Submitted by Tyler Durden on 01/18/2016 - 13:06

Art Cashin: This Is "What You Get Before You Slip Into A Crisis"

Submitted by Tyler Durden on 01/18/2016 - 10:55 "The Fed has painted itself into a corner... [the current situation's severity] is very similar to what you get before you slip into a crisis....The bumpy ride is probably not over yet... stay on guard."

Downgrading Glencore to junk would trigger THE MOTHER OF ALL COLLATERAL CALLS on TRILLIONS in commodity derivative bets.

by Bix Weir, Road to Roota:

It’s happening faster now.

It’s happening faster now.

For the last 6 months I’ve been SCREAMING about the significance of the downgrade of Glencore’s credit rating and how it will rip a huge hole in the manipulation operations of physical oil, gold and ESPECIALLY SILVER!

Just do a search on my website for “Glencore” and you will find out how significant Marc Rich’s metal rigging operation is…

Read More

by Bix Weir, Road to Roota:

It’s happening faster now.

It’s happening faster now.For the last 6 months I’ve been SCREAMING about the significance of the downgrade of Glencore’s credit rating and how it will rip a huge hole in the manipulation operations of physical oil, gold and ESPECIALLY SILVER!

Just do a search on my website for “Glencore” and you will find out how significant Marc Rich’s metal rigging operation is…

Read More

These Are The Cash Flow Negative Energy Companies In The U.S. With A Total Debt Of $325 Billion

Submitted by Tyler Durden on 01/18/2016 - 16:32- There are roughly 80 U.S. companies that had $100mm in LTM revenue and that had negative EBITDA less CapEx.

- The combined market cap of these 80 companies is just shy of half a trillion dollars.

- The combined Total Enterprise Value of these 80 companies is $775 billion.

- The combined debt of these 80 companies is $325 billion.

And The Winner Of The Democrat Debate Is...

Submitted by Tyler Durden on 01/18/2016 - 16:00

Tenge Crashes As Low Oil Prices Take Dramatic Toll On Kazakh Economy

Submitted by Tyler Durden on 01/18/2016 - 15:30 With the lifting of Iran sanctions, the Tenge has crashed5% to record lows at 377/USD (extending the currencies collapse since the USD-peg was scrapped in August). Furthermore, oil production is entering a new year of decline this year in Kazakhstan - a dismal omen for a country so heavily reliant on energy exports.

With Bulls At A Decade Low An Oversold Bounce Is Imminent, But JPM Repeats To Sell Any Rips

Submitted by Tyler Durden on 01/18/2016 - 14:57 One week ago, and just days before Kolanovic again warned - correctly - that a market slump is imminent, JPM's "other" Croat, Mislav Matejka said to "Use Any Bounces As Selling Opportunities." Any bulls who listened to him are in less pain than those who didn't. So what does Matejka think now that all indices are in correction territory and a majority of stocks are in a bear market? The short answer: an oversold bounce is imminent. But what happens next? Well, as JPM itself admits - fade any initial rebound, and STFD.

Worse Than 1860?

Submitted by Tyler Durden on 01/18/2016 - 14:30 The last time the major political parties disintegrated, back in the 1850s, the nation had to go through a bloody convulsion to reconstitute itself. The festering issue of slavery so dominated politics that nothing else is remembered about the dynamics of the period. Today, the festering issue is corruption and racketeering, but none of the candidates uses those precise terms to describe what has happened to us. Nobody knows where the shit show of 2016 is leading. The uncertainty around it is helping to sink what remains of the old economy, and one can easily discern a very dangerous set of feedbacks creeping into place.

China's Top Stock Regulator Gives Up On "Immature" Market, Hands In Resgination

Submitted by Tyler Durden on 01/18/2016 - 14:00 Xiao Gang, chairman of China's securities regulator, has offered to resign amid ongoing turmoil in the country's equity markets - turmoil which he says stems from "inexperienced investors, an imperfect trading system and inappropriate supervision mechanisms."

UK Parliament Debates Banning Donald Trump From Britain - Live Feed

Submitted by Tyler Durden on 01/18/2016 - 13:37 "If the United Kingdom is to continue applying the 'unacceptable behavior' criteria to those who wish to enter its borders, it must be fairly applied to the rich as well as poor, and the weak as well as powerful."

Italian Banks Collapse, Short Sales Banned As Loan Loss Fears Mount

Submitted by Tyler Durden on 01/18/2016 - 12:40 Italian bank stocks are crashing (with BMPS down 40% year-to-date) as Reuters reports that investors are growing increasingly nervous about how the sector will cope with lower interest rates and a 200 billion euro ($218 billion) pile of loans that are unlikely to be repaid. The broad banking sector is down 4% with stocks suspended, and in light of this bloodbath, Italian regulators have decided in their wisdom, to ban short-selling of some bank stocks (which has driven hedgers into the CDS market, spking BMPS credit risk).RANsquawk Week Ahead Video: Focus remains on China while ECB and BoC rate decisions loom

Submitted by RANSquawk Video on 01/18/2016 - 12:36

Germany & The Incompatibility Of Cultures

Submitted by Tyler Durden on 01/18/2016 - 12:05 "The attackers might be politically motivated, but their fear can not be ignored. German society is changing, with right-wing Christian as well as Islamic groups getting stronger by the day. It is an alarming situation for the majority of secular people in Germany and Europe. What happened on New Year's Eve could change the way Germans live and treat foreigners forever."

Francois Hollande Admits Socialist Policies Failed, Declares "Economic State Of Emergency"

Submitted by Tyler Durden on 01/18/2016 - 11:30 Remember when showing 'progress' in Europe was as simple as pointing to your high stock market or low bond yields to "prove" everything is awesome. Well for Francois Hollande, the days of hiding behing manipulated data are over and the open kimono reveals a nation whose stability is wracked by record unemployment. In a desperate-for-re-election speech today, socialist leader Hollande admitted his policies needed reform and that France is an economic "state of emergency."

Glencore's "Investment Grade" Bonds Just Took Out September Crash Lows: Downgrade To Junk Imminent

Submitted by Tyler Durden on 01/18/2016 - 10:36 Glencore's 2021 bonds just hit a 5 year low, taking out the September crash levels, and trading at about 64 cents on the dollar. Following the recent junking of Noble Group which has sent its stock price to 12 year lows and hitning that a bankruptcy is now virtually inevitable, we expect Glencore to be junked any minute, with the ensuing cascade of margin and collateral calls testing just how "systematically unimportant" the world's largest commodity traders really are.

What Crisis Is The Gold/Oil Ratio Predicting This Time?

Submitted by Tyler Durden on 01/18/2016 - 10:30 What happens next? “Peddling fiction” …this is what Mr. Obama said of anyone who believes and says the U.S. has a weak economy.

How ironic he should say this when he did, the State of the Union

address? I mean the timing could not have been any better! In a week

where oil prices hit a 14 year low, freight rates at over 30 year lows,

equity, credit and FOREX markets all over the world crashing and

derivatives blowing up. How do we know derivatives are blowing up?

Simply because the Dallas Fed has given their banks permission not to

mark energy debt to market. In essence, the Fed has instructed their banks TO PEDDLE FICTION!

“Peddling fiction” …this is what Mr. Obama said of anyone who believes and says the U.S. has a weak economy.

How ironic he should say this when he did, the State of the Union

address? I mean the timing could not have been any better! In a week

where oil prices hit a 14 year low, freight rates at over 30 year lows,

equity, credit and FOREX markets all over the world crashing and

derivatives blowing up. How do we know derivatives are blowing up?

Simply because the Dallas Fed has given their banks permission not to

mark energy debt to market. In essence, the Fed has instructed their banks TO PEDDLE FICTION!Read More

Liberta–

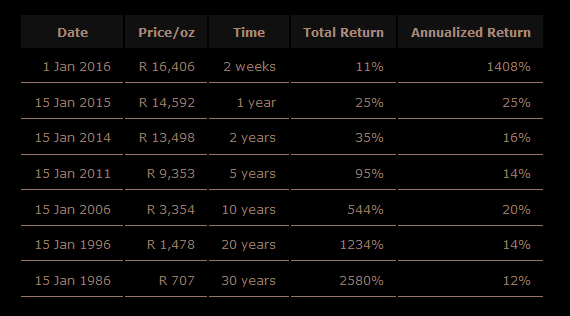

The price of Gold breached R 18,000/oz for the first time ever on the 11th of January 2016 in South Africa (R = Rand). It is currently standing on R 18,239/oz.

Let’s take a look at the price of Gold in South African Rands (ZAR) over the last 30 years, and the returns a saver would have earned had they bought and held Gold over various time periods since then:

Read More

from Wolf Street:

The only exceptions were in the early 1950s

Painful – that’s how you can describe the slew of recent US economic data. And today’s data dump was even worse.

On a regional level, there was the Empire State Manufacturing Survey. The Current Activity Index plunged to the lowest level since March 2009. The last time it had squeaked into positive territory was in July 2015. The Expectations Index plummeted by an unprecedented 29 points, also to the worst level since March 2009.

Read More

The only exceptions were in the early 1950s

Painful – that’s how you can describe the slew of recent US economic data. And today’s data dump was even worse.

On a regional level, there was the Empire State Manufacturing Survey. The Current Activity Index plunged to the lowest level since March 2009. The last time it had squeaked into positive territory was in July 2015. The Expectations Index plummeted by an unprecedented 29 points, also to the worst level since March 2009.

Read More

by Michael Snyder, The Economic Collapse Blog:

It looks like it is going to be another chaotic week for global financial markets. On Sunday, news that Iran plans to dramatically ramp up oil production sent stocks plunging all across the Middle East. Stocks in Kuwait were down 3.1 percent, stocks in Saudi Arabia plummeted 5.4 percent, and stocks in Qatar experienced a mammoth 7 percent decline. And of course all of this comes in the context of a much larger long-term decline for Middle Eastern stocks. At this point, Saudi Arabian stocks are down more than 50 percent from their 2014 highs. Needless to say, a lot of very wealthy people in Saudi Arabia are getting very nervous. Could you imagine waking up someday and realizing that more than half of your fortune had been wiped out? Things aren’t that bad in the U.S. quite yet, but it looks like another rough week could be ahead. The Dow, the S&P 500 and the Nasdaq are all down at least 12 percent from their 52-week highs, and the Russell 2000 is already in bear market territory. Hopefully this week will not be as bad as last week, but events are starting to move very rapidly now. Read More

It looks like it is going to be another chaotic week for global financial markets. On Sunday, news that Iran plans to dramatically ramp up oil production sent stocks plunging all across the Middle East. Stocks in Kuwait were down 3.1 percent, stocks in Saudi Arabia plummeted 5.4 percent, and stocks in Qatar experienced a mammoth 7 percent decline. And of course all of this comes in the context of a much larger long-term decline for Middle Eastern stocks. At this point, Saudi Arabian stocks are down more than 50 percent from their 2014 highs. Needless to say, a lot of very wealthy people in Saudi Arabia are getting very nervous. Could you imagine waking up someday and realizing that more than half of your fortune had been wiped out? Things aren’t that bad in the U.S. quite yet, but it looks like another rough week could be ahead. The Dow, the S&P 500 and the Nasdaq are all down at least 12 percent from their 52-week highs, and the Russell 2000 is already in bear market territory. Hopefully this week will not be as bad as last week, but events are starting to move very rapidly now. Read More

/

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment