Submitted by Tyler Durden on 01/11/2016 - 09:12

Submitted by Tyler Durden on 01/11/2016 - 09:12

The following three charts make last week’s market turmoil easier to understand. Falling trade means lower corporate profits, which, if history is still a valid guide, means less valuable equities. So it could be that the markets are simply figuring this out and revaluing assets accordingly.

Those

who have been reading my work for any length of time know I have been

adamant we would someday face a “global margin call”. I believe this

call was issued last week! No matter how you look at the world,

whether financially, geopolitically, macro, micro or whatever …what

underlies everything in our world today is “credit”. Credit is used to

build, wage war, to produce and deliver, to consume or to trade,

EVERYTHING runs on credit. As a side note, in order for credit to be

extended, the borrower must have some sort of “collateral”. This

collateral can be physical, financial, or simply “faith”, meaning a good

credit rating or at least trust by the lender.

Those

who have been reading my work for any length of time know I have been

adamant we would someday face a “global margin call”. I believe this

call was issued last week! No matter how you look at the world,

whether financially, geopolitically, macro, micro or whatever …what

underlies everything in our world today is “credit”. Credit is used to

build, wage war, to produce and deliver, to consume or to trade,

EVERYTHING runs on credit. As a side note, in order for credit to be

extended, the borrower must have some sort of “collateral”. This

collateral can be physical, financial, or simply “faith”, meaning a good

credit rating or at least trust by the lender.Read More…

from Hang the Bankers:

Newly disclosed emails show that Libya’s plan to create a gold-backed currency to compete with the euro and dollar was a motive for NATO’s intervention.

Newly disclosed emails show that Libya’s plan to create a gold-backed currency to compete with the euro and dollar was a motive for NATO’s intervention.

The New Year’s Eve release of over 3,000 new Hillary Clinton emails from the State Department has CNN abuzz over

gossipy text messages, the “who gets to ride with Hillary” selection

process set up by her staff, and how a “cute” Hillary photo fared on

Facebook.

Read More…

The Question Every Trader Want Answered: Are Stocks Short-Term Oversold Or Long-Term Overbought

Submitted by Tyler Durden on 01/11/2016 - 08:44 "Shorter-term traders will feel that many moves have gone a long way very quickly and hence appear ripe for a brief rebound. The catalyst is that, in the height of a market panic, prices can become dislocated from fundamental valuations, as margin stops get triggered and “weaker” positions get cleaned out. The counter-argument is that distortions caused by the extraordinary monetary policies of global central banks mean markets might have been disconnected from traditional fundamentals for several years."

Futures, USDJPY, Crude Spike As PBOC Tries To Calm Panic

Submitted by Tyler Durden on 01/11/2016 - 08:28 Yuantervention overnight steadied the Chinese currency and despite a plunge in Asian equities, stabilized US equities thanks to an incvessant bid for USDJPY. However, this morning has seen PBOC's Ma crawl out from under the desk to attempt to calm investor panic with two-faced comments about the nation's new FX regime. Noting that PBOC will focus on stability of Yuan vs their new CFETS basket, Ma then back-handedly said two-way volatility was expected to increase (in a clear nod to stopping carry traders piling on). Of course, the crude oil algos loved it and surged, USDJPY jumped, but for now US equities and bond are unimpressed.

Gartman: "In Our Retirement Funds We Shifted To Modestly Net Short, We Have Had No Choice"

Submitted by Tyler Durden on 01/11/2016 - 08:22 " In a bear market, one can have only one of three positions also: aggressively short; modestly short or neutral. In our retirement funds here at TGL we began last week and indeed we began the year modestly long but by the weeks’ end we had shifted to modestly net short. We have had no choice. The market’s voice was loud and very clear." - Dennis Gartman

Man Who Stormed Paris Police Station With Meat Cleaver Tied To German Sex Attacks

Submitted by Tyler Durden on 01/11/2016 - 08:02 The man who ran into a police station in northern Paris wearing a fake explosive vest, waving a meat cleaver, and shouting "Allahu Akbar" on the Charlie Hebdo anniversary once lived in a German refugee center and may have been involved in the New Year's Eve "sex mob" attacks. Walid Salihi used at least seven aliases while roaming around Europe committing what police say was a string of petty crimes including, but probably not limited to: "touching women's behinds at the disco," strangling a roommate, attacking a "passerby," and beating up a homeless man.

Goldman Closes "Top Trade For 2016" With 5.4% Loss Just 11 Days Into 2016, As US Banks Tumble

Submitted by Tyler Durden on 01/11/2016 - 07:47 Just 11 days into 2016, Goldman has been stopped out of one of its 6 "top trades for 2016" following a 5.4% loss on its "long large-cap US banks" trade as these "relatively well-priced, trading just above book value" assets turned out to be relatively unwell priced...

Chinese Stocks Plunge, Asia At 4 Year Lows But PBOC Currency Intervention Pushes US Futures Higher

Submitted by Tyler Durden on 01/11/2016 - 06:57 Initially both European stocks and US equity futures were grateful that China has picked at least one asset class to prop up overnight, and rose in an extremely illiquid market with European shares gaining for first time in 4 days, as S&P futures rise even as the MSCI Asia Pacific ex-Japan index just fell to the lowest level in more than 4 years. However, as of moments ago the Stoxx 600 had faded all its earlier gains and was trading near the flatline, as an algo takes out all stops on the top and bottom once more, and looks set to move on to US futures shortly.

China Contagion Spills Over To Hong Kong Banks As HIBOR Explodes To Record High, Stocks Tumble

Submitted by Tyler Durden on 01/10/2016 - 23:38 Chinese stocks are trading at the lows of the day after Overnight HIBOR rates (Hong Kong's interbank borrowing rate) exploded a stunning 939bps to a record high 13.4%. It is clear that banks are utterly desperate for liquidity and/or are extremely concerned about one another's counterparty risk. This has dragged HSCEI down 5% (to its lowest since Oct 2011).

"Neoconned"

Submitted by Tyler Durden on 01/10/2016 - 22:00 Unique among the countries on earth, the US government insists that its laws and dictates take precedence over the sovereignty of nations. Neoconned Washington claims that as History chose America to exercise its hegemony over the world, no other law is relevant. Only Washington’s will counts.

Here Comes The Yuantervention

Submitted by Tyler Durden on 01/10/2016 - 21:24 Somebody had to do something...

Noble Group's "Margin Call" Part II: The Enron Moment

Submitted by Tyler Durden on 01/10/2016 - 21:17 Our balance sheet - the strongest in recent history - represents a significant advantage as we continue to identify high value growth opportunities across the products and geographies we operate in. Maintaining out investment grade rating with the international rating agencies is a vital part of this strategy.- Noble Group 2014 Annual Report, p. 27

by Michael Snyder, The Economic Collapse Blog:

The stock market is in far worse shape than we are being told. As you will see in this article, the average U.S. stock is already down more than 20 percent from the peak of the market. But of course the major indexes are not down nearly that much. As the week begins, the S&P 500 is down 9.8 percent from its 2015 peak, the Dow Jones Industrial Average is down 10.7 percent from its 2015 peak, and the Nasdaq is down 11.0 percent from its 2015 peak. So if you only look at those indexes, you would think that we are only about halfway to bear market territory. Unfortunately, a few high flying stocks such as Facebook, Amazon, Netflix and Google have been masking a much deeper decline for the rest of the market. When the market closed on Friday, 229 of the stocks on the S&P 500 were down at least 20 percent from their 52 week highs, and when you look at indexes that are even broader things are even worse.

Read More…

The stock market is in far worse shape than we are being told. As you will see in this article, the average U.S. stock is already down more than 20 percent from the peak of the market. But of course the major indexes are not down nearly that much. As the week begins, the S&P 500 is down 9.8 percent from its 2015 peak, the Dow Jones Industrial Average is down 10.7 percent from its 2015 peak, and the Nasdaq is down 11.0 percent from its 2015 peak. So if you only look at those indexes, you would think that we are only about halfway to bear market territory. Unfortunately, a few high flying stocks such as Facebook, Amazon, Netflix and Google have been masking a much deeper decline for the rest of the market. When the market closed on Friday, 229 of the stocks on the S&P 500 were down at least 20 percent from their 52 week highs, and when you look at indexes that are even broader things are even worse.

Read More…

from Wolf Street:

At least, they didn’t blame China.

Thursday afterhours, the Container Store, former LBO queen and IPO hero with 77 stores around the country, reported third quarter “earnings” – in quotes because those “earnings” were a loss.

Consolidated net sales for the quarter ending November 30 rose 3.3% to $197.2 million. But cost of sales rose 5.3%. CEO Kip Tindell blamed their new “$75 free-shipping service.” It’s “driving sales” and is “absolutely a good thing, but of course it’s a headwind to gross margin,” he said. That’s how Amazon leaves its mark.

Read More

At least, they didn’t blame China.

Thursday afterhours, the Container Store, former LBO queen and IPO hero with 77 stores around the country, reported third quarter “earnings” – in quotes because those “earnings” were a loss.

Consolidated net sales for the quarter ending November 30 rose 3.3% to $197.2 million. But cost of sales rose 5.3%. CEO Kip Tindell blamed their new “$75 free-shipping service.” It’s “driving sales” and is “absolutely a good thing, but of course it’s a headwind to gross margin,” he said. That’s how Amazon leaves its mark.

Read More

filed under "white trash"

by R. Emmett Tyrrell, Jr., Spectator:

The Federal Bureau of Investigation will recommend that the Justice

Department bring criminal charges against Hillary Clinton and various of

her aides, and soon. The evidence consists of materials that the Bureau

has gathered in the course of its months-long investigation of Mrs.

Clinton’s personal server. The recommendations will come very soon.

The Federal Bureau of Investigation will recommend that the Justice

Department bring criminal charges against Hillary Clinton and various of

her aides, and soon. The evidence consists of materials that the Bureau

has gathered in the course of its months-long investigation of Mrs.

Clinton’s personal server. The recommendations will come very soon.

The charges will consist of some of the following:

1. Improper disclosure or retention of classified information.

2. Destruction of government records.

3. Lying to federal agents.

4. Lying under oath.

5. Obstruction of justice.

Read More

The Federal Bureau of Investigation will recommend that the Justice

Department bring criminal charges against Hillary Clinton and various of

her aides, and soon. The evidence consists of materials that the Bureau

has gathered in the course of its months-long investigation of Mrs.

Clinton’s personal server. The recommendations will come very soon.

The Federal Bureau of Investigation will recommend that the Justice

Department bring criminal charges against Hillary Clinton and various of

her aides, and soon. The evidence consists of materials that the Bureau

has gathered in the course of its months-long investigation of Mrs.

Clinton’s personal server. The recommendations will come very soon.The charges will consist of some of the following:

1. Improper disclosure or retention of classified information.

2. Destruction of government records.

3. Lying to federal agents.

4. Lying under oath.

5. Obstruction of justice.

Read More

by J. D. Heyes, Natural News:

One timeless question that social researchers have often asked

regarding welfare assistance is whether such assistance is generational.

In other words, if parents are dependent on welfare and other

taxpayer-supported assistance programs, will their children become

dependent as well?

One timeless question that social researchers have often asked

regarding welfare assistance is whether such assistance is generational.

In other words, if parents are dependent on welfare and other

taxpayer-supported assistance programs, will their children become

dependent as well?

According to a new study on the subject, researchers were not able to establish a firm “causal” relationship, but there is much empirical (observed) evidence and data to suggest that there could be a generational link.

As noted in a press release from the University of Chicago citing the study, a number of past studies have “shown that a child’s welfare use is correlated with a parent’s welfare receipt.” But, researchers have been unable to show a causal relation due to a number of unobservable factors across multiple generations, like recipients’ adverse environments or poor health that was inherited. Also, a dearth of large datasets that firmly link family members together across generations has prevented a more comprehensive analysis.

Read More

One timeless question that social researchers have often asked

regarding welfare assistance is whether such assistance is generational.

In other words, if parents are dependent on welfare and other

taxpayer-supported assistance programs, will their children become

dependent as well?

One timeless question that social researchers have often asked

regarding welfare assistance is whether such assistance is generational.

In other words, if parents are dependent on welfare and other

taxpayer-supported assistance programs, will their children become

dependent as well?According to a new study on the subject, researchers were not able to establish a firm “causal” relationship, but there is much empirical (observed) evidence and data to suggest that there could be a generational link.

As noted in a press release from the University of Chicago citing the study, a number of past studies have “shown that a child’s welfare use is correlated with a parent’s welfare receipt.” But, researchers have been unable to show a causal relation due to a number of unobservable factors across multiple generations, like recipients’ adverse environments or poor health that was inherited. Also, a dearth of large datasets that firmly link family members together across generations has prevented a more comprehensive analysis.

Read More

by Sophie McAdam, Global Research:

Whistleblowers, Ecocide, top secret trade deals, and shady ties between

the Islamic State and the West’s closest allies…here are a few hot

topics the mainstream media barely covered in 2015.

Whistleblowers, Ecocide, top secret trade deals, and shady ties between

the Islamic State and the West’s closest allies…here are a few hot

topics the mainstream media barely covered in 2015.

1. Any Tragedy That’s Not Western-Centric

The outpouring of fury, despair and grief by the corporate press over the November 13 Paris attackshighlighted the bias of the mainstream media towards western victims of terrorism. There were two suicide bombings in Lebanon the day before the events in Paris, killing 37 and wounding 180, but they were not mentioned much in the sensationalist coverage of France’s tragedy, nor were they mentioned in the minutes’ silences and vigils conducted across the Western world in the aftermath.

Read More…

Whistleblowers, Ecocide, top secret trade deals, and shady ties between

the Islamic State and the West’s closest allies…here are a few hot

topics the mainstream media barely covered in 2015.

Whistleblowers, Ecocide, top secret trade deals, and shady ties between

the Islamic State and the West’s closest allies…here are a few hot

topics the mainstream media barely covered in 2015.1. Any Tragedy That’s Not Western-Centric

The outpouring of fury, despair and grief by the corporate press over the November 13 Paris attackshighlighted the bias of the mainstream media towards western victims of terrorism. There were two suicide bombings in Lebanon the day before the events in Paris, killing 37 and wounding 180, but they were not mentioned much in the sensationalist coverage of France’s tragedy, nor were they mentioned in the minutes’ silences and vigils conducted across the Western world in the aftermath.

Read More…

by Bradford Richardson, The Hill:

Supply-side economist Arthur Laffer is predicting Republicans will win

the White House in a landslide this year, regardless of the nominee.

Supply-side economist Arthur Laffer is predicting Republicans will win

the White House in a landslide this year, regardless of the nominee.

“I would be surprised if the Republicans don’t take 45, 46, 47 states out of the 50,” Laffer told host John Catsimatidis on “The Cats Roundtable” on New York’s AM-970 on Sunday.

“I mean, I think we’re going to landslide this election.”

Read More

“I would be surprised if the Republicans don’t take 45, 46, 47 states out of the 50,” Laffer told host John Catsimatidis on “The Cats Roundtable” on New York’s AM-970 on Sunday.

“I mean, I think we’re going to landslide this election.”

Read More

Oregon Standoff: Isolated Event Or Sign Of Things To Come?

Submitted by Tyler Durden on 01/10/2016 - 20:50 One thing my years in Washington taught me is that most politicians are followers, not leaders. Therefore we should not waste time and resources trying to educate politicians. Politicians will not support individual liberty and limited government unless and until they are forced to do so by the people.

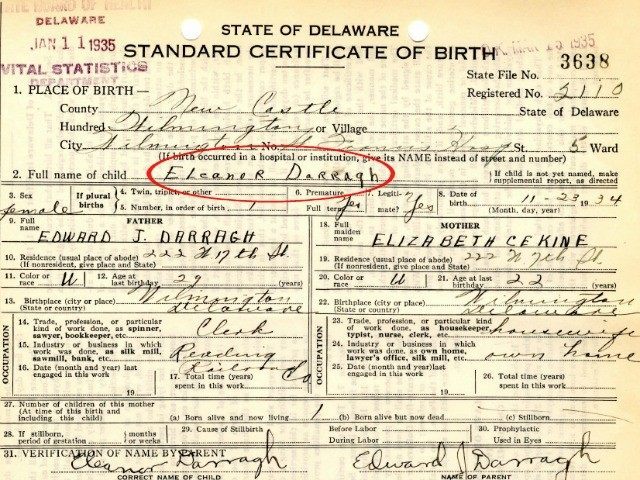

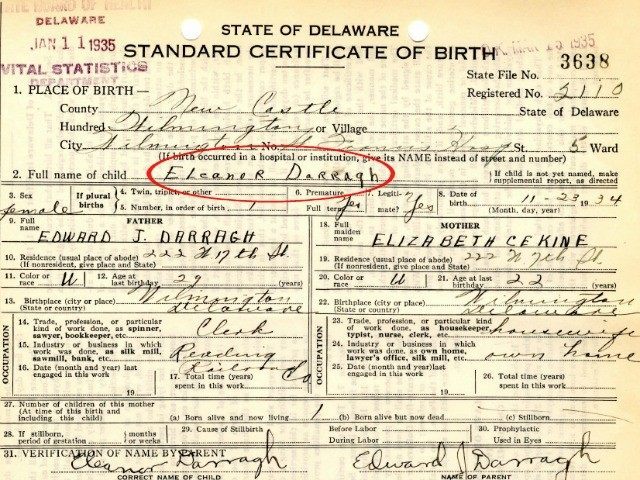

Ted Cruz produces birth certificate after both parents found on Canadian voter list

from Live Leak:

1. This is NOT a Long Form Birth Certificate.

1. This is NOT a Long Form Birth Certificate.

2. This is NOT a State “Birth Certificate”, it clearly states “Standard Certificate of Birth”

3. This lacks the Official Seal of the State.

4. This lacks the required copy certification.

5. Most experts are already saying this is Photoshopped Fraud.

Ted Cruz was NOT born in the United States, and was NOT born abroad on an US Military Reservation. He was born in Canada, and can never be the Republican Nominee for President.

Read More…

from Live Leak:

1. This is NOT a Long Form Birth Certificate.

1. This is NOT a Long Form Birth Certificate.2. This is NOT a State “Birth Certificate”, it clearly states “Standard Certificate of Birth”

3. This lacks the Official Seal of the State.

4. This lacks the required copy certification.

5. Most experts are already saying this is Photoshopped Fraud.

Ted Cruz was NOT born in the United States, and was NOT born abroad on an US Military Reservation. He was born in Canada, and can never be the Republican Nominee for President.

Read More…

/

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment