Submitted by Tyler Durden on 03/23/2016 - 16:55

Submitted by Tyler Durden on 03/23/2016 - 16:55

"Security officials have told The Associated Press that the Islamic State group has trained at least 400 attackers and sent them into Europe for terror attacks."

Collision Course: Latest Delegate Count Shows Trump, Clinton Destined For Duel

Submitted by Tyler Durden on 03/23/2016 - 15:35

China Sends Fed A Warning: Devalues Yuan By Most In 2 Months

Submitted by Tyler Durden on 03/23/2016 - 22:39 With the USD Index stretching to its longest winning streak of the year, jawboned by numerous Fed speakers explaining how April is 'live' (and everyone misunderstood the dovishness of Yellen), it appears that The PBOC wanted to send a message to The Fed - Raise rates and we will unleash turmoil on your 'wealth creation' plan. Large unexpected Yuan drops have rippled through markets in recent months spoiling the party for many and tonight, by devaluing the Yuan fix by the most since January 7th, China made it clear that it really does not want The Fed to hike rates and cause a liquidity suck-out again.

The Reasons Why People Hate Cultural Marxists

Submitted by Tyler Durden on 03/23/2016 - 22:20 The process of forced multiculturalism is driving large portions of the EU and America to become violently opposed to cultural Marxists. I fear that this is leading to irreconcilable division to the point of war, just as what took place during the last Great Depression. And, as I pointed out at the beginning of this article, cultural Marxists are a tiny minority, a paper tiger posing as the real thing. If they do not stop with their incessant subversion and cultism they will end up being the first to pay the price. The rest of us will pay later.

Why Oil Prices Are About To Plunge Again: 31 Million Barrels In Floating Storage Are Coming On Shore

Submitted by Tyler Durden on 03/23/2016 - 21:53 Based on the all-in cost of operating tanker storage (dirty VLCC tanker day rates, financing, transit and transfer loss, insurance and bunkers, Figure 5), the current storage cost is too high relative to the steepness of the Brent forward curve. This means that prices do not justify inventory build, but rather gradual inventory drawdown as existing storage trades are unwound. Comparing the current level of floating storage (157.3 million barrels) versus that in early February (126.6 million barrels), there may be an additional 31 million barrels of inventory to be drawn down between now and the next inventory trough over the next several months.Is It Government Or Oligarchs?

Submitted by Tyler Durden on 03/23/2016 - 21:30 Our structure of government being a republic rather than a democracy invites oligarchy. There has never been a single republic that has ever proven to work. The mixture of money and power always becomes lethal. This is why we blame government, not the oligarchs. They could not buy politicians if they were not (1) career lifetime politicians, and (2) all-powerful law creators. Taxes and regulations become the incentive for the oligarchs to buy government. If we eliminate taxes and career politicians, we will solve most of the problem.

Peak Hypocrisy: Rockefeller Fund Divests Fossil Fuels, Says Exxon Is "Morally Reprehensible"

Submitted by Tyler Durden on 03/23/2016 - 21:02 Here is the real question: will the Rockefellers divest of their full energy holdings, kept in blind, family, and various other (offshore of course - nobody wants to pay taxes, not even green liberals) unknown trusts, due to their disgust with the "morally reprehensible" company created by their ancestor? The answer: of course not.

Japan Goes Full Krugman: Plans Un-Depositable, Non-Cash "Gift-Certificate" Money Drop To Young People

Submitted by Tyler Durden on 03/23/2016 - 20:06 The Swiss, the Finns, and the Ontarians may get their 'Universal Basic Income' but the Japanese are about to turn the Spinal Tap amplifier of extreme monetary experimentation to 11. Sankei reports, with no sourcing, that the Japanese government plans to unleash "vouchers" or "gift certificates" to low-income young people to stimulate the "conspicuous decline" in consumption among young people. The handouts may not be deposited, thus combining helicopter money (inflationary) and fully electronic currency (implicit capital controls and tracking of spending).

The Sleeping Giant Awakens

Had enough "hope and change"?

Yellen, Draghi, Kuroda: Deranged Lab Rats

Submitted by Tyler Durden on 03/23/2016 - 19:25 It’s sad that “we the people” continue to allow deranged captured academics, under the complete command of the banking cabal, to control the destiny of our country. They have failed for 103 years, but we continue to bow down to these central bankers as if they knew what they were doing. They do know how to debase the currency, obfuscate true inflation, prop up financial markets through monetary manipulation, and generate prodigious amounts of propaganda and misinformation to coverup their true purposes. The people will sit idly by until these deranged rats destroy the world.

When "Mother's Milk" Runs Dry

Submitted by Tyler Durden on 03/23/2016 - 19:00 For the third time in six months, US equity markets have exuberantly decoupled from earnings expectations thanks, in large part, to jawboning and coordination from Central Banks. With stocks near record highs despite the earnings "mother's milk" expectations tumbling, one can't help but wonder, as CNBC's Bob Pisani did this morning, given the comments from Evans, Lockhart, and Bullard, "It's possible the Fed has seen the market reaction and become alarmed by the complacency."

Fewer People Wiping More Bottoms: Minimum Wage Hikes Explained

Submitted by Tyler Durden on 03/23/2016 - 18:35 "Ms. Krause is obviously in for a shock when some of her members lose their jobs and have incomes of $0 as a result."

The New "Middle Class" – Making $250,000 A Year In Palo Alto Qualifies For Housing Subsidies

Submitted by Tyler Durden on 03/23/2016 - 18:10 Welcome to the new normal, where in bubble communities, $250,000 per year is now a middle class income. Nothing to see here.

"Sorry For Brussels"

Submitted by Tyler Durden on 03/23/2016 - 17:45 A solemn message from Idomeni...

Stocks Stand On "Tremulous Grounds"

Submitted by Tyler Durden on 03/23/2016 - 17:20 "...the subsequent rally we have been on over the last few weeks or so will be retraced and not only violate that “Bullard Bottom” but will do so with conviction and spike down to levels not seen in years. Again let me iterate – and quickly!"Bonds Best-Bid But Bullion Blasted As Belgium-Bombing-Bounce Is Battered

Submitted by Tyler Durden on 03/23/2016 - 16:33

Peter Schiff Warns "The Fed Is Stuck In The Same Monetary Mud As In 2008"

Submitted by Tyler Durden on 03/23/2016 - 16:30 The last thing the Fed can bear is for a recession that may be bubbling just under the surface to boil over into full view in the months heading into the election. If that occurs, we all may be seeing a great many press conferences from Mar-a-Lago. That is a development that I’m sure Janet Yellen wants to avoid at all costs.

Alice In Wonderland - Why Everything Is Nonsense

Submitted by Tyler Durden on 03/23/2016 - 15:50 The entire Deep State complex is at the heart of the nonsensical, corrupt, and fraudulent system... Expecting the Mad Hatter to protect you? Or the Cheshire Cat? Good luck with that!

Record Loss For Petrobras As Political And Economic Crisis Worsen

Submitted by Tyler Durden on 03/23/2016 - 15:20 Petrobras reported a record loss for the fourth quarter, a horrendous performance that raises questions about the company’s ability to handle its mountain of debt.

Bob Pisani Says "The Fed Is Alarmed By Market Complacency" - Why This Is A Big Problem For Yellen

Submitted by Tyler Durden on 03/23/2016 - 15:11 What happened? It's possible the Fed has seen the market reaction and become alarmed by the complacency. It's true, the probabilities for even a June rate hike—let alone April--declined dramatically in the face of the Fed meeting. That may have alarmed the Fed, and so some members may feel the need to keep the markets more alert.

S&P Plunges Back Into Red For 2016

Well that escalated quickly...

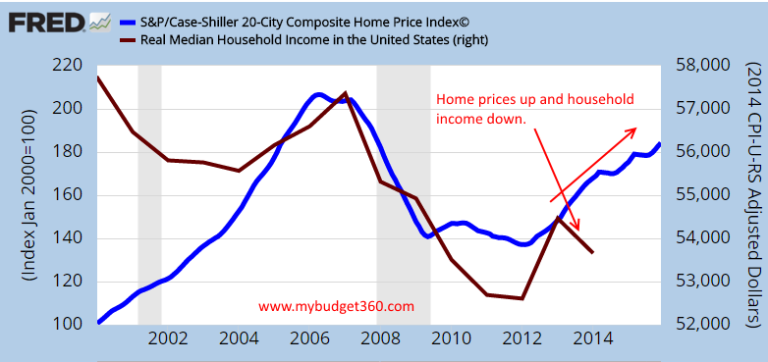

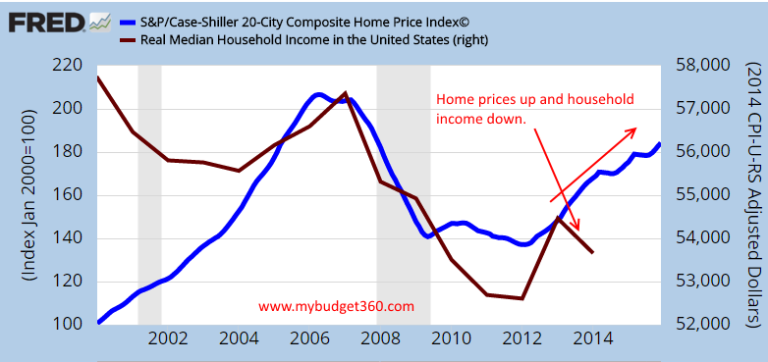

from MyBudget360.com:

“Definition of economic bubble: A market phenomenon characterized by surges in asset prices to levels significantly above the fundamental value of that asset.” We are definitely in another housing bubble. First, most Americans can’t afford to buy a home without utilizing artificially low interest rates and even then they are stretching their budgets like spandex. Second, home prices are surging in the face of stagnant household incomes. That is the biggest sign of a bubble. The underlying asset in housing is moving up even though incomes are not. So what is driving prices up? Speculation, flipping, investors, and what we would categorize as fickle money. This is the ultimate sign of a housing bubble. Homeownership is near a generational low because most households are living month to month unable to buy. If you want to see the housing bubble in one chart look no further.

Read More

“Definition of economic bubble: A market phenomenon characterized by surges in asset prices to levels significantly above the fundamental value of that asset.” We are definitely in another housing bubble. First, most Americans can’t afford to buy a home without utilizing artificially low interest rates and even then they are stretching their budgets like spandex. Second, home prices are surging in the face of stagnant household incomes. That is the biggest sign of a bubble. The underlying asset in housing is moving up even though incomes are not. So what is driving prices up? Speculation, flipping, investors, and what we would categorize as fickle money. This is the ultimate sign of a housing bubble. Homeownership is near a generational low because most households are living month to month unable to buy. If you want to see the housing bubble in one chart look no further.

Read More

by Mike Adams, Natural News:

As part of our EPA Watch program that

aims to test public water supplies across America for toxic heavy

metals and chemicals, I just finished testing a water sample that was

collected from inside the VA hospital located at 950 Campbell Avenue,

West Haven, Connecticut, zip code 06516. Click here for the web page of that VA hospital.

As part of our EPA Watch program that

aims to test public water supplies across America for toxic heavy

metals and chemicals, I just finished testing a water sample that was

collected from inside the VA hospital located at 950 Campbell Avenue,

West Haven, Connecticut, zip code 06516. Click here for the web page of that VA hospital.

The scientific analysis of the water via LC/MS-TOF, shown below, reveals that this VA hospital’s water supply apparently carries a startling array of potentially toxic chemicals.

This water sample was sent to Natural News as part of our nationwide EPA Watch program which has already begun testing water samples for heavy metals, toxic chemicals and more.

Read More

As part of our EPA Watch program that

aims to test public water supplies across America for toxic heavy

metals and chemicals, I just finished testing a water sample that was

collected from inside the VA hospital located at 950 Campbell Avenue,

West Haven, Connecticut, zip code 06516. Click here for the web page of that VA hospital.

As part of our EPA Watch program that

aims to test public water supplies across America for toxic heavy

metals and chemicals, I just finished testing a water sample that was

collected from inside the VA hospital located at 950 Campbell Avenue,

West Haven, Connecticut, zip code 06516. Click here for the web page of that VA hospital.The scientific analysis of the water via LC/MS-TOF, shown below, reveals that this VA hospital’s water supply apparently carries a startling array of potentially toxic chemicals.

This water sample was sent to Natural News as part of our nationwide EPA Watch program which has already begun testing water samples for heavy metals, toxic chemicals and more.

Read More

from The Sovereign Investor:

Back in my days as a finance reporter, we had a big cork bulletin board that dominated one wall of the newsroom. We used it for posting only the most important information.

Usually, that meant our March Madness bracket picks and an outdated lunch menu for the Chinese restaurant down the street.

But my personal favorite pinned to that bulletin board was a Roy Lichtenstein-style cartoon of a well-dressed man slapping his forehead, with the bubble caption: “Oh no! I forgot to get rich!”

Read More

Back in my days as a finance reporter, we had a big cork bulletin board that dominated one wall of the newsroom. We used it for posting only the most important information.

Usually, that meant our March Madness bracket picks and an outdated lunch menu for the Chinese restaurant down the street.

But my personal favorite pinned to that bulletin board was a Roy Lichtenstein-style cartoon of a well-dressed man slapping his forehead, with the bubble caption: “Oh no! I forgot to get rich!”

Read More

by Bix Weir, Road To Roota:

After totally failing as a price setting exchange in late January, a

large portion of the needed market participants have left the LBMA in

order to buy and sell their physical silver using other methods. Many of

them are the needed silver miners and the brokers that the riggers play

off to source the needed REAL METAL to support their 100B oz annual

electronic silver Con Game.

After totally failing as a price setting exchange in late January, a

large portion of the needed market participants have left the LBMA in

order to buy and sell their physical silver using other methods. Many of

them are the needed silver miners and the brokers that the riggers play

off to source the needed REAL METAL to support their 100B oz annual

electronic silver Con Game.

Who could blame them after the debacle that transpired on January 28th: Silver Market in Disarray After Benchmark Price Fixed Far Below Spot Rate

Read More…

After totally failing as a price setting exchange in late January, a

large portion of the needed market participants have left the LBMA in

order to buy and sell their physical silver using other methods. Many of

them are the needed silver miners and the brokers that the riggers play

off to source the needed REAL METAL to support their 100B oz annual

electronic silver Con Game.

After totally failing as a price setting exchange in late January, a

large portion of the needed market participants have left the LBMA in

order to buy and sell their physical silver using other methods. Many of

them are the needed silver miners and the brokers that the riggers play

off to source the needed REAL METAL to support their 100B oz annual

electronic silver Con Game.Who could blame them after the debacle that transpired on January 28th: Silver Market in Disarray After Benchmark Price Fixed Far Below Spot Rate

Read More…

/

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment