Submitted by Tyler Durden on 03/10/2016 - 07:49

Submitted by Tyler Durden on 03/10/2016 - 07:49

Well, the people wanted a "bazooka-sized" surprise from Draghi, and they got it.

Oil Plunges As OPEC/NOPEC "Freeze Production" Meeting Reportedly Unlikely To Happen

Submitted by Tyler Durden on 03/10/2016 - 09:27 When it rains impotence, it pours. All that lying, hope, and hype and now this: OPEC, NON-OPEC MEETING UNLIKELY TO HAPPEN ON MARCH 20 AS IRAN YET TO COMMIT TO OIL PRODUCTION FREEZE - RTRS SOURCES. And oil is tumbling...

The ECB's Embarrassing Inflation Forecast Implodes

Submitted by Tyler Durden on 03/10/2016 - 09:45 Moments ago the ECB reveled its latest, 2016 year-end inflation forecast, which suffered a spectacular implosion, plunging from December's 1.0%, to a laughable 0.1%, still technically 0.1% above our modest prediction which once again was essentially spot on... and the ECB was dead wrong.Draghi Blew It - Euro, Stocks Retrace Bazooka Bounce

Submitted by Tyler Durden on 03/10/2016 - 09:02

This Is The $1 Trillion In European IG Bonds Which The ECB Is Now Buying

Submitted by Tyler Durden on 03/10/2016 - 08:55 Here, courtesy of Goldman, is a snapshot of the total size of Europe's Investment Grade market: this is where the ECB's trading desk will now be actively buying.

US Treasury Curve Collapses To Dec 2008 Lows

Submitted by Tyler Durden on 03/10/2016 - 08:53 The spread between the 30Y US Treasury yield and 2Y has plunged by 7.5bps this morning (as 2Y sells off and 30Y rallies post-Draghi) to 175bps. This is the flattest curve since Dec 2008 lows (at 172bps) which can only bode poorly for financials...

by Matt Agorist, Activist Post:

Under a Freedom of Information Act request, a Pentagon inspector general made public a report last week, admitting to the use of drones to spy on U.S. citizens.

The missions were non-military in nature, meaning they were used for domestic spying purposes. Naturally, the Pentagon is claiming it broke no laws in the deployment of said drones and contends that the flights were rare.

A senior policy analyst for the ACLU, Jay Stanley, said it is good news no legal violations were found, yet the technology is so advanced that it’s possible laws may require revision, according to USA TODAY.

Read More

Under a Freedom of Information Act request, a Pentagon inspector general made public a report last week, admitting to the use of drones to spy on U.S. citizens.

The missions were non-military in nature, meaning they were used for domestic spying purposes. Naturally, the Pentagon is claiming it broke no laws in the deployment of said drones and contends that the flights were rare.

A senior policy analyst for the ACLU, Jay Stanley, said it is good news no legal violations were found, yet the technology is so advanced that it’s possible laws may require revision, according to USA TODAY.

Read More

by Egon Von Greyerz, GoldBroker:

The US and Argentina have a lot in common. Both are beautiful countries

with a major land mass and an abundance of natural resources and

agricultural land. Both had very strong economies around the turn of the

last century. Political and economic problems have gradually caused

Argentina to grow at a much slower rate than the US. The US has had the

major advantage of having the dollar as the reserve currency of the

world. This has meant that the US in the last hundred years never had to

default like Argentina but could just borrow and print more money.

Argentina on the other hand has gone through several periods of default

as well as high inflation or hyperinflation since WWII.

The US and Argentina have a lot in common. Both are beautiful countries

with a major land mass and an abundance of natural resources and

agricultural land. Both had very strong economies around the turn of the

last century. Political and economic problems have gradually caused

Argentina to grow at a much slower rate than the US. The US has had the

major advantage of having the dollar as the reserve currency of the

world. This has meant that the US in the last hundred years never had to

default like Argentina but could just borrow and print more money.

Argentina on the other hand has gone through several periods of default

as well as high inflation or hyperinflation since WWII.

Read More

The US and Argentina have a lot in common. Both are beautiful countries

with a major land mass and an abundance of natural resources and

agricultural land. Both had very strong economies around the turn of the

last century. Political and economic problems have gradually caused

Argentina to grow at a much slower rate than the US. The US has had the

major advantage of having the dollar as the reserve currency of the

world. This has meant that the US in the last hundred years never had to

default like Argentina but could just borrow and print more money.

Argentina on the other hand has gone through several periods of default

as well as high inflation or hyperinflation since WWII.

The US and Argentina have a lot in common. Both are beautiful countries

with a major land mass and an abundance of natural resources and

agricultural land. Both had very strong economies around the turn of the

last century. Political and economic problems have gradually caused

Argentina to grow at a much slower rate than the US. The US has had the

major advantage of having the dollar as the reserve currency of the

world. This has meant that the US in the last hundred years never had to

default like Argentina but could just borrow and print more money.

Argentina on the other hand has gone through several periods of default

as well as high inflation or hyperinflation since WWII.Read More

Jobless Claims Joke Chart Of The Day

Submitted by Tyler Durden on 03/10/2016 - 08:34 Initial jobless claims tumbles to 259k (from a revised 277k) near 43 year lows, leaving the smoother 4-week average lower at 267.5k. What we find "odd" about this seasonally-adjusted data is that the employment components of both the Manufacturing and Services ISM data has completely collapsed in the last few months. So what sector of the economy is maintaining the illusion?

Draghi Delivers "Here Is The Bazooka" Press Conference As Central Banks Make Last Stand

"Whatever it takes"...

Crude Curve Collapse Signals Producers Losing Faith In Oil Recovery

Submitted by Tyler Durden on 03/10/2016 - 08:19 "They don't quite trust the higher spot prices yet," warned one trader as the changing shape of the Brent forward curve suggests oil producers have been locking in recent gains across the crude futures price structure.

Bunds, Euro Tumble As Super Mario Sends Stocks, Credit Soaring

Submitted by Tyler Durden on 03/10/2016 - 08:02 "Whatever it takes" has morphed to "throw everything at it and pray." In a bigger-than-expected bazooka, Mario Draghi sent EURUSD tumbling, Bund yields rising, and stock prices surging (along with considerable bond spread compression). Bank stocks are limit up in various regions but the real question is - what happens if this "doesn't work"?

For Deutsche Bank This Is "The Most Challenging Central Bank Meeting In Living Memory"

Submitted by Tyler Durden on 03/10/2016 - 07:39 Is today's the most challenging central bank meeting in living memory? The reason we say this is that up until now virtually all meetings have rested on will they or won't they ease and if they do by how much? Even in a crisis central banks have generally been able to get bang for their buck by easing more than expected. However there seems to be more at stake for today's ECB get-together. It's the type of easing that matters.

China Proposes Unprecedented Nationalization Of Insolvent Companies: Banks Will Equitize Non-Performing Loans

Submitted by Tyler Durden on 03/10/2016 - 05:48 In one simple move, Beijing is about to "guarantee" trillions in insolvent Chinese debt.

"You Want A Bloodbath?!" New Video Surfaces Of Police Shooting Oregon Protester In Back

Submitted by Tyler Durden on 03/09/2016 - 23:11 "You back down or you kill me now. You want a bloodbath?"

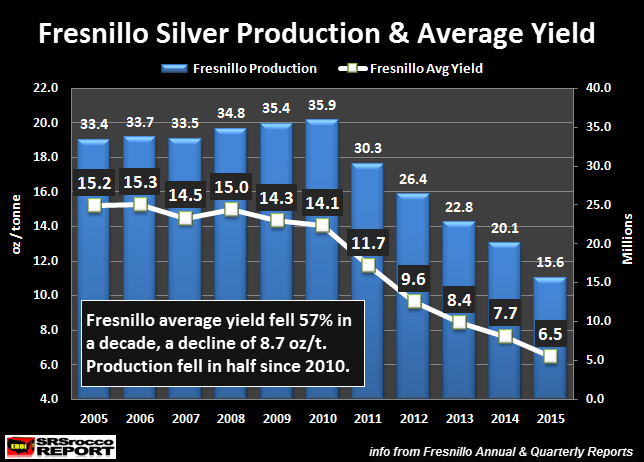

The largest primary silver mine in the world saw its average yield fall to the lowest level ever in 2015. Matter-a-fact, the primary silver mine’s yield fell nearly 16% compared to last year. This is a substantial decline in productivity from the world’s largest mine in Mexico that starting production in 1824.

Actually, the area where this mine is located–Zacatecas, Spaniards start producing silver all the way back in 1540. When initial production at the Great Fresnillo Mine started in 1824, Mexico was producing 55% of the world’s silver production. The ore grades were much higher in those days.

Read More

from Liberty Blitzkrieg:

Hillary

is the candidate of the corrupt establishment. The status quo wants

Hillary in the White House so the parasitic gravy train can roll on. DNC

head and Florida Congresswoman Debbie Wasserman-Schultz is one of these

people. She isn’t interested in reform, because reform wouldn’t advance

her personal interests. She wants things to stay the way they are,

because it’s working great for her.

Hillary

is the candidate of the corrupt establishment. The status quo wants

Hillary in the White House so the parasitic gravy train can roll on. DNC

head and Florida Congresswoman Debbie Wasserman-Schultz is one of these

people. She isn’t interested in reform, because reform wouldn’t advance

her personal interests. She wants things to stay the way they are,

because it’s working great for her.

Genuine liberals are finally starting to see these people for the frauds they are, which is why the Democratic Party is currently splitting in two. On one side there are those who understand United States policy doesn’t need a tweak here or there — it needs to be hauled off to the emergency room immediately. The so-called “elites” in the Democratic Party are just as disconnected and clueless as their Republican counterparts. Instead of accepting that paradigm level reform is required, they merely double down on their support of cronyism and rent-seeking.

– From the post: The Democratic Party’s Civil War Escalates – DNC Chair Attacks Elizabeth Warren’s Reform Efforts

Read More…

Hillary

is the candidate of the corrupt establishment. The status quo wants

Hillary in the White House so the parasitic gravy train can roll on. DNC

head and Florida Congresswoman Debbie Wasserman-Schultz is one of these

people. She isn’t interested in reform, because reform wouldn’t advance

her personal interests. She wants things to stay the way they are,

because it’s working great for her.

Hillary

is the candidate of the corrupt establishment. The status quo wants

Hillary in the White House so the parasitic gravy train can roll on. DNC

head and Florida Congresswoman Debbie Wasserman-Schultz is one of these

people. She isn’t interested in reform, because reform wouldn’t advance

her personal interests. She wants things to stay the way they are,

because it’s working great for her.Genuine liberals are finally starting to see these people for the frauds they are, which is why the Democratic Party is currently splitting in two. On one side there are those who understand United States policy doesn’t need a tweak here or there — it needs to be hauled off to the emergency room immediately. The so-called “elites” in the Democratic Party are just as disconnected and clueless as their Republican counterparts. Instead of accepting that paradigm level reform is required, they merely double down on their support of cronyism and rent-seeking.

– From the post: The Democratic Party’s Civil War Escalates – DNC Chair Attacks Elizabeth Warren’s Reform Efforts

Read More…

by Kit Daniels, Infowars:

Residents should stay home when President Obama visits Austin, Texas, on Friday, the mayor said.

Residents should stay home when President Obama visits Austin, Texas, on Friday, the mayor said.

Mayor Steve Adler cited highway shutdowns due to the Obama motorcade when he encouraged employers to allow residents to work from home.

“Safe to say, when his motorcade is on the move, you won’t be, at least downtown,” he said in a newsletter. “That’s why I am asking you to strongly consider either working from home or asking your employees to work from home on those days.”

Read More…

Residents should stay home when President Obama visits Austin, Texas, on Friday, the mayor said.

Residents should stay home when President Obama visits Austin, Texas, on Friday, the mayor said.

Mayor Steve Adler cited highway shutdowns due to the Obama motorcade when he encouraged employers to allow residents to work from home.

“Safe to say, when his motorcade is on the move, you won’t be, at least downtown,” he said in a newsletter. “That’s why I am asking you to strongly consider either working from home or asking your employees to work from home on those days.”

Read More…

by Christina Sarich, Natural Society:

Drug Prices are as bloated as post-binge politicians in America. But in

China, it seems that drug prices are being slashed where it hurts – in

Big Pharma’s collective wallet. A state-led campaign to slash drug

prices has targeted some of the biggest drug manufacturers in the world.

Drug Prices are as bloated as post-binge politicians in America. But in

China, it seems that drug prices are being slashed where it hurts – in

Big Pharma’s collective wallet. A state-led campaign to slash drug

prices has targeted some of the biggest drug manufacturers in the world.

China’s growing pharmaceutical market is still controlled largely by the government, which is increasingly dealing with a population suffering from illness like diabetes and cancer. China spent more than $115 billion on drugs last year, but with tighter budgets and a struggling economy, advocates are pushing for lower drug prices, and urging the government to negotiate better terms with the companies that sell them.

Read More

Drug Prices are as bloated as post-binge politicians in America. But in

China, it seems that drug prices are being slashed where it hurts – in

Big Pharma’s collective wallet. A state-led campaign to slash drug

prices has targeted some of the biggest drug manufacturers in the world.

Drug Prices are as bloated as post-binge politicians in America. But in

China, it seems that drug prices are being slashed where it hurts – in

Big Pharma’s collective wallet. A state-led campaign to slash drug

prices has targeted some of the biggest drug manufacturers in the world.China’s growing pharmaceutical market is still controlled largely by the government, which is increasingly dealing with a population suffering from illness like diabetes and cancer. China spent more than $115 billion on drugs last year, but with tighter budgets and a struggling economy, advocates are pushing for lower drug prices, and urging the government to negotiate better terms with the companies that sell them.

Read More

from Sovereign Man:

Human beings have come up with some crazy ideas for money and finance

over the years. Conch shells. Beads. Animal skins. Salt. Rice. All of

these were used as a form of money at one time or another.

Human beings have come up with some crazy ideas for money and finance

over the years. Conch shells. Beads. Animal skins. Salt. Rice. All of

these were used as a form of money at one time or another.

But the strangest by far has got to be the Rai Stones of Yap Island.

Yap is a tiny speck in the western Pacific, a few hours by plane from the Philippines and Guam. Long ago, islanders began using gigantic limestone discs called Rai Stones as a form of money Rai Stones were large– the size of a mid-sized car– so they were seldom moved. And they could be anywhere… at the bottom of the ocean, in the middle of the jungle.

Read More

Human beings have come up with some crazy ideas for money and finance

over the years. Conch shells. Beads. Animal skins. Salt. Rice. All of

these were used as a form of money at one time or another.

Human beings have come up with some crazy ideas for money and finance

over the years. Conch shells. Beads. Animal skins. Salt. Rice. All of

these were used as a form of money at one time or another.But the strangest by far has got to be the Rai Stones of Yap Island.

Yap is a tiny speck in the western Pacific, a few hours by plane from the Philippines and Guam. Long ago, islanders began using gigantic limestone discs called Rai Stones as a form of money Rai Stones were large– the size of a mid-sized car– so they were seldom moved. And they could be anywhere… at the bottom of the ocean, in the middle of the jungle.

Read More

by Ben Ramanauskas, TheLibertarianRepublic:

Ever since Hugo Chavez

came to power in 1999, Venezuela has been subjected to socialist

policies. For example, it has undertaken a colossal social spending

program, combined with price and labor-market controls. As the

Government spent more and more, it was forced to rely on the profits of

the State-owned oil company, PDVSA, and and on the country’s central

bank, in a desperate attempt to prolong the socialist project. The

private sector has been eviscerated by expropriations. Oil now accounts

for over 96 percent of export earnings, and represents a massive

increase in the past ten years. Furthermore, the State has done such a

terrible job of managing PDVSA that production has dropped dramatically.

Ever since Hugo Chavez

came to power in 1999, Venezuela has been subjected to socialist

policies. For example, it has undertaken a colossal social spending

program, combined with price and labor-market controls. As the

Government spent more and more, it was forced to rely on the profits of

the State-owned oil company, PDVSA, and and on the country’s central

bank, in a desperate attempt to prolong the socialist project. The

private sector has been eviscerated by expropriations. Oil now accounts

for over 96 percent of export earnings, and represents a massive

increase in the past ten years. Furthermore, the State has done such a

terrible job of managing PDVSA that production has dropped dramatically.

Read More

Ever since Hugo Chavez

came to power in 1999, Venezuela has been subjected to socialist

policies. For example, it has undertaken a colossal social spending

program, combined with price and labor-market controls. As the

Government spent more and more, it was forced to rely on the profits of

the State-owned oil company, PDVSA, and and on the country’s central

bank, in a desperate attempt to prolong the socialist project. The

private sector has been eviscerated by expropriations. Oil now accounts

for over 96 percent of export earnings, and represents a massive

increase in the past ten years. Furthermore, the State has done such a

terrible job of managing PDVSA that production has dropped dramatically.

Ever since Hugo Chavez

came to power in 1999, Venezuela has been subjected to socialist

policies. For example, it has undertaken a colossal social spending

program, combined with price and labor-market controls. As the

Government spent more and more, it was forced to rely on the profits of

the State-owned oil company, PDVSA, and and on the country’s central

bank, in a desperate attempt to prolong the socialist project. The

private sector has been eviscerated by expropriations. Oil now accounts

for over 96 percent of export earnings, and represents a massive

increase in the past ten years. Furthermore, the State has done such a

terrible job of managing PDVSA that production has dropped dramatically.Read More

by Mac Slavo, SHTFPlan:

Who can you trust, turn to or rely upon during a collapse?

Morals are effectively suspended in the midst of a great crisis. And, as the Canadian Prepper explains, you will want to consider and profile high risk people, dangerous personalities and groups to avoid during a disaster – well in advance.

Those with nothing else to turn to will act in desperate ways, and could act unstable during a collapse, during martial law or civil unrest. Many will turn to the system, and go willingly into FEMA camps – but others may drag, steal or lean on you. Worse, they may expose your hideout and compromise your carefully laid survival plans.

Read More

Who can you trust, turn to or rely upon during a collapse?

Morals are effectively suspended in the midst of a great crisis. And, as the Canadian Prepper explains, you will want to consider and profile high risk people, dangerous personalities and groups to avoid during a disaster – well in advance.

Those with nothing else to turn to will act in desperate ways, and could act unstable during a collapse, during martial law or civil unrest. Many will turn to the system, and go willingly into FEMA camps – but others may drag, steal or lean on you. Worse, they may expose your hideout and compromise your carefully laid survival plans.

Read More

by Bobby Casey, GlobalWealthProtection:

Welcome to the North American Edition of… Insolvency Issues!

Welcome to the North American Edition of… Insolvency Issues!

First up, Canada!

She sold off ALL her gold reserves! One economist, Ian Lee, thinks if the US can abandon the gold standard, so can Canada! It’s CAN-ada, after all… not CAN’T-ada. This just happened in the past month, and the claim is there are other “better assets” to pursue. What they are, or what makes them “better” has yet to be addressed by any Canadian officials. If they are truly following in the US footsteps, then I assume they will be looking to China for some economic favors? If not buying up treasuries then buying up real estate.

Read More

Welcome to the North American Edition of… Insolvency Issues!

Welcome to the North American Edition of… Insolvency Issues!First up, Canada!

She sold off ALL her gold reserves! One economist, Ian Lee, thinks if the US can abandon the gold standard, so can Canada! It’s CAN-ada, after all… not CAN’T-ada. This just happened in the past month, and the claim is there are other “better assets” to pursue. What they are, or what makes them “better” has yet to be addressed by any Canadian officials. If they are truly following in the US footsteps, then I assume they will be looking to China for some economic favors? If not buying up treasuries then buying up real estate.

Read More

/

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment