Submitted by Tyler Durden on 01/29/2016 - 14:56

Submitted by Tyler Durden on 01/29/2016 - 14:56

Just as we warned, and she mush have known, it appears at least 22 of the emails found on Hillary Clinton's private email server have been declared "top secret" by The FBI (but will not be releasing the contents) according to AP. The revelation comes just three days before the Iowa presidential nominating caucuses in which Clinton is a candidate. As we previously noted, the implications are tough for The DoJ - if they indict they crush their own candidate's chances of the Presidency, if they do not - someone will leak the details and the FBI will revolt...

The Keynesian Monetary Quacks Are Lost - Grasping For The Bogeyman Of 1937

Submitted by Tyler Durden on 01/29/2016 - 15:20 What’s a Keynesian monetary quack to do when the economy and markets fail to remain “on message” within a few weeks of grandiose declarations that this time, printing truckloads of money has somehow “worked”, in defiance of centuries of experience, and in blatant violation of sound theory? In the weeks since the largely meaningless December rate hike, numerous armchair central planners, many of whom seem to be pining for even more monetary insanity than the actual planners, have begun to berate the Fed for inadvertently summoning that great bugaboo of modern-day money cranks, the “ghost of 1937”.

Negative Rates In The U.S. Are Next: Here's Why In One Chart

Submitted by Tyler Durden on 01/29/2016 - 15:01 Here is the one chart which in our opinion virtually assures that the Fed will follow in the footsteps of Sweden, Denmark, Europe, Switzerland and now Japan.If The "Recovery" Is Real, Why Are Radical Politicians So Damn Popular?, BofA Asks

Submitted by Tyler Durden on 01/29/2016 - 14:40 Bank of America has a simple question: Why, if we are truly seven years into a “recovery”, are populist parties and politicians dominating the political landscape?

$7 Crude? Deutsche Bank Downgrades Oil 'Lower For A Lot Longer'

Submitted by Tyler Durden on 01/29/2016 - 14:20 Oil prices around USD 30/bbl mean that an increasingly significant volume of future oil projects no longer make sense. Although Deutsche Bank does not expect US crude inventories to reach capacity, rising US inventories and high US crude imports may heighten downside pressures to push prices closer to marginal cash costs of USD 7-17/bbl for US tight oil, with few plausible scenarios for a strong price recovery in the short term,

Citi: "Be Prepared For All Sorts Of Insanity Today; Everyone I Talk To Wants To Fade This Move"

Submitted by Tyler Durden on 01/29/2016 - 13:59 "I am pretty mixed on what this BoJ move means but my main observation is that people are incredibly skeptical. Almost everyone I talk to wants to fade this move; it’s just a matter of how long to wait before going the other way... Be prepared for all sorts of insanity today as the market tries to wrap its collective head around month end flows + what this BOJ action means." - Citi

"Reset" Or "Recession"?

Submitted by Tyler Durden on 01/29/2016 - 13:40 Following years of QE-inspired excess returns, investors in 2016 suddenly find themselves embroiled in a broad and brutal bear market. The 10-year rolling return loss from commodities (-5.1%) is currently the worst since 1938, and equal-weighted US stock index down 25% from recent highs. However, in BofAML's view, the pertinent question for investors is whether the current bear market represents a healthy "reset" of both profit expectations and equity and credit valuations, or more ominously, the onset of a broader economic malaise that will require a major policy intervention in coming months to reverse.

Norway's Kroner Conundrum Deepens As Central Bank Buys Record Amount Of Currency

Submitted by Tyler Durden on 01/29/2016 - 13:20 This is the paradox for Norway: the country needs to buy NOK in order to fund stimulus and support the economy. But by doing so, the Norges Bank is putting upward pressure on the currency at a time when it really needs to depreciate. In other words, what Norway must do to pay for stimulus (buy kroner) is indirectly hurting the economy by keeping the NOK from depreciating and functioning as a counter cyclical buffer.

$5.5 Trillion In Government Bonds Now Have Negative Yields, Covering 23% Of Global GDP

Submitted by Tyler Durden on 01/29/2016 - 13:08 "Never before have so many central banks explored sub-zero territory at the same time."

WTI Crude Slides Despite Significant Rig Count Decline

Submitted by Tyler Durden on 01/29/2016 - 13:08 The US total rig count dropped 18 to 619 in the last week with a drop of 12 in oil rigs (to 498) as the ongoing lagged drop of crude drives rig counts every lower. Perhaps oddly, given the rig count decline, WTI is tumbling as a 12 rig drop is clearly not enough...

Russian-OPEC Production Cut Remains A Long Shot

Submitted by Tyler Durden on 01/29/2016 - 12:25 Coordination on production cuts between OPEC and Russia has always been a long shot, and probably still remains an unlikely development. The big difference this time around, though, is Russia’s change in tone. Saudi Arabia had hinted at its willingness last year to undertake a 5 percent production cut if Russia did the same, but up until now Moscow never really took the idea seriously. However, don’t get too excited.

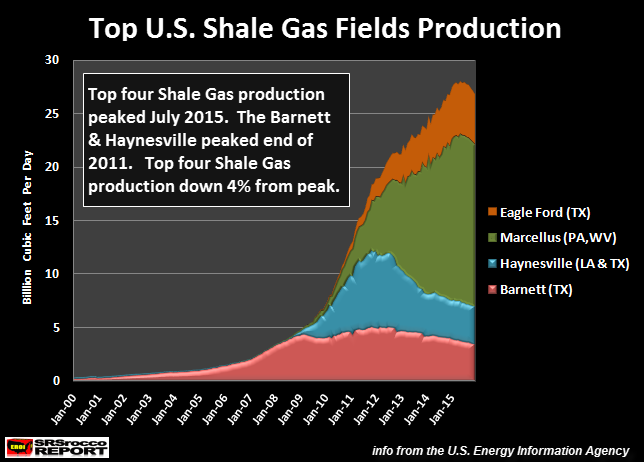

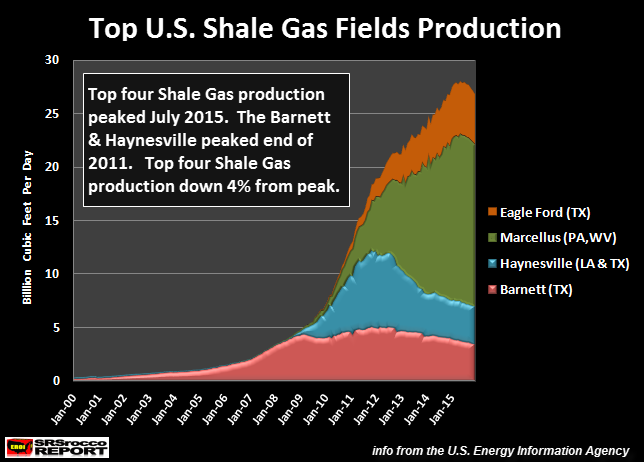

by Steve St. Angelo, SRS Rocco Report:

The U.S. Empire is in serious trouble as the collapse of its domestic shale gas production has begun. This is just another nail in a series of nails that have been driven into the U.S. Empire coffin. Unfortunately, most investors don’t pay attention to what is taking place in the U.S. Energy Industry. Without energy, the U.S. economy would grind to a halt. All the trillions of Dollars in financial assets mean nothing without oil, natural gas or coal. Energy drives the economy and finance steers it. As I stated several times before, the financial industry is driving us over the cliff.

The Great U.S. Shale Gas Boom Is Likely Over For Good

Very few Americans noticed that the top four shale gas fields combined production peaked back in July 2015. Total shale gas production from the Barnett, Eagle Ford, Haynesville and Marcellus peaked at 27.9 billion cubic feet per day (Bcf/d) in July and fell to 26.7 Bcf/d by December 2015:

Read More

The U.S. Empire is in serious trouble as the collapse of its domestic shale gas production has begun. This is just another nail in a series of nails that have been driven into the U.S. Empire coffin. Unfortunately, most investors don’t pay attention to what is taking place in the U.S. Energy Industry. Without energy, the U.S. economy would grind to a halt. All the trillions of Dollars in financial assets mean nothing without oil, natural gas or coal. Energy drives the economy and finance steers it. As I stated several times before, the financial industry is driving us over the cliff.

The Great U.S. Shale Gas Boom Is Likely Over For Good

Very few Americans noticed that the top four shale gas fields combined production peaked back in July 2015. Total shale gas production from the Barnett, Eagle Ford, Haynesville and Marcellus peaked at 27.9 billion cubic feet per day (Bcf/d) in July and fell to 26.7 Bcf/d by December 2015:

Read More

by Alasdair Macleod, Gold Money:

The month of January has been a wake-up call for complacent equity investors.

From the peaks of last year stock indices in the major markets have fallen 10-20%, give or take. On their own, these falls could be read as healthy corrections in an ongoing bull market, and doubtless there are investors hanging on to their investments in the hope that this is true.

The conditions that have led to the fall in equities are tied up in the realization that global economic activity has contracted sharply.

Read More

The month of January has been a wake-up call for complacent equity investors.

From the peaks of last year stock indices in the major markets have fallen 10-20%, give or take. On their own, these falls could be read as healthy corrections in an ongoing bull market, and doubtless there are investors hanging on to their investments in the hope that this is true.

The conditions that have led to the fall in equities are tied up in the realization that global economic activity has contracted sharply.

Read More

by Andrew P. Napolitano, The Burning Platform:

I honestly wish Judge Napolitano was right but I don’t know what America he thinks we live in and what FBI he sees. He cites violations and reasons why she should be indicted regardless of her “intent” because she was sworn in. The problem is he is using silly logic; Obama swore to uphold the Constitution and he hasn’t been indicted for his violations. Where are the indictments for Lois Lerner, AG Holder, Blankenfein, et al…?

I have the utmost respect for the Judge but are my eyes lying, am I stupid or do I simply lack the foolhardy optimism that the Judge is espousing?

Even with the constant “revelations” about Hillary’s transgressions and the cult of personality that is The Donald, I think there is a 50/50 shot she is the next Emperor of ‘Murka. Hopefully I am wrong and will be dining on the below dish…

Read More

I honestly wish Judge Napolitano was right but I don’t know what America he thinks we live in and what FBI he sees. He cites violations and reasons why she should be indicted regardless of her “intent” because she was sworn in. The problem is he is using silly logic; Obama swore to uphold the Constitution and he hasn’t been indicted for his violations. Where are the indictments for Lois Lerner, AG Holder, Blankenfein, et al…?

I have the utmost respect for the Judge but are my eyes lying, am I stupid or do I simply lack the foolhardy optimism that the Judge is espousing?

Even with the constant “revelations” about Hillary’s transgressions and the cult of personality that is The Donald, I think there is a 50/50 shot she is the next Emperor of ‘Murka. Hopefully I am wrong and will be dining on the below dish…

Read More

from The Daily Sheeple:

Hysteria sells and…

It’s hysteria time again. Let me run it down for you.

This is the word: The dreaded Zika virus! Watch out! It’s carried by mosquitos! It can cause birth defects—babies are born with very small heads and impaired brains!

Here are a few scare headlines that were running on Drudge as of 1/26:

“Brazil sends 200,000 soldiers to stop spread of Zika.”

Read More

Hysteria sells and…

It’s hysteria time again. Let me run it down for you.

This is the word: The dreaded Zika virus! Watch out! It’s carried by mosquitos! It can cause birth defects—babies are born with very small heads and impaired brains!

Here are a few scare headlines that were running on Drudge as of 1/26:

“Brazil sends 200,000 soldiers to stop spread of Zika.”

Read More

by Daniel McAdams, The News Doctors:

Robert Ford was US Ambassador to Syria when the revolt against Syrian president Assad was launched. He not only was a chief architect of regime change in Syria, but actively worked with rebels to aid their overthrow of the Syrian government.

Ford assured us that those taking up arms to overthrow the Syrian government were simply moderates and democrats seeking to change Syria’s autocratic system. Anyone pointing out the obviously Islamist extremist nature of the rebellion and the foreign funding and backing for the jihadists was written off as an Assad apologist or worse.

Read More

Robert Ford was US Ambassador to Syria when the revolt against Syrian president Assad was launched. He not only was a chief architect of regime change in Syria, but actively worked with rebels to aid their overthrow of the Syrian government.

Ford assured us that those taking up arms to overthrow the Syrian government were simply moderates and democrats seeking to change Syria’s autocratic system. Anyone pointing out the obviously Islamist extremist nature of the rebellion and the foreign funding and backing for the jihadists was written off as an Assad apologist or worse.

Read More

/

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment