Submitted by Tyler Durden on 01/21/2016 - 09:47 From omnipotence to impotence... in 90 minutes

Euro Tumbles; Stocks, Futures Surge After Draghi Says ECB "Will Reconsider Policy Stance In March"

Submitted by Tyler Durden on 01/21/2016 - 08:58

Dutch Bond Yields Collapse To Record Lows At -42.5bps!

WTF Draghi!!

Here Comes The National Team

Submitted by Tyler Durden on 01/21/2016 - 09:29 Yesterday a mysterious and large bidder suddenly arrived mid-morning to surge offshore Yuan and encourage global carry trades against JPY - spiking The Dow 400 points in the process. Overnight offshore Yuan tumbled and for a while dragged stocks with it... but now after 2 clear interventions, CNH is surging into the US open to provide just the "ECB-confirming" momentum ignition to ensure a positive market for professionals to sell into...

by Brandon Smith, Alt-Market:

While the economic implosion progresses this year, there will be

considerable misdirection and disinformation as to the true nature of

what is taking place. As I have outlined in the past, the masses were so

ill informed by the mainstream media during the Great Depression that

most people had no idea they were actually in the midst of an “official”

depression until years after it began. The chorus of economic

journalists of the day made sure to argue consistently that recovery was

“right around the corner.” Our current depression has been no

different, but something is about to change.

While the economic implosion progresses this year, there will be

considerable misdirection and disinformation as to the true nature of

what is taking place. As I have outlined in the past, the masses were so

ill informed by the mainstream media during the Great Depression that

most people had no idea they were actually in the midst of an “official”

depression until years after it began. The chorus of economic

journalists of the day made sure to argue consistently that recovery was

“right around the corner.” Our current depression has been no

different, but something is about to change.

Unlike the Great Depression, social crisis will eventually eclipse economic crisis in the U.S. That is to say, our society today is so unequipped to deal with a financial collapse that the event will inevitably trigger cultural upheaval and violent internal conflict. In the 1930s, nearly 50% of the American population was rural. Farmers made up 21% of the labor force. Today, only 20% of the population is rural. Less than 2% work in farming and agriculture. That’s a rather dramatic shift from a more independent and knowledgeable land-utilizing society to a far more helpless and hapless consumer-based system.

Read More

While the economic implosion progresses this year, there will be

considerable misdirection and disinformation as to the true nature of

what is taking place. As I have outlined in the past, the masses were so

ill informed by the mainstream media during the Great Depression that

most people had no idea they were actually in the midst of an “official”

depression until years after it began. The chorus of economic

journalists of the day made sure to argue consistently that recovery was

“right around the corner.” Our current depression has been no

different, but something is about to change.

While the economic implosion progresses this year, there will be

considerable misdirection and disinformation as to the true nature of

what is taking place. As I have outlined in the past, the masses were so

ill informed by the mainstream media during the Great Depression that

most people had no idea they were actually in the midst of an “official”

depression until years after it began. The chorus of economic

journalists of the day made sure to argue consistently that recovery was

“right around the corner.” Our current depression has been no

different, but something is about to change.Unlike the Great Depression, social crisis will eventually eclipse economic crisis in the U.S. That is to say, our society today is so unequipped to deal with a financial collapse that the event will inevitably trigger cultural upheaval and violent internal conflict. In the 1930s, nearly 50% of the American population was rural. Farmers made up 21% of the labor force. Today, only 20% of the population is rural. Less than 2% work in farming and agriculture. That’s a rather dramatic shift from a more independent and knowledgeable land-utilizing society to a far more helpless and hapless consumer-based system.

Read More

George Soros: "Europe Is On The Verge Of Collapse"

Submitted by Tyler Durden on 01/21/2016 - 03:00 "China will exert a negative influence on the rest of the world by reinforcing the deflationary tendencies that are already prevalent. China is responsible for a larger share of the world economy than ever before and the problems it faces have never been more intractable...the EU is on the verge of collapse. The Greek crisis taught the European authorities the art of kicking the can down the road, although it would be more accurate to describe it as kicking a ball uphill so that it keeps rolling back down. The EU now is confronted with not one but five or six crises at the same time."

Stephen Hawking Warns Humanity: Leave Earth Before The Ruling Class Destroys It

Submitted by Tyler Durden on 01/21/2016 - 09:18 Humanity’s future is in peril thanks to so-called advancements in science and technology, claims Professor Stephen Hawking, who cited “nuclear war, global warming, and genetically-modified viruses” as deadly threats to our existence. Concern over the automation of the world’s workforce coupled with capitalist greed also earned the scientist’s stern alarm.

Philly Fed Contracts For 5th Month In A Row As "Hope" Crashes To 3-Year Lows

Submitted by Tyler Durden on 01/21/2016 - 08:47 Philly Fed improved from a dismal -10.2 to a just terrible -3.5 for the 5th consecutive month of contraction with the number of employees and average workweek both tumbling. Shipments increased but new orders remain in contraction as inventories dropped. The more troubling news is the total collapse in "hope" as the six-month-forward outlook collapsed to Nov 2012 lows...

Initial Jobless Claims Surge To 6-Month Highs

Submitted by Tyler Durden on 01/21/2016 - 08:36 The last 4 months have seen a notable change in the jobless claims regime. After ratcheting lower week after week for 5 years, initial jobless claims have risen from 42 year lows at 243k in October to 293k today. The first time we reached these levels was July 2014 and claims are rising at the fastest rate since the financial crisis. Crucially for those who look at 'record' low jobless claims as a positive, history tells us that is the time to worry as recessions loom on the upswing.

Mario Draghi Deer In Headlights Presser - Live Feed

Submitted by Tyler Durden on 01/21/2016 - 08:26 Despite the turmoil reverberating across global markets, the ECB kept the depo rate unchanged on Thursday at -0.30%. The focus now turns to the Draghi presser where market participants will be keen on parsing the former Goldmanite’s every word for hints at how the central bank plans to cope with the disinflationary impulse unleashed by sub-$30 crude and the ongoing “adjustment” of the Chinese economy and currency.Russian Ruble Crashes To Record Lows In "Panic": "Some Investors Are Selling At Any Price"

Submitted by Tyler Durden on 01/21/2016 - 08:08 “It’s falling faster than any other currency as we see panic selling in the ruble after it breached the 80 per USD level. Some investors are selling at any price,”

ECB Keeps Rates Unchanged, Focus Turns To Draghi

Submitted by Tyler Durden on 01/21/2016 - 07:50 Nobody was expecting a rate cut (and hopefully not a hike) from the ECB today, and that's precisely what they got when moments ago the ECB announced it would keep its three key rates unchanged,

US Equity Futures Fail To Sustain Bounce; Resume Slide On Oil Fears

Submitted by Tyler Durden on 01/21/2016 - 07:00 Things are looking increasingly shaky for central planners around the globe.

Stocks, Crude Tumble As Offshore Yuan Sinks To Day Session Lows

Submitted by Tyler Durden on 01/20/2016 - 23:29 From the close of the US day session, offshore Yuan began to weaken and despite the largest liquidity injection in 3 years, has tumbled almost 200 pips from the dead-cat-bounce highs, testing the lows once again. This in turn has weighed on crude and dropped Dow futures 140 points off the after-hours highs...

"If Assets Remain Correlated, There'll Be A Depression": Ray Dalio Says QE4 Just Around The Corner

Submitted by Tyler Durden on 01/20/2016 - 23:15 CNBC’s Andrew Ross Sorkin and Becky Quick, donning their finest goose down bubble coats to remind viewers they’re reporting live from scenic Davos, generously took some time out of their busy schedules to chat with Ray Dalio on Wednesday and unsurprisingly, the “zen master” again predicted the Fed will reverse course and embark on more QE.The "Historic" Winter Blizard Was Just Upgraded To A "Potentially Epic Winter Blockbuster"

Submitted by Tyler Durden on 01/20/2016 - 23:02 The upcoming winter storm hyperbole factor just went up a notch, this time courtesy the Weather Undereground's Bob Henson, who has decided that merely "historic" is too cut and dry, and has instead dubbed the imminent climatic phenomenon no

by Adan Salazar, Infowars:

Federal employees revel in the fact that they swindle land from private

property owners at pennies on the dollar, in astonishing admissions

captured in a recently released video.

Federal employees revel in the fact that they swindle land from private

property owners at pennies on the dollar, in astonishing admissions

captured in a recently released video.

“We went out to the mine and the owners were two little guys that had been in the Second World War,” a California park service employee recalls at a retirement celebration for Mojave National Preserve Superintendent Mary Martin in 2005.

The employee brags about how the veterans’ mine was appraised by the federal government at $40 million, and acquired for a paltry $2.5 million.

Read More

Federal employees revel in the fact that they swindle land from private

property owners at pennies on the dollar, in astonishing admissions

captured in a recently released video.

Federal employees revel in the fact that they swindle land from private

property owners at pennies on the dollar, in astonishing admissions

captured in a recently released video.“We went out to the mine and the owners were two little guys that had been in the Second World War,” a California park service employee recalls at a retirement celebration for Mojave National Preserve Superintendent Mary Martin in 2005.

The employee brags about how the veterans’ mine was appraised by the federal government at $40 million, and acquired for a paltry $2.5 million.

Read More

by Michael Snyder, The Economic Collapse Blog:

It’s official – global stocks have entered a bear market. On Wednesday,

we learned that the MSCI All-Country World Index has fallen a total of

more than 20 percent from the peak of the market. So that means that

roughly one-fifth of all the stock market wealth in the entire world has

already been wiped out. How much more is it going to take before

everyone will finally admit that we have a major financial crisis on our

hands? 30 percent? 40 percent? This new round of chaos began last night

in Asia. Japanese stocks were down more than 600 points and Hong Kong

was down more than 700 points. The nightmare continued to roll on when

Europe opened, and European stocks ended up down about 3.2 percent when

the markets over there finally closed. In the U.S., it looked like it

was going to be a truly historic day for a while there. At one point the

Dow had fallen 566 points, but a curious rebound resulted in a loss of

only 249 points for the day.

It’s official – global stocks have entered a bear market. On Wednesday,

we learned that the MSCI All-Country World Index has fallen a total of

more than 20 percent from the peak of the market. So that means that

roughly one-fifth of all the stock market wealth in the entire world has

already been wiped out. How much more is it going to take before

everyone will finally admit that we have a major financial crisis on our

hands? 30 percent? 40 percent? This new round of chaos began last night

in Asia. Japanese stocks were down more than 600 points and Hong Kong

was down more than 700 points. The nightmare continued to roll on when

Europe opened, and European stocks ended up down about 3.2 percent when

the markets over there finally closed. In the U.S., it looked like it

was going to be a truly historic day for a while there. At one point the

Dow had fallen 566 points, but a curious rebound resulted in a loss of

only 249 points for the day.

Read More

It’s official – global stocks have entered a bear market. On Wednesday,

we learned that the MSCI All-Country World Index has fallen a total of

more than 20 percent from the peak of the market. So that means that

roughly one-fifth of all the stock market wealth in the entire world has

already been wiped out. How much more is it going to take before

everyone will finally admit that we have a major financial crisis on our

hands? 30 percent? 40 percent? This new round of chaos began last night

in Asia. Japanese stocks were down more than 600 points and Hong Kong

was down more than 700 points. The nightmare continued to roll on when

Europe opened, and European stocks ended up down about 3.2 percent when

the markets over there finally closed. In the U.S., it looked like it

was going to be a truly historic day for a while there. At one point the

Dow had fallen 566 points, but a curious rebound resulted in a loss of

only 249 points for the day.

It’s official – global stocks have entered a bear market. On Wednesday,

we learned that the MSCI All-Country World Index has fallen a total of

more than 20 percent from the peak of the market. So that means that

roughly one-fifth of all the stock market wealth in the entire world has

already been wiped out. How much more is it going to take before

everyone will finally admit that we have a major financial crisis on our

hands? 30 percent? 40 percent? This new round of chaos began last night

in Asia. Japanese stocks were down more than 600 points and Hong Kong

was down more than 700 points. The nightmare continued to roll on when

Europe opened, and European stocks ended up down about 3.2 percent when

the markets over there finally closed. In the U.S., it looked like it

was going to be a truly historic day for a while there. At one point the

Dow had fallen 566 points, but a curious rebound resulted in a loss of

only 249 points for the day.Read More

If

you still own stocks and mutual fund shares, you still aren’t grasping

the systemic risk in the stock market. No matter what you claim to

BELIEVE, it is your ACTIONS that actually determine your true grasp of

reality. Failing to sell all your stock holdings right now could result

in massive losses as the world’s bubble markets continue with an

implosion that could wipe out 50% of current valuations for many stocks.

If

you still own stocks and mutual fund shares, you still aren’t grasping

the systemic risk in the stock market. No matter what you claim to

BELIEVE, it is your ACTIONS that actually determine your true grasp of

reality. Failing to sell all your stock holdings right now could result

in massive losses as the world’s bubble markets continue with an

implosion that could wipe out 50% of current valuations for many stocks.The massive market bubble currently in place has been propped up by a steady stream of fiat money being printed by the Federal Reserve and handed out to banksters who have ties to Washington. This, combined with near-zero interest rates, is the only thing propping up the bubble market (and creating the illusion of economic prosperity).

Read More

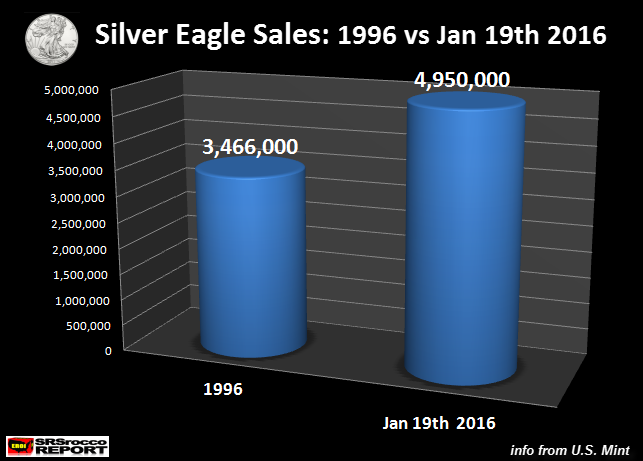

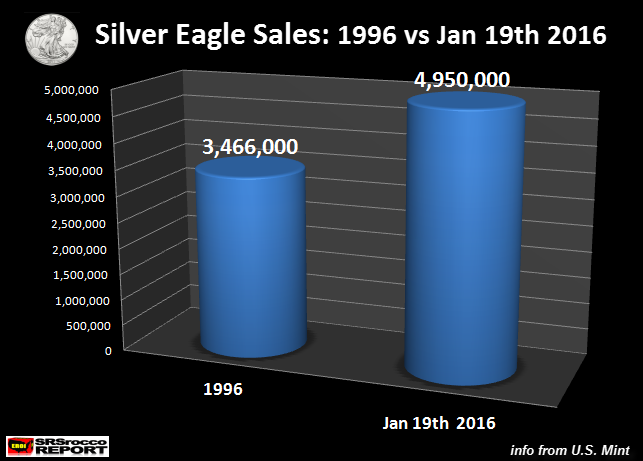

by Steve St. Angelo, SRS Rocco Report:

As the global stock markets continue to crash, demand for precious metals will continue to increase. Already, the U.S. Mint had to ration Silver Eagles sales due to a shortage of silver blanks. Sales of Silver Eagles in a little more than a week have reached nearly five million oz.

While Silver Eagle sales in January are normally very high compared to the rest of the year, initial sales this month are starting off with a real bang. The Authorized Dealers purchased all of the four million oz of Silver Eagles allocated last week and have already taken delivery of 950,000 of the 1 million oz allotment this week. There are only 50,000 Silver Eagles remaining until next week’s allotment (Source: CoinNews.net).

As I am writing this article, the Hang Seng stock market is down 701 points and the Nikkei is off 518. I would imagine the U.S. stock indices will be deeply in the red when they open, unless the magicians at the Fed and U.S. Treasury decide to bring out their bag of tricks.

Read More

As the global stock markets continue to crash, demand for precious metals will continue to increase. Already, the U.S. Mint had to ration Silver Eagles sales due to a shortage of silver blanks. Sales of Silver Eagles in a little more than a week have reached nearly five million oz.

While Silver Eagle sales in January are normally very high compared to the rest of the year, initial sales this month are starting off with a real bang. The Authorized Dealers purchased all of the four million oz of Silver Eagles allocated last week and have already taken delivery of 950,000 of the 1 million oz allotment this week. There are only 50,000 Silver Eagles remaining until next week’s allotment (Source: CoinNews.net).

As I am writing this article, the Hang Seng stock market is down 701 points and the Nikkei is off 518. I would imagine the U.S. stock indices will be deeply in the red when they open, unless the magicians at the Fed and U.S. Treasury decide to bring out their bag of tricks.

Read More

by Jeff Nielson, Bullion Bulls:

Part I of this two-part series alerted readers to a 31-minute presentation by the UK propaganda-hub: The Economist. The video

was titled “The World in 2016.” In that video, despite its best efforts

to hide the fact, we learned from the Economist that the World of 2016

is (literally) the world of the Oligarchs.

Part I of this two-part series alerted readers to a 31-minute presentation by the UK propaganda-hub: The Economist. The video

was titled “The World in 2016.” In that video, despite its best efforts

to hide the fact, we learned from the Economist that the World of 2016

is (literally) the world of the Oligarchs.

For the first time [in history], the richest 1% of the global population will enjoy a greater share of global wealth than the other 99%.

Given the timing of the release of this video, and the data cited above, it is impossible to believe that The Economist was not already aware of the very similar data which was about to be released by another (but much different) UK publication, The Guardian:

Richest 62 people as wealthy as half of world’s population, says OxFam

Read More

Part I of this two-part series alerted readers to a 31-minute presentation by the UK propaganda-hub: The Economist. The video

was titled “The World in 2016.” In that video, despite its best efforts

to hide the fact, we learned from the Economist that the World of 2016

is (literally) the world of the Oligarchs.

Part I of this two-part series alerted readers to a 31-minute presentation by the UK propaganda-hub: The Economist. The video

was titled “The World in 2016.” In that video, despite its best efforts

to hide the fact, we learned from the Economist that the World of 2016

is (literally) the world of the Oligarchs.For the first time [in history], the richest 1% of the global population will enjoy a greater share of global wealth than the other 99%.

Given the timing of the release of this video, and the data cited above, it is impossible to believe that The Economist was not already aware of the very similar data which was about to be released by another (but much different) UK publication, The Guardian:

Richest 62 people as wealthy as half of world’s population, says OxFam

Read More

from Charles Hugh Smith:

In response to a recent post on the structural decline in the velocity

of money, correspondent Mike Fasano described a key dynamic in both the

decline of money velocity and the middle class.

In response to a recent post on the structural decline in the velocity

of money, correspondent Mike Fasano described a key dynamic in both the

decline of money velocity and the middle class.

“There is another reason for falling velocity. People like me who have saved all their lives realize that they their savings (no matter how much) will never throw off enough money to allow retirement, unless I live off principal. This is especially so since one can reasonably expect social security to phased out, indexed out or dropped altogether. Accordingly, I realize that when I get to the point when I can no longer work, I’ll be living off capital and not interest. This is an incentive to keep working and not to spend.”

Read More

In response to a recent post on the structural decline in the velocity

of money, correspondent Mike Fasano described a key dynamic in both the

decline of money velocity and the middle class.

In response to a recent post on the structural decline in the velocity

of money, correspondent Mike Fasano described a key dynamic in both the

decline of money velocity and the middle class.“There is another reason for falling velocity. People like me who have saved all their lives realize that they their savings (no matter how much) will never throw off enough money to allow retirement, unless I live off principal. This is especially so since one can reasonably expect social security to phased out, indexed out or dropped altogether. Accordingly, I realize that when I get to the point when I can no longer work, I’ll be living off capital and not interest. This is an incentive to keep working and not to spend.”

Read More

Rising Fed interest rates means “liquidity could drop dramatically, and that scares everyone”, warns IMF deputy

by Ambrose Evans-Pritchard, The Telegraph:

The International Monetary Fund is increasingly alarmed by signs that

market liquidity is drying up and may trigger an even more violent

global sell-off if investors rush for the exits at the same time.

The International Monetary Fund is increasingly alarmed by signs that

market liquidity is drying up and may trigger an even more violent

global sell-off if investors rush for the exits at the same time.

Zhu Min, the IMF’s deputy director, said the stock market rout of the last three weeks is just a foretaste of what may happen as the US Federal Reserve continues to raise interest rates this year, pushing up borrowing costs across the planet.

by Ambrose Evans-Pritchard, The Telegraph:

The International Monetary Fund is increasingly alarmed by signs that

market liquidity is drying up and may trigger an even more violent

global sell-off if investors rush for the exits at the same time.

The International Monetary Fund is increasingly alarmed by signs that

market liquidity is drying up and may trigger an even more violent

global sell-off if investors rush for the exits at the same time.Zhu Min, the IMF’s deputy director, said the stock market rout of the last three weeks is just a foretaste of what may happen as the US Federal Reserve continues to raise interest rates this year, pushing up borrowing costs across the planet.

He warned that investors and wealth funds have clustered together in

crowded positions. Asset markets have become dangerously correlated,

amplifying the effects of any shift in mood.

Read More

Read More

by Jeff Nielson, Bullion Bulls:

As I’ve mentioned before; we’re now in the Silly Stage of the

banksters’ bubble-and-crash cycle. This is where the Criminals keep the

bubbles propped-up at an absurd high, so that the markets can get totally rancid — and THEN they detonate the bubbles (and push down hard), to get the vertical lines that the One Bank likes to see so much.

As I’ve mentioned before; we’re now in the Silly Stage of the

banksters’ bubble-and-crash cycle. This is where the Criminals keep the

bubbles propped-up at an absurd high, so that the markets can get totally rancid — and THEN they detonate the bubbles (and push down hard), to get the vertical lines that the One Bank likes to see so much.

In the Silly Stage, the propaganda machine pretends to bifurcate. You get the minority of Alarmists, who suggest that maybe the economy isn’t quite the pie-in-the-sky Paradise as portrayed by most of the propaganda. Such warnings are whispered by the Corporate media.

Then we have the Cheerleaders. Except, at the Silly Stage, the Cheerleaders turn into Rabid Zealots. There has never been a better time to buy than RIGHT NOW! And, naturally, the Corporate media continues to blare the propaganda of the Rabid Zealots at maximum decibels. Why not buy, with all U.S. markets sitting at record, bubble highs?

Read More

In the Silly Stage, the propaganda machine pretends to bifurcate. You get the minority of Alarmists, who suggest that maybe the economy isn’t quite the pie-in-the-sky Paradise as portrayed by most of the propaganda. Such warnings are whispered by the Corporate media.

Then we have the Cheerleaders. Except, at the Silly Stage, the Cheerleaders turn into Rabid Zealots. There has never been a better time to buy than RIGHT NOW! And, naturally, the Corporate media continues to blare the propaganda of the Rabid Zealots at maximum decibels. Why not buy, with all U.S. markets sitting at record, bubble highs?

Read More

from The Daily Bell:

“This

is personal,” Florida Sen. Marco Rubio told an estimated 300 people at

the Hilton Garden Inn … It was foreign affairs that really got Rubio

going claiming Obama is cutting “deals” with the enemies putting

Americans in harms way, he said. “If you take an American as a hostage,

Barack Obama will cut a deal with you (for release).” America must stand

strong with a larger military, he said, “Weakness invites danger,

violence, war.” – Nonpareilonline

“This

is personal,” Florida Sen. Marco Rubio told an estimated 300 people at

the Hilton Garden Inn … It was foreign affairs that really got Rubio

going claiming Obama is cutting “deals” with the enemies putting

Americans in harms way, he said. “If you take an American as a hostage,

Barack Obama will cut a deal with you (for release).” America must stand

strong with a larger military, he said, “Weakness invites danger,

violence, war.” – Nonpareilonline

Dominant Social Theme: America is perpetually at war and should stay that way.

Free-Market Analysis: GOP warmongering is increasingly a problem from a civil society standpoint. With Ron Paul out of the race and officially retired, lofting the banner of military non-interference abroad fell to his son, Rand Paul.

Read More

“This

is personal,” Florida Sen. Marco Rubio told an estimated 300 people at

the Hilton Garden Inn … It was foreign affairs that really got Rubio

going claiming Obama is cutting “deals” with the enemies putting

Americans in harms way, he said. “If you take an American as a hostage,

Barack Obama will cut a deal with you (for release).” America must stand

strong with a larger military, he said, “Weakness invites danger,

violence, war.” – Nonpareilonline

“This

is personal,” Florida Sen. Marco Rubio told an estimated 300 people at

the Hilton Garden Inn … It was foreign affairs that really got Rubio

going claiming Obama is cutting “deals” with the enemies putting

Americans in harms way, he said. “If you take an American as a hostage,

Barack Obama will cut a deal with you (for release).” America must stand

strong with a larger military, he said, “Weakness invites danger,

violence, war.” – NonpareilonlineDominant Social Theme: America is perpetually at war and should stay that way.

Free-Market Analysis: GOP warmongering is increasingly a problem from a civil society standpoint. With Ron Paul out of the race and officially retired, lofting the banner of military non-interference abroad fell to his son, Rand Paul.

Read More

/

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment