from FaceLikeTheSun:

The IMF Just Confirmed The Nightmare Scenario For Central Banks Is Now In Play

Submitted by Tyler Durden on 09/06/2015 - 19:59 The centrally-planned house of cards is finally starting to shake uncontrollably.

China's "S&P" Limit Up 10%, Banks Plunge 5% As Xinhua Confirms "Stock Market Stabilized"

Submitted by Tyler Durden on 09/06/2015 - 22:18 Presented with little comment aside from a snarky glare as Xinhua's headline "After a roller coaster rush since July 2014, China's stock market has stabilized and risks have been released to some extent, the securities regulator said Sunday." CSI-300 was limit up 10% shortly after the open, then was hammered 5% lower. Shanghai Composite was not as easily manipulated and is down 0.5%!!

CyberWar & The False Comfort Of Mutually Assured Destruction

Submitted by Tyler Durden on 09/06/2015 - 22:00 As an investor, you have enough to be concerned about just taking into account factors like inflation, deflation, Fed policy and the overall state of the economy. Now you have another major threat looming – financial warfare, enabled by cyberattacks and force multipliers. What can you do to preserve wealth when these cyberfinancial wars break out? The key is to have some portion of your total assets invested in nondigital assets that cannot be hacked, wiped out or disrupted by financial warfare. The time to take defensive action by acquiring some non-digital assets is now.

China Stocks "Death Cross", Default Risk Hits 2-Year High As Regulators Promise G-20 'Whatever It Takes' To Stabilize Market

Submitted by Tyler Durden on 09/06/2015 - 21:22 Even before China reopened from its 5-day holiday, regulators were pitching Chinese stocks as cheap (37.3x P/E) and less-margined (+108% YoY) and promised to "safeguard stability" in a "variety of forms" seemingly pouting cold water on The FT's recent report (and the malicious instigator of China's market crash). All of this is quite ironic, given China's chief central bankers admitted "the chinese bubble has burst." As stocks open, CSI-300 (China's S&P 500) has confirmed a 'Death Cross' which in 2008 was followed by a further 60% decline. More troubling, however, is the incessant rise in interbank rates as despite CNY530bn of liquidity injected in the last 3 weeks, overnight rates have doubled. China credit risk jumps to 2-year highs and AsiaPac stocks are generally lower at the open (as US futures dumped'n'pumped) not helped by Japanese weakness on BoJ tapering concerns. PBOC strengthened the Yuan fix for the 4th day in a row - the most since Sept 2010.

Why The New Car Bubble's Days Are Numbered

Submitted by Tyler Durden on 09/06/2015 - 21:00 Having recently detailed the automakers' worst nightmare - surging new car inventories - supply; amid rapidly declining growth around the world (EM and China) - demand, it appears the bubble in new car sales is about to be crushed by yet another unintended consequence of The Fed's lower for longer experiment. As WSJ reports, Edmunds.com estimates that around 28% of new vehicles this year will be leased - a near-record pace - leaving 13.4 million vehicles (leased over the past 3 years in The US) - compared with just 7 million in the three years to 2011 - set to spark a massive surplus of high-quality used cars. Great for consumers (if there are any left who have not leased a car in the last 3 years) but crushing for automakers' margins as luxury used-care prices are tumbling just as residuals have surged.Homeland Defense: The Pentagon Declares War on America

from Global Research:

Global Editor’s Note

Global Editor’s Note

The Department of Defense now authorizes the domestic deployment of US troops in “the conduct of operations other than war” including law enforcement activities and the quelling of “civil disturbances”: “Federal military commanders have the authority, in extraordinary emergency circumstances where prior authorization by the President is impossible and duly constituted local authorities are unable to control the situation, to engage temporarily in activities that are necessary to quell large-scale, unexpected civil disturbances…“

These developments –which are currently the object of heated debate– are the result of more than ten years of “repressive legislation” which increasingly points to the “fusion of the police and military functions both within the US and abroad”.

Read More

Global Editor’s Note

Global Editor’s NoteThe Department of Defense now authorizes the domestic deployment of US troops in “the conduct of operations other than war” including law enforcement activities and the quelling of “civil disturbances”: “Federal military commanders have the authority, in extraordinary emergency circumstances where prior authorization by the President is impossible and duly constituted local authorities are unable to control the situation, to engage temporarily in activities that are necessary to quell large-scale, unexpected civil disturbances…“

These developments –which are currently the object of heated debate– are the result of more than ten years of “repressive legislation” which increasingly points to the “fusion of the police and military functions both within the US and abroad”.

Read More

The "Great Unwind" Has Arrived

The world is in the waning days of a historic multi-decade experiment in unfettered finance. International finance has for too long been effectively operating without constraints on either the quantity or the quality of Credit issued. From the perspective of unsound finance on a globalized basis, this period has been unique. History, however, is replete with isolated episodes of booms fueled by bouts of unsound money and Credit – monetary fiascos inevitably ending in disaster. We see discomforting confirmation that the current historic global monetary fiasco’s disaster phase is now unfolding.

from Armstrong Economics:

The press is cleverly twisting the Hillary e-mail scandal to her benefit by narrowing their focus on what qualifies as “secret” instead of the fact that she conducted all national security business from her private e-mail server to avoid getting subpoenaed. There is no question whatsoever from a legal perspective that what Hillary did was outright criminal and conducting the business of the Secretary of State from a private server from which she then deleted 31,000 emails was at minimum obstruction of justice if not treason to the United States.

What Hillary did was far more direct treason than what Edward Snowden was accused of. Even Snowden has come out and stated bluntly that others go to jail for what Hillary did. How can Hillary claim privacy when she and the Obama Administration have supported the grabbing of every email by the NSA? Why has the press not demanded the NSA turnover all the emails Hillary erased when they have everything?

Read More

The press is cleverly twisting the Hillary e-mail scandal to her benefit by narrowing their focus on what qualifies as “secret” instead of the fact that she conducted all national security business from her private e-mail server to avoid getting subpoenaed. There is no question whatsoever from a legal perspective that what Hillary did was outright criminal and conducting the business of the Secretary of State from a private server from which she then deleted 31,000 emails was at minimum obstruction of justice if not treason to the United States.

What Hillary did was far more direct treason than what Edward Snowden was accused of. Even Snowden has come out and stated bluntly that others go to jail for what Hillary did. How can Hillary claim privacy when she and the Obama Administration have supported the grabbing of every email by the NSA? Why has the press not demanded the NSA turnover all the emails Hillary erased when they have everything?

Read More

by Michael Snyder, End of the American Dream:

The Obama administration is telling us that the unemployment rate in

the United States has fallen to 5.1 percent, but does that number

actually bear any resemblance to reality? On Friday, news outlets all

over America celebrated the fact that the U.S. economy added 173,000

jobs in August. We were told that the unemployment rate has fallen to a

seven year low and that wages are going up. So everything must be

getting better for the middle class, right? After all, isn’t that what

the official numbers are telling us?

The Obama administration is telling us that the unemployment rate in

the United States has fallen to 5.1 percent, but does that number

actually bear any resemblance to reality? On Friday, news outlets all

over America celebrated the fact that the U.S. economy added 173,000

jobs in August. We were told that the unemployment rate has fallen to a

seven year low and that wages are going up. So everything must be

getting better for the middle class, right? After all, isn’t that what

the official numbers are telling us?

The financial markets are buzzing over this news because the unemployment rate has fallen into a range that the Federal Reserve has typically considered to be “full employment”, so there is an expectation that the Fed may raise interest rates shortly. The following comes from Business Insider…

Read More…

The Obama administration is telling us that the unemployment rate in

the United States has fallen to 5.1 percent, but does that number

actually bear any resemblance to reality? On Friday, news outlets all

over America celebrated the fact that the U.S. economy added 173,000

jobs in August. We were told that the unemployment rate has fallen to a

seven year low and that wages are going up. So everything must be

getting better for the middle class, right? After all, isn’t that what

the official numbers are telling us?

The Obama administration is telling us that the unemployment rate in

the United States has fallen to 5.1 percent, but does that number

actually bear any resemblance to reality? On Friday, news outlets all

over America celebrated the fact that the U.S. economy added 173,000

jobs in August. We were told that the unemployment rate has fallen to a

seven year low and that wages are going up. So everything must be

getting better for the middle class, right? After all, isn’t that what

the official numbers are telling us?The financial markets are buzzing over this news because the unemployment rate has fallen into a range that the Federal Reserve has typically considered to be “full employment”, so there is an expectation that the Fed may raise interest rates shortly. The following comes from Business Insider…

Read More…

Global financial markets are being whipsawed from one day to the next

as we get closer to the Federal Reserve’s fateful decision on interest

rates. Maybe everything will calm down on September 17 once investors

learn that Fed officials have decided they’re finally going to raise

interest rates by one-quarter of a percentage point after nearly seven

years of keeping them near zero.

Global financial markets are being whipsawed from one day to the next

as we get closer to the Federal Reserve’s fateful decision on interest

rates. Maybe everything will calm down on September 17 once investors

learn that Fed officials have decided they’re finally going to raise

interest rates by one-quarter of a percentage point after nearly seven

years of keeping them near zero.Or maybe everything will spin even further out of control, with currencies crashing and traders anguishing over devastating losses because they bet wrong; the Fed has opted to wait until December.

Read More

from GoldSeek:

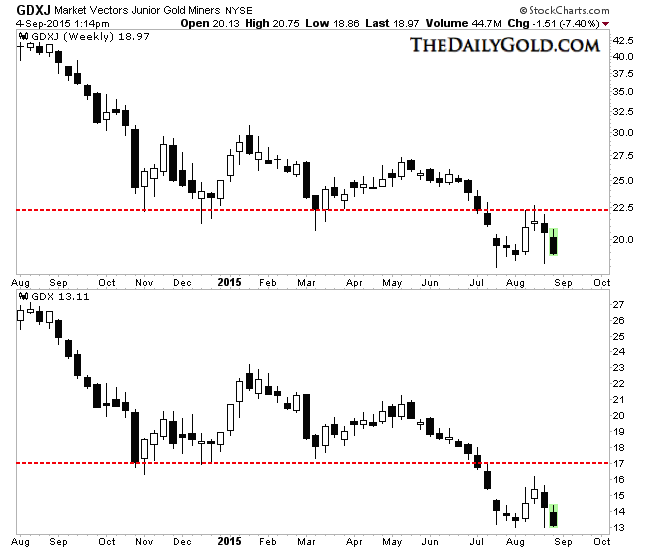

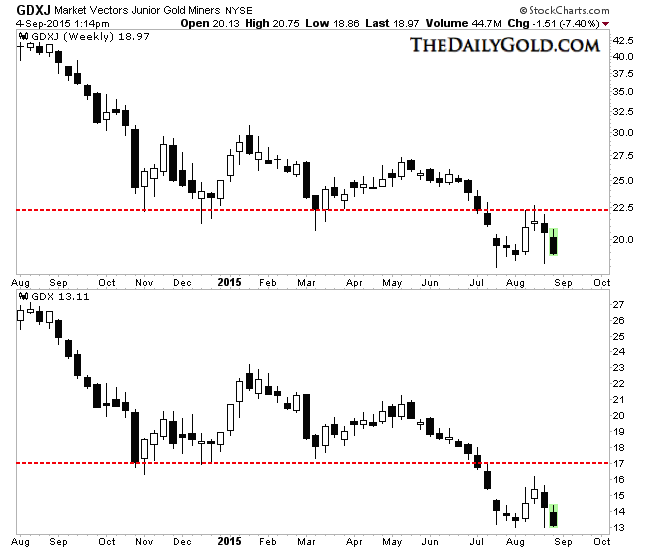

While turmoil in global capital markets may ultimately benefit the

precious metals sector, it certainly is not an immediate catalyst. As

global markets have weakened in recent days so too have precious metals

and precious metals companies. The gold miners are nearing recent lows

ahead of conventional markets while the recoveries in Gold and Silver

appear to be reversing. This could be the start of a final flush that

marks the end of the bear market.

While turmoil in global capital markets may ultimately benefit the

precious metals sector, it certainly is not an immediate catalyst. As

global markets have weakened in recent days so too have precious metals

and precious metals companies. The gold miners are nearing recent lows

ahead of conventional markets while the recoveries in Gold and Silver

appear to be reversing. This could be the start of a final flush that

marks the end of the bear market.

As the last week of summer (unofficially) comes to a close, the near term prognosis in the miners could not be more clear.

Read More

While turmoil in global capital markets may ultimately benefit the

precious metals sector, it certainly is not an immediate catalyst. As

global markets have weakened in recent days so too have precious metals

and precious metals companies. The gold miners are nearing recent lows

ahead of conventional markets while the recoveries in Gold and Silver

appear to be reversing. This could be the start of a final flush that

marks the end of the bear market.

While turmoil in global capital markets may ultimately benefit the

precious metals sector, it certainly is not an immediate catalyst. As

global markets have weakened in recent days so too have precious metals

and precious metals companies. The gold miners are nearing recent lows

ahead of conventional markets while the recoveries in Gold and Silver

appear to be reversing. This could be the start of a final flush that

marks the end of the bear market.As the last week of summer (unofficially) comes to a close, the near term prognosis in the miners could not be more clear.

Read More

Presenting Five Channels Of Contagion From China's Hard Landing

Submitted by Tyler Durden on 09/06/2015 - 14:59 Before China’s bursting equity bubble grabbed international headlines, and before the PBoC’s subsequent devaluation of the yuan served notice to the world that things had officially gotten serious in the global currency wars, all anyone wanted to talk about when it came to China was a "hard landing." Now that the yuan devaluation has all but proven that China has landed, and landed hard, here are the five channels of contagion.

This Is What A Short Squeeze Looks Like

Submitted by Tyler Durden on 09/06/2015 - 16:30 Despite Brent crude prices easing modstly last week, WTI crude gained nearly 2% (after screaming higher the week before). With the 2nd largest speculative short position since 2006 in NYMEX futures and options, the prompt market is significantly unbalanced and extremely susceptible to upside catalysts.

Dow Dip-Buyers Evident After Futures Open With Another Mini-Flash-Crash

Submitted by Tyler Durden on 09/06/2015 - 18:15 As Dow futures opened ahead of this evening's China open (after being closed since Wednesday), it appears someone (or something) decided it was time to test down 100 points to Friday's pre-ramp lows. Of course that mini-flash-crash has now been followed - since stops were run - with a 140 point ripfest, we assume gunning for the stops just above Friday's late-day highs...

Three Reasons Why Saudi Arabia Flip-Flopped On Iran. And Now Supports The US "Nuclear Deal"

Submitted by Tyler Durden on 09/06/2015 - 18:01 To summarize: in order to get the Saudis to "agree" to the Iran deal, all the US had to do is remind King Salman, that as long as oil is where it is to a big extent as a result of Saudi's own record oil production, crushing countless US oil corporations and leading to the biggest layoffs in Texas since the financial crisis, the country will urgently need access to yield-starved US debt investors. If in the process, US corporations can invest in Saudi Arabia (and use the resulting assets as further collateral against which to take out even more debt), while US military corporations sell billions in weapons and ammo to the Saudi army, so much the better.

ESPN: Cutting The Cord Or Political Turn Off?

Submitted by Tyler Durden on 09/06/2015 - 18:45 The catchphrase that seems to be picking up more and more steam is “cutting the cord” when referring to those that are dropping traditional cable TV for viewing choices or alternatives by other means. However, is “cutting the cord” really the reason for ESPN’s loss of millions viewers? Perhaps a large part of the underlying reason is: ESPN (like a few notable others such as NBC™) has seemingly transformed at near hyper-speed from sports reporting – to political sports reporting. The political edge now rampant throughout the shows, games, interviews, et al is overbearing, overburdening, and overdone.filed under (unt

Why Hillary Can't Tell If Her Email Is Classified

Presented with no comment...

Presented with no comment...

11,000 Icelanders Offer To House Syrian Refugees

Submitted by Tyler Durden on 09/06/2015 - 17:15 The Icelandic government is reconsidering its national refugee quota after a social media campaign resulted in over 11,000 Icelanders (the "most peaceful nation in the world") offering up a room in their homes to refugees. As Europe struggles to cope with unprecedented levels of those seeking shelter, residents of the sparsely populated Nordic island country resorted to direct action to pressure their leaders.

The Collapse Of The NY Taxi Cartel

Submitted by Tyler Durden on 09/06/2015 - 15:45 It is interesting that the free market has actually found a way to undermine a cartel that up until recently appeared to be completely safe. In some cities, Uber is being fought tooth and nail to protect the sinecures of the established taxi industry. It is a microcosm of the cronyism that is the rule almost everywhere these days. Just think about how greatly our lives would improve if all the regulations that have been designed for no other reason than to protect established businesses against competition from upstarts were rescinded.from Bill Still:

by Koos Jansen, Bullion Star:

The UK net exported a record 32.4 tonnes of gold directly to China mainland in June 2015.

In 2014 the conventional conduits of bullion flows to China, from all around the world first to Hong Kong and then to the mainland, have been replaced by direct exports. For example, the UK is exporting bullion directly to China since April 2014 – as I reported at the time. The result of the rearrangement in these gold flows is that Hong Kong’s export to the mainland has lost its accuracy as an indicator for China’s gold hunger. In a few posts we’ll have a look at trade data from several gold exporting nations and trading hubs to grasp how much gold China is importing this year.

Starting April last year, UK shipments of gold directly to China have been going up. In June 2015 the UK net exported a record 32.4 tonnes of gold to China, up 6.5 % m/m, up 116 % y/y.

Read More

The UK net exported a record 32.4 tonnes of gold directly to China mainland in June 2015.

In 2014 the conventional conduits of bullion flows to China, from all around the world first to Hong Kong and then to the mainland, have been replaced by direct exports. For example, the UK is exporting bullion directly to China since April 2014 – as I reported at the time. The result of the rearrangement in these gold flows is that Hong Kong’s export to the mainland has lost its accuracy as an indicator for China’s gold hunger. In a few posts we’ll have a look at trade data from several gold exporting nations and trading hubs to grasp how much gold China is importing this year.

Starting April last year, UK shipments of gold directly to China have been going up. In June 2015 the UK net exported a record 32.4 tonnes of gold to China, up 6.5 % m/m, up 116 % y/y.

Read More

Take note of the white hand on the right...that the Black guy that did the shooting had...

Also notice the lack of movement of the victim while being hit with bullets...

from ron johnson:

This slow motion recount clearly shows that NO BULLET CASINGS eject from the “weapon.”

This slow motion recount clearly shows that NO BULLET CASINGS eject from the “weapon.”

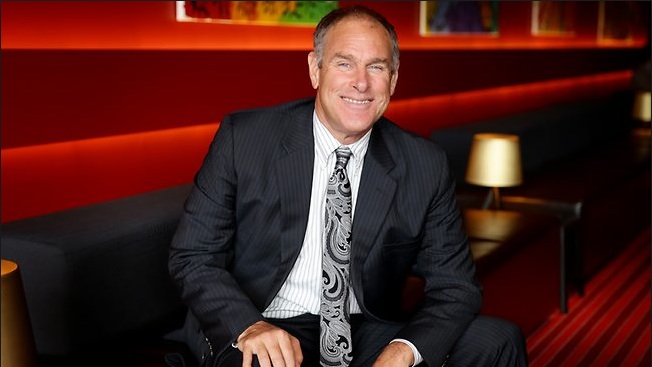

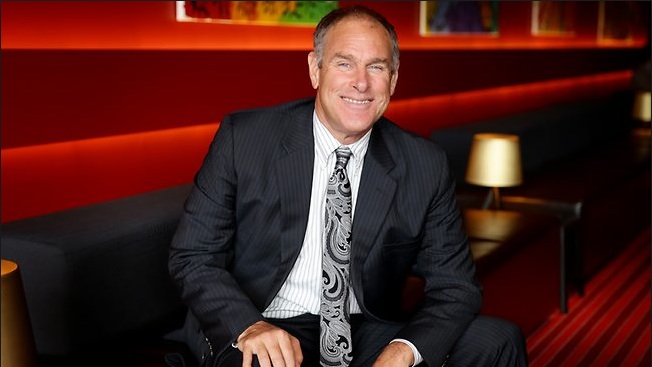

from KingWorldNews:

Rick is known as one of the most “street-smart” people in the natural

resource sector and gold world with nearly 40 years of experience.

Sprott Asset Management USA Inc. manages over a billion and through

acquisition is now part of the $7 billion Sprott Asset Management LP.

Sprott Asset Management USA Inc. provides investment advice and

brokerage services to high net worth individuals, institutional

investors and corporate entities worldwide. Rick and his team are also

successfully involved in agriculture, alternative energy, conventional

energy, forestry, infrastructure, mining and water resources investing

on a world wide basis.

Rick is known as one of the most “street-smart” people in the natural

resource sector and gold world with nearly 40 years of experience.

Sprott Asset Management USA Inc. manages over a billion and through

acquisition is now part of the $7 billion Sprott Asset Management LP.

Sprott Asset Management USA Inc. provides investment advice and

brokerage services to high net worth individuals, institutional

investors and corporate entities worldwide. Rick and his team are also

successfully involved in agriculture, alternative energy, conventional

energy, forestry, infrastructure, mining and water resources investing

on a world wide basis.

Read More/Audio Interview @ KingWorldNews.com

Rick is known as one of the most “street-smart” people in the natural

resource sector and gold world with nearly 40 years of experience.

Sprott Asset Management USA Inc. manages over a billion and through

acquisition is now part of the $7 billion Sprott Asset Management LP.

Sprott Asset Management USA Inc. provides investment advice and

brokerage services to high net worth individuals, institutional

investors and corporate entities worldwide. Rick and his team are also

successfully involved in agriculture, alternative energy, conventional

energy, forestry, infrastructure, mining and water resources investing

on a world wide basis.

Rick is known as one of the most “street-smart” people in the natural

resource sector and gold world with nearly 40 years of experience.

Sprott Asset Management USA Inc. manages over a billion and through

acquisition is now part of the $7 billion Sprott Asset Management LP.

Sprott Asset Management USA Inc. provides investment advice and

brokerage services to high net worth individuals, institutional

investors and corporate entities worldwide. Rick and his team are also

successfully involved in agriculture, alternative energy, conventional

energy, forestry, infrastructure, mining and water resources investing

on a world wide basis.Read More/Audio Interview @ KingWorldNews.com

from Natural News:

In an increasingly globalized world, and especially for a country whose

president plays loose and fast with the nation’s immigration laws,

there is always a concern about so-called “lone wolf” terrorism – a

single person using some sort of weapon to cause mass casualties as

quickly as possible. (Republished from NationalSecurity.news.)

In an increasingly globalized world, and especially for a country whose

president plays loose and fast with the nation’s immigration laws,

there is always a concern about so-called “lone wolf” terrorism – a

single person using some sort of weapon to cause mass casualties as

quickly as possible. (Republished from NationalSecurity.news.)

The weapon of choice for a lone wolf terrorist is most often a firearm, as Americans witnessed recently in Chattanooga, Tennessee, when Mohammad Abdulazeez used a military-look-alike rifle to shoot and kill four Marines and a Navy sailor at a recruiting center, or when a radicalized Islamist Army officer used a handgun to kill 13 and wound 30 at Fort Hood, Texas, in November 2009.

Read More

In an increasingly globalized world, and especially for a country whose

president plays loose and fast with the nation’s immigration laws,

there is always a concern about so-called “lone wolf” terrorism – a

single person using some sort of weapon to cause mass casualties as

quickly as possible. (Republished from NationalSecurity.news.)

In an increasingly globalized world, and especially for a country whose

president plays loose and fast with the nation’s immigration laws,

there is always a concern about so-called “lone wolf” terrorism – a

single person using some sort of weapon to cause mass casualties as

quickly as possible. (Republished from NationalSecurity.news.)The weapon of choice for a lone wolf terrorist is most often a firearm, as Americans witnessed recently in Chattanooga, Tennessee, when Mohammad Abdulazeez used a military-look-alike rifle to shoot and kill four Marines and a Navy sailor at a recruiting center, or when a radicalized Islamist Army officer used a handgun to kill 13 and wound 30 at Fort Hood, Texas, in November 2009.

Read More

Premiums on silver over the past weeks have exploded! Generally speaking, 10-25%+ seems to be the norm and anywhere from two – six weeks delay for delivery. We have talked about the dichotomy between silver being panic “sold” and “shortages” occurring simultaneously. In a free market, this is an impossibility.

What I’d like to do today is get you to think forward or around the corner. If premiums exist today in what has been a declining market, what will happen in a rising market?

If we look at the move in 1980 when silver traded to $50, what was the backdrop? There was actually more silver above ground (we still had Manhattan project silver as supply) and the uses were far less than they are today. Also, the amount of debt, money supply “people” with a living standard high enough to buy silver were much smaller than today. Debt and money supply have risen maybe tenfold and those with the ability to purchase silver around the world has at least doubled, maybe even tripled.

If there are currently very high premiums for real metal, is this a function of low prices? The answer is yes and no. (I am not hedging as you will soon see). Premiums are a function of real demand being greater than real supply. The premium has risen presumably because the gap between supply and demand is widening and sellers are less willing to let go of product as the price approaches zero.

Now, what would happen to premiums if the same supply demand dynamics were applied, but rather than the price declining …it was rising? In a rising market, buyers will pay a premium out of fear! This fear will arise not only because other assets are crashing around them but because owners of fiat don’t want to be stuck with something worthless. The other side of the coin, the supply side, will also be a source of fear. “Fear” of metal going “no offer” (which it will) and having no exit door at all!

We will very soon see a new currency regimes and even new currencies to replace old and tired ones. Any new currency MUST have the confidence of the public in order to be accepted. In my mind, the litmus test as to whether a new currency is accepted is whether or not holders of gold or silver will sell part of their hoard for paper currency.

You may be shocked with the current 25% premiums in silver, don’t be. You might ask yourself “what is the price of silver”? Is it COMEX/LBMA pricing or is it whatever you must pay to get it into your hands? You might mistakenly at first quote the paper price. In the near future you will have no question what the “price” is. This is an exercise in sharks (Goldman) eating sharks. In silver, there are no more little fish left and even many of the previous sharks are no more. The day where those who hold (real silver) and choose not to sell is close at hand. OWNERS of silver will be the ones pricing it. You will have no questions as to what the “price” really is. In fact, the term “discount” will be applied to paper rather than “premium” to physical.

Standing Watch,

Bill Holter

Holter-Sinclair collaboration

Comments welcome! bholter@hotmail.com

/

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment