 workers who went on

wildcat strike this week at its Bokoni platinum mine in South Africa,

according to a company official.

Anglo American Platinum fired 12,000 wildcat strikers over labor strife

sweeping South Africa, Africa’s largest economy. Since the strikes

began in the critical mining sector, nearly 50 people have been killed.

President Jacob Zuma’s ruling ANC is struggling to keep control of the

region as the worst social unrest since the apartheid continues to grow.

The termination noticed, delivered to many SMS, was surprising, despite

threats by Amplats that it planned to discipline strikers. In a

related move, Atlatsa Resources also fired 2,500 workers who went on

wildcat strike this week at its Bokoni platinum mine in South Africa,

according to a company official.On Saturday, several hundred workers held a two-hour rally in the vicinity of a soccer stadium near the platinum city of Rustenburg as police in armored vehicles and a helicopter watched. The rally took place about 70 miles northwest of Johannesburg.

The rally was calmer than the protests of recent weeks.

Read More @ Silver Vigilante

Please Donate Donations will help defray the operational costs. Paypal, a leading provider of secure online money transfers, will handle the donations. Thank you for your contribution.

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment