Submitted by Tyler Durden on 03/10/2016 - 15:16

Submitted by Tyler Durden on 03/10/2016 - 15:16

The story of the theft of $100 million from the Bangladesh central bank - by way of the New York Federal Reserve - is getting more fascinating by the day.

UK Inquiry Finds Gulf "Allies" Sustaining ISIS In The Face Of Oil Price Collapse

Submitted by Tyler Durden on 03/10/2016 - 18:00 “Some might wonder to what extent Gulf Arab financing has continued to subsidise the caliphate. Certainly, IS was able to draw on some other sources of income between January 2015, when Raqqa’s economy had reportedly collapsed, and mid-January 2016, when IS forces have been able to launch a major new Syrian offensive. The money is coming from somewhere.”

The Germans React To Draghi's Monetary "Tidal Wave"

Submitted by Tyler Durden on 03/10/2016 - 17:32 "A determined ECB chief Mario Draghi plows ahead with his negative interest rate policy. The positive effects on the economy are low. Great, however, are the risks: this is the greatest redistribution of wealth in Europe since World War II."

Obama To GOP: Stop Blaming Me For 'Creating' Trump

Submitted by Tyler Durden on 03/10/2016 - 17:05 While admitting he shares some blame for the widening partisan divide during his term in office, President Obama dismissed the notion that he's responsible for the rise of Donald Trump, who has harnessed voter anger during his presidential run, urging GOP elites to do some "introspection" about the how "the politics they've engaged in allows the circus we've been seeing to transpire."Gold Soars As Draghi "Dud" Unleashes Chaos In Bonds, Stocks, & FX

Submitted by Tyler Durden on 03/10/2016 - 16:46

7 Harsh Realities Of Life Millennials Need To Understand

Submitted by Tyler Durden on 03/10/2016 - 16:35 Millennials. They may not yet be the present, but they’re certainly the future. These young, uninitiated minds will someday soon become our politicians, doctors, scientists, chefs, television producers, fashion designers, manufacturers, and, one would hope, the new proponents of liberty. But are they ready for it? It’s time millennials understood these 7 harsh realities of life so we don’t end up with a generation of gutless adult babies running the show.

Bernie-nomics Explained

Submitted by Tyler Durden on 03/10/2016 - 15:50 Presented with no comment...

German Bank That Almost Failed Now Being Paid To Borrow Money

Submitted by Tyler Durden on 03/10/2016 - 15:30 We’re repeating the same crazy thing that nearly brought down the system back in 2008 - paying people to borrow money. The primary difference is that, this time around, the bubble is much bigger. Back then, the subprime bubble was “only” $1.3 trillion. Today, conservative estimates show that there’s over $7 trillion in negative rate bonds. What could possibly go wrong?

Global Liquidity Collapses To 2008 Crisis Levels

Submitted by Tyler Durden on 03/10/2016 - 14:50 The last time that global liquidity conditions contracted at this pace was March 2008 (right as stocks dead-cat-bounced on the back of The Fed's guarantee of Bear Stearns' sale to JPMorgan)... and things escalated rather quickly thereafter.

The Fed's Got A Problem

Submitted by Tyler Durden on 03/10/2016 - 14:50 Of course, if things were as good economically as we are told by Wall Street and the mainstream media, would the ECB really be needing to drop further into negative interest rate territory and boost QE? By fully committing to hiking interest rates, and promoting the economic recovery meme, changing direction now would lead to a loss of confidence and a more dramatic swoon in the financial markets. Such an event would create the very recession they are trying to avoid.

Did Draghi Just Blow His Bazooka's Wad: Gold Soars, EUR Spikes, Stocks Slump

Submitted by Tyler Durden on 03/10/2016 - 14:23 From omnipotent to impotent in an hour...

China Is Now In Control Of Global Silver Prices

Submitted by Tyler Durden on 03/10/2016 - 14:10 China has been an unofficial price-setter for most metals over the past decade. And this week, the country became an official participant in setting prices for one of the world’s most important precious metals markets. That’s the London Bullion Market silver price. Where one of China’s largest banks just became a member of an elite group of players that controls fluctuations in this key metal.by Andy Hoffman, Miles Franklin:

It’s still Wednesday evening, but I’m confident enough in what will happen tomorrow to not only start writing before tomorrow morning’s ECB’s policy decision, but create a hyperbolic title. After all, if the past two weeks’ manic market manipulation – in today’s instance, featuring every imaginable “DLITG,” or don’t let it turn green, algorithm in Precious Metals; and “DLITR,” or don’t let it turn red, in the “Dow Jones Propaganda Average – can’t convince you that “something’s afoot,” I don’t know what will. In the latter case, the “smart money” has been selling for six straight weeks – which begs the question, who has been buying? I’ll give you a hint…the same who that is naked shorting “selling” gold and silver.

Read More

by Mac Slavo, SHTFPlan:

You may find that the below report is, as President Obama might suggest, once again “peddling fiction.”

But for the average American, we can assure you that the economic recession is a very real situation.

Walmart, which made its billions serving low to middle income Americans, is struggling and it’s because their core customer base is too broke to shop. As Michael Snyder recently pointed out, they are just one of many domestic retailers laying off workers amid falling store sales.

Read More

You may find that the below report is, as President Obama might suggest, once again “peddling fiction.”

But for the average American, we can assure you that the economic recession is a very real situation.

Walmart, which made its billions serving low to middle income Americans, is struggling and it’s because their core customer base is too broke to shop. As Michael Snyder recently pointed out, they are just one of many domestic retailers laying off workers amid falling store sales.

Read More

by Daniel McAdams, The News Doctors:

On his own and through his proxies in what is called the US “Israel Lobby,” Benjamin Netanyahu expended enormous political and financial capital in attempt to sink President Obama’s nuclear deal with Iran. Though the deal is already done, the pro-Likud lobby in Washington with the backing of a significant number of elected Members of the House and Senate is still determined to turn back the hands of time to a US war-footing against Iran. They may well succeed, particularly as most presidential candidates have promised to rip up the Iran deal on day one.

But Netanyahu is no dummy. Once he saw the writing on the wall — even if only temporarily — he decided to make lemonade from Obama’s lemons.

Read More

On his own and through his proxies in what is called the US “Israel Lobby,” Benjamin Netanyahu expended enormous political and financial capital in attempt to sink President Obama’s nuclear deal with Iran. Though the deal is already done, the pro-Likud lobby in Washington with the backing of a significant number of elected Members of the House and Senate is still determined to turn back the hands of time to a US war-footing against Iran. They may well succeed, particularly as most presidential candidates have promised to rip up the Iran deal on day one.

But Netanyahu is no dummy. Once he saw the writing on the wall — even if only temporarily — he decided to make lemonade from Obama’s lemons.

Read More

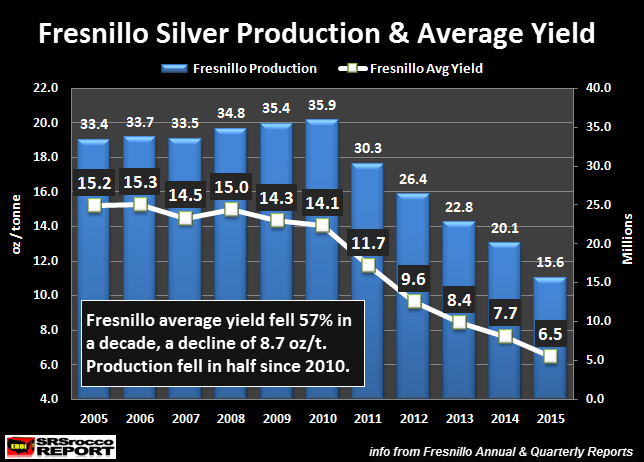

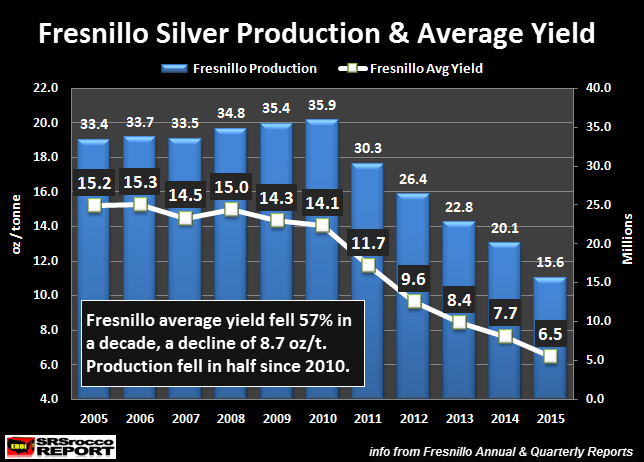

by Steve St. Angelo, SRS Rocco Report:

The largest primary silver mine in the world saw its average yield fall to the lowest level ever in 2015. Matter-a-fact, the primary silver mine’s yield fell nearly 16% compared to last year. This is a substantial decline in productivity from the world’s largest mine in Mexico that starting production in 1824.

Actually, the area where this mine is located–Zacatecas, Spaniards start producing silver all the way back in 1540. When initial production at the Great Fresnillo Mine started in 1824, Mexico was producing 55% of the world’s silver production. The ore grades were much higher in those days.

Read More

The largest primary silver mine in the world saw its average yield fall to the lowest level ever in 2015. Matter-a-fact, the primary silver mine’s yield fell nearly 16% compared to last year. This is a substantial decline in productivity from the world’s largest mine in Mexico that starting production in 1824.

Actually, the area where this mine is located–Zacatecas, Spaniards start producing silver all the way back in 1540. When initial production at the Great Fresnillo Mine started in 1824, Mexico was producing 55% of the world’s silver production. The ore grades were much higher in those days.

Read More

from The Sleuth Journal:

A

massive wave of government propaganda is coming and the method of

transmission will be Hollywood. Hollywood is one of the most important

brainwashing tools to keep the masses ignorant of reality and government

corruption. And as we’ve seen in the past, it is designed to reinforce

numerous government lies the masses are supposed to believe. Whenever

Hollywood releases a film endorsing a government narrative it usually

represents the final phase of a false flag, staged event narrative being

sold.

A

massive wave of government propaganda is coming and the method of

transmission will be Hollywood. Hollywood is one of the most important

brainwashing tools to keep the masses ignorant of reality and government

corruption. And as we’ve seen in the past, it is designed to reinforce

numerous government lies the masses are supposed to believe. Whenever

Hollywood releases a film endorsing a government narrative it usually

represents the final phase of a false flag, staged event narrative being

sold.

Remember what former CIA director William Casey said. Until EVERYTHING that everyone believes is a lie, the control system feels they are not done lying to you yet.

Read More

A

massive wave of government propaganda is coming and the method of

transmission will be Hollywood. Hollywood is one of the most important

brainwashing tools to keep the masses ignorant of reality and government

corruption. And as we’ve seen in the past, it is designed to reinforce

numerous government lies the masses are supposed to believe. Whenever

Hollywood releases a film endorsing a government narrative it usually

represents the final phase of a false flag, staged event narrative being

sold.

A

massive wave of government propaganda is coming and the method of

transmission will be Hollywood. Hollywood is one of the most important

brainwashing tools to keep the masses ignorant of reality and government

corruption. And as we’ve seen in the past, it is designed to reinforce

numerous government lies the masses are supposed to believe. Whenever

Hollywood releases a film endorsing a government narrative it usually

represents the final phase of a false flag, staged event narrative being

sold.Remember what former CIA director William Casey said. Until EVERYTHING that everyone believes is a lie, the control system feels they are not done lying to you yet.

Read More

by Mark O’Byrne, Gold Core:

Silver hasn’t been so cheap relative to gold for more than seven years and with silver ETF holdings having surged in recent days, silver coin and bar demand very robust and mine supplies forecast to contract this year, there are signs that silver is set to resume its bull market and outperform gold once again.

Eddie Van Der Walt and Ranjeetha Pakiam write in Bloomberg today:

Mine production of silver will probably drop in 2016 for the first time in over a decade and demand is set to outstrip supply for a fourth straight year, says Standard Chartered Plc.

Read More

Silver hasn’t been so cheap relative to gold for more than seven years and with silver ETF holdings having surged in recent days, silver coin and bar demand very robust and mine supplies forecast to contract this year, there are signs that silver is set to resume its bull market and outperform gold once again.

Eddie Van Der Walt and Ranjeetha Pakiam write in Bloomberg today:

Mine production of silver will probably drop in 2016 for the first time in over a decade and demand is set to outstrip supply for a fourth straight year, says Standard Chartered Plc.

Read More

from Washington’s Blog:

Hillary Clinton approved the construction

in South Africa of the world’s two largest coal-fired power-plants, and

helped them get Export-Import Bank financing (U.S. taxpayer backing);

then, some of her friends received construction contracts to build them.

This was revealed by Itai Vardi in a terrific investigative news report at the desmog blog, on March 7th. Here’s an abbreviated version of it, courtesy of that extraordinary fine news-site:

The plants – named Medupi and Kusile –

were set to each emit a staggering 25 million tons of CO2 into the

atmosphere a year. To help finance the Medupi plant, the South African

government turned to The World Bank, requesting a $3.5 billion loan.

Read More/

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment