by Michael Snyder, The Economic Collapse Blog:

For the first time ever, total credit card debt in the United States is approaching a trillion dollars. Instead of learning painful lessons from the last recession, Americans continue to make the same horrendous financial mistakes over and over again. In fact, U.S. consumers accumulated more new credit card debt during the 4th quarter of 2015 than they did during the years of 2009, 2010 and 2011 combined. That is absolutely insanity, because other than payday loans, credit card debt is just about the worst kind of debt that consumers could possibly go into. Extremely high rates of interest, combined with severe penalties and fees, can choke the financial life out of almost any family in no time at all.

Read More

For the first time ever, total credit card debt in the United States is approaching a trillion dollars. Instead of learning painful lessons from the last recession, Americans continue to make the same horrendous financial mistakes over and over again. In fact, U.S. consumers accumulated more new credit card debt during the 4th quarter of 2015 than they did during the years of 2009, 2010 and 2011 combined. That is absolutely insanity, because other than payday loans, credit card debt is just about the worst kind of debt that consumers could possibly go into. Extremely high rates of interest, combined with severe penalties and fees, can choke the financial life out of almost any family in no time at all.

Read More

The Year Of The Red Monkey: Volatility Reigns Supreme

Submitted by Tyler Durden on 03/12/2016 - 13:50 In the lunar calendar that started February 8, this is the Year of the Red Monkey. "According to Chinese Five Elements Horoscopes, Monkey contains Metal and Water. Metal is connected to gold. Water is connected to wisdom and danger...That implies the status of events will be changing very quickly. Think twice before you leap when making changes for your finance, career, business relationship and people relationship." For those who don’t believe in astrological forecasts, there are plenty of other reasons to anticipate sustained volatility in 2016 that strips certainty and cash from bulls and bear alike.Trump Blames "Organized Thugs" For Violence, Establishment Blames Trump

Amid

confusion over the cancellation, due to more security concerns, of

today's rally in Ohio - since denied by Trump campaign officials - the

finger of blame for last night's violent protests is wending its way

through the mainstream media, leading to even more confusion...

Amid

confusion over the cancellation, due to more security concerns, of

today's rally in Ohio - since denied by Trump campaign officials - the

finger of blame for last night's violent protests is wending its way

through the mainstream media, leading to even more confusion...

Gold Is The Only Sound Money

Submitted by Tyler Durden on 03/12/2016 - 11:13 The technical situation for the gold price has sharply improved, to the evident surprise of many mainstream analysts, but what are the reasons behind the turnaround, and implications for the future?Sweden Stunned At "Unreal" Surge In Refugee Sex Attacks

Submitted by Tyler Durden on 03/12/2016 - 13:18The Moment Of Truth - What The Charts Say

Submitted by Tyler Durden on 03/12/2016 - 12:30 We have arrived. The moment of truth. No matter whether you believe this to be a bull market ready to re-assert itself or you view the recent rally in the context of a bear market about to unfold you must acknowledge the pivotal nature of where the market now finds itself in the days ahead.

North Korean Submarine "Goes Missing" During "Largest Ever" US, South Korea Assault Drill

Submitted by Tyler Durden on 03/12/2016 - 10:30 A North Korean submarine is missing as the reclusive state issued a fresh threat of retaliation against US and South Korean forces involved in joint military drills. At the same time, U.S. and South Korean troops staged a massive amphibious landing exercise Saturday, storming simulated North Korean beach defenses amid and threats by Pyongyang to annihilate its enemies.

JPMorgan: "The ECB Could Purchase Equities Next"

Submitted by Tyler Durden on 03/12/2016 - 09:45 "To the extent this week’s ECB decision marks a shift towards private sector asset purchases, the ammunition the ECB has expands hugely. Assuming the ECB will be willing to navigate eventually into other private sector asset classes, the asset universe for QE purchases could expand to include uncovered bank bonds, bank loans and equities."

Norway’s Interest Rate Conundrum

Submitted by Tyler Durden on 03/12/2016 - 09:13 We are experiencing 1970’s style stagflation, coming from the supply side, not demand. Prices are going up because Norges Bank continues to destroy the Norwegian Krone, turning it into the Nordic Peso. This is where they are “hiding” the damage to save rest of the economy. For example, housing prices will rise in NOK but fall in USD or gold (universal commodity) terms. It’s a shell game, leading to long term decline or even worse, an unexpected period of elevated inflation, requiring a rapid rise in interest rates.

"Gloom" Returns To China's Economy: Industrial Production, Retail Sales Miss Lowest Estimates

Submitted by Tyler Durden on 03/12/2016 - 08:17 Factory output grew just 5.4% in January and February from a year earlier, data released by the National Bureau of Statistics (NBS) showed, slowing from a 5.9% rise in December to the weakest since November 2008; the print matched the lowest Wall Street estimate. Meanwhile, retail sales rose 10.2% over the two-month period from a year ago, below the lowest Wall Street estimate of 10.5%, and far below the December’s 11.1% increase, pushing the trend growth in this series to lows not seen since early 2015.Trump Cancels Chicago Speech After Violent "Make America Hate Again" Protests Erupt

Submitted by Tyler Durden on 03/12/2016 - 05:00

Fukushima Five Years Later: "The Fuel Rods Melted Through Containment And Nobody Knows Where They Are Now"

Submitted by Tyler Durden on 03/11/2016 - 23:27 :The fuel rods melted through their containment vessels in the reactors, and no one knows exactly where they are now... Tepco has been developing robots, which can swim under water and negotiate obstacles in damaged tunnels and piping to search for the melted fuel rods. But as soon as they get close to the reactors, the radiation destroys their wiring and renders them useless."Democracy, Be Damned - The "Sea Island" Conspiracy Reveals The Deep State

Submitted by Tyler Durden on 03/11/2016 - 22:00 What we see at Sea Island is that, despite all their babble about bringing the blessings of “democracy” to the world’s benighted, AEI, Neocon Central, believes less in democracy than in perpetual control of the American nation by the ruling Beltway elites. If an outsider like Trump imperils that control, democracy be damned. The elites will come together to bring him down, because, behind party ties, they are soul brothers in the pursuit of power.

What The Average Zhou Thinks Of China's Housing Bubble: "Only After War Breaks Out, We'll Be Able To Afford It"

Submitted by Tyler Durden on 03/11/2016 - 21:30 "[the empty homes] belong to the real estate speculators, the hoarders and the corrupt officials... It's just a game for the rich! Beijing isn't a livable city at all. The price makes it off-limits. It’s also a food chain: Only the richest and most capable people can live here... The housing market is part of the bubble economy. In 5 years or so, after a war has broken out, then the middle class will be able to afford a home."

Political and financial turmoil reign around the world, by design. It is the classic example of the elites at work working their never-fail formula of Problem-Reaction-Solution. They create havoc of some kind, any kind, wherever they choose, the Problem. It is usually political upheaval fomenting unrest, and the broader the unrest the better. It often takes the form of financial turmoil, disrupting a country’s GDP, currency, whatever, as long as there is disruption. It can be war, a function no other country creates more of than the US. It can be massive immigrant migration, currently underway. Why does the name Soros come to mind?

Form does not matter, function does, and as long as there are distracting and decidedly real Problems going on, much of the world is unhappy, and the elites are smiling, pleased.

Read More

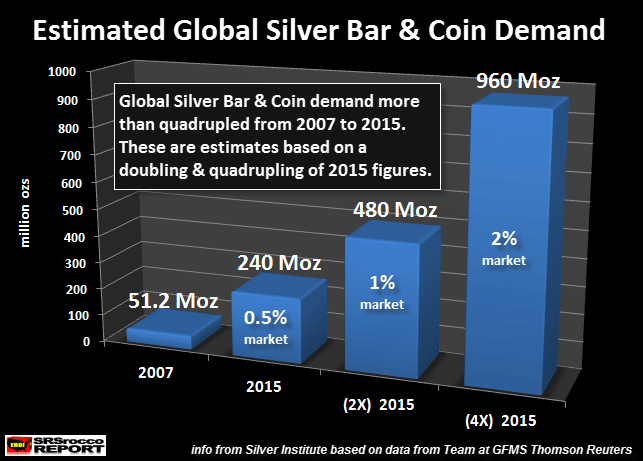

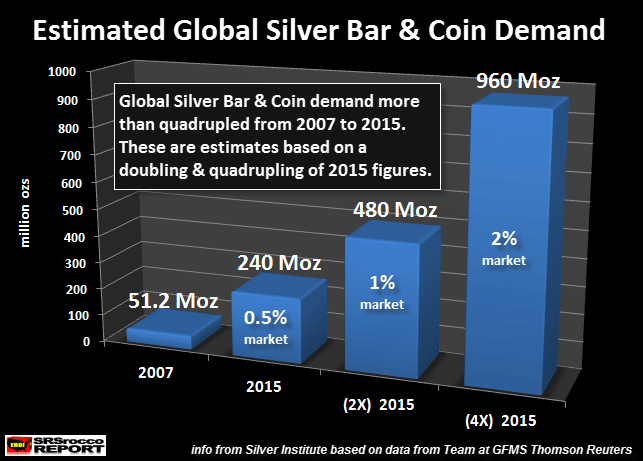

by Steve St. Angelo, SRS Rocco:

It’s no secret to the precious metal community that silver is one of the most undervalued assets in the market, however 99% of Mainstream investors are still in the dark. This was done on purpose to keep the majority of individuals invested in Wall Street’s Greatest Financial Ponzi Scheme in history.

You see, this is the classic PUMP & DUMP strategy. Unfortunately, it’s not a lousy penny stock that Wall Street is pumping, rather it’s the entire market. Most pump & dump stock campaigns last a day, week or a few months. Sadly, this one has gone on for decades and the outcome will be disastrous for the typical American.

Read More

It’s no secret to the precious metal community that silver is one of the most undervalued assets in the market, however 99% of Mainstream investors are still in the dark. This was done on purpose to keep the majority of individuals invested in Wall Street’s Greatest Financial Ponzi Scheme in history.

You see, this is the classic PUMP & DUMP strategy. Unfortunately, it’s not a lousy penny stock that Wall Street is pumping, rather it’s the entire market. Most pump & dump stock campaigns last a day, week or a few months. Sadly, this one has gone on for decades and the outcome will be disastrous for the typical American.

Read More

from RT:

President Obama is pushing for TPP as part of his legacy, despite the fact than many economists say the deal will result in the loss of manufacturing jobs, the Alliance for American Manufacturing’s Scott Paul told RT’s Ed Schultz.

President Obama is pushing for TPP as part of his legacy, despite the fact than many economists say the deal will result in the loss of manufacturing jobs, the Alliance for American Manufacturing’s Scott Paul told RT’s Ed Schultz.

National Security Advisor Susan Rice said Wednesday President Obama

is fully committed to the ratification of the Trans-Pacific Partnership

[TPP], despite predictions the deal would further erode America’s

manufacturing base.

Obama stands against the majority of Democrats on the issue – including two Democrat presidential candidates Bernie Sanders and Hillary Clinton.

Read More

Obama stands against the majority of Democrats on the issue – including two Democrat presidential candidates Bernie Sanders and Hillary Clinton.

Read More

from Wolf Street:

Every now and then we get a sign.

Money creation in China has gone bonkers. Authorities have opened the valves, and new credit is surging through money pipelines, including state-owned banks and the “shadow banking” system, and so loans in just the first two months this year soared by $1 trillion. Where did this money go?

We don’t know, but we’re getting indications that some of it is showing up right here in the US.

At the same time, “China is getting into the venture capital business in a big way. A really, really big way,” as Bloomberg put it: Government-backed venture funds raised about 1.5 trillion yuan ($231 billion) last year to bring the total to 2.2 trillion yuan. “That’s the biggest pot of money for startups in the world and almost five times the sum raised by other venture firms last year globally….”

Read More

Every now and then we get a sign.

Money creation in China has gone bonkers. Authorities have opened the valves, and new credit is surging through money pipelines, including state-owned banks and the “shadow banking” system, and so loans in just the first two months this year soared by $1 trillion. Where did this money go?

We don’t know, but we’re getting indications that some of it is showing up right here in the US.

At the same time, “China is getting into the venture capital business in a big way. A really, really big way,” as Bloomberg put it: Government-backed venture funds raised about 1.5 trillion yuan ($231 billion) last year to bring the total to 2.2 trillion yuan. “That’s the biggest pot of money for startups in the world and almost five times the sum raised by other venture firms last year globally….”

Read More

/

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment