Submitted by Tyler Durden on 03/05/2016 - 10:27

Submitted by Tyler Durden on 03/05/2016 - 10:27

Does this mean the short squeeze - whether ordinary course of business or engineered by banks to push the price of both the S&P and oil higher so that energy companies can sell equity and repay secured bank loans (as we speculated last week) - is over? According to JPM, not just yet, even though by now the weakest hands have clearly tapped out. In fact, since there has been virtually no rotation into ETFs, the most brutal part of the squeeze may be just ahead. Here's why:

"The Bounce Has Run Its Course" Bob 'The Bear' Janjuah Warns S&P Heading To 1700s

Submitted by Tyler Durden on 03/05/2016 - 15:20 It is important to remember that in bear markets the strength is to the downside, the violence is to the upside, with counter-trend rallies in bear markets often being the most painful. Markets simply do not go down (or up) in straight lines. The over-reach of central bankers and their failed policies is not news to me. What is news to us, especially after the BOJ's easing in January, is that markets are now either at or very close to losing all confidence in the post-GFC policy response crafted by the Fed/ECB/BOJ et al much earlier in 2016 than even we had expected.

"See How The Bank Of Japan's Assets Are Growing"

"What’s scary about this huge balance sheet expansion, is that it’s not having a bigger impact (although we don’t have a counterfactual). Indeed, the Nikkei is down -11% ytd and the yen has strengthened +6%."

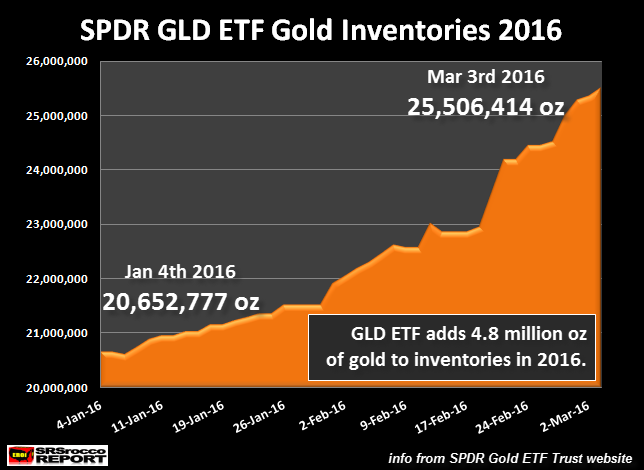

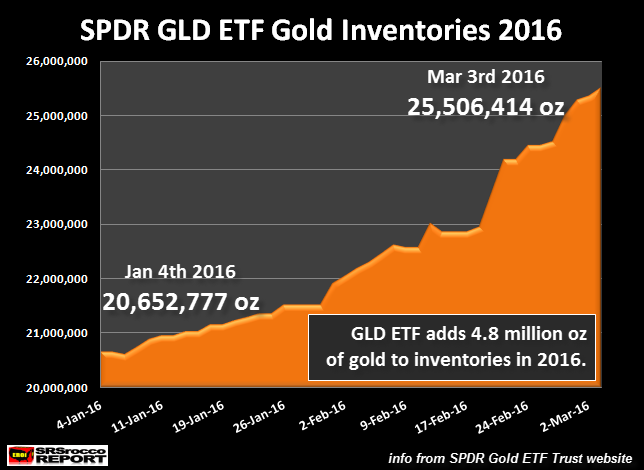

The Last Time Gold ETF Flows Were This Strong, The Fed Was Starting QE

Submitted by Tyler Durden on 03/05/2016 - 12:40 The cracks are starting to appear in the 'paper' gold market.

by Steve St. Angelo, SRSrocco Report:

The Death of the paper gold market picked up speed today as Blackrock announced that issuance of new Gold IAU ETF shares was suspended. However, it’s much worse than the information in news release when we factor in the total supply and demand situation.

According to the article on Zerohedge, BlackRock Suspends ETF Issuance Due To “Surging Demand For Gold”:

BlackRock’s Gold ETF (IAU) has seen fund inflows every day in 2016 (no outflows at all) and with the stock trading above its NAV for most of the year, the world’s largest asset manager has made a significant decision:

Read More

The Death of the paper gold market picked up speed today as Blackrock announced that issuance of new Gold IAU ETF shares was suspended. However, it’s much worse than the information in news release when we factor in the total supply and demand situation.

According to the article on Zerohedge, BlackRock Suspends ETF Issuance Due To “Surging Demand For Gold”:

BlackRock’s Gold ETF (IAU) has seen fund inflows every day in 2016 (no outflows at all) and with the stock trading above its NAV for most of the year, the world’s largest asset manager has made a significant decision:

Read More

CBOE Signals VIX "Death Cross"

Submitted by Tyler Durden on 03/05/2016 - 14:00 While it may not be the traditional signal, CBOE's Russell Rhoads points out that the so-called 'fear index' VIX has just signalled the first Death Cross since its apocalyptic warning in November 2007. With VIX having plunged to 2016 lows, VIX volatility at post-QE3 lows (signalling extreme complacency), and VIX having decoupled once again from credit risk, the 'death cross' may be worth paying attention to once again as the ides of March strike.

"Everything's Interconnected"

Submitted by Tyler Durden on 03/05/2016 - 13:20 Everything happening today is in some ways interconnected: popularity of ‘non-establishment’ political candidates; ineffectiveness of central bank policy in lifting inflation; economic pessimism; weak capital spending (from handcuffed capitalism); and angst due to perceptions of inequality. Let us explain...Filed under "IDIOTS"

Sweden Begins 5 Year Countdown Until It Eliminates Cash

Submitted by Tyler Durden on 03/05/2016 - 11:20 Famous. Last. Words. "... but I think it's going to be so simple that you pretty soon realize that this is a lot easier and better than having cash"

"It's A Depression" - The Disturbing Email A Houston CEO Sent His Soon To Be Laid Off Employees

Submitted by Tyler Durden on 03/04/2016 - 18:20 This is the email that David Little, Chairman and CEO of Houston-based DXP Enterprises sent to his employees to explain why, "due to bank obligations and to continue a positive cash flow profile" the company has to freeze 401(k), why it is cutting pay in some cases as much as 60% and why many employees are about to lose their jobs in the middle of what is an "oil and gas depression." It is a disturbing read.

Democratic Presidential Candidate Jim Webb Says He Won't Vote For Clinton, Might Vote Trump

Submitted by Tyler Durden on 03/05/2016 - 12:03 "If you’re voting for Donald Trump, you might be getting something very good or very bad. If you’re voting for Hillary Clinton, you’re going to get the same thing. Do you want the same thing?"

China Fails To Deliver Major Fiscal Stimulus At People's Congress, Makes Many Promises Instead

Submitted by Tyler Durden on 03/05/2016 - 09:20 There were hopes that China would announce a raft of fscal stimulus measures at the much ballyhooed NPC aimed boosting growth and taking some of the pressure off of montary policy. No such luck. The budget deficit came in at just 3%, an expansion from last year's 2.3%, but well below the 4% some analyasts were hoping for.

"Democracy Ends In Turkey": Prominent Anti-Erdogan Newspaper Seized In Midnight Raid

Submitted by Tyler Durden on 03/05/2016 - 08:19 Overnight both freedom of press, and democracy officially died in Turkey, with time of death just before midnight, when Turkish authorities stormed the Zaman daily, a newspaper staunchly opposed to president Recep Tayyip Erdogan, and after using tear gas and water cannon they seized its headquarters in a dramatic raid that raised fresh alarm over declining media freedoms.

Former UK Ambassador To Syria: US/UK Foreign Policy Is Doomed, Even Corrupt

Submitted by Tyler Durden on 03/04/2016 - 22:25 "Realistically, Assad is not going to be overthrown. This becomes more clear with every day that passes. Western analysts have been indulging in wishful thinking for 5 years; it’s time to get real, we owe it to the Syrian people to be much more realistic and hard headed about this. The West has to stop propping up the so-called 'moderate opposition', which is not moderate at all."If Voting Mattered, They Wouldn't Let You Do It

Submitted by Tyler Durden on 03/04/2016 - 21:50

from The Daily Sheeple:

This is so dumb, it’s hard to write about it.

Apparently it’s just coming to light that the LAPD is currently testing a knife found buried on OJ Simpson’s property years ago.

A construction worker on the property found the knife and turned it over to an off-duty cop sometime during 1998 or thereafter. The cop… wait for it… KEPT IT AS A SOUVENIR instead of turning it over as potential evidence in the commission of two still-officially-unsolved murders.

Read More

This is so dumb, it’s hard to write about it.

Apparently it’s just coming to light that the LAPD is currently testing a knife found buried on OJ Simpson’s property years ago.

A construction worker on the property found the knife and turned it over to an off-duty cop sometime during 1998 or thereafter. The cop… wait for it… KEPT IT AS A SOUVENIR instead of turning it over as potential evidence in the commission of two still-officially-unsolved murders.

Read More

from Wolf Street:

When a PE firm is through strip-mining a company.

Sports Authority, which had skipped a $20-million interest payment in January while trying to arm-twist subordinated bondholders into accepting a haircut, and which filed for Chapter 11 bankruptcy on Wednesday, isn’t the only retailer in the US that was taken over by private equity firms before the Financial Crisis.

The list is long: Neiman Marcus, Albertsons, Safeway, J. Crew Group, 99 Cents Only Stores, Bon-Ton Stores, Claire Stores, the Container Store…. And they all have problems.

Read More

When a PE firm is through strip-mining a company.

Sports Authority, which had skipped a $20-million interest payment in January while trying to arm-twist subordinated bondholders into accepting a haircut, and which filed for Chapter 11 bankruptcy on Wednesday, isn’t the only retailer in the US that was taken over by private equity firms before the Financial Crisis.

The list is long: Neiman Marcus, Albertsons, Safeway, J. Crew Group, 99 Cents Only Stores, Bon-Ton Stores, Claire Stores, the Container Store…. And they all have problems.

Read More

by Jeff Nielson, Bullion Bulls:

By now, regular readers are very familiar with my views on “markets”. We no longer have markets. Instead, we merely have computerized price-fixing operations which are called “markets”. All markets act and react according to a predictable set of patterns and principles. Our so-called markets now no longer exhibit any of these patterns and principles, hence they can’t be markets.

More Evidence of the Master Trading Algorithm

This absolute hijacking of our markets was completed in 2011. Since that time; the One Bank has exerted virtually absolute control over these former markets. The most obvious example of market-defying behavior is with the price of gold (and silver) and this was explained in a previous commentary.

Read More

By now, regular readers are very familiar with my views on “markets”. We no longer have markets. Instead, we merely have computerized price-fixing operations which are called “markets”. All markets act and react according to a predictable set of patterns and principles. Our so-called markets now no longer exhibit any of these patterns and principles, hence they can’t be markets.

More Evidence of the Master Trading Algorithm

This absolute hijacking of our markets was completed in 2011. Since that time; the One Bank has exerted virtually absolute control over these former markets. The most obvious example of market-defying behavior is with the price of gold (and silver) and this was explained in a previous commentary.

Read More

from Lew Rockwell:

Does a JFK, RFK, MLK Moment Await Trump? Bipartisan

gangsters running America let nothing interfere with their ruthless

agenda, waging war on humanity at home and abroad, serving monied

interests exclusively.

Does a JFK, RFK, MLK Moment Await Trump? Bipartisan

gangsters running America let nothing interfere with their ruthless

agenda, waging war on humanity at home and abroad, serving monied

interests exclusively.

Trump won’t change longstanding policies if elected president. Yet Republican power brokers and media scoundrels want anyone but him representing the party in November.

Will they choose the nuclear option to prevent it? Will long knives eliminate his candidacy the old-fashioned way?

Read More

Does a JFK, RFK, MLK Moment Await Trump? Bipartisan

gangsters running America let nothing interfere with their ruthless

agenda, waging war on humanity at home and abroad, serving monied

interests exclusively.

Does a JFK, RFK, MLK Moment Await Trump? Bipartisan

gangsters running America let nothing interfere with their ruthless

agenda, waging war on humanity at home and abroad, serving monied

interests exclusively.Trump won’t change longstanding policies if elected president. Yet Republican power brokers and media scoundrels want anyone but him representing the party in November.

Will they choose the nuclear option to prevent it? Will long knives eliminate his candidacy the old-fashioned way?

Read More

/

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment