Submitted by Tyler Durden on 03/16/2016 - 09:37 "If you disenfranchise those people, and you say, 'I'm sorry, you're 100 votes short' ... I think you'd have problems like you've never seen before."

Obama To Unveil Merrick Garland As Supreme Court Pick

Submitted by Tyler Durden on 03/16/2016 - 10:09 Today at 11:00, President Obama will announce Merrick Garland as his nominee for the Supreme Court seat left vacant by the death of revered Justice Antonin Scalia.

Largest U.S. Coal Producer Skips Interest Payment, Warns Of Bankruptcy; Stock Crashes

Submitted by Tyler Durden on 03/16/2016 - 07:54 After a historic short squeeze which sent the stock of Peabody Energy soaring from $2.50 to $6.50 in under two weeks, things promptly reverted back to normal when the stock crashed back to earth plunging by 30% to $2.80 in the pre-market, and wiping out virtually all recent gains, after Peabody announced in its just filed 10-K, reported that it may have to join its peers Arch Coal and Alpha Natural in 11 bankruptcy protection, after it delayed $71 million in interest payment due on March 15.

Manufacturing 'Recession' Continues (Unless Industrial Production Is Doing Something It Has Not Done In 64 Years)

Submitted by Tyler Durden on 03/16/2016 - 09:25 The current decline in US manufactiring would be the first time since 1952 that Industrial Production has declined for four straight months without the US economy not being in recession. A worse-then-expected 0.5% MoM plunge - near the worst since 2009, led to a 1.0% drop YoY, the 4th monthly decline, led by a 9.9% YoY crash in mining.

Bonds & Stocks Tumble As Core CPI Surges By Most Since October 2008

Submitted by Tyler Durden on 03/16/2016 - 09:10 Following last month's inflation 'jolt' to the marketplace, Core CPI increased 2.3% YoY in Feb - the biggest jump since October 2008 (led by the biggest monthly surge in apparel prices since 2009). Bond & Stock markets are dropping in the news as it corners The Fed further into a hawkish stance, despite the recessionary warning signals screaming from the manufacturing (and increasingly Services) sector.

"The Dollar Rally Is Far From Over," Goldman Insists

Submitted by Tyler Durden on 03/16/2016 - 09:01 "We expect the Fed to signal that it wants to continue normalizing policy, which means three hikes this year and four in 2017, with the statement referring to the risks as “nearly balanced,” reverting to phraseology used in October, just before December lift-off. Overall, our sense is that the outcome will be more hawkish than market pricing."

Housing Starts Beat Expectations, As Slowdown In Rental Permits Suggest Further Rent Increases In Coming Months

Submitted by Tyler Durden on 03/16/2016 - 08:50 Coming at the same time as an inflationary report which showed Core CPI rising at 2.30%, or the highest rate since October 2008, and one which will put further pressure on the Fed to hike rates as shelter inflation is now simply too big to sweep under the rug, we also got February's housing starts and permits, which while painting a mixed picture of the US housing market suggested further strength in the US housing sector in the past month.

Deutsche Bank Tumbles After CEO Says Bank Won't Be Profitable This Year

Submitted by Tyler Durden on 03/16/2016 - 08:12 We suppose this shouldn't come as a surprise to anyone since it emanates from the CEO of what could turn out to be the next Lehman, but the market isn't so pleased with Deutsche Bank's John Cryan, who on Wednesday delivered the latest bad news for the German behemoth when the CEO said the bank likely would not be profitable in 2016.

by Michael Snyder, The Economic Collapse Blog:

Exports fell precipitously during the last two recessions, and now it is happening again. So how in the world can anyone make the claim that the U.S. economy is in good shape? On my website I have been repeatedly pointing out the parallels between the last two major economic downturns and the current crisis, and I am going to discuss another one today. Since peaking in late 2014, U.S. exports have been steadily declining, and this is something that we never see outside of a major recession. On the chart that I have shared below, the shaded gray bars represent the last two recessions, and you can see that exports of goods and services plunged dramatically in both instances…

Read More

Exports fell precipitously during the last two recessions, and now it is happening again. So how in the world can anyone make the claim that the U.S. economy is in good shape? On my website I have been repeatedly pointing out the parallels between the last two major economic downturns and the current crisis, and I am going to discuss another one today. Since peaking in late 2014, U.S. exports have been steadily declining, and this is something that we never see outside of a major recession. On the chart that I have shared below, the shaded gray bars represent the last two recessions, and you can see that exports of goods and services plunged dramatically in both instances…

Read More

Frontrunning: March 16

- Trump knocks Rubio out of race, Republicans in turmoil (Reuters)

- Fed to Signal Worst Is Over, Hikes Coming: Decision-Day Guide (BBG)

- Four Economists See a Surprise from the Fed This Week (BBG)

- Global Stocks Muted Ahead of Fed Announcement (WSJ)

- Stop-Trump Groups Make One Last Bet on Rubio, and Lose (BBG)

- China's Li Seeks 'Win-Win' for Growth-Reform Plan Analysts Doubt (BBG)

Oil Jumps After Latest Output Freeze Meeting "News"

Submitted by Tyler Durden on 03/16/2016 - 07:01 Here we go again. WTI halts a 2-day decline and Brent rises above $39 as Qatar says oil producers will meet next month to hammer out the details of the elusive output freeze - with or without the Iranians.

All Eyes On Yellen: Futures Flat Ahead Of Fed Meeting Expected To Usher In More Rate Hikes

Submitted by Tyler Durden on 03/16/2016 - 06:50 Today Janet Yellen and the FOMC will go back to square one and try to reset global expectations unleashed by the ill-fated December rate "policy mistake" hike, when at 2pm the Fed will announce assessment of the economy, even if not rate hike is expected today. Just like in December the Fed will be forced to telegraph that it is hiking rates as a signal of a strengthening US, and global, economy where "risks are balanced" and hope that the subsequent global reaction will not be a rerun of what happened in January and February when confusion about the Fed's intentions led to a global market rout.US Government Blames 9/11 On Iran, Fines Iran $10.5 Billion; Iran Refuses To Pay

Submitted by Tyler Durden on 03/15/2016 - 22:30 And, as far as the 9/11-victim families are concerned: the U.S. government, obviously, has higher priorities than to be concerned about any sort of real “justice” for them. Punishing Iran (until it breaks, ‘America’s’ way) is far more important, to the powers-that-be in America.

The magic of Consensual Hallucination.

The simple fact is that corporate earnings data is out there for everyone to see, but no one wants to see it. Instead, everyone wants to see and believe the sweet fairy tale that Wall Street and Corporate America spin with such skill just for us, because if everyone believes that everyone believes in this fairy tale, even knowing that it is a fairy tale, it will somehow lead to ever higher stock prices.This is part of a phenomenon we’ve come to call “Consensual Hallucination.”

Read More

by Michael Krieger, Liberty Blitzkrieg:

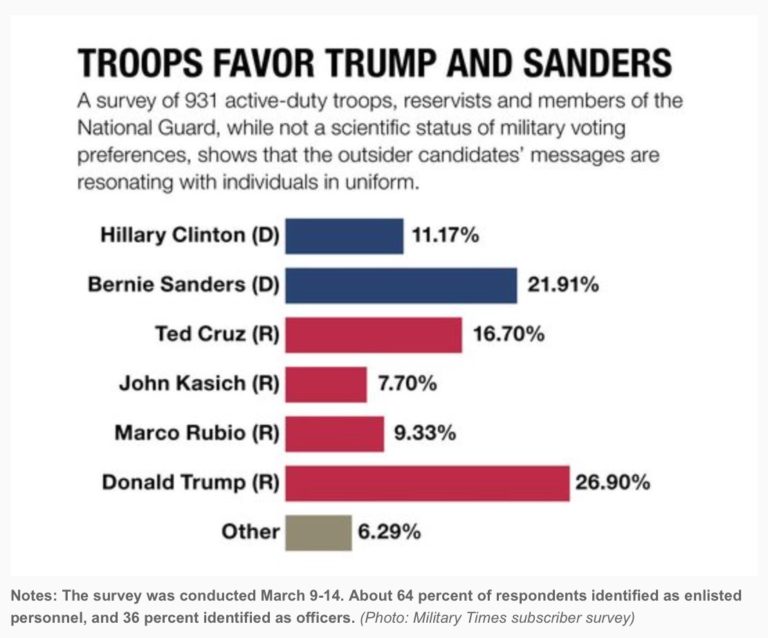

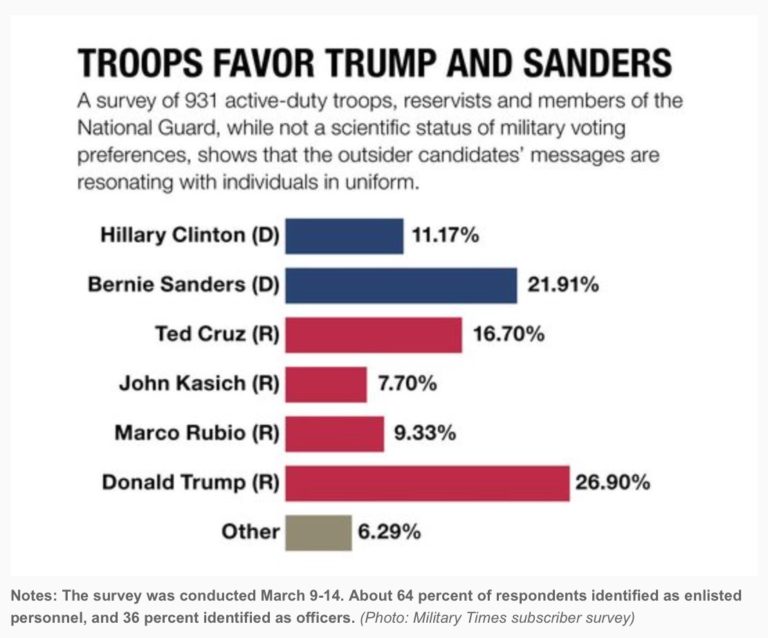

The U.S. presidential campaign in 2016 thus far has exhibited a dramatic and much needed public rejection of the status quo, aka “the establishment.” While a majority of the commentary has been justifiably focused on anger about the economy and how a smaller and smaller group of “insiders” have systematically accumulated more and more wealth via parasitic rent-seeking behavior, there’s another very important repudiation occurring. A total rejection of neocon, interventionist foreign policy.

Longtime readers of Liberty Blitzkrieg will be under no illusions about the fact that the Obama administration has represented a perfect continuation of the George W. Bush foreign policy doctrine, albeit with a more sleek marketing approach to placate the conscience of willfully ignorant fake liberals. Well the blowback from this one party foreign policy approach has arrived, with its evidence appearing in the form of military support of both Trump and Sanders.

Read More

The U.S. presidential campaign in 2016 thus far has exhibited a dramatic and much needed public rejection of the status quo, aka “the establishment.” While a majority of the commentary has been justifiably focused on anger about the economy and how a smaller and smaller group of “insiders” have systematically accumulated more and more wealth via parasitic rent-seeking behavior, there’s another very important repudiation occurring. A total rejection of neocon, interventionist foreign policy.

Longtime readers of Liberty Blitzkrieg will be under no illusions about the fact that the Obama administration has represented a perfect continuation of the George W. Bush foreign policy doctrine, albeit with a more sleek marketing approach to placate the conscience of willfully ignorant fake liberals. Well the blowback from this one party foreign policy approach has arrived, with its evidence appearing in the form of military support of both Trump and Sanders.

Read More

by Robert Jonathan Inquisitr:

Donald Trump, the current GOP front-runner in election 2016, will select Susana Martinez, the governor of New Mexico, as his vice presidential running mate, assuming Trump wins the Republican nomination.

Given that Hillary Clinton is his likely (but not 100 percent certain) opponent, and that The Donald has been accused of misogyny, it seems essential to put a woman on the Trump ticket.

Susana Martinez is the first woman ever to be elected governor of her state and the first Hispanic female governor in the U.S. She is the 2016 chair of the Republican Governors Association.

Read More

Donald Trump, the current GOP front-runner in election 2016, will select Susana Martinez, the governor of New Mexico, as his vice presidential running mate, assuming Trump wins the Republican nomination.

Given that Hillary Clinton is his likely (but not 100 percent certain) opponent, and that The Donald has been accused of misogyny, it seems essential to put a woman on the Trump ticket.

Susana Martinez is the first woman ever to be elected governor of her state and the first Hispanic female governor in the U.S. She is the 2016 chair of the Republican Governors Association.

Read More

by J. D. Heyes, Natural News:

In a rather bizarre turn of events, the Food and Drug Administration

appears set to reverse course on earlier data proving that electroshock

therapy had no medical value, by reclassifying the devices, thereby

making it easier for psychiatrists to use on certain mentally impaired patients.

In a rather bizarre turn of events, the Food and Drug Administration

appears set to reverse course on earlier data proving that electroshock

therapy had no medical value, by reclassifying the devices, thereby

making it easier for psychiatrists to use on certain mentally impaired patients.

That said, the FDA’s effort to reclassify Electroconvulsive Therapy (ECT) devices from their current level of Class III – the highest rating for medical equipment – to Class II, which is much less regulated, appears to be part of a two-pronged effort. In early December, Medicine.news reported that a bill had been introduced in Congress that “essentially weakens the already weak standards for the approval process of prescription drugs and medical devices, solely benefiting the pharmaceutical industry while placing Americans directly in harm’s way as they unknowingly become guinea pigs.”

Read More

In a rather bizarre turn of events, the Food and Drug Administration

appears set to reverse course on earlier data proving that electroshock

therapy had no medical value, by reclassifying the devices, thereby

making it easier for psychiatrists to use on certain mentally impaired patients.

In a rather bizarre turn of events, the Food and Drug Administration

appears set to reverse course on earlier data proving that electroshock

therapy had no medical value, by reclassifying the devices, thereby

making it easier for psychiatrists to use on certain mentally impaired patients.That said, the FDA’s effort to reclassify Electroconvulsive Therapy (ECT) devices from their current level of Class III – the highest rating for medical equipment – to Class II, which is much less regulated, appears to be part of a two-pronged effort. In early December, Medicine.news reported that a bill had been introduced in Congress that “essentially weakens the already weak standards for the approval process of prescription drugs and medical devices, solely benefiting the pharmaceutical industry while placing Americans directly in harm’s way as they unknowingly become guinea pigs.”

Read More

by Pam Martens and Russ Martens, Wall Street on Parade:

On March 8, 2016 the Securities and Exchange Commission (SEC) wired

$750,000 into the bank account of Eric Hunsader as a whistleblower award

for spotting and documenting an illegality at the New York Stock

Exchange. Hunsader is a trading software and market data expert and

founder of Nanex LLC, a market data company that also provides a boatload of free research

on behalf of the public interest. Hunsader is one more thing: he’s the

SEC’s biggest critic when it comes to its failure to restore integrity

to U.S. stock exchanges and U.S. markets.

On March 8, 2016 the Securities and Exchange Commission (SEC) wired

$750,000 into the bank account of Eric Hunsader as a whistleblower award

for spotting and documenting an illegality at the New York Stock

Exchange. Hunsader is a trading software and market data expert and

founder of Nanex LLC, a market data company that also provides a boatload of free research

on behalf of the public interest. Hunsader is one more thing: he’s the

SEC’s biggest critic when it comes to its failure to restore integrity

to U.S. stock exchanges and U.S. markets.

The SEC doesn’t release the names of its whistleblowers but Hunsader alerted the media himself to his award in order to silence critics and one particular executive at the New York Stock Exchange who had, heretofore, disparaged in public Hunsader’s allegations about the NYSE’s discriminatory dissemination of market data in order to benefit high frequency traders.

Read More…

On March 8, 2016 the Securities and Exchange Commission (SEC) wired

$750,000 into the bank account of Eric Hunsader as a whistleblower award

for spotting and documenting an illegality at the New York Stock

Exchange. Hunsader is a trading software and market data expert and

founder of Nanex LLC, a market data company that also provides a boatload of free research

on behalf of the public interest. Hunsader is one more thing: he’s the

SEC’s biggest critic when it comes to its failure to restore integrity

to U.S. stock exchanges and U.S. markets.

On March 8, 2016 the Securities and Exchange Commission (SEC) wired

$750,000 into the bank account of Eric Hunsader as a whistleblower award

for spotting and documenting an illegality at the New York Stock

Exchange. Hunsader is a trading software and market data expert and

founder of Nanex LLC, a market data company that also provides a boatload of free research

on behalf of the public interest. Hunsader is one more thing: he’s the

SEC’s biggest critic when it comes to its failure to restore integrity

to U.S. stock exchanges and U.S. markets.The SEC doesn’t release the names of its whistleblowers but Hunsader alerted the media himself to his award in order to silence critics and one particular executive at the New York Stock Exchange who had, heretofore, disparaged in public Hunsader’s allegations about the NYSE’s discriminatory dissemination of market data in order to benefit high frequency traders.

Read More…

by Christina Sarich, Natural Society:

A landmark case about the dirty-money and politics that go into keeping Big Food and Big Biotech afloat was just decided.

A landmark case about the dirty-money and politics that go into keeping Big Food and Big Biotech afloat was just decided.

Judge Anne Hirsch awarded a summary judgment in a suit brought against the Grocery Manufacturer’s Association by Attorney General Bob Ferguson, finding the GMA guilty of a money laundering scheme that shielded members’ identities as they helped to defeat Washington’s 2013 GMO labeling ballot initiative, I-522, with their donations.

Read More

A landmark case about the dirty-money and politics that go into keeping Big Food and Big Biotech afloat was just decided.

A landmark case about the dirty-money and politics that go into keeping Big Food and Big Biotech afloat was just decided.Judge Anne Hirsch awarded a summary judgment in a suit brought against the Grocery Manufacturer’s Association by Attorney General Bob Ferguson, finding the GMA guilty of a money laundering scheme that shielded members’ identities as they helped to defeat Washington’s 2013 GMO labeling ballot initiative, I-522, with their donations.

Read More

/

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment