Submitted by Tyler Durden on 01/19/2016 - 15:07

Stocks, Commodities, & Bond Yields Are Collapsing

Submitted by Tyler Durden on 01/19/2016 - 23:01

by Bill Holter, JS Mineset, SGT Report.com:

“Someone is lying?” is a humorous title because in today’s world this

could pertain to nearly anything. In this case I am speaking of the

Dallas Fed and the banks they oversee. As you know, Zerohedge wrote last

Friday of the Dallas Fed. They said the Fed had “issued guidance” to

the banks they oversee to not report non performing energy loans and

also to not push any of these entities into bankruptcy. Yesterday the

Dallas Fed responded with denial in a tweet.

“Someone is lying?” is a humorous title because in today’s world this

could pertain to nearly anything. In this case I am speaking of the

Dallas Fed and the banks they oversee. As you know, Zerohedge wrote last

Friday of the Dallas Fed. They said the Fed had “issued guidance” to

the banks they oversee to not report non performing energy loans and

also to not push any of these entities into bankruptcy. Yesterday the

Dallas Fed responded with denial in a tweet.

Before continuing, please read the response from Zerohedge.

First, I am not a lawyer but ZH’s response sounds very much like a legal response and speaks to “discovery”. This in itself is quite interesting as it is about the closest thing to “audit the Fed” as we have gotten to this point. For the Dallas Fed to respond in a public tweet was in my opinion a VERY BAD idea.

Read More

“Someone is lying?” is a humorous title because in today’s world this

could pertain to nearly anything. In this case I am speaking of the

Dallas Fed and the banks they oversee. As you know, Zerohedge wrote last

Friday of the Dallas Fed. They said the Fed had “issued guidance” to

the banks they oversee to not report non performing energy loans and

also to not push any of these entities into bankruptcy. Yesterday the

Dallas Fed responded with denial in a tweet.

“Someone is lying?” is a humorous title because in today’s world this

could pertain to nearly anything. In this case I am speaking of the

Dallas Fed and the banks they oversee. As you know, Zerohedge wrote last

Friday of the Dallas Fed. They said the Fed had “issued guidance” to

the banks they oversee to not report non performing energy loans and

also to not push any of these entities into bankruptcy. Yesterday the

Dallas Fed responded with denial in a tweet.Before continuing, please read the response from Zerohedge.

First, I am not a lawyer but ZH’s response sounds very much like a legal response and speaks to “discovery”. This in itself is quite interesting as it is about the closest thing to “audit the Fed” as we have gotten to this point. For the Dallas Fed to respond in a public tweet was in my opinion a VERY BAD idea.

Read More

from Zero Hedge:

The Fed may have officially tapered QE at the end of 2014 but that

doesn’t mean it is done buying Treasuries: since the Fed never ended

rolling over maturing paper, it means that it will remain indefinitely

active in the open market. And while there were no sizable maturities

from the Fed’s various QEs to date (only $474 million in 2014 and $3.5

billion in 2015) that will change dramatically this year, when Brian

Sack’s team will have to purchase about $216 billion to replace matured

TSYs.According to JPM calculations, this represents half the net new government debt that will be issued over the next 12 months.

The Fed may have officially tapered QE at the end of 2014 but that

doesn’t mean it is done buying Treasuries: since the Fed never ended

rolling over maturing paper, it means that it will remain indefinitely

active in the open market. And while there were no sizable maturities

from the Fed’s various QEs to date (only $474 million in 2014 and $3.5

billion in 2015) that will change dramatically this year, when Brian

Sack’s team will have to purchase about $216 billion to replace matured

TSYs.According to JPM calculations, this represents half the net new government debt that will be issued over the next 12 months.

Read More

The Fed may have officially tapered QE at the end of 2014 but that

doesn’t mean it is done buying Treasuries: since the Fed never ended

rolling over maturing paper, it means that it will remain indefinitely

active in the open market. And while there were no sizable maturities

from the Fed’s various QEs to date (only $474 million in 2014 and $3.5

billion in 2015) that will change dramatically this year, when Brian

Sack’s team will have to purchase about $216 billion to replace matured

TSYs.According to JPM calculations, this represents half the net new government debt that will be issued over the next 12 months.

The Fed may have officially tapered QE at the end of 2014 but that

doesn’t mean it is done buying Treasuries: since the Fed never ended

rolling over maturing paper, it means that it will remain indefinitely

active in the open market. And while there were no sizable maturities

from the Fed’s various QEs to date (only $474 million in 2014 and $3.5

billion in 2015) that will change dramatically this year, when Brian

Sack’s team will have to purchase about $216 billion to replace matured

TSYs.According to JPM calculations, this represents half the net new government debt that will be issued over the next 12 months.Read More

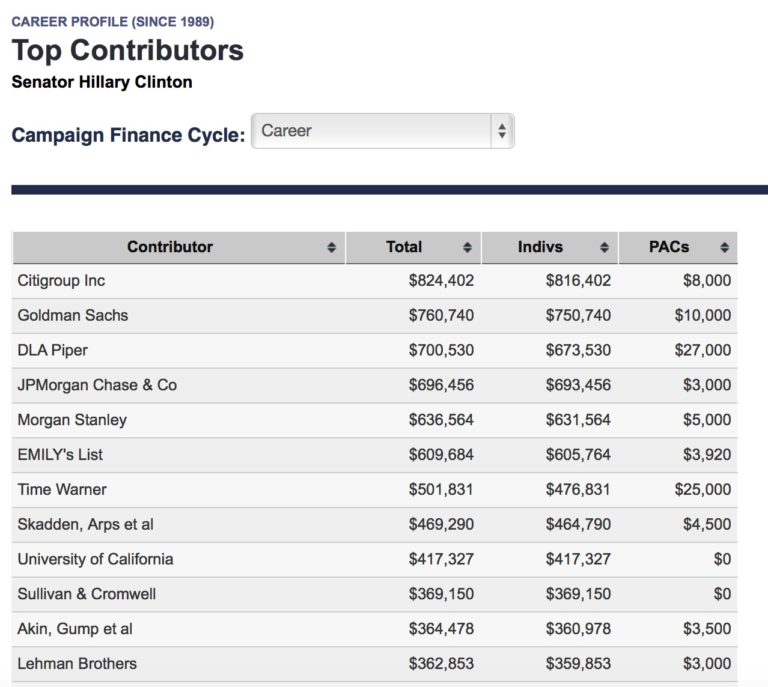

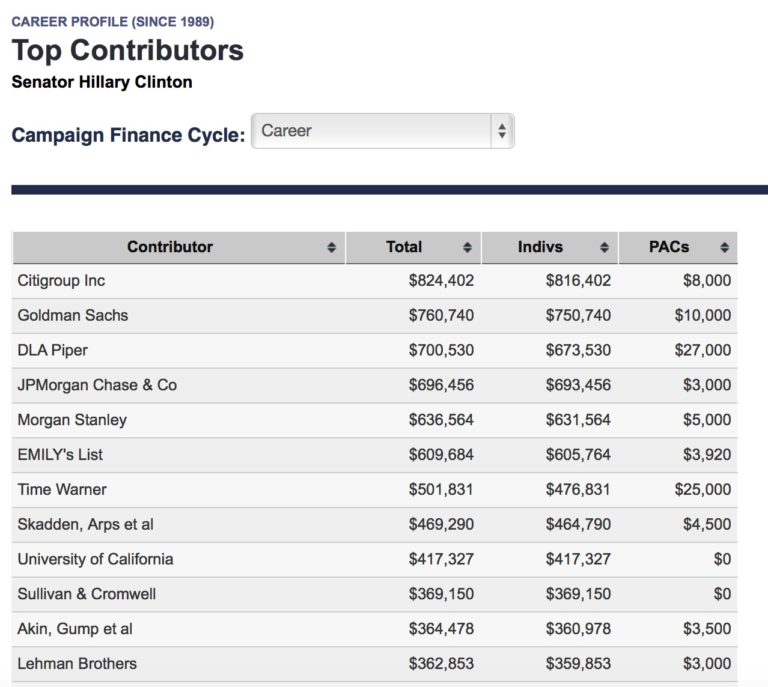

Clinton Vs. Sanders - What Does Google Say... And The Facts

Submitted by Tyler Durden on 01/19/2016 - 22:45

from Liberty Blitzkrieg:

“She’s not doing the big rallies because she can’t get the big crowds,” said the Iowa Clinton ally. “Maybe people are too anxious over this, and that anxiety is spilling over into cautiousness and overthinking decisions. Everyone’s on edge given how much we’ve invested in Iowa.”

– From the Mashable article: Bernie Sanders is Surging in Iowa and Hillary Clinton’s Campaign is Freaked

Hillary Clinton’s campaign is absolutely imploding right now. When people get desperate, they do desperate things, and the latest move by the Clinton campaign reeks of putrid, panicked desperation.

Read More…

“She’s not doing the big rallies because she can’t get the big crowds,” said the Iowa Clinton ally. “Maybe people are too anxious over this, and that anxiety is spilling over into cautiousness and overthinking decisions. Everyone’s on edge given how much we’ve invested in Iowa.”

– From the Mashable article: Bernie Sanders is Surging in Iowa and Hillary Clinton’s Campaign is Freaked

Hillary Clinton’s campaign is absolutely imploding right now. When people get desperate, they do desperate things, and the latest move by the Clinton campaign reeks of putrid, panicked desperation.

Read More…

The 21st Century: An Era Of Fraud

Submitted by Tyler Durden on 01/19/2016 - 22:15 In “freedom and democracy” America, the government and the economy serve interests totally removed from the interests of the American people. The sellout of the American people is protected by a huge canopy of propaganda provided by free market economists and financial presstitutes paid to lie for their living. It is unclear that the US economy can be revived. When America fails, so will Washington’s vassal states in Europe, Canada, Australia, and Japan.

What Keeps Bank Of America's Junk Bond Analyst Up At Night

Submitted by Tyler Durden on 01/19/2016 - 21:50 "What keeps us up at night, however, is a situation where history is little indicator of what’s to come. Although there is no doubt that we do not need to have a recession in 2016 to experience further high yield weakness, we are concerned that this cycle could prove to be not only different, but more severe than past cycles. Should a slowdown today be swifter and deeper, more akin to 2008 than 2002, we are concerned about the ability of the central bank to create enough monetary stimulus to stem a crisis."

When Correlation Is Causation - The Most Important Chart In The World If You're A Realtor In London Or NYC

Submitted by Tyler Durden on 01/19/2016 - 21:15 If ever there was any doubts about the narrative of freedom-seeking China capital outflows driving the irrationally exuberant prices of homes in some of the world's largest cities to record highs, the following two charts will extinguish them entirely. As China continues to strengthen (as quietly as possible) its capital controls to slow the leak of money from the devaluing currency nation, and US authorities clamp-down on the anonymity of cash-only transactions, realtors in NYC, Miami, and London better hope that correlation is not causation.

Shanghai Opens Below 3,000 As Animal Spirits Leave The Building: Longest Margin Debt Drop In 6 Months

Submitted by Tyler Durden on 01/19/2016 - 20:51 At this point it is practically impossible to track all the Chinese market breakages, which like connected vessels appear at the most random of places, and the moment one hole is patched up, another immediately takes its place.

Washington Unveils Investigation Into "Russian Meddling" In The EU

Submitted by Tyler Durden on 01/19/2016 - 20:45 News broke last Saturday evening that the US is to conduct a "major investigation" into how the Kremlin is "infiltrating political parties in Europe" amid "mounting concerns" of a new Cold War. The exclusive, which was published by the UK’s Telegraph newspaper, revealed that James Clapper, the US Director of National Intelligence has been instructed by Congress to begin the major review into Russia’s "clandestine" funding of EU parties over the last decade. Hypocritical? Oh, let us count the ways...

"What To Own In An Equity Death Spiral"

Submitted by Tyler Durden on 01/19/2016 - 20:34 As BofA admits, "this sell-off differs from a typical growth scare in that parts of the recession playbook are failing miserably." So until we have clarity on whether or not this is a garden variety correction or a true bear market, here is BofA's advice on what to own in an "equity death spiral"We Know How This Ends - Part 1

Submitted by Tyler Durden on 01/19/2016 - 20:15

And You Thought QE Was Over: The Fed Will Monetize Half Of This Year's U.S. Treasury Issuance

Submitted by Tyler Durden on 01/19/2016 - 19:57 The Fed may have officially tapered QE at the end of 2014 but that doesn't mean it is done buying Treasuries: since the Fed never ended rolling over maturing paper, it means that it will remain indefinitely active in the open market. And while there were no sizable maturities from the Fed's various QEs to date (only $474 million in 2014 and $3.5 billion in 2015) that will change dramatically this year, when Brian Sack's team will have to purchase about $216 billion to replace matured TSYs. According to JPM calculations, this represents half the net new government debt that will be issued over the next 12 months.

Crude Oil Slides Below $28, Lowest Since 2003, Dragging US Equity Futures Lower

Submitted by Tyler Durden on 01/19/2016 - 19:38 Traders had some hope that they could take at least a brief nap ahead of the China open before all risk hell broke loose in the latest evening session, however either some liquidating algo or the Iranian oil trading desk had different plans, and moments ago WTI dipped below $28 per barrel, sliding as low as $27.92, doing so only for the first time since 2003, a new 12 year low.

Borderland Homicides Show Mexico's Gun Control Has Failed

Submitted by Tyler Durden on 01/19/2016 - 19:30 While it refuses to admit the abject failure of its gun control program, the Mexican state instead attempts to shift the blame to Americans and has attempted to impose international gun control measures on the US. For Mexican politicians, it's easier to shift the blame than to recognize the fact that neighboring Americans right across the border enjoy far lower homicide rates along side relatively easy access to firearms. (Even California looks like a gun-owner's paradise compared to Mexico.) The Mexican state (and many Mexicans) are unfortunately impervious to these facts, and, many Mexicans still believe that Mexicans will be safer if the Mexican regime tightens its grip even more on firearms, in spite of the spectacular failure of gun control in that country.

Hedge Fund Which Predicted The Subprime Crisis Expects Massive Yuan Devaluation In 2016

Submitted by Tyler Durden on 01/19/2016 - 18:57 Today, another Texas-based hedge fund manager who just like Kyle Bass correctly predicted, and profited from, the subprime crisis, Corriente Advisors' Mark Hart, has not only reiterated Kyle Bass CNY devaluation call, but has gone as far as quantifying by how much the Chinese currency will have to fall. Cited by Bloomberg, Hart has said that "China should weaken its currency by more than 50 percent this year."

How Elon Musk Stole My Car

Submitted by Tyler Durden on 01/19/2016 - 18:55 If a tech-savvy $100k car buyer can have this experience, what hope is there for this organization to go mainstream? Tesla is a publicly traded company that loses money. So, strictly speaking, it doesn’t need customers as long as it can fund its losses via Wall Street. In my experience, its a hobby masquerading as a company, and it can probably run as a hobbyist organization for some time. But, at some point, customers will matter, they always do.by Andrea K. Mitchell, Hartford Community Court:

A court case relating to Sandy Hook, initiated through false complaints by Dr. H. Wayne Carver is now approaching a three-year threshold with critical exculpatory evidence being withheld by Carl Ajello & Gail P. Hardy of the Hartford State’s Attorneys office. As of January 2016, the State’s Attorney’s Office is withholding all 28 items of exculpatory evidence, has denied a motion for a speedy trial by jury, and has not produced discovery materials and police reports to the defense in violation of the Connecticut Practice Book.

An official and un-redacted version of the complete Connecticut State Police Sandy Hook Elementary School Shooting Report has been requested as exculpatory evidence through a discovery request, along with 27 other sources of evidence by the defense counsel. The State of Connecticut has been non-compliant with receiving motions of discovery and a motion for trial by jury.

Read More

by Joseph P. Farrell, Giza Death Star:

Many regular readers here shared this article, and its importance

require alerting you to it. Over the years, I’ve been blogging about the

GMO issue, and chiefly from the point of view of its potential

geopolitical significance, advancing the idea that eventually nations

like Russia, which have registered profound misgivings about the

“science” behind GMOs assuring consumers of their safety, could

conceivably steal a march on giant Western agribusiness companies like

Mon(ster)santo by entering the international agricultural market and

selling not only non-GMO foodstuffs, but also non-GMO seeds.

Additionally, recent court decisions in France have raised issues, once

again, about the corporate claims for the safety of their products, and

finally, because of the growing backlash against GMOs, agvribusiness

giants like Mon(ster)santo have recently announced cutbacks and layoffs

due to falling profits.

Many regular readers here shared this article, and its importance

require alerting you to it. Over the years, I’ve been blogging about the

GMO issue, and chiefly from the point of view of its potential

geopolitical significance, advancing the idea that eventually nations

like Russia, which have registered profound misgivings about the

“science” behind GMOs assuring consumers of their safety, could

conceivably steal a march on giant Western agribusiness companies like

Mon(ster)santo by entering the international agricultural market and

selling not only non-GMO foodstuffs, but also non-GMO seeds.

Additionally, recent court decisions in France have raised issues, once

again, about the corporate claims for the safety of their products, and

finally, because of the growing backlash against GMOs, agvribusiness

giants like Mon(ster)santo have recently announced cutbacks and layoffs

due to falling profits.

Read More

Many regular readers here shared this article, and its importance

require alerting you to it. Over the years, I’ve been blogging about the

GMO issue, and chiefly from the point of view of its potential

geopolitical significance, advancing the idea that eventually nations

like Russia, which have registered profound misgivings about the

“science” behind GMOs assuring consumers of their safety, could

conceivably steal a march on giant Western agribusiness companies like

Mon(ster)santo by entering the international agricultural market and

selling not only non-GMO foodstuffs, but also non-GMO seeds.

Additionally, recent court decisions in France have raised issues, once

again, about the corporate claims for the safety of their products, and

finally, because of the growing backlash against GMOs, agvribusiness

giants like Mon(ster)santo have recently announced cutbacks and layoffs

due to falling profits.

Many regular readers here shared this article, and its importance

require alerting you to it. Over the years, I’ve been blogging about the

GMO issue, and chiefly from the point of view of its potential

geopolitical significance, advancing the idea that eventually nations

like Russia, which have registered profound misgivings about the

“science” behind GMOs assuring consumers of their safety, could

conceivably steal a march on giant Western agribusiness companies like

Mon(ster)santo by entering the international agricultural market and

selling not only non-GMO foodstuffs, but also non-GMO seeds.

Additionally, recent court decisions in France have raised issues, once

again, about the corporate claims for the safety of their products, and

finally, because of the growing backlash against GMOs, agvribusiness

giants like Mon(ster)santo have recently announced cutbacks and layoffs

due to falling profits.Read More

by J. D. Heyes, Natural News:

It’s no secret to tens of millions of Americans that Big Food is

poisoning us daily with their fare. If that were not the case, then

GMO-free restaurant chains like Chipotle wouldn’t be as popular as they

are, and sales of organic foods would not be reaching record levels year after year.

It’s no secret to tens of millions of Americans that Big Food is

poisoning us daily with their fare. If that were not the case, then

GMO-free restaurant chains like Chipotle wouldn’t be as popular as they

are, and sales of organic foods would not be reaching record levels year after year.

Big Food, of course, isn’t taking that lying down. “Mainstream” food producers may be enlisting the help of academia in getting Americans who believe in sustainable, clean food, declared mentally unstable.

As reported by Waking Times, scientists at the University of Northern Colorado, who recently conducted a case study about the obsession with healthy eating, have concluded that such clean-food preoccupation could be a mental disorder.

Read More

It’s no secret to tens of millions of Americans that Big Food is

poisoning us daily with their fare. If that were not the case, then

GMO-free restaurant chains like Chipotle wouldn’t be as popular as they

are, and sales of organic foods would not be reaching record levels year after year.

It’s no secret to tens of millions of Americans that Big Food is

poisoning us daily with their fare. If that were not the case, then

GMO-free restaurant chains like Chipotle wouldn’t be as popular as they

are, and sales of organic foods would not be reaching record levels year after year.Big Food, of course, isn’t taking that lying down. “Mainstream” food producers may be enlisting the help of academia in getting Americans who believe in sustainable, clean food, declared mentally unstable.

As reported by Waking Times, scientists at the University of Northern Colorado, who recently conducted a case study about the obsession with healthy eating, have concluded that such clean-food preoccupation could be a mental disorder.

Read More

from Parents Against Mandatory Vaccines:

For the past several decades the number of vaccinations recommended (or required) by physicians, schools, colleges and employers has increased exponentially. The Center for Disease Control, Inc. launched a program in 2010 called Healthy People 2020 and increasing vaccination rates is a significant part of this well funded program.

Vaccines (dangerous pharmaceutical products that the manufactuers don’t warrant as either safe or effective) are extremely profitable for Big Pharma. So the establishment of policies for schools, colleges and medical facilities that require “up to date” vaccinations is a virtual economic windfall for the industry. Let’s not forget that the words “do not harm living men, women or children” are not included in Big Pharma’s corporate charters.

Read More

For the past several decades the number of vaccinations recommended (or required) by physicians, schools, colleges and employers has increased exponentially. The Center for Disease Control, Inc. launched a program in 2010 called Healthy People 2020 and increasing vaccination rates is a significant part of this well funded program.

Vaccines (dangerous pharmaceutical products that the manufactuers don’t warrant as either safe or effective) are extremely profitable for Big Pharma. So the establishment of policies for schools, colleges and medical facilities that require “up to date” vaccinations is a virtual economic windfall for the industry. Let’s not forget that the words “do not harm living men, women or children” are not included in Big Pharma’s corporate charters.

Read More

Why This Slump Has Legs

from The Automatic Earth:

…We’re

all going to regret engaging in the debt game, and not letting the

bubble deflate in an orderly fashion when we still could, but all those

thoughts are too late now…

…We’re

all going to regret engaging in the debt game, and not letting the

bubble deflate in an orderly fashion when we still could, but all those

thoughts are too late now…

We’ve only really been in two weeks of trading in the new year, things are looking pretty bad to say the least, so predictably the press are asking -and often answering- questions about when the slump will be over. Rebound, recovery, the usual terminology. When will we get back to growth?

For me personally, but that’s just me, that last question sounds a bit more stupid every single time I hear and read it. Just a bit, but there’s been a lot of those bits, more than I care to remember. Luckily, the answer is easy. The slump will not be over for a very long time, there will be no rebound or recovery, and please stop talking about a return to growth unless you can explain what you want to grow into.

Read More

from The Automatic Earth:

…We’re

all going to regret engaging in the debt game, and not letting the

bubble deflate in an orderly fashion when we still could, but all those

thoughts are too late now…

…We’re

all going to regret engaging in the debt game, and not letting the

bubble deflate in an orderly fashion when we still could, but all those

thoughts are too late now…We’ve only really been in two weeks of trading in the new year, things are looking pretty bad to say the least, so predictably the press are asking -and often answering- questions about when the slump will be over. Rebound, recovery, the usual terminology. When will we get back to growth?

For me personally, but that’s just me, that last question sounds a bit more stupid every single time I hear and read it. Just a bit, but there’s been a lot of those bits, more than I care to remember. Luckily, the answer is easy. The slump will not be over for a very long time, there will be no rebound or recovery, and please stop talking about a return to growth unless you can explain what you want to grow into.

Read More

/

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment