Submitted by Tyler Durden on 01/27/2016 - 14:01

Submitted by Tyler Durden on 01/27/2016 - 14:01

Treading a fine line between losing all credibility and exposing their total devotion to the stock market, it appears The Fed is maintaining its delusion that everything will be fine as they unwind the largest and most experimental monetary policy of all time, and yet for the first time we get proof that the Fed admits it made an error by hiking into a slowing economy: "labor market conditions improved further even as economic growth slowed late last year.

Dow Crashes 350 Points From Post-Fed Highs

Submitted by Tyler Durden on 01/27/2016 - 15:15 Well that escalated quickly...Why Lower Gasoline Prices Are Not Stimulating The Economy

Submitted by Tyler Durden on 01/27/2016 - 15:25 Fed officials and financial news reporters are collectively wondering why the economy seems to be slowing down, even though lower oil and gasoline prices ought to be a stimulative factor. If consumers are spending less of their money on gasoline, then they ought to have more to spend on other stuff, or so goes the reasoning. So why is it not working?

US, Britain, France Ready Military Action In Libya As ISIS Closes In On Country's Oil

Submitted by Tyler Durden on 01/27/2016 - 15:01 Washington's individual efforts to meddle in Mid-East affairs have now seemingly all melded into one giant, bloody melee and incredibly, America's solution is to go right back in and meddle some more. What could possibly go wrong?

Cupertino, We Have A Problem: China's JD.Com Just Cut Prices On Apple Products By 17%

Submitted by Tyler Durden on 01/27/2016 - 14:53 JD.com cut prices of Apple products on the internet marketplace by as much as 17%, according to information on the JD website. Customers can also purchase Apple products in 12 monthly installments with no interest charges and no downpayment." Among the discounts, iPad Air tablet with 16GB memory is priced at CNY 2,399 (USD 365), compared with CNY 2,888 on the Apple online store in China. The iPhone 6s Plus handset with 64GB memory is priced at CNY 6,288, compared with the official price of CNY 6,888.

The Resurrection Of The Dying Art Of Economic Analysis (Or When The Fed Fails)

Submitted by Tyler Durden on 01/27/2016 - 14:35 Detailed analysis of economic data is a dying art. The past seven year bull-market has largely justified the logic of such an approach, but the frenzied panic of the last month raises the question of whether investors will know how to adapt if the framework changes again. Recent market ructions offer the first evidence that central banks may be near the limit of their ability, or their willingness, to keep pumping up asset prices.

Market Reaction To "Not Dovish Enough Statement" - Disappointment

Submitted by Tyler Durden on 01/27/2016 - 14:14 Fed Funds futures now imply the next rate hike will not occur until at least H2 2016 and this level of fear about the economy appears to have spooked stocks and crude and put a bid under bonds and bullion... VIX is chaos as the machines try desperately to get stocks higher...

Fed Mouthpiece Parses Back-Pedaling Fed Statement

Submitted by Tyler Durden on 01/27/2016 - 14:08 "The Federal Reserve signaled renewed worry about financial market turbulence and slow overseas economic growth, but didn’t rule out raising short-term interest rates in March."FOMC Preview: "A Rate Cut Is Very Much In The Mix"

Submitted by Tyler Durden on 01/27/2016 - 13:42 This is the first meeting we can remember where serious and important market participants differed so strongly on the issue of what they ought to do. It’s not just hold or raise, cut is very much in the mix.

Former House Majority Leader Claims FBI Is "Ready To Indict" Hillary Clinton

Submitted by Tyler Durden on 01/27/2016 - 13:35 "They're ready to recommend an indictment and they also say that if the attorney general does not indict, they’re going public..."

Ugly 5 Year Auction Results In Biggest Tail In Months

Submitted by Tyler Durden on 01/27/2016 - 13:12 While many were surprised when yesterday's 2 Year auction saw absolutely blistering demand, including a near record Indirect take down and a yield stopping deeply through the When Issued, none of that was on display in today's 5 Year auction which concluded moments ago when the Treasury sold $35 billion of Cusip N89 at a yield of 1.496%. The problem: this was 0.9 bps wide of the When Issued and one of the biggest auction tails in recent months.

These Two Commodity "Experts" May Not Have Long To Live

Submitted by Tyler Durden on 01/27/2016 - 13:05 There is reason for the saying "never say never", as demonstrated vividly by these two energy experts:

US Economy: On A Knife's Edge

Submitted by Tyler Durden on 01/27/2016 - 12:45 We may not yet have final confirmation that a recession is imminent, but so far nothing suggests that the danger has receded.

Refugee Murders 22-Year-Old Swedish Woman In Knife Attack

Submitted by Tyler Durden on 01/27/2016 - 12:26 “It was messy, of course, a crime scene with blood"...

23,144 Ways America Created Terrorists In 2015

Submitted by Tyler Durden on 01/27/2016 - 12:05 “The Effort to purify the world is self-defeating; the United States becomes a Sisyphus with bombs, able to set off explosions, but unable to cope with its own burden." The more aggressive their attempts to eradicate evil, the stronger evil becomes on both sides. Each of the 23,144 bombs dropped on Muslim countries in 2015 potentially created another terrorist.

Showdown Imminent: FBI Sets Up Checkpoints Around Oregon Refuge

Submitted by Tyler Durden on 01/27/2016 - 11:55 “I don't know what to tell you but if somebody saying 'peaceful resolution' comes in and points guns at me...”

from The Daily Sheeple:

The standoff between law enforcement and the Ammon Bundy led militia, took a turn for the worst on Tuesday at 4:25 PM. The FBI and the Oregon State Police attempted to arrest several members of the militia during a traffic stop. At the time the group was en route to a community meeting at a senior center, 70 miles north of Burns, Oregon.

Shots were fired during the traffic stop, which led to the death of Arizona rancher LaVoy Finicum, and the hospitalization of Ryan Bundy with non-life-threatening injuries. A total of 8 people have since been arrested, including Ammon Bundy and his brother.

Read More

The standoff between law enforcement and the Ammon Bundy led militia, took a turn for the worst on Tuesday at 4:25 PM. The FBI and the Oregon State Police attempted to arrest several members of the militia during a traffic stop. At the time the group was en route to a community meeting at a senior center, 70 miles north of Burns, Oregon.

Shots were fired during the traffic stop, which led to the death of Arizona rancher LaVoy Finicum, and the hospitalization of Ryan Bundy with non-life-threatening injuries. A total of 8 people have since been arrested, including Ammon Bundy and his brother.

Read More

Stocks Storm Green, Oil Surges After Russia Says Will Discuss "Possible Production Cuts With OPEC"

Submitted by Tyler Durden on 01/27/2016 - 11:47 For those wondering what matters in this market, here is the answer: moments ago US stocks stormed into the green, following oil which after some confusion after today's massive DOE inventory build, has surged back over $32, one just one piece of news: moments ago both Reuters and Bloomberg cited the CEO of Russia's Transneft, who said that Russia and OPEC will discuss possible output cuts: BREAKING: Russia's Transneft says Russia and OPEC will discuss possible output cuts -TASS; RUSSIA TO DISCUSS OIL OUTPUT LEVELS W/ OPEC: TOKAREV

The Illusion Of Safety: Index Funds Are Not Low-Risk

Submitted by Tyler Durden on 01/27/2016 - 11:30 The financial service industry's Prime Directive is to exploit humanity's core drives of Greed and Fear. Financial service companies promise high returns (fulfilling our greed) that are low-risk, i.e. "safe" (placating our fear of losing our nest-egg). But the safety of many supposedly low-risk investments is illusory.

Goldman Trading Desk's 4 Reasons For A Tactical Bounce Ahead Of Renewed Shorting Between 1925-1950

Submitted by Tyler Durden on 01/27/2016 - 11:08 "S&P e-minis have now rallied 5% off the YTD low print (1804.25). As we see it, the argument for a continued short-term, tactical bounce in S&P is: 1) month-end pension rebalancing (GS expects $14bn of equities to buy as of 22Jan );2) majority of corporates exiting their buyback blackout window next week;3)perceived reduction of CTA driven equity supply an 4) oversold conditions (Kostin’s Sentiment Indicator was at 3 last Friday). I still think the market is going to look to re-initiate shorts between 1925-1950."

US Crude Inventories Are The Highest Since The Great Depression

Submitted by Tyler Durden on 01/27/2016 - 10:46 In case you were under the impression that oil was stabilizing, we thought this chart might help clarify just how "different" it is this time in the energy complex...

Oil Oscillates As Inventories Surge Most In 9 Months And Demand Plunges

Submitted by Tyler Durden on 01/27/2016 - 10:38 Following last night's huge 11.4mm barrel inventory build forecast from API (the largest since 1996), DOE reports an 8.4mm build (against analysts estimates of +4mm). It seems the blowback from the huge gasoline and inventory builds is flowing back upstream to crude but there is some good news as Cushing saw a 771k draw after 11 weeks of builds (and production dropped very modestly). On the demand side, it's just as ugly with Gasoline demand -2.5% YoY and Distillate demand down a stunning 14.8% YoY. Having tested the API ledge in prices twice this morning, WTI is hovering between $30.50 and $31.

Manufacturing Depression Enters Uncharted Territory: Caterpillar Retail Sales Have Never Been Worse

Submitted by Tyler Durden on 01/27/2016 - 10:14 Moments ago Caterpillar reported its latest monthly retail sales statistics and the numbers have never been worse.

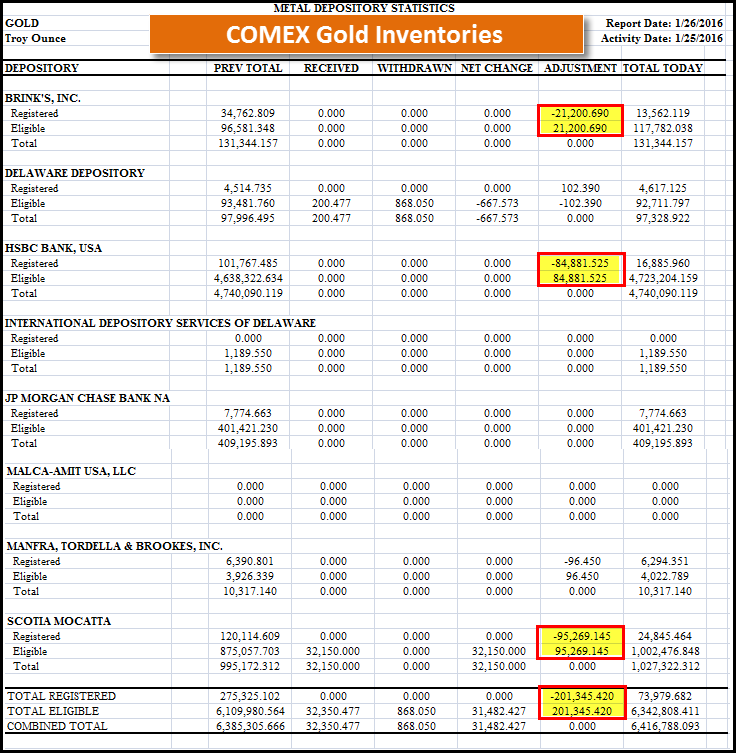

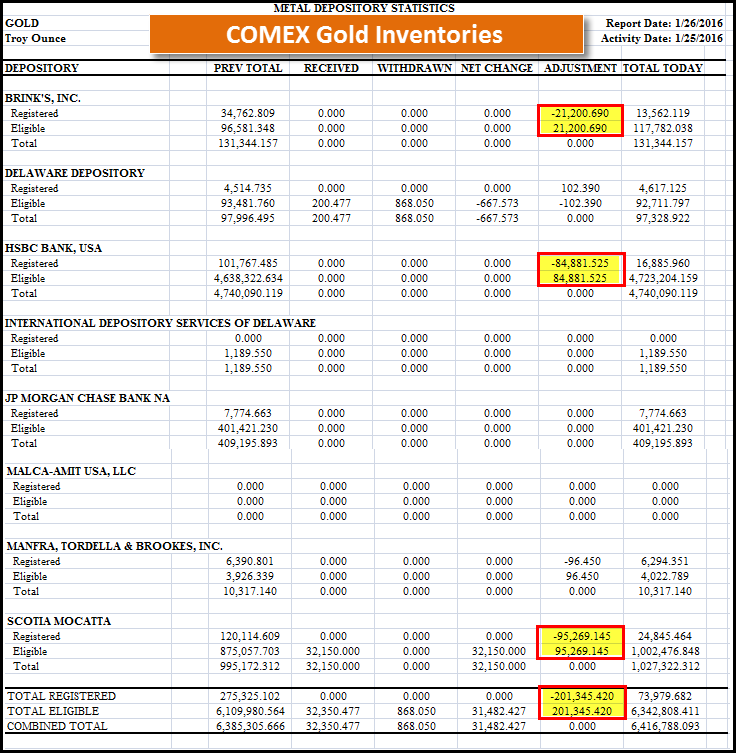

by Steve St. Angelo, SRS Rocco Report:

Looks like something big is about to take place on the Comex as Registered Gold inventories declined a whopping 73% in one day. This is a very suprising update as Comex Gold inventories haven’t experienced much movement over the past few months.

Well, this all changed today as a stunning 201,345 oz (73%) of the total 275,325 oz of Registered Gold was transferred to the Eligible Category today:

Read More

Looks like something big is about to take place on the Comex as Registered Gold inventories declined a whopping 73% in one day. This is a very suprising update as Comex Gold inventories haven’t experienced much movement over the past few months.

Well, this all changed today as a stunning 201,345 oz (73%) of the total 275,325 oz of Registered Gold was transferred to the Eligible Category today:

Read More

by John Whitehead, The Burning Platform:

“Never has our future been more unpredictable, never have we depended so much on political forces that cannot be trusted to follow the rules of common sense and self-interest—forces that look like sheer insanity, if judged by the standards of other centuries.” ― Hannah Arendt, The Origins of Totalitarianism

Adding yet another layer of farce to an already comical spectacle, the 2016 presidential election has been given its own reality show. Presented by Showtime, The Circus: Inside the Greatest Political Show on Earthwill follow the various presidential candidates from now until Election Day.

Read More

“Never has our future been more unpredictable, never have we depended so much on political forces that cannot be trusted to follow the rules of common sense and self-interest—forces that look like sheer insanity, if judged by the standards of other centuries.” ― Hannah Arendt, The Origins of Totalitarianism

Adding yet another layer of farce to an already comical spectacle, the 2016 presidential election has been given its own reality show. Presented by Showtime, The Circus: Inside the Greatest Political Show on Earthwill follow the various presidential candidates from now until Election Day.

Read More

by Dave Hodges, The Common Sense Show:

Things are much worse that they appear. We are entering a time of unparalleled peril. Economic collapse is here and is underway in many parts of the economy.

The architect of the Arab Spring has made a stunning proclamation. In an exclusive interview with a German magazine, George Soros recently stated that the European Union will soon be no more. The EU is imploding before our very eyes. This proclamation comes on the heels of Germany’s answer to President Obama, Angela Merkel, correctly predicted that the EU would be crushed under the weight of Middle Eastern immigration. Merkel, at the same time, has declared de facto martial law in Germany.

Read More

Things are much worse that they appear. We are entering a time of unparalleled peril. Economic collapse is here and is underway in many parts of the economy.

The architect of the Arab Spring has made a stunning proclamation. In an exclusive interview with a German magazine, George Soros recently stated that the European Union will soon be no more. The EU is imploding before our very eyes. This proclamation comes on the heels of Germany’s answer to President Obama, Angela Merkel, correctly predicted that the EU would be crushed under the weight of Middle Eastern immigration. Merkel, at the same time, has declared de facto martial law in Germany.

Read More

from The Sleuth Journal:

A detailed investigation of the Boston marathon bombing that reveals that it, too, was another drill with Hollywood special effects, where none of the purported victims died and the two brothers, Tamerlan and Dzhokhar Tsarnaev, were framed for a crime they did not commit. The Boston police were calling out on bullhorns, “This is a drill! This is a drill!” The Boston Globe was tweeting that a demonstration bomb would be set off for the benefit of bomb squad activities.

There was noise and smoke but no blood, which only began to show up later. The smoke was produce by a smoke machine. It was done using amputee actors. The backpacks that blew up were black nylon, but neither brother was wearing a black nylon backpack.

Read More

A detailed investigation of the Boston marathon bombing that reveals that it, too, was another drill with Hollywood special effects, where none of the purported victims died and the two brothers, Tamerlan and Dzhokhar Tsarnaev, were framed for a crime they did not commit. The Boston police were calling out on bullhorns, “This is a drill! This is a drill!” The Boston Globe was tweeting that a demonstration bomb would be set off for the benefit of bomb squad activities.

There was noise and smoke but no blood, which only began to show up later. The smoke was produce by a smoke machine. It was done using amputee actors. The backpacks that blew up were black nylon, but neither brother was wearing a black nylon backpack.

Read More

/

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment