"Is This What We Want For A President?" - Trump Launches First Hillary Attack Ad

Submitted by Tyler Durden on 03/16/2016 - 16:25 ISIS, a laughing Vladimir Putin, and a barking Hillary Clinton: what do they have in common? These are the key elements of Donald Trump's first Hillary Clinton attack ad.

Ackman Begins Portfolio Liquidation To Shore Up Cash, Sells $800 Million In Mondelez After Losing 26% YTD

Submitted by Tyler Durden on 03/16/2016 - 17:42 "Dear Pershing Square Investor: After the close, we completed a block sale of 20 million shares of Mondelez International. As a result of the sale, we now own a 5.6% stake in the company, are the third largest owner, and have substantial uninvested cash."Here Is What Janet Yellen Answered When Steve Liesman Asked If The Fed "Has A Credibility Problem"

Submitted by Tyler Durden on 03/16/2016 - 17:23 Santelli: Steve, could you understand any of it? Any of it seriously? Just a yes or no.Liesman: Not much, it was not precisely responsive to the question i asked.

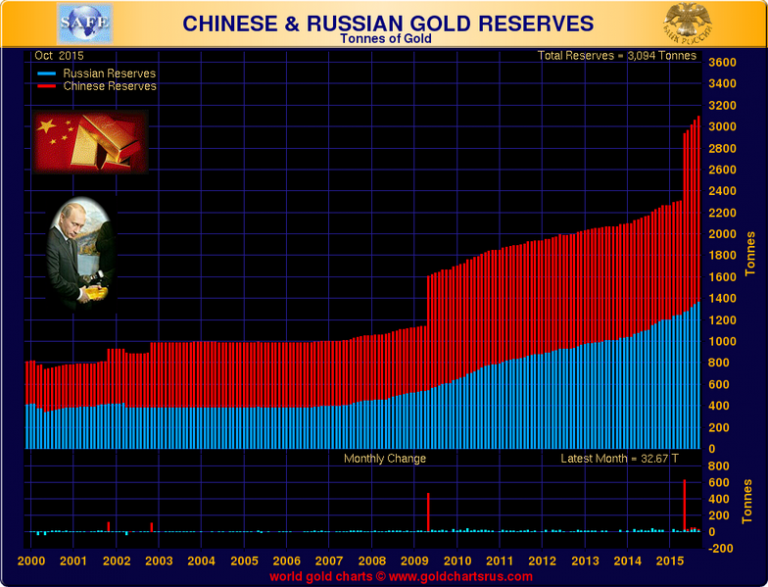

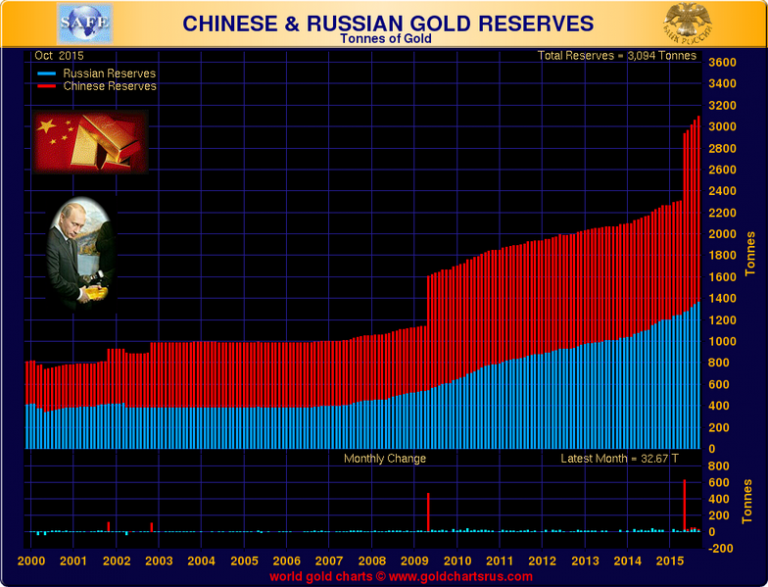

by Tactical Investor, SRSrocco Report:

Central bankers have been on a massive Gold Buying Spree led by Russia and China. One must remember that not only is Putin ex-KGB, but he is also an economist and holds a black belt in judo. Judo teaches you to use your opponent’s momentum to defeat him or her, and that appears to what Putin is doing. He has this administration running circles, by the time they figure out what he is up to, it is too late to do anything. Putin and China can see that the writing is on the wall that the days of U.S holding the top spot are numbered. Our economy is in shambles and only appears to look strong because of the hot money that is holding it up. Regarding illusions, it is a perfect illusion and for now, the masses have bought it, but Russia and China have not.

Putin is also aware that the average life span of a super power is 250 years, and the U.S has been in this position for 240 years, so it is running out of time.

Read More

Central bankers have been on a massive Gold Buying Spree led by Russia and China. One must remember that not only is Putin ex-KGB, but he is also an economist and holds a black belt in judo. Judo teaches you to use your opponent’s momentum to defeat him or her, and that appears to what Putin is doing. He has this administration running circles, by the time they figure out what he is up to, it is too late to do anything. Putin and China can see that the writing is on the wall that the days of U.S holding the top spot are numbered. Our economy is in shambles and only appears to look strong because of the hot money that is holding it up. Regarding illusions, it is a perfect illusion and for now, the masses have bought it, but Russia and China have not.

Putin is also aware that the average life span of a super power is 250 years, and the U.S has been in this position for 240 years, so it is running out of time.

Read More

Gold, Stocks, & Bonds Soar As "Cowardly Lyin'" Fed Batters Banks & Greenback

Submitted by Tyler Durden on 03/16/2016 - 16:53

from The Wealth Watchman:

As things continue to heat up here in the election primaries, things

are likewise, really getting intense over in Europe. From the massive

islamic migrant invasion, to forced “migrant quotas”, to oppressive

banking and financial demands, to a cratering economic situation, the

peoples of Europe are quickly learning to hate this unfortunate,

bankster experiment.

As things continue to heat up here in the election primaries, things

are likewise, really getting intense over in Europe. From the massive

islamic migrant invasion, to forced “migrant quotas”, to oppressive

banking and financial demands, to a cratering economic situation, the

peoples of Europe are quickly learning to hate this unfortunate,

bankster experiment.

We all know that the EU was a globalist plot to undermine sovereign, nation-states in Europe, and attempt to impose a “United States of Europe upon the hapless peoples. In the last 6 months though, it appears the United Kingdom has gained a real shot at leaving the EU, and this headline now has some very powerful European oligarchs very nervous!

Read More

As things continue to heat up here in the election primaries, things

are likewise, really getting intense over in Europe. From the massive

islamic migrant invasion, to forced “migrant quotas”, to oppressive

banking and financial demands, to a cratering economic situation, the

peoples of Europe are quickly learning to hate this unfortunate,

bankster experiment.

As things continue to heat up here in the election primaries, things

are likewise, really getting intense over in Europe. From the massive

islamic migrant invasion, to forced “migrant quotas”, to oppressive

banking and financial demands, to a cratering economic situation, the

peoples of Europe are quickly learning to hate this unfortunate,

bankster experiment.We all know that the EU was a globalist plot to undermine sovereign, nation-states in Europe, and attempt to impose a “United States of Europe upon the hapless peoples. In the last 6 months though, it appears the United Kingdom has gained a real shot at leaving the EU, and this headline now has some very powerful European oligarchs very nervous!

Read More

We Need The Pain That Comes With More Saving

Submitted by Tyler Durden on 03/16/2016 - 16:50 Propping up the markets and encouraging misguided consumption and malinvestments will be the death blow to western civilization. Only near-term pain can allow long-term growth. Economic savings are the cure, and to be welcomed with open arms.

Valeant Pharmaceuticals (VRX) stock has plunged 86% since August 6. The latest plunge occurred today, with the stock losing 51% from its close of $78 yesterday:

The initial triggers were concerns over the Valeant’s drug-pricing policies and questions surrounding its methodology for booking revenues. However, with just a casual “look under the hood” at VRX’s SEC-filed financials, there is likely a great deal of fraud lurking beneath what’s already been questioned. In fact, this is starting to smell a lot like Enron or Bear Stearns. The only component missing from this story is a CNBC rant from Cramer issuing a table-pounding buy on VRX stock. That may yet occur.

Read More

Sweden Minister Says Cashless Society "Not Possible"; Elderly, Disabled People Blamed

Submitted by Tyler Durden on 03/16/2016 - 15:55 Just when Sweden was set to become a cashless utopia, a problem emerged...

"We Choose The Nominee, Not The Voters" - Republican Party Split Looms

Submitted by Tyler Durden on 03/16/2016 - 15:40 "The media has created the perception that the voters choose the nomination. That's the conflict here." So a Republican split is looking more likely. They have drawn the line in the sand. By no means will they accept Trump. He might as well begin forming a third party. What is going to be exposed is that we do not live in a Democracy. The Republicans prefer Hillary to Trump any day of the week.

"Data Dependent" Fed Chickens Out Again: Blames "Global" Risks For Unchanged Rates, Cuts Rate Hike Forecast

Submitted by Tyler Durden on 03/16/2016 - 15:32 Not too dovish (upgrade uncertainty), not too hawkish (lowered rate hikes), a goldilocks statement, with just a little less inflation and just a little less GDP growth, and just two more quarter of near-ZIRP rates is what it takes for the world to get it all together.

Former Fed Employee Avoids Jail, Gets $2,000 Fine For Stealing Fed Secrets On Behalf Of Goldman Sachs

Submitted by Tyler Durden on 03/16/2016 - 15:20 Jason Gross was the latest former banker to make a mockery of the US judicial system when he was spared prison on Wednesday, for stealing NY Fed secrets on behalf of Goldman Sachs. Instead Gross, 37, was fined $2,000 by U.S. Magistrate Judge Gabriel Gorenstein in Manhattan and sentenced to a year of probation with 200 hours of community service after pleading guilty to a misdemeanor charge of theft of government property.

Goldman Does It Again: Dollar Plummets After Goldman FX Says "Dollar Rally Far From Over"

Submitted by Tyler Durden on 03/16/2016 - 15:13 Goldman's Robin Brooks has to be a sadist: that is the only way we can explain his ability to crush the greatest number of Goldman clients at every possible opportunity.

The Fed Decision Explained In 1 Simple Chart

Submitted by Tyler Durden on 03/16/2016 - 14:54 Tumbling US unemployment and surging US inflation is not what really matters to 'Global' Janet. She knows what happened the last time "market" expectations were so disclocatedly bullish relative to "economic" expectations... and doesn't want to be driving the current bus off the great-er depression cliff...

The Biggest Winner From A Coward Fed: Gold

Submitted by Tyler Durden on 03/16/2016 - 14:34 With the Fed Funds market now slashing rate-hike expectations for the rest of the year, just as The Fed tries to catch down to the market expectations, the biggest winner so far from the cowardly Fed is... a pet rock.

Janet Yellen Explains What Data-Dependent Really Means: FOMC Presser - Live Feed

Submitted by Tyler Durden on 03/16/2016 - 14:27 Be careful what you wish for - awesomely low unemployment (which is in no way misleadingly manipulated by a collapsing workforce) and surging inflation appear no longer as important as Brazilian exchange rates, Chinese equity volatility, or Japanese bank stock prices... unless of course all that "good" US data is just propaganda bullshit? We are sure at least one member of the press will ask the tough questions... though the last time someone dared to cross the line into actual reporting, they were blackballed...Here Are The "Dots" - Fed Downgrades Economic Outlook, Sees Just Two Rate Hikes In 2016

Submitted by Tyler Durden on 03/16/2016 - 14:18

Bonds & Bullion Surge As Stocks Give Up Initial Fed Gains

Submitted by Tyler Durden on 03/16/2016 - 14:17

Fed Mouthpiece Parses Timid Janet's Latest Pronouncement

Submitted by Tyler Durden on 03/16/2016 - 14:15 "Federal Reserve officials reduced estimates of how much they expect to raise short-term interest rates in 2016 and beyond, nodding to lingering risks to the economic outlook posed by soft global economic growth and financial-market volatility."

Trading The FOMC

Submitted by Tyler Durden on 03/16/2016 - 13:50 With the market already pricing in dramatically fewer rate-hikes that the "cheerleading" Fed, Deutsche Bank expects the USD to respond favorably to the FOMC’s signals on Wednesday, contrary to the pattern seen after the last four FOMC meetings with press conferences. While 'bankers' are clamoring for rate-hikes (warning of "consequences" should The Fed fail to deliver), Citi sees 5 of the 6 main drivers of Fed decision-making pointing to a hike... and an echo of Oct 2015's dip-and-rip.

American presstitutes, such as the New York Times and the Wall Street Journal, expressed surprise at Russia’s support for the Syrian ceasefire, which Russia has been seeking, by Putin’s halt to attacks on the Islamic State and a partial withdrawal of Russian forces. The American presstitutes are captives of their own propaganda and are now surprised at the failure of their propagandistic predictions.

Having stripped the Islamic State of offensive capability and liberated Syria from the Washington-supported terrorists, Putin has now shifted to diplomacy. If peace fails in Syria, the failure cannot be blamed on Russia.

Read More

by Wayne Madsen, The News Doctors:

The United States, which was founded upon winning a revolutionary war for independence against a decrepit and insane King George III of England, has become the world’s chief promoter of restoring monarchies in nations it has invaded. The latest attempt of monarchy restoration has come in the failed nation of Libya, which saw its legitimate government overthrown in 2011 as a result of NATO intervention in a civil war.

The civil strife in Libya was initiated by the US Central Intelligence Agency and non-state actors financed by non-governmental organizations that included George Soros’s various front groups, the US National Endowment for Democracy (NED), and the Turkish government of Recep Tayyip Erdogan.

Read More

The United States, which was founded upon winning a revolutionary war for independence against a decrepit and insane King George III of England, has become the world’s chief promoter of restoring monarchies in nations it has invaded. The latest attempt of monarchy restoration has come in the failed nation of Libya, which saw its legitimate government overthrown in 2011 as a result of NATO intervention in a civil war.

The civil strife in Libya was initiated by the US Central Intelligence Agency and non-state actors financed by non-governmental organizations that included George Soros’s various front groups, the US National Endowment for Democracy (NED), and the Turkish government of Recep Tayyip Erdogan.

Read More

by Andy Hoffman, Miles Franklin:

It’s 3:30 AM MST on Wednesday morning (“Twas’ the night before Janet”),

and I wasn’t planning to write until her Royal Printing Press-ness

delivered her latest “most important announcement ever.” However, given

how the Precious Metal community has been besieged this week with the

same misdirection, cluelessness, and borderline Cartel-produced

propaganda that has characterized newsletter writer “analysis” for the

past 15 years, I thought it would be a good time to throw my ring into

the hat – in light of the, yet again, paralyzing fear today’s FOMC

statement has engendered, amidst one of the most vicious Cartel raids to

date. Particularly appropriate, I might add, on a day when we learned

JP Morgan has been serially manipulating the aluminum market for years.

But no, the far tinier, far more “systemically important” Precious Metal

markets couldn’t possibly be manipulated, too. Right?

It’s 3:30 AM MST on Wednesday morning (“Twas’ the night before Janet”),

and I wasn’t planning to write until her Royal Printing Press-ness

delivered her latest “most important announcement ever.” However, given

how the Precious Metal community has been besieged this week with the

same misdirection, cluelessness, and borderline Cartel-produced

propaganda that has characterized newsletter writer “analysis” for the

past 15 years, I thought it would be a good time to throw my ring into

the hat – in light of the, yet again, paralyzing fear today’s FOMC

statement has engendered, amidst one of the most vicious Cartel raids to

date. Particularly appropriate, I might add, on a day when we learned

JP Morgan has been serially manipulating the aluminum market for years.

But no, the far tinier, far more “systemically important” Precious Metal

markets couldn’t possibly be manipulated, too. Right?

Before I “update” what I first wrote of the COMEX “COTs” four years ago, let’s just put the past 24 hours’ news flow into perspective, heading into yet another sure to be another pathetic – but likely, market moving – FOMC word cloud; so you’ll understand, recent equity and commodity “short squeeze” notwithstanding, how wildly bearish global economic trends continue to be for financial assets, and bullish for real money.

Read More…

It’s 3:30 AM MST on Wednesday morning (“Twas’ the night before Janet”),

and I wasn’t planning to write until her Royal Printing Press-ness

delivered her latest “most important announcement ever.” However, given

how the Precious Metal community has been besieged this week with the

same misdirection, cluelessness, and borderline Cartel-produced

propaganda that has characterized newsletter writer “analysis” for the

past 15 years, I thought it would be a good time to throw my ring into

the hat – in light of the, yet again, paralyzing fear today’s FOMC

statement has engendered, amidst one of the most vicious Cartel raids to

date. Particularly appropriate, I might add, on a day when we learned

JP Morgan has been serially manipulating the aluminum market for years.

But no, the far tinier, far more “systemically important” Precious Metal

markets couldn’t possibly be manipulated, too. Right?

It’s 3:30 AM MST on Wednesday morning (“Twas’ the night before Janet”),

and I wasn’t planning to write until her Royal Printing Press-ness

delivered her latest “most important announcement ever.” However, given

how the Precious Metal community has been besieged this week with the

same misdirection, cluelessness, and borderline Cartel-produced

propaganda that has characterized newsletter writer “analysis” for the

past 15 years, I thought it would be a good time to throw my ring into

the hat – in light of the, yet again, paralyzing fear today’s FOMC

statement has engendered, amidst one of the most vicious Cartel raids to

date. Particularly appropriate, I might add, on a day when we learned

JP Morgan has been serially manipulating the aluminum market for years.

But no, the far tinier, far more “systemically important” Precious Metal

markets couldn’t possibly be manipulated, too. Right?Before I “update” what I first wrote of the COMEX “COTs” four years ago, let’s just put the past 24 hours’ news flow into perspective, heading into yet another sure to be another pathetic – but likely, market moving – FOMC word cloud; so you’ll understand, recent equity and commodity “short squeeze” notwithstanding, how wildly bearish global economic trends continue to be for financial assets, and bullish for real money.

Read More…

/

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment