Submitted by Tyler Durden on 01/15/2016 - 21:30

Submitted by Tyler Durden on 01/15/2016 - 21:30

The Great War ended on the 11th hour of November 11th, 1918, when the signed armistice came into effect. Though this peace would signal the end of the war, it would also help lead to a series of further destruction: this time the destruction of wealth and savings. The world’s most famous hyperinflation event, which took place in Germany from 1921 and 1924, was a financial calamity that led millions of people to have their savings erased.

by Dave Kranzler, Investment Research Dynamics:

It’s days like today that will keep the muppets invested as we keep going down. – Jim Quinn of The Burning Platform in reference to Thursday’s stock market moon-shot

Well, I was wrong. I was predicting that the Census Bureau would engineer a miraculously positive retail sales report for December. As it turns out, the CB is admitting to a .1% drop in retail sales for the month. The question begs, then, just how bad were the real numbers? They also are purporting that November retail sales rose .4% instead of the .2% originally reported.

Read More

It’s days like today that will keep the muppets invested as we keep going down. – Jim Quinn of The Burning Platform in reference to Thursday’s stock market moon-shot

Well, I was wrong. I was predicting that the Census Bureau would engineer a miraculously positive retail sales report for December. As it turns out, the CB is admitting to a .1% drop in retail sales for the month. The question begs, then, just how bad were the real numbers? They also are purporting that November retail sales rose .4% instead of the .2% originally reported.

Read More

The Financial Crimes Enforcement Network (FinCEN) has fined a Los

Angeles precious metals company $200,000 for not having the proper USA Patriot Act anti–money laundering programs in place.

The Financial Crimes Enforcement Network (FinCEN) has fined a Los

Angeles precious metals company $200,000 for not having the proper USA Patriot Act anti–money laundering programs in place.The hefty fine is FinCEN’s first action against a dealer in precious metals, precious stones, or jewels, a statement said.

“In my opinion the reason this press release was issued is to put the industry on notice,” says Cecilia Gardner, president and CEO of the Jewelers Vigilance Committee (JVC), which follows Patriot Act–related issues. “Law enforcement takes seriously these requirements, and now they are going to now start issuing fines.”

Read Mo

This Is The Cartoon Germany Hands Out To Sexually Frustrated Refugees

Submitted by Tyler Durden on 01/15/2016 - 19:10

Black Friday

Submitted by Tyler Durden on 01/15/2016 - 16:04

The Ascendance of Sociopaths in U.S. Governance

Submitted by Tyler Durden on 01/15/2016 - 22:00 The U.S. government, in particular, has been overrun by the wrong kind of person. It’s a trend that’s been in motion for many years but has now reached a point of no return. In other words, a type of moral rot has become so prevalent that it’s institutional in nature. There is not going to be, therefore, any serious change in the direction in which the U.S. is headed until a genuine crisis topples the existing order. Until then, the trend will accelerate.

Oil, War, & Drastic Global Change

Submitted by Tyler Durden on 01/15/2016 - 21:00 The consequences of all this will be felt all over the world, and for a long time to come. All of our economic systems run on oil, so many jobs are related to it, so many ‘fields’ in the economy, and no, things won’t get easier when oil is at $20 or $10, it’ll be a disaster of biblical proportions, like a swarm of locusts that leaves precious little behind. Squeeze oil and you squeeze the entire economic system. That’s what all the ‘low oil prices are great for the economy’ analysts missed (many still do). Entire nations will undergo drastic changes in leadership and prosperity.

Why Donald Trump Is Praying For A Market Crash

Submitted by Tyler Durden on 01/15/2016 - 20:23 Since 1928, there have been 22 Presidential Elections. In 14 of them, the S&P 500 climbed during the three months preceding election day. The incumbent President or party won in 12 of those 14 instances. However, in 7 of the 8 elections where the S&P 500 fell over that three month period, the incumbent party lost. Statistically, the market has an 86.4% success rate in forecasting the election!"We Live In A Time Of Piecemeal-Planning & Incremental-Interventionism"

Submitted by Tyler Durden on 01/15/2016 - 20:00

GM/Ford Credit Risk Surges To 2 Year Highs As Fitch Raises Auto Sector Concerns

Submitted by Tyler Durden on 01/15/2016 - 18:30 With the feds probing Deutsche Bank's exaggerating Auto ABS demand, car dealerships suing automakers for being forced to channel-stuff, direct evidence of massive channel-stuffing with near-record inventories-to-sales, and sales now beginning to tumble after last month's weak credit growth, it is perhaps no wonder that Fitch has raised the warning flag about automotive vehicle and parts makers...

German Town Bans Refugees From Pools

Submitted by Tyler Durden on 01/15/2016 - 18:00 "There have been complaints of sexual harassment and chatting-up going on in this swimming pool ... by groups of young men, and this has prompted some women to leave (the premises). This led to my decision that adult males from our asylum shelters may not enter the swimming pool until further notice."Atlanta Fed Explains Why It Waited Until The Market Close To Reveal The Lowest Q4 GDP Estimate Yet

Submitted by Tyler Durden on 01/15/2016 - 17:28

Weekend Reading: Breaking Markets - Season II

Submitted by Tyler Durden on 01/15/2016 - 16:35 “Fed Chair Janet Yellen will be forced to either acknowledge labor market tightening as reason to continue with the four-hike schedule for 2016 or risk her credibility, belittle job market stability and sound a warning about the risks of lower oil prices and cheap gasoline (sacrilege to regular Americans) by slowing the hiking pace after a single 0.25 percent increase last month. If she gets it wrong, things could get ugly fast."

Atlanta Fed Waits Until The Close To Reveal 0.6% Q4 GDP Estimate

Submitted by Tyler Durden on 01/15/2016 - 16:15 The GDPNow model forecast for real GDP growth (seasonally adjusted annual rate) in the fourth quarter of 2015 is 0.6 percent on January 15, down from 0.8 percent on January 8. The forecast for fourth quarter real consumer spending growth fell from 2.0 percent to 1.7 percent after this morning's retail sales report from the U.S. Census Bureau and the industrial production release from the Federal Reserve.

Americans This Weekend (In 1 Chart)

Submitted by Tyler Durden on 01/15/2016 - 15:55 (3)01k?

The US Consumer Is Drowning His Sorrows At The Bar

Submitted by Tyler Durden on 01/15/2016 - 15:40 "Today we feast, for tomorrow we die..."

Here's A Chart You Won't See On CNBC

Submitted by Tyler Durden on 01/15/2016 - 15:36 What goes up, comes down considerably faster...

Bill Gross' Advice To Traders As Stocks Crash

Submitted by Tyler Durden on 01/15/2016 - 15:29 "Stay out of the bathroom."

Chipotle To Close All Stores Next Month For Meeting On How Not To Poison People

Submitted by Tyler Durden on 01/15/2016 - 15:15 America's favorite "fast casual" darling is set to hold a kind of ad hoc “try not to poison anyone” meeting on February 8, when all stores will close “for a few hours” so that management can “discuss some of the changes [its] making to enhance food safety, to talk about the restaurant’s role in all of that and to answer questions from employees.”

The Game Of Chicken Between The Fed & The PBOC Escalates

Submitted by Tyler Durden on 01/15/2016 - 15:05 There’s more than a whiff of 2008 in the air. The sources of systemic financial sector risk are different this time (they always are), but China and the global industrial/commodity complex are even larger tectonic plates than the US housing market, and their shifts are no less destructive. There’s also more than a whiff of 1938 in the air, as we have a Fed that is apparently hell-bent on raising rates even as a Category 5 deflationary hurricane heads our way, even as the yield curve continues to flatten.

Revisiting The "No Brainer" XIV-SPY Convergence Trade

Submitted by Tyler Durden on 01/15/2016 - 14:50 At the start of September last year, as stocks began to ramp aggressively off the Black Monday crash lows, we unveiled a rather discomforting "decoupling" that suggested strongly "don't believe the hype." Four months later, and able to remain strongly convicted of the trade, the inverse VIX ETF (XIV) and the S&P 500 ETF (SPY) have recoupled back at the lows from August 24th. We await the recoupling of equity exuberance to credit curmudgeon-ness...

What If There Is No "Fed Put" - Paul Brodsky Thinks Yellen Will Not Bailout Markets This Time

Submitted by Tyler Durden on 01/15/2016 - 14:30 Earlier today, Art Cashin summarized most (very desperate) traders' thoughts when he said that as a result of today's market crash, "the Fed will try anything" to prop up the wealth effect it had so carefully engineered with seven years of central planning in the aftermath of the financial crisis. Yet one person who is far less sanguine abou the latest in a long series of central bank bailouts of the stock market is Macro-Allocation's Paul Brodsky, who believes that instead of the Fed Put, the time of the Fed Call has come.It's Official: Trump Is Now The Bookies' Favorite

Submitted by Tyler Durden on 01/15/2016 - 14:01

from Bibliotecapleyade:

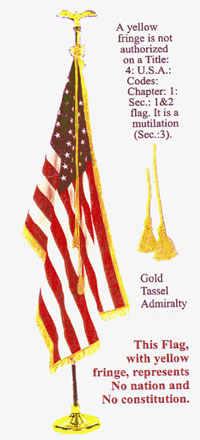

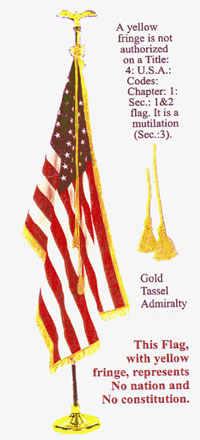

This Awareness* wishes briefly to remind entities that the admiralty court is the court in which the gold braid goes around the American Flag which indicates the court is under martial law,

or under admiralty law, from the martial law since Abraham Lincoln’s

executive order putting it under martial law, and in order to continue

staying under martial law, the country has to have some kind of war

every two years. Thus, the war on drugs, the war on poverty, et cetera,

and the admiralty laws are used in the courts in such a way that they

are not necessarily tied to the Constitution, although the Constitution

is said to be the law of the land.

This Awareness* wishes briefly to remind entities that the admiralty court is the court in which the gold braid goes around the American Flag which indicates the court is under martial law,

or under admiralty law, from the martial law since Abraham Lincoln’s

executive order putting it under martial law, and in order to continue

staying under martial law, the country has to have some kind of war

every two years. Thus, the war on drugs, the war on poverty, et cetera,

and the admiralty laws are used in the courts in such a way that they

are not necessarily tied to the Constitution, although the Constitution

is said to be the law of the land.

Did you know the U.S. has a Military and a Civil Flag?

This Awareness indicates that when Lincoln was assassinated, no one thought to put an end to this declaration of martial law because of the Civil War and because the martial law has continued up to this time, from the time of the Civil War, the nation can be directed by what is called Admiralty Law or martial law by simply a command of the President or the authority of the land or his agents.

Read More…

This Awareness* wishes briefly to remind entities that the admiralty court is the court in which the gold braid goes around the American Flag which indicates the court is under martial law,

or under admiralty law, from the martial law since Abraham Lincoln’s

executive order putting it under martial law, and in order to continue

staying under martial law, the country has to have some kind of war

every two years. Thus, the war on drugs, the war on poverty, et cetera,

and the admiralty laws are used in the courts in such a way that they

are not necessarily tied to the Constitution, although the Constitution

is said to be the law of the land.

This Awareness* wishes briefly to remind entities that the admiralty court is the court in which the gold braid goes around the American Flag which indicates the court is under martial law,

or under admiralty law, from the martial law since Abraham Lincoln’s

executive order putting it under martial law, and in order to continue

staying under martial law, the country has to have some kind of war

every two years. Thus, the war on drugs, the war on poverty, et cetera,

and the admiralty laws are used in the courts in such a way that they

are not necessarily tied to the Constitution, although the Constitution

is said to be the law of the land.Did you know the U.S. has a Military and a Civil Flag?

This Awareness indicates that when Lincoln was assassinated, no one thought to put an end to this declaration of martial law because of the Civil War and because the martial law has continued up to this time, from the time of the Civil War, the nation can be directed by what is called Admiralty Law or martial law by simply a command of the President or the authority of the land or his agents.

Read More…

by David Stockman, Contra Corner:

The hordes of Washington politicians promising to boost the nation’s economic growth rate and the posse of monetary central planners and their Keynesian economists (excuse the redundancy) lamenting that “escape velocity” appears to have gone MIA have one thing in common. To wit, they have never looked at the chart below, or don’t get it if they have.

Plain and simple, the sum of Washington policy is to induce the business economy to eat it seed corn and bury itself in debt. Capitol Hill does its part with a tax code which provides a giant incentive for debt finance, and the Fed completes the job through massive intrusion in the money and capital markets. The result of systemic financial repression is deeply artificial, subsidized interest rates and free money for carry trade gamblers—–distortions which have turned the C-suites of corporate America into stock trading rooms.

Read More…

The hordes of Washington politicians promising to boost the nation’s economic growth rate and the posse of monetary central planners and their Keynesian economists (excuse the redundancy) lamenting that “escape velocity” appears to have gone MIA have one thing in common. To wit, they have never looked at the chart below, or don’t get it if they have.

Plain and simple, the sum of Washington policy is to induce the business economy to eat it seed corn and bury itself in debt. Capitol Hill does its part with a tax code which provides a giant incentive for debt finance, and the Fed completes the job through massive intrusion in the money and capital markets. The result of systemic financial repression is deeply artificial, subsidized interest rates and free money for carry trade gamblers—–distortions which have turned the C-suites of corporate America into stock trading rooms.

Read More…

by Daniel Barker, Natural News:

There are all sorts of ways the federal government actively poisons the population:

• The EPA spills toxic waste into rivers.

• The FDA keeps cancer causing additives in the food supply.

• The CDC pushes toxic vaccines laced with mercury… even when that mercury gets injected into children in California.

• The USDA approves toxic GMO crops that use deadly herbicide chemicals linked with cancer.

Read More

There are all sorts of ways the federal government actively poisons the population:

• The EPA spills toxic waste into rivers.

• The FDA keeps cancer causing additives in the food supply.

• The CDC pushes toxic vaccines laced with mercury… even when that mercury gets injected into children in California.

• The USDA approves toxic GMO crops that use deadly herbicide chemicals linked with cancer.

Read More

/

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment