Submitted by Tyler Durden on 03/30/2016 - 09:05

Submitted by Tyler Durden on 03/30/2016 - 09:05

In the latest developments from the never-ending Hillary Clinton e-mail saga, a second federal judge will allow Judicial Watch to seek sworn testimony from officials. "Where there is evidence of government wrong-doing and bad faith, as here, limited discovery is appropriate, even though it is exceedingly rare in FOIA cases," U.S. District Court Judge Royce Lamberth said, in an order entered on Tuesday.

(Poor) Judgment Matters - Hillary's "Inconsequential" Emails

Submitted by Tyler Durden on 03/29/2016 - 22:00 As inconsequential as the email issue might seem to most of us, judgment matters! And if judgment matters, the text of Hillary Clinton’s speeches should be critical to the Democratic Party faithful when making up their minds whether they would want her to be the party’s nominee. The DNC’s complicity in failing to denounce the speeches’ secrecy is an affront to the truth, showing the machinations of dirty politics.

from Liberty Blitzkrieg:

While

it might sound strange, a coronation of Hillary Clinton in the

Democratic primary will mark the end of the party as we know it. There’s

been a lot written about the “Sanders surge,” with much of it revolving

around Hillary Clinton’s extreme personal weakness as a candidate.

While this is indisputable, it’s also a convenient way for the status

quo to exempt itself from fault and discount genuine grassroots anger.

I’m of the view that Sanders’ support is more about people liking him

than them disliking Hillary, particularly when it comes to registered

Democrats. He’s not merely seen as the “least bad choice.” People really

do like him.

While

it might sound strange, a coronation of Hillary Clinton in the

Democratic primary will mark the end of the party as we know it. There’s

been a lot written about the “Sanders surge,” with much of it revolving

around Hillary Clinton’s extreme personal weakness as a candidate.

While this is indisputable, it’s also a convenient way for the status

quo to exempt itself from fault and discount genuine grassroots anger.

I’m of the view that Sanders’ support is more about people liking him

than them disliking Hillary, particularly when it comes to registered

Democrats. He’s not merely seen as the “least bad choice.” People really

do like him.

The Sanders appeal is twofold. He is seen as unusually honest and consistent for someone who’s held elected office for much of his life, plus he advocates a refreshingly anti-establishment view on core issues that matter to an increasing number of Americans. These include militarism, Wall Street bailouts, a two-tiered justice system, the prohibitive cost of college education, healthcare insecurity and a “rigged economy.” While Hillary is being forced to pay lip service to these issues, everybody knows she doesn’t mean a word of it. She means it less than Obama meant it in 2008, and Obama really didn’t mean it.

Read More…

While

it might sound strange, a coronation of Hillary Clinton in the

Democratic primary will mark the end of the party as we know it. There’s

been a lot written about the “Sanders surge,” with much of it revolving

around Hillary Clinton’s extreme personal weakness as a candidate.

While this is indisputable, it’s also a convenient way for the status

quo to exempt itself from fault and discount genuine grassroots anger.

I’m of the view that Sanders’ support is more about people liking him

than them disliking Hillary, particularly when it comes to registered

Democrats. He’s not merely seen as the “least bad choice.” People really

do like him.

While

it might sound strange, a coronation of Hillary Clinton in the

Democratic primary will mark the end of the party as we know it. There’s

been a lot written about the “Sanders surge,” with much of it revolving

around Hillary Clinton’s extreme personal weakness as a candidate.

While this is indisputable, it’s also a convenient way for the status

quo to exempt itself from fault and discount genuine grassroots anger.

I’m of the view that Sanders’ support is more about people liking him

than them disliking Hillary, particularly when it comes to registered

Democrats. He’s not merely seen as the “least bad choice.” People really

do like him.The Sanders appeal is twofold. He is seen as unusually honest and consistent for someone who’s held elected office for much of his life, plus he advocates a refreshingly anti-establishment view on core issues that matter to an increasing number of Americans. These include militarism, Wall Street bailouts, a two-tiered justice system, the prohibitive cost of college education, healthcare insecurity and a “rigged economy.” While Hillary is being forced to pay lip service to these issues, everybody knows she doesn’t mean a word of it. She means it less than Obama meant it in 2008, and Obama really didn’t mean it.

Read More…

from DC Clothesline:

It’s looking more and more like TrusTed is BusTed.

Rumors that Ted Cruz has had affairs with not one but FIVE mistresses (at least) began to circulate last week. Cruz accused Donald Trump of planting the story, which was published by The National Enquirer.

Two days after the story broke, Cruz responded to the accusations of adultery with a bizarre statement, including this gem:

Read More

It’s looking more and more like TrusTed is BusTed.

Rumors that Ted Cruz has had affairs with not one but FIVE mistresses (at least) began to circulate last week. Cruz accused Donald Trump of planting the story, which was published by The National Enquirer.

Two days after the story broke, Cruz responded to the accusations of adultery with a bizarre statement, including this gem:

Well let me be clear: Donald Trump may be a rat, but I have no desire to copulate with him.I’m not sure what that means, and I’m positive that I don’t want to know.

Read More

What Janet Hath Wrought...

Submitted by Tyler Durden on 03/30/2016 - 09:56 "Unequivocally" dovish Yellen has sent oil prices soaring this morning - because, well who the f##k knows anymore. Strength in gold and bonds yesterday was clearly not acceptable and now traders are rushing into Biotech safe-havens and dumping protection (VIX at 13.40 - lowest since Oct 2015).

The End Of Europe As We Know It?

Submitted by Tyler Durden on 03/30/2016 - 09:46 Amid secular stagnation, the Eurozone's old fiscal, monetary and banking challenges are escalating, along with new threats, including the Brexit, demise of Schengen, anti-EU opposition and geopolitical friction. Brussels can no longer avoid hard political decisions for or against an integrated Europe, with or without the euro.

Former Fed President: "Living In Constant Fear Of Market Reaction Is Not How You Manage Central Bank Policy"

Submitted by Tyler Durden on 03/30/2016 - 09:29 Back in January Fisher said (what even Liesman has now suggested) that "We Frontloaded A Tremendous Market Rally" and there is "No Ammo Left", followed by a second appearance earlier this month when he said that the Fed "Injected Cocaine And Heroin Into The System To Create A Wealth Effect." This morning Fisher was again on CNBC to discuss Yellen's dovish speech at the Economic Club of NY, and said that the Fed is "living in a constant fear of a market reaction. This is not how the way you manage central bank policy."

Gross To Central Banks: "Get Global Growth Moving Now, Or Else"

Submitted by Tyler Durden on 03/30/2016 - 08:38 "The reality is this. Central bank polices consisting of QE’s and negative/artificially low interest rates must successfully reflate global economies or else. They are running out of time. Or else what? Or else markets and the capitalistic business models based upon them and priced for them will begin to go south. Capital gains and the expectations for future gains will become Giant Pandas – very rare and sort of inefficient at reproduction."

About That ADP Jobs Number: Dear Mark Zandi, Please Explain This (Again)

Submitted by Tyler Durden on 03/30/2016 - 08:23 Against expectations of a 195k gain, ADP reported 200k (from a downwardly revised 205k -was 214k - in Feb). While manufacturing has been weak, Services sector job gains have been the pillar of this 'recovery' so with ISM Services Employment plumbing 2-year low depths, we simply ask Mark Zandi to explain how ADP sees such strength in that same sector. Services added 191k, goods added 9k as small businesses gained 86k jobs (the most of the cohorts)... as Zandi explains "the econmy is doing very well, ignore GDP.""Wrong Way Gartman"

Gartman Remains Bearish "Of Stocks"

Submitted by Tyler Durden on 03/30/2016 - 07:59 "We are still going to err bearishly of stocks and certainly we shall not err bullishly of them. We are, in our retirement account here at TGL long of gold in EUR and Yen related terms."

Boeing Will Terminate More Than 4,500 Workers

Submitted by Tyler Durden on 03/30/2016 - 07:41 Now that Yellen has taken us back to square one where the worse the news, the better for assets, the latest announcement by Boeing, which overnight announced it will eliminate about 4,000 jobs in its commercial airplanes division by the middle of this year and another roughly 550 jobs in a division that conducts flight and lab tests, should help push the iconic ExIm bank-supported company's shares to new 2016 highs.

Emerging Market Currencies Have Best Month In 18 Years As Yellen Buoys Sentiment

Submitted by Tyler Durden on 03/30/2016 - 07:27 "[There was] a lot of ‘let’s not forget the far more hawkish statements other Fed officials made last week,’ [but] this was not a bolt out of the blue. As she spoke, I couldn’t help picturing a mother lion swatting her misbehaving cubs back into line."

"Bad News Is Great Again" - Global Stocks Soar After Yellen Admits Global Economy Is Much Weaker

Submitted by Tyler Durden on 03/30/2016 - 06:48 At the end of the day, it was all about the dollar and the reason for this morning's stock surge around the globe, as we noted last night, is absurdly delightful: Yellen signaled "weakening world growth" and "less confidence in the renormalization process." In other words, the "bad news is good news" mantra is back front and center.

Yesterday's Dystopian Fiction Is Today's New World Order

Submitted by Tyler Durden on 03/29/2016 - 23:00 The shift is toward totalitarianism, and the populations have been (and are being) conditioned to accept, if not embrace, collectivist thought and socialism. Orwell envisioned it. His work is labeled a work of fiction, although all of the measures Oceania pursued are either currently in place in the United States or they’re being developed.

by Michael Snyder, The Economic Collapse Blog:

Ten years ago, a major Hollywood film entitled “Idiocracy” was released, and it was an excellent metaphor for what would happen to America over the course of the next decade. In the movie, an “average American” wakes up 500 years in the future only to discover that he is the most intelligent person by far in the “dumbed down” society that he suddenly finds himself in. Sadly, I truly believe that if people of average intellect from the 1950s and 1960s were transported to 2016, they would likely be considered mental giants compared to the rest of us. We have a country where criminals are being paid $1000 a month not to shoot people, and the highest paid public employee in more than half the states is a football coach. Hardly anyone takes time to read a book anymore, and yet the average American spends 302 minutes a day watching television. 75 percent of our young adults cannot find Israel on a map of the Middle East, but they sure know how to find smut on the Internet. It may be hard to believe, but there are more than 4 million adult websites on the Internet today, and they get more traffic than Netflix, Amazon and Twitter combined.

Read More

Ten years ago, a major Hollywood film entitled “Idiocracy” was released, and it was an excellent metaphor for what would happen to America over the course of the next decade. In the movie, an “average American” wakes up 500 years in the future only to discover that he is the most intelligent person by far in the “dumbed down” society that he suddenly finds himself in. Sadly, I truly believe that if people of average intellect from the 1950s and 1960s were transported to 2016, they would likely be considered mental giants compared to the rest of us. We have a country where criminals are being paid $1000 a month not to shoot people, and the highest paid public employee in more than half the states is a football coach. Hardly anyone takes time to read a book anymore, and yet the average American spends 302 minutes a day watching television. 75 percent of our young adults cannot find Israel on a map of the Middle East, but they sure know how to find smut on the Internet. It may be hard to believe, but there are more than 4 million adult websites on the Internet today, and they get more traffic than Netflix, Amazon and Twitter combined.

Read More

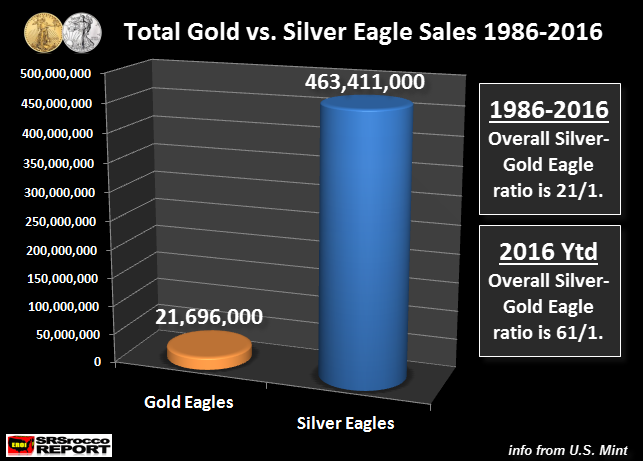

What is the better investment? Silver or Gold? Well, if we look at the following two charts below, we can spot some interesting trends. The U.S. Mint has been producing Gold and Silver Eagles for over thirty years now. Since 1986, the U.S. Mint has sold 21.7 million Gold Eagles versus 463.4 million Silver Eagles. The overall Silver-Gold Eagle Ratio from 1986-2016 is 21.1:

However, if we look at the Gold Eagle sales of 252,500 oz versus Silver Eagles at 14,842,500 for 2016, the ratio is 61/1. Investors are currently buying Silver Eagles this year at three times the historic overall ratio. Furthermore, if we break down Gold versus Silver Eagle sales in the following two periods, we can see an interesting trend:

Read More

from Wolf Street:

“Hangover from years of lenient credit may become painful.”

Credit rating agencies, such as Standard & Poor’s, are not known for early warnings. They’re mired in conflicts of interest and reluctant to cut ratings for fear of losing clients. When they finally do warn, it’s late and it’s feeble, and the problem is already here and it’s big.

So Standard & Poor’s, via a report by S&P Capital IQ, just warned about US corporate borrowers’ average credit rating, which at “BB,” and thus in junk territory, hit a record low, even “below the average we recorded in the aftermath of the 2008-2009 credit crisis.”

Read More

“Hangover from years of lenient credit may become painful.”

Credit rating agencies, such as Standard & Poor’s, are not known for early warnings. They’re mired in conflicts of interest and reluctant to cut ratings for fear of losing clients. When they finally do warn, it’s late and it’s feeble, and the problem is already here and it’s big.

So Standard & Poor’s, via a report by S&P Capital IQ, just warned about US corporate borrowers’ average credit rating, which at “BB,” and thus in junk territory, hit a record low, even “below the average we recorded in the aftermath of the 2008-2009 credit crisis.”

Read More

from Zen Gardner:

Our health care system is now based on a pharmaceutical model of care with a strong emphasis on vaccinations. In the 1800s, homeopathic and nutritional health care approaches successfully treated many people who suffered during disease epidemics. Orthodox medical treatments were dangerous and comparatively less successful in treating patients.

Great divides existed between orthodox and homeopathic physicians. The attempt to suppress homeopathic medicine was accelerated in 1910 with the Flexner Report, influenced by the funding by John D. Rockefeller and Andrew Carnegie. In effect, healthcare in the US was bought out and successful homeopathic physicians disallowed from further practice. This important change led to safe, inexpensive treatments being forced to the fringe of mainstream medicine, a practice which remains in effect today.

Read More…

Our health care system is now based on a pharmaceutical model of care with a strong emphasis on vaccinations. In the 1800s, homeopathic and nutritional health care approaches successfully treated many people who suffered during disease epidemics. Orthodox medical treatments were dangerous and comparatively less successful in treating patients.

Great divides existed between orthodox and homeopathic physicians. The attempt to suppress homeopathic medicine was accelerated in 1910 with the Flexner Report, influenced by the funding by John D. Rockefeller and Andrew Carnegie. In effect, healthcare in the US was bought out and successful homeopathic physicians disallowed from further practice. This important change led to safe, inexpensive treatments being forced to the fringe of mainstream medicine, a practice which remains in effect today.

Read More…

from The Daily Bell:

…

Along with the crackdown on dissent and freedom of speech, as well as

an increasingly ideological tone, some observers worry that Chinese

politics is now taking a more authoritarian direction of the kind not

seen since the days of Chairman Mao. And with the normal political

process so opaque and closed, the things we can glimpse on the edges of

China’s parliamentary set pieces are sometimes all we have to go on in

trying to assess the truth.- BBC

…

Along with the crackdown on dissent and freedom of speech, as well as

an increasingly ideological tone, some observers worry that Chinese

politics is now taking a more authoritarian direction of the kind not

seen since the days of Chairman Mao. And with the normal political

process so opaque and closed, the things we can glimpse on the edges of

China’s parliamentary set pieces are sometimes all we have to go on in

trying to assess the truth.- BBC

There have been two communication revolutions in the past millennium.

The first unleashed the Gutenberg press that allowed masses of people to read, first the Bible and then other books – and to discover that they had been lied to on many fronts. This led to the Reformation and many other disruptive religious, sociopolitical and economic changes.

Read More

…

Along with the crackdown on dissent and freedom of speech, as well as

an increasingly ideological tone, some observers worry that Chinese

politics is now taking a more authoritarian direction of the kind not

seen since the days of Chairman Mao. And with the normal political

process so opaque and closed, the things we can glimpse on the edges of

China’s parliamentary set pieces are sometimes all we have to go on in

trying to assess the truth.- BBC

…

Along with the crackdown on dissent and freedom of speech, as well as

an increasingly ideological tone, some observers worry that Chinese

politics is now taking a more authoritarian direction of the kind not

seen since the days of Chairman Mao. And with the normal political

process so opaque and closed, the things we can glimpse on the edges of

China’s parliamentary set pieces are sometimes all we have to go on in

trying to assess the truth.- BBCThere have been two communication revolutions in the past millennium.

The first unleashed the Gutenberg press that allowed masses of people to read, first the Bible and then other books – and to discover that they had been lied to on many fronts. This led to the Reformation and many other disruptive religious, sociopolitical and economic changes.

Read More

by Christina Sarich, Underground Reporter:

Share prices — plummeting. Royalties — cut. Consumer opinion — in the

toilet. Governments — fed up. Monsanto’s earnings represent the writing

on the wall, but the company’s glory days are nearing an end for many

reasons ranging from farmer and consumer resistance to government

crackdowns on GMO products and even Monsanto’s best-selling chemical

product, glyphosate. Monsanto’s days are about as numbered as a fruit

fly’s.

Share prices — plummeting. Royalties — cut. Consumer opinion — in the

toilet. Governments — fed up. Monsanto’s earnings represent the writing

on the wall, but the company’s glory days are nearing an end for many

reasons ranging from farmer and consumer resistance to government

crackdowns on GMO products and even Monsanto’s best-selling chemical

product, glyphosate. Monsanto’s days are about as numbered as a fruit

fly’s.

If we were to ascertain Monsanto’s financial health by their stock price alone, you could safely say that they are suffering. The company recently slashed its 2016 earnings forecast from the $5.10-$5.60 per share it had forecast in December, to $4.40-$5.10, claiming that the reduction was due to a lagging strength in the U.S. dollar — but there’s much more to the picture.

Read More

Share prices — plummeting. Royalties — cut. Consumer opinion — in the

toilet. Governments — fed up. Monsanto’s earnings represent the writing

on the wall, but the company’s glory days are nearing an end for many

reasons ranging from farmer and consumer resistance to government

crackdowns on GMO products and even Monsanto’s best-selling chemical

product, glyphosate. Monsanto’s days are about as numbered as a fruit

fly’s.

Share prices — plummeting. Royalties — cut. Consumer opinion — in the

toilet. Governments — fed up. Monsanto’s earnings represent the writing

on the wall, but the company’s glory days are nearing an end for many

reasons ranging from farmer and consumer resistance to government

crackdowns on GMO products and even Monsanto’s best-selling chemical

product, glyphosate. Monsanto’s days are about as numbered as a fruit

fly’s.If we were to ascertain Monsanto’s financial health by their stock price alone, you could safely say that they are suffering. The company recently slashed its 2016 earnings forecast from the $5.10-$5.60 per share it had forecast in December, to $4.40-$5.10, claiming that the reduction was due to a lagging strength in the U.S. dollar — but there’s much more to the picture.

Read More

/

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment