Submitted by Tyler Durden on 03/11/2016 - 09:27

Submitted by Tyler Durden on 03/11/2016 - 09:27

Call buying of stock options has been extremely subdued relative to puts recently – typically a bullish contrarian signal; however...

Ben Carson Endorses The Donald Press Conference - Live Feed

Submitted by Tyler Durden on 03/11/2016 - 09:08 Opposites attract? Softly-spoken Dr. Ben Carson is reportedly set to endorse The Donald this morning but Trump's press conference will, we are sure, have more to offer than just that...

by Dave Kranzler, InvestmentResearchDynamics:

Using the “jobless claims” metric, the financial media and snake oil

salesmen would have us believe that the Government-compiled jobs market

metrics indicate “sustained strength in the labor market that should

further dispel fears of a recession” – Reuters’ Animal Farm.

Using the “jobless claims” metric, the financial media and snake oil

salesmen would have us believe that the Government-compiled jobs market

metrics indicate “sustained strength in the labor market that should

further dispel fears of a recession” – Reuters’ Animal Farm.

A reader asks: “if the jobs market is so good why did my bilingual daughter, who graduated with a 3.8 GPA from Ga. Tech [Dr. Paul Craig Roberts’ undergrad school], not get a job offer for two months until someone I know hired her?”

Read More

Using the “jobless claims” metric, the financial media and snake oil

salesmen would have us believe that the Government-compiled jobs market

metrics indicate “sustained strength in the labor market that should

further dispel fears of a recession” – Reuters’ Animal Farm.

Using the “jobless claims” metric, the financial media and snake oil

salesmen would have us believe that the Government-compiled jobs market

metrics indicate “sustained strength in the labor market that should

further dispel fears of a recession” – Reuters’ Animal Farm.A reader asks: “if the jobs market is so good why did my bilingual daughter, who graduated with a 3.8 GPA from Ga. Tech [Dr. Paul Craig Roberts’ undergrad school], not get a job offer for two months until someone I know hired her?”

Read More

Why Despite Today's Market Surge, Bank of America Stubbornly Refuses To Join The Rally

Submitted by Tyler Durden on 03/11/2016 - 08:59 "Risk assets about to top: ultimately markets about "rates" and "earnings", little else; central banks have played “rates card” as aggressively as they can; ECB done, BoJ has nothing in the tank, and any US macro strength will elicit Fed rate hike expectations (the Fed wants to tighten); EPS momentum simply not strong enough near-term to overwhelm Q2 risks of Brexit, BoJ failure, US politics, China debt deflation."

China Exports Most Deflation To US Since 2010

Submitted by Tyler Durden on 03/11/2016 - 08:41 For the 18th month in a row, US Import prices fell YoY (down 6.1% vs expectations of a 6.5% drop). This is the longest deflationary streak since 1999. Under the hood we see the first first rise in prices (ex food, fuel) since May 2014. Fuel price dropped 3.9% - the 8th consecutive drop - and foreign food product prices dropped 2% - the most since Feb 2012. Perhaps most crucially, China's forced deflationary wave continues to build with the index at its lowest since 2010.

The Good, The Bad, And The Petulant Child: Three "Morning After" Reactions To The ECB's All-In Gamble

Submitted by Tyler Durden on 03/11/2016 - 08:13 As can be seen by the violently volatile markets themselves, over the past 24 hours there has been substantial confusion about the implications of the ECB's "all in" gamble, with the initial kneejerk euphoria leading to a rapid selloff and surge in the EUR, followed by an overnight levitation in all risk assets (and gradual EUR fade) as virtually the entire ECB move has now been undone on both sides. Still, much confusion remains as can be seen by the following three reactions by financial pundits... two of whom even work for the same company.

Draghi Warns About Rising Inequality Hours After Boosting QE, As BIS Warns QE Leads To Inequality

Submitted by Tyler Durden on 03/11/2016 - 07:53 "The crucial question is whether a person can participate fully in the economy over his or her life-time – get a good education, find a job, buy a home for the family. Income and wealth follow. What makes me worry is that increasing inequality might prevent people from doing that. This is an issue all our societies need to look at carefully."

Oil Rebounds After IEA Says Price "Bottomed" As Goldman Warns Of "Sharply Lower" Prices As Storage Fills

Submitted by Tyler Durden on 03/11/2016 - 07:02 While today's IEA report which said that oil prices "may have bottomed" served to boost the price of oil, roughly at the same time Goldman released its own report, reiterating a well-known warning on inventory constraints, and repeating that oil prices may drop "sharply lower" as US "storage saturation" is reached:

Global Markets Surge After Traders "Reassess" ECB Stimulus

Submitted by Tyler Durden on 03/11/2016 - 06:30 Less than 24 hours after European stocks tumbled on initial disappointment by Draghi's announcement that rates will not be cut further, mood has changed dramatically and the result has been that after "reassessing" the ECB kitchen sink stimulus, risk has soared overnight with both Asian and European stocks surging. As of this moment European bourses are all broadly higher led by banks, with the DAX and FTSE both up over 2.7%, while the Stoxx 600 is higher by 2.3% as of this writing.

What We Know About Draghi's Coming Corporate Bond Purchases: The Winners And Losers

Submitted by Tyler Durden on 03/11/2016 - 04:21 No doubt, more about the ECB’s plans for credit will be revealed in the weeks ahead. But if ECB buying is material in size (something we questioned though last week), investors could end up “crowded into” what the ECB isn’t buying. And, if a large, price-insensitive buyer in the corporate bond market (The ECB) has indeed just emerged today, we think credit market liquidity may deteriorate even further.Rigged Democracy – Nearly 10% Of Democratic Party Superdelegates Are Lobbyists

Submitted by Tyler Durden on 03/10/2016 - 22:00 "Super delegates don't "represent people" I'm not elected by anyone. I'll do what I think is right for the country..." Any questions?

7 Harsh Realities Of Life Millennials Need To Understand

Submitted by Tyler Durden on 03/10/2016 - 23:55 Millennials. They may not yet be the present, but they’re certainly the future. These young, uninitiated minds will someday soon become our politicians, doctors, scientists, chefs, television producers, fashion designers, manufacturers, and, one would hope, the new proponents of liberty. But are they ready for it? It’s time millennials understood these 7 harsh realities of life so we don’t end up with a generation of gutless adult babies running the show.

And the Bitter Irony?

All 11 Japanese asset managers that offer money market funds have stopped accepting new investments into them and are planning to scuttle them after returning their remaining assets to investors. This marks another big accomplishments of negative interest rates.

After years of zero-interest-rate policy, and after gobbling up every Japanese government bond that wasn’t nailed down, the Bank of Japan decided in January to go beyond what had already failed and introduced its negative-interest-rate policy.

As a result of QQE, as it calls its asset-buying program, and the new NIRP, even the 10-year JGB yield is now negative, and yields on shorter maturities are sinking deeper into the negative.

Read More

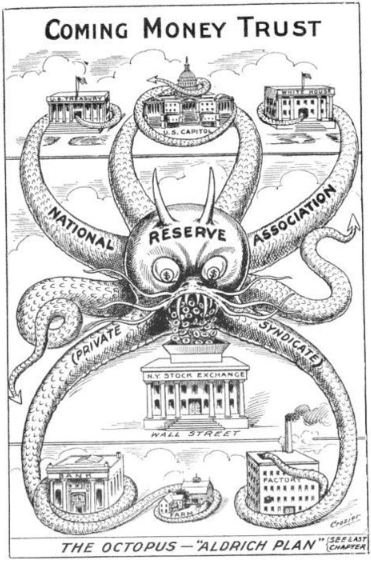

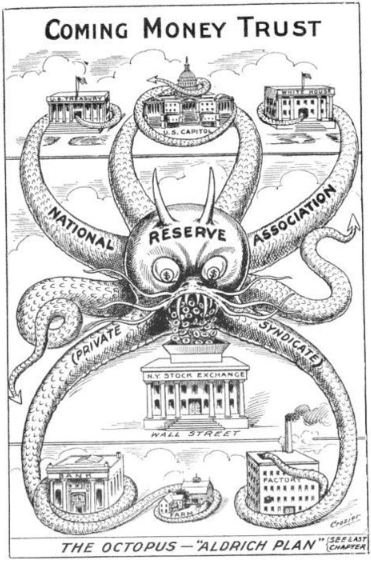

from The Burning Platform:

Billionaire oligarchs, media titans, and bought off politicians get together for a secret meeting on some islands off the Georgia coast to decide the future of the country. What could possibly go wrong? I’m sure they have the best interests of the common man at heart. Right?

Create a secretive privately owned central bank. (1910)

Stop Donald Trump from being elected by the popular vote of the citizens. (2016)

Read More

Billionaire oligarchs, media titans, and bought off politicians get together for a secret meeting on some islands off the Georgia coast to decide the future of the country. What could possibly go wrong? I’m sure they have the best interests of the common man at heart. Right?

Create a secretive privately owned central bank. (1910)

Stop Donald Trump from being elected by the popular vote of the citizens. (2016)

Read More

from RT:

Four

months after the death of former Russian press minister and prominent

media figure Mikhail Lesin in a DC hotel, Washington’s chief medical

examiner has revealed forensic data indicating that Lesin died of

injuries to the head.

Four

months after the death of former Russian press minister and prominent

media figure Mikhail Lesin in a DC hotel, Washington’s chief medical

examiner has revealed forensic data indicating that Lesin died of

injuries to the head.

While initial reports following Lesin’s death in DC’s Dupont Hotel on November 5, 2015 indicated that a heart attack had been to blame, no conclusive official forensic data has been released until now.

A joint statement by the District of Colombia’s Office of the Chief Medical Examiner (OCME) and Metropolitan Police Department said that the former minister’s death had been a violent one, as cited by RIA Novosti on Thursday.

Read More

Four

months after the death of former Russian press minister and prominent

media figure Mikhail Lesin in a DC hotel, Washington’s chief medical

examiner has revealed forensic data indicating that Lesin died of

injuries to the head.

Four

months after the death of former Russian press minister and prominent

media figure Mikhail Lesin in a DC hotel, Washington’s chief medical

examiner has revealed forensic data indicating that Lesin died of

injuries to the head.While initial reports following Lesin’s death in DC’s Dupont Hotel on November 5, 2015 indicated that a heart attack had been to blame, no conclusive official forensic data has been released until now.

A joint statement by the District of Colombia’s Office of the Chief Medical Examiner (OCME) and Metropolitan Police Department said that the former minister’s death had been a violent one, as cited by RIA Novosti on Thursday.

Read More

by Alasdair Macleod, GoldMoney:

This

article notes that the technical situation for the gold price has

sharply improved, to the evident surprise of many mainstream analysts.

It discusses possible reasons behind the turnaround, and implications

for the future

This

article notes that the technical situation for the gold price has

sharply improved, to the evident surprise of many mainstream analysts.

It discusses possible reasons behind the turnaround, and implications

for the future

The technical situation is shown in the chart below.

Read More

This

article notes that the technical situation for the gold price has

sharply improved, to the evident surprise of many mainstream analysts.

It discusses possible reasons behind the turnaround, and implications

for the future

This

article notes that the technical situation for the gold price has

sharply improved, to the evident surprise of many mainstream analysts.

It discusses possible reasons behind the turnaround, and implications

for the futureThe technical situation is shown in the chart below.

Read More

by Dave Forest, Oil Price:

China has been an unofficial price-setter for most metals over the past

decade. And this week, the country became an official participant in

setting prices for one of the world’s most important precious metals

markets.

China has been an unofficial price-setter for most metals over the past

decade. And this week, the country became an official participant in

setting prices for one of the world’s most important precious metals

markets.

That’s the London Bullion Market silver price. Where one of China’s largest banks just became a member of an elite group of players that controls fluctuations in this key metal.

Read More

China has been an unofficial price-setter for most metals over the past

decade. And this week, the country became an official participant in

setting prices for one of the world’s most important precious metals

markets.

China has been an unofficial price-setter for most metals over the past

decade. And this week, the country became an official participant in

setting prices for one of the world’s most important precious metals

markets.That’s the London Bullion Market silver price. Where one of China’s largest banks just became a member of an elite group of players that controls fluctuations in this key metal.

Read More

/

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment