from KingWorldNews:

Economic activity in welfare states around the globe is stagnant. That

means living standards are declining. Even more worrisome are the years

of profligate, runaway spending by politicians in these welfare states

that have created an unserviceable debt burden. Central banks have been

trying to paper over these problems, but to no avail. Despite the

cheerleading by vested interests, unemployment remains high in the

overleveraged welfare states in Europe and of course the United States.

All the central banks have managed to do is destroy wealth with their

zero-interest-rate policy.

Economic activity in welfare states around the globe is stagnant. That

means living standards are declining. Even more worrisome are the years

of profligate, runaway spending by politicians in these welfare states

that have created an unserviceable debt burden. Central banks have been

trying to paper over these problems, but to no avail. Despite the

cheerleading by vested interests, unemployment remains high in the

overleveraged welfare states in Europe and of course the United States.

All the central banks have managed to do is destroy wealth with their

zero-interest-rate policy.

That’s One Scary Looking Chart

So far the newly created money from various QE programs around the world has had limited impact, but actions have consequences. In this regard, I am watching the following chart of money velocity. It is a scary chart, but what is it really telling us?

Read More

Economic activity in welfare states around the globe is stagnant. That

means living standards are declining. Even more worrisome are the years

of profligate, runaway spending by politicians in these welfare states

that have created an unserviceable debt burden. Central banks have been

trying to paper over these problems, but to no avail. Despite the

cheerleading by vested interests, unemployment remains high in the

overleveraged welfare states in Europe and of course the United States.

All the central banks have managed to do is destroy wealth with their

zero-interest-rate policy.

Economic activity in welfare states around the globe is stagnant. That

means living standards are declining. Even more worrisome are the years

of profligate, runaway spending by politicians in these welfare states

that have created an unserviceable debt burden. Central banks have been

trying to paper over these problems, but to no avail. Despite the

cheerleading by vested interests, unemployment remains high in the

overleveraged welfare states in Europe and of course the United States.

All the central banks have managed to do is destroy wealth with their

zero-interest-rate policy.That’s One Scary Looking Chart

So far the newly created money from various QE programs around the world has had limited impact, but actions have consequences. In this regard, I am watching the following chart of money velocity. It is a scary chart, but what is it really telling us?

Read More

by Bix Weir, Road to Roota:

I have posted dozens of interviews over the years but none has been

more successful as far as “views” as the one I did explaining the

shocking truth behind YOUR stocks, bonds, etf’s and anything else you

hold in the electronic or paper form.

I have posted dozens of interviews over the years but none has been

more successful as far as “views” as the one I did explaining the

shocking truth behind YOUR stocks, bonds, etf’s and anything else you

hold in the electronic or paper form.

THEY ARE NOT PURCHASED IN YOUR NAME!!!

THEY ARE NOT YOUR PROPERTY!!!

THEY ARE NOT REAL!!!

Read More

I have posted dozens of interviews over the years but none has been

more successful as far as “views” as the one I did explaining the

shocking truth behind YOUR stocks, bonds, etf’s and anything else you

hold in the electronic or paper form.

I have posted dozens of interviews over the years but none has been

more successful as far as “views” as the one I did explaining the

shocking truth behind YOUR stocks, bonds, etf’s and anything else you

hold in the electronic or paper form.THEY ARE NOT PURCHASED IN YOUR NAME!!!

THEY ARE NOT YOUR PROPERTY!!!

THEY ARE NOT REAL!!!

Read More

by Michael Snyder, The Economic Collapse Blog:

Is something about to happen in Germany that will shake the entire

world? According to disturbing new intel that I have received, a major

financial event in Germany could be imminent. Now when I say imminent, I

do not mean to suggest that it will happen tomorrow. But I do believe

that we have entered a season of time when another “Lehman Brothers

moment” may occur. Most observers tend to regard Germany as the strong

hub that is holding the rest of Europe together economically, but the

truth is that serious trouble is brewing under the surface. As I write

this, the German DAX stock index is down close to 20 percent from the

all-time high that was set back in April, and there are lots of signs of

turmoil at Germany’s largest bank. There are very few banks in the

world that are more prestigious or more influential than Deutsche Bank,

and it has been making headlines for all of the wrong reasons recently.

Is something about to happen in Germany that will shake the entire

world? According to disturbing new intel that I have received, a major

financial event in Germany could be imminent. Now when I say imminent, I

do not mean to suggest that it will happen tomorrow. But I do believe

that we have entered a season of time when another “Lehman Brothers

moment” may occur. Most observers tend to regard Germany as the strong

hub that is holding the rest of Europe together economically, but the

truth is that serious trouble is brewing under the surface. As I write

this, the German DAX stock index is down close to 20 percent from the

all-time high that was set back in April, and there are lots of signs of

turmoil at Germany’s largest bank. There are very few banks in the

world that are more prestigious or more influential than Deutsche Bank,

and it has been making headlines for all of the wrong reasons recently.

Read More…

from X22 Report:

Is something about to happen in Germany that will shake the entire

world? According to disturbing new intel that I have received, a major

financial event in Germany could be imminent. Now when I say imminent, I

do not mean to suggest that it will happen tomorrow. But I do believe

that we have entered a season of time when another “Lehman Brothers

moment” may occur. Most observers tend to regard Germany as the strong

hub that is holding the rest of Europe together economically, but the

truth is that serious trouble is brewing under the surface. As I write

this, the German DAX stock index is down close to 20 percent from the

all-time high that was set back in April, and there are lots of signs of

turmoil at Germany’s largest bank. There are very few banks in the

world that are more prestigious or more influential than Deutsche Bank,

and it has been making headlines for all of the wrong reasons recently.

Is something about to happen in Germany that will shake the entire

world? According to disturbing new intel that I have received, a major

financial event in Germany could be imminent. Now when I say imminent, I

do not mean to suggest that it will happen tomorrow. But I do believe

that we have entered a season of time when another “Lehman Brothers

moment” may occur. Most observers tend to regard Germany as the strong

hub that is holding the rest of Europe together economically, but the

truth is that serious trouble is brewing under the surface. As I write

this, the German DAX stock index is down close to 20 percent from the

all-time high that was set back in April, and there are lots of signs of

turmoil at Germany’s largest bank. There are very few banks in the

world that are more prestigious or more influential than Deutsche Bank,

and it has been making headlines for all of the wrong reasons recently.Read More…

from X22 Report:

2,000 Russian Troops Head To Syria For "First Phase" Of Mission To Support Assad

Submitted by Tyler Durden on 09/22/2015 - 08:32 "They were very busy over the weekend"...

"(Not Always) Smart Money" Hedgers Are Record Long S&P 500 Futures

Submitted by Tyler Durden on 09/22/2015 - 08:58 The only other time the S&P 500 Hedgers’ net long position exceeded 60,000 contracts was... September 25-October 9, 2007. We may or may not have to remind you that October 9, 2007 marked the all-time high in the S&P 500 to that point – and for 6 years to follow. Obviously, this was decidedly NOT a well-timed long extreme.

from Popular Liberty:

As of today you really can pay your taxes, your credit cards, your

mortgage, shop at Costco, and buy your groceries without so much as a

bank account while using sound money.

As of today you really can pay your taxes, your credit cards, your

mortgage, shop at Costco, and buy your groceries without so much as a

bank account while using sound money.

The fact that Texas announced that it withdrawing its gold from Manhattan and is creating a state gold depository generated a good deal of interest because there would also be a way to transfer gold to others via said depository. So much interest that Texas received calls from all over the United States from folks that wanted to be part of such a system. The articles covering the future Texas depository cumulatively received millions of views. What was missed in all of this coverage is that a functional, and legal depository that allows anyone in the country to pay and save in gold dollars already exists. In Utah.

Read More

As of today you really can pay your taxes, your credit cards, your

mortgage, shop at Costco, and buy your groceries without so much as a

bank account while using sound money.

As of today you really can pay your taxes, your credit cards, your

mortgage, shop at Costco, and buy your groceries without so much as a

bank account while using sound money.The fact that Texas announced that it withdrawing its gold from Manhattan and is creating a state gold depository generated a good deal of interest because there would also be a way to transfer gold to others via said depository. So much interest that Texas received calls from all over the United States from folks that wanted to be part of such a system. The articles covering the future Texas depository cumulatively received millions of views. What was missed in all of this coverage is that a functional, and legal depository that allows anyone in the country to pay and save in gold dollars already exists. In Utah.

Read More

from Jesse’s Café Américain:

“The IMF has put Monetary gold right at the top of the global reserve assets list – above SDRs. The IMF writes, ‘…The gold bullion component of monetary gold is the only case of a financial asset with no counterpart liability.'”

“The IMF has put Monetary gold right at the top of the global reserve assets list – above SDRs. The IMF writes, ‘…The gold bullion component of monetary gold is the only case of a financial asset with no counterpart liability.'”

Koos Jansen

Gold took a light hit on the London PM fix and the opening of The Bucket Shop this morning. Silver took a hit as well but managed to bounce back up and finish positive on the day, probably because it is in an ‘active month’ on the better parlor on the Hudson.

I read an analyst talk the old ‘gold vs. silver’ argument over the weekend. In my opinion it is a fruitless argument to consider in the abstract, and so I don’t.

Read More

“The IMF has put Monetary gold right at the top of the global reserve assets list – above SDRs. The IMF writes, ‘…The gold bullion component of monetary gold is the only case of a financial asset with no counterpart liability.'”

“The IMF has put Monetary gold right at the top of the global reserve assets list – above SDRs. The IMF writes, ‘…The gold bullion component of monetary gold is the only case of a financial asset with no counterpart liability.'”Koos Jansen

Gold took a light hit on the London PM fix and the opening of The Bucket Shop this morning. Silver took a hit as well but managed to bounce back up and finish positive on the day, probably because it is in an ‘active month’ on the better parlor on the Hudson.

I read an analyst talk the old ‘gold vs. silver’ argument over the weekend. In my opinion it is a fruitless argument to consider in the abstract, and so I don’t.

Read More

by Dan Popescu, Gold Broker:

In this article I want to approach the idea of a gold standard from a

more “regular people” perspective rather than from a “high academic”

economic/finance and, sometimes, legalistic perspective. I constantly

read books and articles full of mathematics written by the economic

academia, trying to show why a gold standard is a relic of Antiquity,

undignified of the modern world.

In this article I want to approach the idea of a gold standard from a

more “regular people” perspective rather than from a “high academic”

economic/finance and, sometimes, legalistic perspective. I constantly

read books and articles full of mathematics written by the economic

academia, trying to show why a gold standard is a relic of Antiquity,

undignified of the modern world.

As a physicist, still, I would like to remind economists that they would not be able to write their papers on a PC, communicate with an iPhone, drive a car or fly on a plane, if it weren’t for two relics of Antiquity essential to scientists and more than 3,000 years old that barely changed since then: algebra and geometry.

Read More…

In this article I want to approach the idea of a gold standard from a

more “regular people” perspective rather than from a “high academic”

economic/finance and, sometimes, legalistic perspective. I constantly

read books and articles full of mathematics written by the economic

academia, trying to show why a gold standard is a relic of Antiquity,

undignified of the modern world.

In this article I want to approach the idea of a gold standard from a

more “regular people” perspective rather than from a “high academic”

economic/finance and, sometimes, legalistic perspective. I constantly

read books and articles full of mathematics written by the economic

academia, trying to show why a gold standard is a relic of Antiquity,

undignified of the modern world.As a physicist, still, I would like to remind economists that they would not be able to write their papers on a PC, communicate with an iPhone, drive a car or fly on a plane, if it weren’t for two relics of Antiquity essential to scientists and more than 3,000 years old that barely changed since then: algebra and geometry.

Read More…

Dead Cat Bounce Dies - Dow Down 700 Points From Fed's Fold

Submitted by Tyler Durden on 09/22/2015 - 08:43 Rule 48 to be unleashed any minute now... Dow futures are now down 300 points (and down 700 from post-FOMC algo exuberance)....

by Jeff Nielson, Sprott Money:

First we had “too big to fail”. Then came “too big to jail”. Now, finally, the U.S. Department of “Justice” is letting us know what it really thinks: U.S. Big Banks simply have a license to steal.

First we had “too big to fail”. Then came “too big to jail”. Now, finally, the U.S. Department of “Justice” is letting us know what it really thinks: U.S. Big Banks simply have a license to steal.

The most amazing thing about the Justice Department’s new guidelines on prosecution of corporate crime is that the DOJ is effectively acknowledging there was a big problem with how it did things before.

Yes. As these criminalized institutions now perpetrate financial mega-crimes measured (literally) in the$trillions, we have the so-called Justice Department claiming it has been too hard on this financial crime syndicate. Yes. Presumably if the DOJ hadn’t taken its previous, supposed “tough love” approach to these financial criminals, they would now already be perpetrating multi-QUADRILLION dollar crimes. And the U.S. government certainly won’t stand in the way of “progress”.

Read More

First we had “too big to fail”. Then came “too big to jail”. Now, finally, the U.S. Department of “Justice” is letting us know what it really thinks: U.S. Big Banks simply have a license to steal.

First we had “too big to fail”. Then came “too big to jail”. Now, finally, the U.S. Department of “Justice” is letting us know what it really thinks: U.S. Big Banks simply have a license to steal.The most amazing thing about the Justice Department’s new guidelines on prosecution of corporate crime is that the DOJ is effectively acknowledging there was a big problem with how it did things before.

Yes. As these criminalized institutions now perpetrate financial mega-crimes measured (literally) in the$trillions, we have the so-called Justice Department claiming it has been too hard on this financial crime syndicate. Yes. Presumably if the DOJ hadn’t taken its previous, supposed “tough love” approach to these financial criminals, they would now already be perpetrating multi-QUADRILLION dollar crimes. And the U.S. government certainly won’t stand in the way of “progress”.

Read More

by Jeff Kingston, Japan Times:

The International Atomic Energy Agency’s recently released postmortem

on the Fukushima nuclear accident of 2011 makes for grim reading and

serves as a timely reminder of why the restart of the Sendai nuclear

plant in Kyushu is a bad idea.

The International Atomic Energy Agency’s recently released postmortem

on the Fukushima nuclear accident of 2011 makes for grim reading and

serves as a timely reminder of why the restart of the Sendai nuclear

plant in Kyushu is a bad idea.

When an atomic energy advocacy organization delivers multiple harsh assessments of Japan’s woeful nuclear safety culture and inadequate emergency countermeasures and disaster management protocols, it’s time to wonder how much has really changed in the past five years — and whether restarting any of the nation’s nuclear reactors is a good idea.

Read More…

The International Atomic Energy Agency’s recently released postmortem

on the Fukushima nuclear accident of 2011 makes for grim reading and

serves as a timely reminder of why the restart of the Sendai nuclear

plant in Kyushu is a bad idea.

The International Atomic Energy Agency’s recently released postmortem

on the Fukushima nuclear accident of 2011 makes for grim reading and

serves as a timely reminder of why the restart of the Sendai nuclear

plant in Kyushu is a bad idea.When an atomic energy advocacy organization delivers multiple harsh assessments of Japan’s woeful nuclear safety culture and inadequate emergency countermeasures and disaster management protocols, it’s time to wonder how much has really changed in the past five years — and whether restarting any of the nation’s nuclear reactors is a good idea.

Read More…

Goldman CEO Lloyd Blankfein Reveals He Has Lymphoma

Submitted by Tyler Durden on 09/22/2015 - 08:15 To my colleagues, our clients and our shareholders,Late this summer after several weeks of not feeling well, I underwent a series of tests, which culminated in a biopsy last week. After the biopsy, I was told by my doctors that I have lymphoma. Fortunately, my form of lymphoma is highly curable and my doctors' and my own expectation is that I will be cured.

Volkswagen's CEO Is Out German Media Reports; Company Denies

Submitted by Tyler Durden on 09/22/2015 - 08:01 A series of dramatic moves at the helm of Germany's iconic carmaker leaves many wondering what's next. Here are some thoughts.Frontrunning: September 22

- Pressure builds on Volkswagen CEO as emissions-cheating probe spreads (Reuters)

- Volkswagen Emissions Scandal Relates to 11 Million Cars (WSJ)

- Volkswagen Emissions Investigations Should Widen to Entire Auto Industry, Officials Say (WSJ)

- Germany's Bosch makes VW's U.S. diesel components (Reuters)

- Volkswagen scandal will have personnel consequences - state economy minister (Reuters)

- Glencore Falls to Record as Mining Shares Lead Stock Losses (BBG)

- Despite Slump, China’s Xi Jinping Pledges Economic Reforms (WSJ)

Futures Plunge On Renewed Growth, Central Bank Fears; Volkswagen Shares Crash As Default Risk Surges

Submitted by Tyler Durden on 09/22/2015 - 06:49 While Asian trading overnight started off on the right foot, chasing US momentum higher, things rapidly shifted once Europe opened as attention moved back to global growth fears, global central banks losing credibility, as well as miners and the ongoing Volkswagen fiasco.

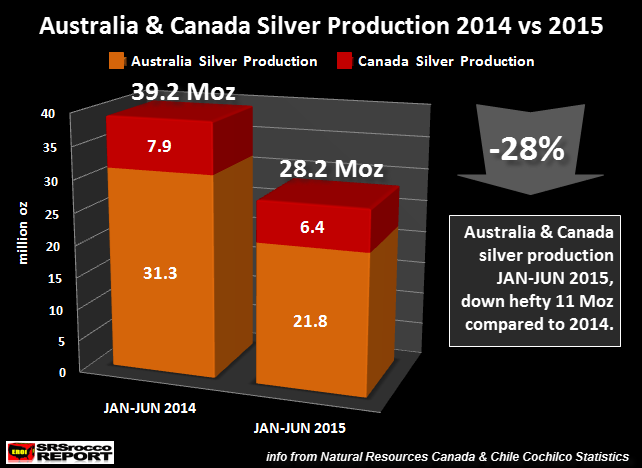

There is no other way to describe the radical change that has taken place in several areas of the silver supply market this year other than to say…. it’s quite shocking. While certain analysts stated that the silver supply would indeed fall this year, I don’t believe anyone could have envisioned the kind of declines experienced in the chart below.

When I first discussed this subject matter in an interview last month, I thought there might be a chance that this silver data was incorrect… a typo of some sort. However, the second quarter figures that were just released, do confirm just how dreadful silver supply has fallen from these two areas.

With the ongoing surge in physical silver investment demand and the rapidly falling Registered Silver Inventories at the COMEX, any decline in silver supply will only exacerbate the current tightness in the silver market.

Read More

from Western Journalism:

The U.S. government is certainly NOT of the people, NOT by the people,

and NOT for the people. In the vernacular of the day, what do we have?

Government of the People, by the People, for the People. NOT.

The U.S. government is certainly NOT of the people, NOT by the people,

and NOT for the people. In the vernacular of the day, what do we have?

Government of the People, by the People, for the People. NOT.

I submit that the people or peoples that inhabit a certain portion of North America known as America did not overthrow the government of Iran in 1953. They did not direct themselves into the Vietnam War. They did not decide to bomb Serbia, starve the people of Iraq, and later invade Iraq. They didn’t decide to debase the dollar. They did not devise or pass Obamacare. They did not decide to bail out Wall Street investment bankers or hedge funds. They did not decide to militarize America’s police.

Read More

The U.S. government is certainly NOT of the people, NOT by the people,

and NOT for the people. In the vernacular of the day, what do we have?

Government of the People, by the People, for the People. NOT.

The U.S. government is certainly NOT of the people, NOT by the people,

and NOT for the people. In the vernacular of the day, what do we have?

Government of the People, by the People, for the People. NOT.I submit that the people or peoples that inhabit a certain portion of North America known as America did not overthrow the government of Iran in 1953. They did not direct themselves into the Vietnam War. They did not decide to bomb Serbia, starve the people of Iraq, and later invade Iraq. They didn’t decide to debase the dollar. They did not devise or pass Obamacare. They did not decide to bail out Wall Street investment bankers or hedge funds. They did not decide to militarize America’s police.

Read More

from Wolf Street:

Markets threw a hissy-fit in the wake of the Fed’s widely ridiculed “None and Done” decision to hold rates at near zero where they’ve been through thick and thin since December 2008. So it was time for St. Louis Fed President James Bullard to distance himself from this debacle.

And he did on Saturday, at the annual meeting of the Community Bankers Association of Illinois, by shooting an expertly targeted broadside at the Federal Open Market Committee, of which he is a non-voting member this year. But the broadside was directed at a lot more than just the failure of the FOMC to raise rates at the last meeting. And shrapnel perforated his own foot.

The meeting was “pressure packed,” he said, and the decision was “a close call,” with “a large majority of the FOMC” expecting to kick off “policy normalization” – raising rates – “this year.”

Read More

Markets threw a hissy-fit in the wake of the Fed’s widely ridiculed “None and Done” decision to hold rates at near zero where they’ve been through thick and thin since December 2008. So it was time for St. Louis Fed President James Bullard to distance himself from this debacle.

And he did on Saturday, at the annual meeting of the Community Bankers Association of Illinois, by shooting an expertly targeted broadside at the Federal Open Market Committee, of which he is a non-voting member this year. But the broadside was directed at a lot more than just the failure of the FOMC to raise rates at the last meeting. And shrapnel perforated his own foot.

The meeting was “pressure packed,” he said, and the decision was “a close call,” with “a large majority of the FOMC” expecting to kick off “policy normalization” – raising rates – “this year.”

Read More

from TheAlexJonesChannel:

by Mac Slavo, SHTFPlan:

Who are the real enemies in the Middle East?

Who are the real enemies in the Middle East?

Is is ISIS – ransacking, raping and beheading its way across the region to carve out a new Caliphate and threatening terrorism inside U.S. borders – or is it Putin and his gang, cornering American statesmen in a deadly game of chess that could lead at any time to all-out nuclear war?

The answers may be conflicting, but it is clear that Obama has no idea what he is doing, and no way of containing all that confronts U.S. interests overseas. Check.

With Ukraine still boiling in the background, Vladimir Putin has taken things up a notch in Syria, by deploying 28 combat planes to aid Assad’s regime for reasons that don’t exactly rule out offensive attacks, or downplay concerns about Russian aggression..

Read More

Who are the real enemies in the Middle East?

Who are the real enemies in the Middle East?Is is ISIS – ransacking, raping and beheading its way across the region to carve out a new Caliphate and threatening terrorism inside U.S. borders – or is it Putin and his gang, cornering American statesmen in a deadly game of chess that could lead at any time to all-out nuclear war?

The answers may be conflicting, but it is clear that Obama has no idea what he is doing, and no way of containing all that confronts U.S. interests overseas. Check.

With Ukraine still boiling in the background, Vladimir Putin has taken things up a notch in Syria, by deploying 28 combat planes to aid Assad’s regime for reasons that don’t exactly rule out offensive attacks, or downplay concerns about Russian aggression..

Read More

from CrushTheStreet:

by Justin O’Connell, Crypto Coin News:

The

British monarchy is richer than ever. Queen Elizabeth became the

longest serving royal ever on September 9 after 64 years on the throne.

Reuters found that the British monarchy has benefitted from an increase

in house and land prices especially in the wake of the 2007 global

financial crisis.

The

British monarchy is richer than ever. Queen Elizabeth became the

longest serving royal ever on September 9 after 64 years on the throne.

Reuters found that the British monarchy has benefitted from an increase

in house and land prices especially in the wake of the 2007 global

financial crisis.

The queen has made headlines by using thrifty space heaters to keep her “chilly” palaces warm. In recent days, however, she has made headlines for a different reason: her family’s vast wealth after years on the throne. According to spokespeople, the queen is actually thrifty, owning little more than a few race horses.

Read More

The

British monarchy is richer than ever. Queen Elizabeth became the

longest serving royal ever on September 9 after 64 years on the throne.

Reuters found that the British monarchy has benefitted from an increase

in house and land prices especially in the wake of the 2007 global

financial crisis.

The

British monarchy is richer than ever. Queen Elizabeth became the

longest serving royal ever on September 9 after 64 years on the throne.

Reuters found that the British monarchy has benefitted from an increase

in house and land prices especially in the wake of the 2007 global

financial crisis. The queen has made headlines by using thrifty space heaters to keep her “chilly” palaces warm. In recent days, however, she has made headlines for a different reason: her family’s vast wealth after years on the throne. According to spokespeople, the queen is actually thrifty, owning little more than a few race horses.

Read More

by Anthony Gucciardi, Natural Society:

Russia

has just announced a game-changing move in the fight against Monsanto’s

GMOs, completely banning the use of genetically modified ingredients in

any and all food production.

Russia

has just announced a game-changing move in the fight against Monsanto’s

GMOs, completely banning the use of genetically modified ingredients in

any and all food production.

In other words, Russia just blazed way past the issue of GMO labeling and shut down the use of any and all GMOs that would have otherwise entered the food supply through the creation of packaged foods (and the cultivation of GMO crops).

“As far as genetically-modified organisms are concerned, we have made decision not to use any GMO in food productions,” Deputy PM Arkady Dvorkovich revealed during an international conference on biotechnology.

Read More

Russia

has just announced a game-changing move in the fight against Monsanto’s

GMOs, completely banning the use of genetically modified ingredients in

any and all food production.

Russia

has just announced a game-changing move in the fight against Monsanto’s

GMOs, completely banning the use of genetically modified ingredients in

any and all food production.In other words, Russia just blazed way past the issue of GMO labeling and shut down the use of any and all GMOs that would have otherwise entered the food supply through the creation of packaged foods (and the cultivation of GMO crops).

“As far as genetically-modified organisms are concerned, we have made decision not to use any GMO in food productions,” Deputy PM Arkady Dvorkovich revealed during an international conference on biotechnology.

Read More

/

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment