Submitted by Tyler Durden on 01/15/2016 - 08:29

Here It Comes: New York Fed President Says "If Economy Weakens Further, Would Consider Negative Rates"

Submitted by Tyler Durden on 01/15/2016 - 09:43 Remember when the Fed's dots - less than a month ago - suggested there would be 4 rate hikes in 2016? Ah, the memories. Well, you can not only forget that (now that the market is estimating the next rate hike will come in October if ever), but it appears that the Fed will follow Kocherlakota's advice after all and not only cut rates (the possibility of a January rate cut now is 10%), but will pass go, and collect negative rates:- DUDLEY: IF ECONOMY WEAKENED, WOULD CONSIDER NEGATIVE RATES

Gold & Silver Spike To Crucial Technical Levels

Submitted by Tyler Durden on 01/15/2016 - 09:37 It has been a roller-coaster week for precious metals as the 50-day moving average remains key support for Gold and resistance for silver. This morning's chaos appears to have reignited the bid for safety once again...

Recession Confirmed? Industrial Production Crashes Most In 8 Years

Submitted by Tyler Durden on 01/15/2016 - 09:23 There comes a time when you just have to admit you were wrong... You were wrong. Industrial Production plunged 1.8% year-over-year - the fastest pace of collapse since May 2008 and a level that has never not produced a recession.

WalMart To Fire 16,000 As It Closes 269 Stores Globally

Submitted by Tyler Durden on 01/15/2016 - 09:12 Behold: the effect of an across the board minimum wage hike...

Retail Sales End Weakest Year Since 2009 As Control Group Tumbles

Submitted by Tyler Durden on 01/15/2016 - 08:43 American consumers curbed their spending in December, a lackluster finish to a year marked by slowing consumption despite a steadily improving labor market and months of cheap gasoline. But the biggest disappointment was the Retail Sales ex auto which was down 0.1% in December, below the 0.2% expected. Putting this miss in context, 66 out of 69 economists thought December retail sales ex autos would've been higher than actual. So much for those "gas savings" prompting Americans to spend, spend, spend...

Empire Fed Crashes At Fastest Pace "Since Lehman"

Submitted by Tyler Durden on 01/15/2016 - 08:42 Against hope-strewnm expectations of a bounce from -4.6 to -4, Empire Fed printed a disastrous -19.37 - the largest miss on record. New orders collapsed, shipments plunged, and employees and workweek continue to contract. Forward-looking employment expectations also plunged. The last time Empire Fed crashed to these levels was the immediate aftermath of the Lehman bankuptcy and the global financial crisis and the peak of the recession in 2001... but we are sure this is just transitory.

China Bank Lending Slows Dramatically, Confirming Concerns About Soaring Bad Loans

Submitted by Tyler Durden on 01/15/2016 - 08:21 In the latest Chinese domestic financing report released by the PBOC last night, there were two divergent themes: on one hand bank loans grew far less than the expected 700Bn yuan; on the other hand total social financing soared to 1.82 trillion yuan, smashing forecasts of a 1.15 trillion increase, and the highest since June. As noted last night, this may have been the catalyst that spooked the markets, because as Bloomberg confirms, "the data shows companies are turning to alternative sources for credit given banks’ reluctance to lend."

Bullard Bounce Erased As Crude Crashes Back Below $30

Submitted by Tyler Durden on 01/15/2016 - 08:13 Dow futures are now over 400 points off the Bullard Bounce highs as it appears The Fed's ability to convince the world it will save it once again is fading. Thanks to deflation-inspiring credit growth in China (yes, you read that right) and Kuroda's implied "we are done for now" comments, growth scares have spread across every asset class with crude and copper clubbed, bonds bid, and stocks tumbling...

World's Largest Miner Books Massive $7.2 Billion Writedown On US Shale "Assets"

Submitted by Tyler Durden on 01/15/2016 - 07:53 “Yeah well, considering you’ve got a book value of $20 billion and you haven’t reported an operating EBIT gain in the last two years, I think they’ve been lucky to get away with such a modest amount. I think they’ll be having the same discussions with their auditors in July."

Global Risk Off: China Reenters Bear Market, Oil Tumbles Under $30; Global Stocks, US Futures Gutted

Submitted by Tyler Durden on 01/15/2016 - 06:57 Yesterday, when looking at the market's "Bullard 2.0" moment, which in many ways was a carbon copy of the market's response to Bullard's "QE4" comments from October 17, 2014 until just a few minutes before the market close when suddenly selling pressure appeared, we said that either the S&P would soar - as it did in 2014 - hitting all time highs just a few months later, or the "Fed is now shooting VWAP blanks." Judging by what has happened since, in what may come as a very unpleasant surprise to the "the market is very oversold" bulls, it appears to have been the latter.

Dow Dumps 250Pts, Nikkei Plunges 500Pts After China Credit Concerns, Kuroda Comment

Submitted by Tyler Durden on 01/15/2016 - 01:07 It appears the world is ganging up on The Fed as following China's recent clear and present threat should the USD strengthen, BoJ's Kuroda warned that further QQE might threaten the bank's finances - implicitly demanding moar from Yellen because he knows he's out of bullets. Add to that the surge in China credit which merely extends the life of already zombified firms, thus spreading more deflationary stress to the world and stocks from China (SHCOMP -3%), Japan (NKY -500) to US (Dow -280 points from Bullard Bounce highs) are tumbling.

by Michael Snyder, The Economic Collapse Blog:

For the first time ever, the Baltic Dry Index has fallen under 400. As I write this article, it is sitting at 394. To be honest, I never even imagined that it could go this low. Back in early August, the Baltic Dry Index was sitting at 1,222, and since then it has been on a steady decline. Of course the Baltic Dry Index crashed hard just before the great stock market crash of 2008 too, but at this point it is already lower than it was during that entire crisis. This is just more evidence that global trade is grinding to a halt and that 2016 is going to be a “cataclysmic year” for the global economy.

If you are not familiar with the Baltic Dry Index, here is a helpful definition from Wikipedia…

Read More…

For the first time ever, the Baltic Dry Index has fallen under 400. As I write this article, it is sitting at 394. To be honest, I never even imagined that it could go this low. Back in early August, the Baltic Dry Index was sitting at 1,222, and since then it has been on a steady decline. Of course the Baltic Dry Index crashed hard just before the great stock market crash of 2008 too, but at this point it is already lower than it was during that entire crisis. This is just more evidence that global trade is grinding to a halt and that 2016 is going to be a “cataclysmic year” for the global economy.

If you are not familiar with the Baltic Dry Index, here is a helpful definition from Wikipedia…

Read More…

A 31-minute documentary, titled “The World in 2016” was recently passed along to this writer by the intrepid news team at SGTreport.com. The producer of this clip was the notorious hub of mainstream indoctrination, The Economist. More than enough to pique the curiosity of any self-respecting journalist.

A 31-minute documentary, titled “The World in 2016” was recently passed along to this writer by the intrepid news team at SGTreport.com. The producer of this clip was the notorious hub of mainstream indoctrination, The Economist. More than enough to pique the curiosity of any self-respecting journalist.This article will argue that The Economist has succeeded in presenting “the world in 2016”, but not in the manner which that propaganda outlet intended. The World in 2016 succeeds in showing us what the world is really like not through its content, but rather by what is omitted, and how this exercise in brainwashing was constructed.

This article will do, in a few, short pages what The Economist refused to do within the scope of a 30+ minute presentation: present a cohesive overview of our “world” – the world of the Oligarchs. Indeed, that was one of the largest/most important messages in the entire clip, buried near the end.

Read More…

by Michael Rivero, WhatReallyHappened:

No person except a natural born Citizen, or a Citizen of the United States, at the time of the Adoption of this Constitution, shall be eligible to the Office of President; neither shall any Person be eligible to that Office who shall not have attained to the Age of thirty-five Years, and been fourteen Years a Resident within the United States.” — Constitution, Article 2, Section 1, clause 5

Ted Cruz is ineligible to run for President of the United States. He was born in Canada, of parents who were Canadian citizens at the time of his birth. Cruz’s mother claims to have been born in Delaware. The State of Delaware claims not to have any records of her. (The authenticity of the Birth Certificate provided by the Cruz campaign is now in dispute.) But even if genuine, it makes Cruz a US citizen, but not “Natural Born.”

Read More…

No person except a natural born Citizen, or a Citizen of the United States, at the time of the Adoption of this Constitution, shall be eligible to the Office of President; neither shall any Person be eligible to that Office who shall not have attained to the Age of thirty-five Years, and been fourteen Years a Resident within the United States.” — Constitution, Article 2, Section 1, clause 5

Ted Cruz is ineligible to run for President of the United States. He was born in Canada, of parents who were Canadian citizens at the time of his birth. Cruz’s mother claims to have been born in Delaware. The State of Delaware claims not to have any records of her. (The authenticity of the Birth Certificate provided by the Cruz campaign is now in dispute.) But even if genuine, it makes Cruz a US citizen, but not “Natural Born.”

Read More…

from Zen Gardner:

This week, Harney County Fire Marshall Chris Briels resigned after discovering undercover FBI agents posing as militia members near the Malheur National Wildlife Refuge, which has been the site of a standoff for weeks now. According to Briels, he found FBI agents who were impersonating militia members lurking around the town’s armory. When he inquired about the undercover operation with county Judge Steve Grasty he was told to back off.

Just before this discovery was made, there were reports of people who looked like militia harassing locals, which is uncharacteristic of the protesters who initially assembled at the refuge. It turns out that these militia members suspected of harassing locals were actually undercover FBI agents.

Read More

This week, Harney County Fire Marshall Chris Briels resigned after discovering undercover FBI agents posing as militia members near the Malheur National Wildlife Refuge, which has been the site of a standoff for weeks now. According to Briels, he found FBI agents who were impersonating militia members lurking around the town’s armory. When he inquired about the undercover operation with county Judge Steve Grasty he was told to back off.

Just before this discovery was made, there were reports of people who looked like militia harassing locals, which is uncharacteristic of the protesters who initially assembled at the refuge. It turns out that these militia members suspected of harassing locals were actually undercover FBI agents.

Read More

from Wolf Street:

Bank of Mexico Governor Augustin Carstens doesn’t always mince his words in public. In April last year, he went where no senior central banker had ever dared go, by openly questioning the sustainability – even the wisdom – of the loose monetary policies favored by certain central banks. But things have changed a great deal since then, especially for emerging economies like Mexico.

“Last year was a terrible year, probably worse than 2009,” the head of Mexico’s central bank told a conference of central bankers in Paris on Tuesday. It was the first year since 1988 that emerging markets saw net capital outflows, according to the Institute of International Finance, a Washington-based association of global banks and finance houses.

Read More

Bank of Mexico Governor Augustin Carstens doesn’t always mince his words in public. In April last year, he went where no senior central banker had ever dared go, by openly questioning the sustainability – even the wisdom – of the loose monetary policies favored by certain central banks. But things have changed a great deal since then, especially for emerging economies like Mexico.

“Last year was a terrible year, probably worse than 2009,” the head of Mexico’s central bank told a conference of central bankers in Paris on Tuesday. It was the first year since 1988 that emerging markets saw net capital outflows, according to the Institute of International Finance, a Washington-based association of global banks and finance houses.

Read More

from X22Report:

by Vladmir Platov, NEO:

Over the past month, many US media

publications have been sounding the alarm: death of the middle class of

America and the end of the “American Dream”.

According to the independent American portal – “End Of American Dream”,

one of the main reasons for this is that the rate of the cost of living

increase in the United States is higher than the growth of wages. In

particular, the cost increase for food, rent, health insurance, and

therefore the number of the “working poor” in the country is increasing

exponentially every year. However, the current US authorities do not

care about the decline of the middle class, which once supported the

country.

Read More

by Mac Slavo, SHTFPlan:

Disaster

at home has once again brought out the National Guard to provide

emergency relief to hundreds of thousands of people facing toxic tap

water. Americans are in peril, and government agencies are scrambling to

patch up the failure to provide decent conditions to its residents.

Disaster

at home has once again brought out the National Guard to provide

emergency relief to hundreds of thousands of people facing toxic tap

water. Americans are in peril, and government agencies are scrambling to

patch up the failure to provide decent conditions to its residents.

On the upside, the government is taking the contamination of water in and around Flint, Michigan seriously.

Read More

Disaster

at home has once again brought out the National Guard to provide

emergency relief to hundreds of thousands of people facing toxic tap

water. Americans are in peril, and government agencies are scrambling to

patch up the failure to provide decent conditions to its residents.

Disaster

at home has once again brought out the National Guard to provide

emergency relief to hundreds of thousands of people facing toxic tap

water. Americans are in peril, and government agencies are scrambling to

patch up the failure to provide decent conditions to its residents.On the upside, the government is taking the contamination of water in and around Flint, Michigan seriously.

Read More

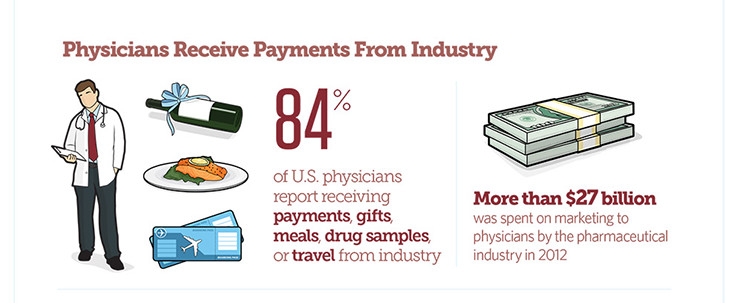

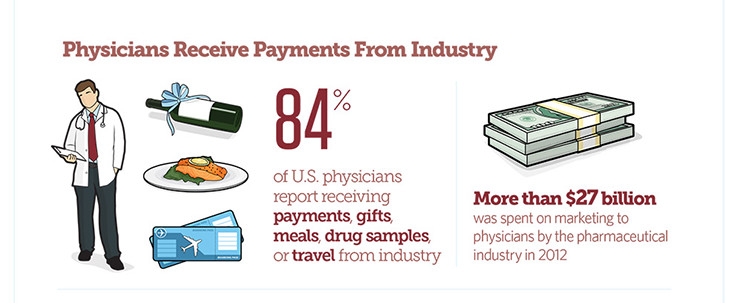

Is YOUR doctor being paid?

by Christina Sarich, Natural Society:

“Drug companies are like high school boyfriends. They’re more

interested in getting inside you than in being effective once they are

there.” This is just one of the hilariously-accurate remarks made by

John Oliver, who was a hopeful replacement for Jon Stewart on the Daily

Show.

“Drug companies are like high school boyfriends. They’re more

interested in getting inside you than in being effective once they are

there.” This is just one of the hilariously-accurate remarks made by

John Oliver, who was a hopeful replacement for Jon Stewart on the Daily

Show.

Oliver made his comments on HBOs Last Week Tonight, in a 17-minute long, scathingly honest diatribe about how the pharmaceutical industry bribes doctors to sell us drugs we don’t really need. [1]

Read More

by Christina Sarich, Natural Society:

“Drug companies are like high school boyfriends. They’re more

interested in getting inside you than in being effective once they are

there.” This is just one of the hilariously-accurate remarks made by

John Oliver, who was a hopeful replacement for Jon Stewart on the Daily

Show.

“Drug companies are like high school boyfriends. They’re more

interested in getting inside you than in being effective once they are

there.” This is just one of the hilariously-accurate remarks made by

John Oliver, who was a hopeful replacement for Jon Stewart on the Daily

Show.Oliver made his comments on HBOs Last Week Tonight, in a 17-minute long, scathingly honest diatribe about how the pharmaceutical industry bribes doctors to sell us drugs we don’t really need. [1]

Read More

by J. D. Heyes, Natural News:

2015 will go down in history for a number of things, including being the year that college campuses went crazy with Marxism.

2015 will go down in history for a number of things, including being the year that college campuses went crazy with Marxism.

For instance, the concept of “microaggressions” – that is, uses of once-normal speech that the PC Police within school administrations and student body leadership have deemed harmful to select demographic and ethnic groups in some way – was introduced with much fanfare by liberals, who seek to use such declarations to actually chill speech they don’t agree with.

Most Americans, on and off college campuses, have judged such antics to be both nonsensical and constitutionally precarious. Nevertheless, the term – and the concept behind microaggressions – is now firmly entrenched in the verbiage of the Left, and thus will continue to be employed into the future as a way of avoiding debate over social and political issues, and imposing a singular point of view.

Read More

2015 will go down in history for a number of things, including being the year that college campuses went crazy with Marxism.

2015 will go down in history for a number of things, including being the year that college campuses went crazy with Marxism.For instance, the concept of “microaggressions” – that is, uses of once-normal speech that the PC Police within school administrations and student body leadership have deemed harmful to select demographic and ethnic groups in some way – was introduced with much fanfare by liberals, who seek to use such declarations to actually chill speech they don’t agree with.

Most Americans, on and off college campuses, have judged such antics to be both nonsensical and constitutionally precarious. Nevertheless, the term – and the concept behind microaggressions – is now firmly entrenched in the verbiage of the Left, and thus will continue to be employed into the future as a way of avoiding debate over social and political issues, and imposing a singular point of view.

Read More

/

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment