Submitted by Tyler Durden on 03/24/2016 - 12:28

from Washington’s Blog:

Presidents, Prime Ministers, Congressmen, Generals, Spooks, Soldiers and Police ADMIT to False Flag Terror

In the following instances, officials in the government which carried out the attack (or seriously proposed an attack) admit to it, either orally, in writing, or through photographs or videos:

(1) Japanese troops set off a small explosion on a train track in 1931, and falsely blamed it on China in order to justify an invasion of Manchuria. This is known as the “Mukden Incident” or the “Manchurian Incident”.

Read More

Presidents, Prime Ministers, Congressmen, Generals, Spooks, Soldiers and Police ADMIT to False Flag Terror

In the following instances, officials in the government which carried out the attack (or seriously proposed an attack) admit to it, either orally, in writing, or through photographs or videos:

(1) Japanese troops set off a small explosion on a train track in 1931, and falsely blamed it on China in order to justify an invasion of Manchuria. This is known as the “Mukden Incident” or the “Manchurian Incident”.

Read More

These Are The 8 Biggest Barriers To Economic Growth

Submitted by Tyler Durden on 03/24/2016 - 12:50 What are the barriers to productivity growth, and what can we do to remove them? Not surprisingly, most barriers are the result of counterproductive government policies.

The Stock Market Is A Monetary Policy Junkie - Quantifying The Fed's Unprecedented Impact On The S&P

Submitted by Tyler Durden on 03/24/2016 - 12:10 The bulls will presumably argue that this Fed impact is now part of the accepted wisdom, and that P/Es should remain higher than history in order to reflect the Greenspan/Bernanke/Yellen Put. The bears will suggest that if ever there were a time for the scales to fall from investors’ eyes over the Wizard-of-Oz-like nature of the Fed, then this is it. We are inclined to the latter view. Betting on the Fed’s ability to generate continued market levitation seems like a dangerous game to us, but as Newton long ago opined, “I can calculate the motion of heavenly bodies, but not the madness of people.”What Killed The Middle Class?

Submitted by Tyler Durden on 03/24/2016 - 09:02 If the four structural trends highlighted below don't reverse, the middle class is heading for extinction.Chinese Take Over Canada's Real Estate Market, Buy One-Third Of All Vancouver Homes Sold In 2015

Submitted by Tyler Durden on 03/24/2016 - 12:10

Altanta Fed GDP Forecast Tumbles To 1.4% To Justify Fed's Downbeat Outlook On Economy

Submitted by Tyler Durden on 03/24/2016 - 12:05 Some time in the second week of February, when the market was tumbling on, among other things, fears of a U.S. recession, the Atlanta Fed was scrambling to give the all clear signal on the US economy when it surprised watchers by releasing a far stronger than consensus Q1 GDP nowcast of 2.7%. Since then things have once again not gone quite as planned, and following the latest flurry of poor economic data, the Atlanta Fed just confirmed that the current US economy is about as weak as it was when the Atlanta Fed first started estimating it at the start of February with a paltry 1.2% forecast.

Are 'Wealthy' Americans Scrambling To Find Cash To Cover Their Tax Bill?

Submitted by Tyler Durden on 03/24/2016 - 11:50 Every year around this time, Americans face the certainty of tax time, and that means - in general - finding the cash to pay Uncle Sam his just deserts. This scramble for cash is seasonally evident in the variable-rate tax-exempt (Muni) bond market, where the typically wealthy stash their cash, as rates rise into tax time and fall after (as flows come and go). This year however, the scale of the outflows is enormous, spiking money-market fund rates from 1bp to 29bps...

Why "It’s Hard Being A Bear"

Submitted by Tyler Durden on 03/24/2016 - 11:33 It is always hard to buck the crowd, to be a bear when the market is up this much, this fast. Stocks are rallying and being underweight gets harder to maintain every day. The bulls are out there yapping about how this was just another correction, another dip to buy and that we better get back in, yada, yada, yada. What makes being bearish so hard is the noise of the perpetually bullish street, the lure of easy money in a market you know is overvalued but keeps going higher. Like JM Keynes "I change my mind when the facts change." Despite the rally, the facts – at least for now – still favor the bears.

Brussels Suicide Bombers Planted Hidden Camera At Home Of Top Belgium Nuclear Official

Submitted by Tyler Durden on 03/24/2016 - 11:10 "I don’t understand how you could have been in possession of this video since Nov. 30, but on Jan. 13, when I questioned you on this, you answered, ‘There is no specific threat to the nuclear facilities.’ ”

'Caged' Refugees Say They Will Jump In Sea If Deported

Submitted by Tyler Durden on 03/24/2016 - 10:49 "Turkey is a bad country, sorry about that, but it’s a bad country," he said. "If they send us back from Turkey, Turkey will send us back to Iraq or Syria. We’ll die in Iraq, we’ll die in Syria."

The Next Critical Level For The S&P: Stay Above 2,028 Or Channel Support Is Broken

Submitted by Tyler Durden on 03/24/2016 - 10:30 The S&P 500 is stalling below 2085 as daily momentum for price action and especially market breadth is waning. Similar to early November, confirmation of a near-term S&P 500 peak could come on a close below rising channel support near 2028 with daily Williams %R moving out of overbought. This would place the focus on the 200 and 100- day MAs near 2017 and 1997, respectively, which are ahead of chart support at 1969- 1947.

The 8 Major Problems The Next President Will Face

Submitted by Tyler Durden on 03/24/2016 - 10:15 Dear Donald and Hillary: In around ten months, one of you will wake up as Mr. or Mrs. President. After the fabulous fun of post-inaugural balls, you will walk into the Oval Office on Saturday, January 22 and launch into your first 90 days in office. To make your job just a little more manageable, what we would like to do is take you around the world and review some of the economic realities faced by our global partners. For many of them, those realities are not pretty. And you want this job why?

"Worst May Be To Come" Services PMI Signals "Softest Expansion Of New Business Since 2009"

Submitted by Tyler Durden on 03/24/2016 - 09:55 Having blamed the weather for the Services PMI collapse into contractionary levels in February, the very modesty rebound (from 49.7 to 51.0) is a big let down: "The lack of a strong rebound in service sector activity in March is a big disappointment, as bad weather had been blamed for part of the weakness in the first two months of the year." Indeed, confidence remains subdued and as Markit warns "The US economy is going through its worst growth spell for three and a half years...and the worst may be to come as the greatest concern is the near-stalling of new business growth."

Stocks Slammed Into Red For 2016; Bond Yields Plunge Most In 6 Months; Gold Bouncing Back

Submitted by Tyler Durden on 03/24/2016 - 09:38 The last two days have seen 30Y yields plunge over 12bps (the biggest move since September's Fed fold) to one-month lows. At the same time, thanks to The Fed's hawkish jawboning, stocks are dumping also with The Dow joining the rest in the red for 2016. Gold is rallying back from its monkey-hammering yesterday but remains the laggard post-Fed.

The Latest Key Developments In The Brussels Terror Attacks

Submitted by Tyler Durden on 03/24/2016 - 09:22 Two days after the tragic terrorist attacks in Brussles, the situation remains extremely fluid, with the largest concern being that more sleeper cells may be activated especially since the third man who participated at the Zaventerm airport suicide bombing is still at large. Here, courtesy of the Guardian and Politico, are the most recent key developments out of Belgium.

by Daniel McAdams, The News Doctors:

Here’s the big — really big — story of the day: AP is reporting that ISIS has sent at least 400 fighters into Europe in semi-autonomous cells to rain down a wave of terror that may make the Brussels attacks earlier this week look like child’s play. This underground terror army is said to have trained in Syria, Iraq, and possibly some of the former republics of the USSR, and they have infiltrated themselves into Europe to await further instructions.

Guess why they are so furious with Europe and the West? Years of intervention, regime change, bombs, and attacks, starting at least with the idiotic 2003 US invasion of Iraq. Before the neocons had the bright idea to overthrow the secular authoritarian Saddam Hussein, there was no al-Qaeda or ISIS (an al-Qaeda breakaway group) in Iraq.

Read More

Here’s the big — really big — story of the day: AP is reporting that ISIS has sent at least 400 fighters into Europe in semi-autonomous cells to rain down a wave of terror that may make the Brussels attacks earlier this week look like child’s play. This underground terror army is said to have trained in Syria, Iraq, and possibly some of the former republics of the USSR, and they have infiltrated themselves into Europe to await further instructions.

Guess why they are so furious with Europe and the West? Years of intervention, regime change, bombs, and attacks, starting at least with the idiotic 2003 US invasion of Iraq. Before the neocons had the bright idea to overthrow the secular authoritarian Saddam Hussein, there was no al-Qaeda or ISIS (an al-Qaeda breakaway group) in Iraq.

Read More

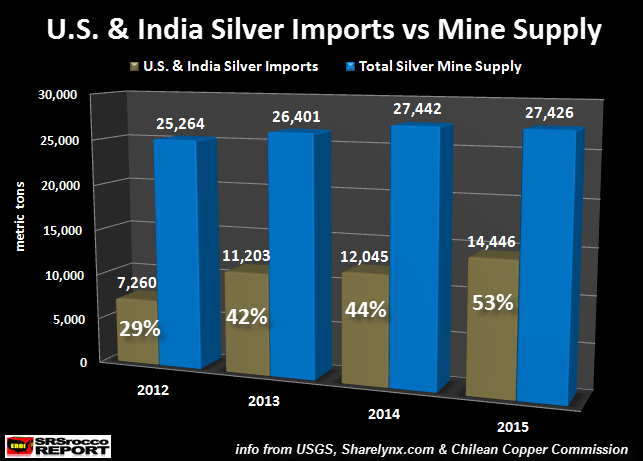

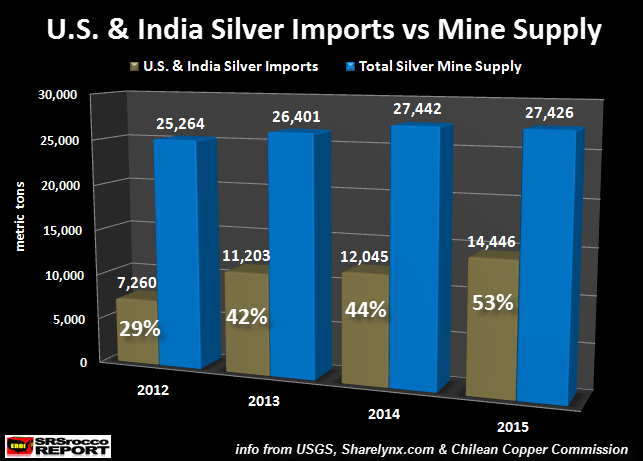

by Steve St. Angelo, SRS Rocco:

There were two record-breaking silver factors in 2015 that could turn out to be quite an interesting development for 2016. The figures that make up these separate factors don’t seem so striking until we combine them and study at the trends.

This is what I enjoy doing the most. Why? Because I can see interesting developments that aren’t readily apparent when we look at the figures or data individually. By combing this data, we can spot noteworthy trends that could likely set up the market for stunning future price movements in silver.

Read More

There were two record-breaking silver factors in 2015 that could turn out to be quite an interesting development for 2016. The figures that make up these separate factors don’t seem so striking until we combine them and study at the trends.

This is what I enjoy doing the most. Why? Because I can see interesting developments that aren’t readily apparent when we look at the figures or data individually. By combing this data, we can spot noteworthy trends that could likely set up the market for stunning future price movements in silver.

Read More

from The Sleuth Journal:

The globalist Establishment must be even more concerned now with Republican frontrunner, Donald J. Trump.

The magnate issued two explicit warnings on Monday regarding two of the most obscure and out of control organizations in the planet: NATO and the United Nations.

On the UN, Trump clearly pointed out its weaknesses and its irrelevance as well as its complicity in many of the disastrous foreign policy decisions adopted by the international community.

Read More

The globalist Establishment must be even more concerned now with Republican frontrunner, Donald J. Trump.

The magnate issued two explicit warnings on Monday regarding two of the most obscure and out of control organizations in the planet: NATO and the United Nations.

On the UN, Trump clearly pointed out its weaknesses and its irrelevance as well as its complicity in many of the disastrous foreign policy decisions adopted by the international community.

Read More

/

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment