Whether Trump does or does not make it all the way to the White House, the wave he’s riding will only grow stronger, tsunami-strength when the economy collapses and the world descends into war. If the idiot class and its rabble subvert him, a quote from John F. Kennedy will surely come back to haunt them: "those who make peaceful revolution impossible will make violent revolution inevitable."

Nassim Taleb Sums Up America's Election In 17 "Black Swan" Words

Submitted by Tyler Durden on 03/13/2016 - 15:45 "People are not voting for Trump (or Sanders). People are just voting, finally, to destroy the establishment."

The Defense Of The Oligarchs: MoveOn.org's "Simple & Utter Brutishness"

Submitted by Tyler Durden on 03/13/2016 - 13:40 It appears the plutocrats themselves are awakening to their own limitations of omnipotence over the world. Their ability to falsify the economic well being of the developed world has deteriorated so sharply so quickly that what was once a threat has become a reality, manifesting through the likes of Sanders and Trump. But revolts can be crushed and that is the strategy of MoveOn.org: simple and utter brutishness.

Martin Armstrong Exclaims "Central Bankers Are Crazy & The Public Is Out Of Its Mind"

Submitted by Tyler Durden on 03/13/2016 - 15:00 The central bankers are simply crazy, not evil. They are trying to steer the economy by utilizing this simpleton theory that if you make something cheaper, someone will buy it. Then we have the trading public. They are celebrating the public admission of Draghi that all his efforts to date have failed, so let’s do even more of the same. And they love this nonsense?

Energy Wars Of Attrition - The Irony Of Oil Abundance

Submitted by Tyler Durden on 03/13/2016 - 20:00 In the end, the oil attrition wars may lead us not into a future of North American triumphalism, nor even to a more modest Saudi version of the same, but into a strange new world in which an unlimited capacity to produce oil meets an increasingly crippled capitalist system without the capacity to absorb it. Think of it this way: in the conflagration of the take-no-prisoners war the Saudis let loose, a centuries-old world based on oil may be ending in both a glut and a hollowing out on an increasingly overheated planet. A war of attrition indeed.

Japan Is "Fixed" - Machine Orders Suddenly Spike By Most In Over 13 Years

Submitted by Tyler Durden on 03/13/2016 - 19:20 The Aussies did it with their employment data (and then admitted it), and now we see Japan's Economic and Social reserch Institute post the most ridiculous macro print ever. Over 4 standard deviations from expectations and almost double the highest expectations, Japan Machinery Orders spiked 15.0% MoM - the biggest since Jan 2003. We presume this means that Japan is "fixed" and there will be no need for additional extraordinarily idiotically experimental monetary policy this week...

Goldman Warns Its Clients They Are Overlooking "The Largest Macro Market Risk"

Submitted by Tyler Durden on 03/13/2016 - 16:58 "While investors focus on oil and the ECB, they overlook the largest current macro market risk – and opportunity – which centers on the Fed. Although our economists expect rates will remain unchanged, a credible argument can be made for the FOMC to proceed with the “flight path” it had previously outlined.... The market’s eventual acceptance of the Fed tightening path will spur some parts of the momentum trade to resume and others to unwind."

"There Won't Be A Wave Of Layoffs," "No Stimulus Is Needed": China Insists That No One Panic

Submitted by Tyler Durden on 03/13/2016 - 19:30 The market is worried about China. Worried about growth, worried about whether Beijing can actually manage to pull off the transition to a consumption-led economic model, worried about the yuan, and perhaps most pressingly, worrried about whether a push to stamp out the excess capacity that's driving the global deflationary supply glut will end up creating an employment crisis. Here to 'reassure" you are People’s Bank of China Governor Zhou Xiaochuan and Xiao Yaqing, who oversees the government commission that looks after state assets.

Silver hasn’t been so cheap relative to gold for more than seven years and with mine supplies forecast to contract this year that may be a sign it’s ready to come out of the yellow metal’s shadow.

Mine production of silver will probably drop in 2016 for the first time in over a decade and demand is set to outstrip supply for a fourth straight year, says Standard Chartered Plc. Much of the world’s silver is extracted from the ground with other minerals, and output cuts announced by the biggest miners will hurt supplies of the metal as well as others such as copper and zinc.

Silver’s 10 percent advance this year has trailed gold’s 18 percent surge as financial turmoil and worries about a global slowdown sent investors flocking to the yellow metal as a haven.

Read More

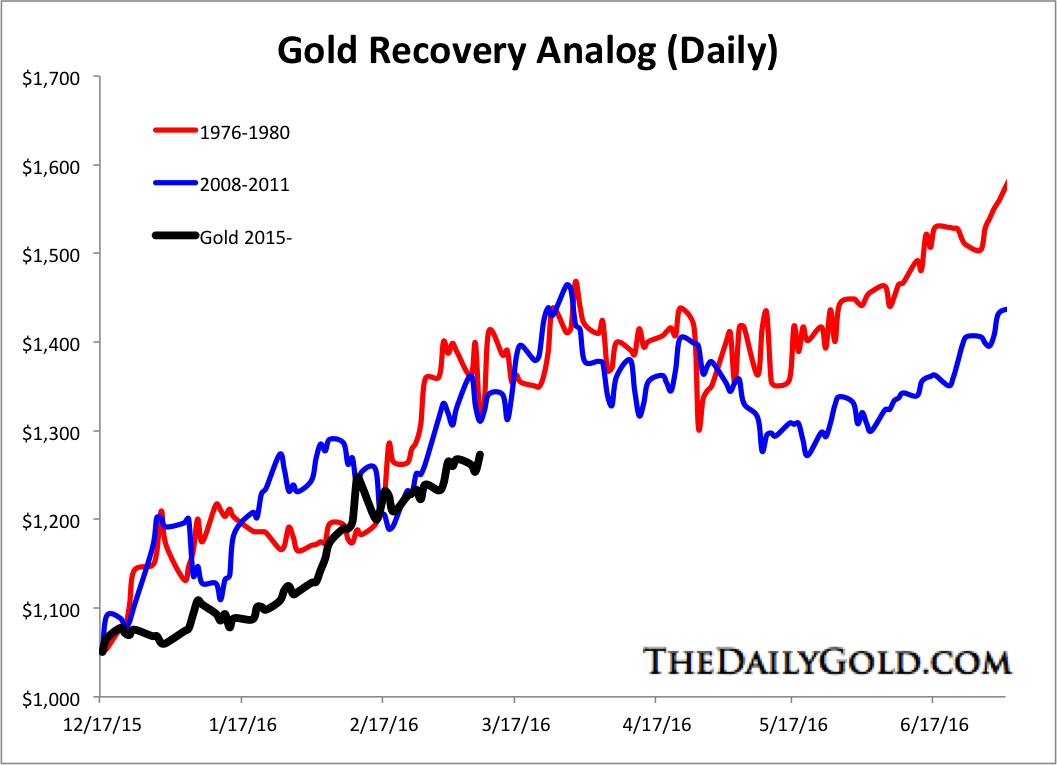

At the start of 2016, renowned fund manager and bond king Jeff Gundlach predicted Gold would surge to $1400/oz. That was quite the call considering Gold was still in a bear market. He reiterated his target a few days ago in a webcast. Gold closed the week below $1260/oz after reaching as high as $1287/oz following the ECB decision. Corrections in both Gold and gold stocks have been limited to swift declines lasting no more than two days. While we cannot predict the future, we think there is some chance that Gold could reach Gundlach’s target before a sustained correction.

Below is the Gold recovery analog chart or bull analog chart. We compare the current rebound to those from major lows seen in 1976 and 2008. By the way, it is great to be constructing bullish analogs rather than bearish analogs. As we can see, if this recovery in Gold continues to follow the path of those two recoveries then Gold could reach $1400/oz before correcting. The analog hints that if Gold reached $1400/oz then it could correct $100-$120/oz.

Read More

by S. D. Wells, Natural News:

To

be able to explain this research, it is best to get a few things out in

the open for the global community of health enthusiasts to appreciate.

The “artificial sweetener” conversation and research is changing, so

there must be a new definition of what artificial sweetener means

and the platform upon which they are ALL sold to the unknowing public.

Consider the following definitions that serve as building blocks for

total appreciation of this breaking research revealed about human

metabolism:

To

be able to explain this research, it is best to get a few things out in

the open for the global community of health enthusiasts to appreciate.

The “artificial sweetener” conversation and research is changing, so

there must be a new definition of what artificial sweetener means

and the platform upon which they are ALL sold to the unknowing public.

Consider the following definitions that serve as building blocks for

total appreciation of this breaking research revealed about human

metabolism:

Metabolic is defined as relating to or deriving from the metabolism of a living organism.

Read More

To

be able to explain this research, it is best to get a few things out in

the open for the global community of health enthusiasts to appreciate.

The “artificial sweetener” conversation and research is changing, so

there must be a new definition of what artificial sweetener means

and the platform upon which they are ALL sold to the unknowing public.

Consider the following definitions that serve as building blocks for

total appreciation of this breaking research revealed about human

metabolism:

To

be able to explain this research, it is best to get a few things out in

the open for the global community of health enthusiasts to appreciate.

The “artificial sweetener” conversation and research is changing, so

there must be a new definition of what artificial sweetener means

and the platform upon which they are ALL sold to the unknowing public.

Consider the following definitions that serve as building blocks for

total appreciation of this breaking research revealed about human

metabolism:Metabolic is defined as relating to or deriving from the metabolism of a living organism.

Read More

Oil Prices Should Fall, Possibly Hard

Submitted by Tyler Durden on 03/13/2016 - 16:20 "I hope that oil prices increase but cannot find any substantive reason why they should do anything but fall." As market balance reality re-emerges in investor consciousness and the false euphoria of a production freeze recedes, prices should correct to around $30. A little bad economic or political news could send prices much lower."Let Them Come For Me!" Maduro Defiant As Thousands Protest In Venezuela

Submitted by Tyler Durden on 03/13/2016 - 15:41

'Bust' Town Texas - "We Never Expected The Good Times To End"

Submitted by Tyler Durden on 03/13/2016 - 18:30 When oil is booming, the hotels, restaurants, and stores boom. When oil busts, businesses bust with it.

"X-Rated" Markets Expose A Gaggle Of Fantasy-Enablers

Submitted by Tyler Durden on 03/13/2016 - 18:00 As shameful as the market has become, what’s just as disgraceful is the cohort of so-called “smart people” arguing why not only is all this trash good, but also, giving detailed explanations of economic theories, equations, formulas, extrapolations, causation, blah, blah, blah as to explain the nuances of it all. We have just one statement for the so-called “smart crowd.” Please stop it. You are now not only embarrassing yourselves ever the more (if it were even possible at this stage) You are now annoying everyone with any decency of what free markets are supposed to represent. You’ve gone past the once laughable stage to the outright vulgar. So please – spare us.

What Happens Next?

Submitted by Tyler Durden on 03/13/2016 - 17:45 Draghi dead-cat-bounce deja-vu all over again...

Peak Online Lending? SoFi Starts Hedge Fund Just To Buy Loans From Itself

Submitted by Tyler Durden on 03/13/2016 - 17:31 Concerns about the health of the US economy and the true state of the labor market will likely mean that demand for marketplace-backed paper won’t exactly be what one would call “robust” going forward. Of course that’s a problem for lenders like SoFi, which pools its loans and sells them to free up space on the books for still more loans. But don’t worry, because SoFi - which originates billions in personal loans - has an idea...

Trump Threatens "Communist Friend" Bernie, Swamps Rubio In Florida

Submitted by Tyler Durden on 03/13/2016 - 17:30 Amid the maelstrom of Sunday's political show machinations over Trump's rallies, one awkward fact remains - The Donald's lead increases. The latest NBC/Marist polls show Trump 'swamping' Rubio in his home state of Florida (43% to 21%), a solid lead in Illinois (34% to Cruz's 25%), and is closing the gap on Kasich in Ohio (33% to Kasich's 39%). However, as Reuters reports, despite the growing social unrest, The Donald shows no sign of toning down his rhetoric, theatening to send his supporters to the campaign rallies of "Communist friend" Bernie Sanders and hammering Kasich's "Ohio recovery" narrative.

"They Should Leave Us Alone": Iran Wants No Part Of Oil Freeze Until Output Higher

Submitted by Tyler Durden on 03/13/2016 - 14:20 Hot on the heels of Kuwaiti oil minister Anas al-Saleh's rather stark warning to the rest of OPEC that his country would "go full power if there's no agreement" from Iran on an oil freeze, Tehran has its own message for the rest of the crude producing world.

by Dave Hodges, The Common Sense Show:

A snap military exercise is one in which a potential combatant executes a known military exercise, against a known enemy, in the proximity of an enemy or its resources. The exercise quickly turns from a drill to a live event. In the Asian region, we are witnessing the potential for several “snap” exercises that could easily go live. In fact, suffice it to say, that two of my most trusted insider sources believe that this is a definite possibility in the present time and World War III could commence with almost no warning. In fact, one could say, with some degree of accuracy, that World War III, in many ways has already commenced.

Since I first reported on World War III scenarios in Asia, involving Korea, the fluid events keep shifting. However, the basic premise I ran with 10 days ago, remains in play only with more concrete detail.

Read More

A snap military exercise is one in which a potential combatant executes a known military exercise, against a known enemy, in the proximity of an enemy or its resources. The exercise quickly turns from a drill to a live event. In the Asian region, we are witnessing the potential for several “snap” exercises that could easily go live. In fact, suffice it to say, that two of my most trusted insider sources believe that this is a definite possibility in the present time and World War III could commence with almost no warning. In fact, one could say, with some degree of accuracy, that World War III, in many ways has already commenced.

Since I first reported on World War III scenarios in Asia, involving Korea, the fluid events keep shifting. However, the basic premise I ran with 10 days ago, remains in play only with more concrete detail.

Read More

from The Daily Sheeple:

If you’re reading this, then I’m willing to bet that you’ve been called many different names throughout your life. If I were to hazard a guess, I would say they were names like kook, paranoid, conspiracy theorist, alarmist, insane, or gullible. And after this week, you can go by a new name: Vindicated.

I’m of course talking about recent revelations from the NSA. Long before Edward Snowden came along, it was no secret that the NSA was spying on everyone without good cause. Anyone who believed that fact was called a conspiracy theorist, but their fears were eventually validated.

Read More

If you’re reading this, then I’m willing to bet that you’ve been called many different names throughout your life. If I were to hazard a guess, I would say they were names like kook, paranoid, conspiracy theorist, alarmist, insane, or gullible. And after this week, you can go by a new name: Vindicated.

I’m of course talking about recent revelations from the NSA. Long before Edward Snowden came along, it was no secret that the NSA was spying on everyone without good cause. Anyone who believed that fact was called a conspiracy theorist, but their fears were eventually validated.

Read More

from The Sleuth Journal:

Economists and professional investors follow the Baltic Dry Index because it is a leading indicator on the forecast for international trade. A week ago this gauge hit an all time low. Since then a small upturn has moved the index upward slightly. Hellenic Shipping News observes in Baltic Dry Index climbs to 349, up 7.

“Baltic Dry Index is compiled by the London-based Baltic Exchange and covers prices for transported cargo such as coal, grain and iron ore. The index is based on a daily survey of agents all over the world. Baltic Dry hit a temporary peak on May 20, 2008, when the index hit 11,793. The lowest level ever reached was on Wednesday the 10th of February 2016, when the index dropped to 290 points.”

Read More

Economists and professional investors follow the Baltic Dry Index because it is a leading indicator on the forecast for international trade. A week ago this gauge hit an all time low. Since then a small upturn has moved the index upward slightly. Hellenic Shipping News observes in Baltic Dry Index climbs to 349, up 7.

“Baltic Dry Index is compiled by the London-based Baltic Exchange and covers prices for transported cargo such as coal, grain and iron ore. The index is based on a daily survey of agents all over the world. Baltic Dry hit a temporary peak on May 20, 2008, when the index hit 11,793. The lowest level ever reached was on Wednesday the 10th of February 2016, when the index dropped to 290 points.”

Read More

/

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment