from Dollar Collapse:

Some major banks — which over the past few decades have grown into the biggest financial entities the world has ever seen — appear to have hit a wall, and are now shedding tens of thousands of workers. Some recent examples:

Some major banks — which over the past few decades have grown into the biggest financial entities the world has ever seen — appear to have hit a wall, and are now shedding tens of thousands of workers. Some recent examples:

Barclays plans to cut more than 30,000 jobs

(CNBC) – Barclays plans to cut more than 30,000 jobs within two years after firing Chief Executive Antony Jenkins this month, The Times reported on Sunday.

This redundancy program, which could reduce the bank’s global workforce below 100,000 by 2017 end, is considered as the only way to address the bank’s chronic underperformance and double its share price, the newspaper said, citing senior sources.

Read More

by Pam Martens and Russ Martens, Wall Street on Parade:

While the U.S. taxpayer was involuntarily shoveling over $2 trillion in bailout funds and loans into Citigroup from 2008 to 2010, the bank was committing at least one admitted felony on its foreign currency trading desk. And if ongoing testimony in a London court is to be believed, the U.S. Justice Department could have brought charges against individuals instead of settling its case for one single felony charge against the banking unit only.

Citigroup’s banking unit, Citicorp, along with three other global banks (JPMorgan Chase, Barclays and RBS) admitted to a felony charge of rigging the foreign currency market brought by the U.S. Justice Department on May 20. Approximately $5 trillion in foreign currency trades are made globally each day, with billions of dollars to be made through advance knowledge of where prices will be fixed.

Read More

While the U.S. taxpayer was involuntarily shoveling over $2 trillion in bailout funds and loans into Citigroup from 2008 to 2010, the bank was committing at least one admitted felony on its foreign currency trading desk. And if ongoing testimony in a London court is to be believed, the U.S. Justice Department could have brought charges against individuals instead of settling its case for one single felony charge against the banking unit only.

Citigroup’s banking unit, Citicorp, along with three other global banks (JPMorgan Chase, Barclays and RBS) admitted to a felony charge of rigging the foreign currency market brought by the U.S. Justice Department on May 20. Approximately $5 trillion in foreign currency trades are made globally each day, with billions of dollars to be made through advance knowledge of where prices will be fixed.

Read More

T-Minus One Day: How Were The Markets Positioned The Day Before The Last Three Rate Hikes

Submitted by Tyler Durden on 09/16/2015 - 09:43

Axel Merk Warns "Investors Are In For A Rude Awakening"

Submitted by Tyler Durden on 09/16/2015 - 09:25 Will she raise or will she not? As financial markets focus on whether we will see a Fed rate hike this week, investors may be in for a rude awakening. The gold market is out of whack. The table below presents the settlement prices for Comex gold at the Friday close last week.

The gold market is out of whack. The table below presents the settlement prices for Comex gold at the Friday close last week.You can see that it is cheaper to buy gold for delivery in December than it is to purchase the spot contract. Gold is in backwardation, which of course is abnormal.

The following table shows the settlement prices for yesterday. The backwardation eased somewhat in that only November delivery is below spot, but Comex has been reporting anomalies like this for a while now.

Read More

"The End Of The EU": Merkel's "Heroic" Refugee Response May Destroy Union, Slovakia Warns

Submitted by Tyler Durden on 09/16/2015 - 09:06

Silver & Gold Jump, Dollar Dumps After CPI Disappoints

Submitted by Tyler Durden on 09/16/2015 - 08:46

from Anthony Antonello:

A Russian Bank has been caught using fake gold and had it’s license pulled. Just imagine if more people knew that gold might not be a good hedge for the fact that it might not be real gold.

A Russian Bank has been caught using fake gold and had it’s license pulled. Just imagine if more people knew that gold might not be a good hedge for the fact that it might not be real gold.

from Mike Maloney:

Fed Enters Rate Hike Meeting With First Headline Deflation Since January

Submitted by Tyler Durden on 09/16/2015 - 08:38 As the final inflation data before the FOMC decision, some have argued that this print matters most as an excuse to stay in 'emergency mode' - perhaps they are right. Consumer Prices dropped 0.1% (as expected) in August - this is the first 'deflation' since January - great news for consumers. Gasoline and airline tickets saw the biggest drops dragging down YoY CPI but The Fed will shrug its "transitory" shoulders but ex-food-and-energy did miss expectations, rising 1.8% YoY (against 1.9% exp). Notably food prices rose 0.2% in August, driven by a surge in egg prices. So WWJYD?

from SRS Rocco:

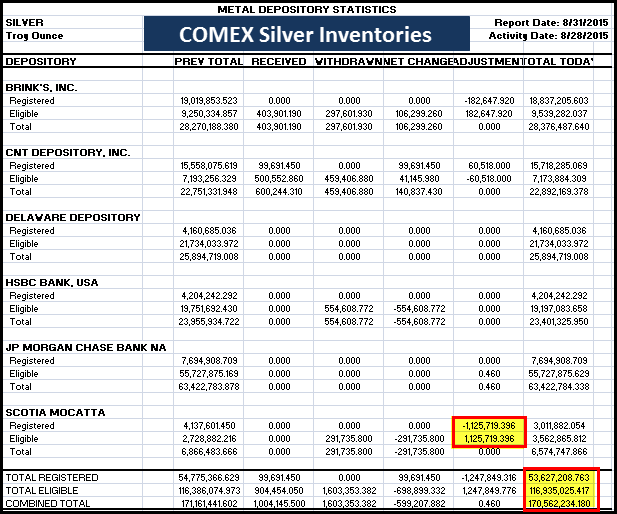

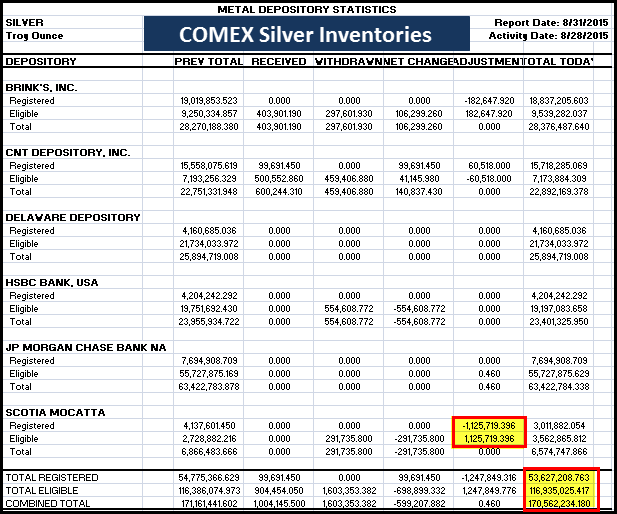

While the drain of COMEX gold and silver Registered inventories continues as demand for physical precious metals increases, JP Morgan experienced a 45% decline of its Registered Gold Inventories in one day. JP Morgan now only has a lousy 10,777 oz of gold remaining in its Registered gold inventories.

Basically, JP Morgan holds 1/3 metric ton of gold in its Registered inventories. This is the reason we are seeing the paper gold ratio on the COMEX above the 250/1 ratio. If we look at the COMEX warehouse table below, we can see just how little Registered Gold remains on the exchange:

Read More…

While the drain of COMEX gold and silver Registered inventories continues as demand for physical precious metals increases, JP Morgan experienced a 45% decline of its Registered Gold Inventories in one day. JP Morgan now only has a lousy 10,777 oz of gold remaining in its Registered gold inventories.

Basically, JP Morgan holds 1/3 metric ton of gold in its Registered inventories. This is the reason we are seeing the paper gold ratio on the COMEX above the 250/1 ratio. If we look at the COMEX warehouse table below, we can see just how little Registered Gold remains on the exchange:

Read More…

from Wolf Street:

Stocks, bonds, real estate, classic cars, art, credits at Ashley Madison,

whatever… nearly everything except commodities has soared over the past

six years, perhaps not in lockstep exactly, with one moving ahead while

others were still declining, but by last year, just about every asset

class had soared to all-time record highs.

Stocks, bonds, real estate, classic cars, art, credits at Ashley Madison,

whatever… nearly everything except commodities has soared over the past

six years, perhaps not in lockstep exactly, with one moving ahead while

others were still declining, but by last year, just about every asset

class had soared to all-time record highs.

Asset price inflation, the express goal of the monetary policies set by the Fed and other central banks, worked for a long time. If you got in early, it was one heck of a ride up. If you had a billion bucks in early 2009, you’re now sitting on multiple billions, without having had to think all that much.

Read More

Stocks, bonds, real estate, classic cars, art, credits at Ashley Madison,

whatever… nearly everything except commodities has soared over the past

six years, perhaps not in lockstep exactly, with one moving ahead while

others were still declining, but by last year, just about every asset

class had soared to all-time record highs.

Stocks, bonds, real estate, classic cars, art, credits at Ashley Madison,

whatever… nearly everything except commodities has soared over the past

six years, perhaps not in lockstep exactly, with one moving ahead while

others were still declining, but by last year, just about every asset

class had soared to all-time record highs.Asset price inflation, the express goal of the monetary policies set by the Fed and other central banks, worked for a long time. If you got in early, it was one heck of a ride up. If you had a billion bucks in early 2009, you’re now sitting on multiple billions, without having had to think all that much.

Read More

OECD Joins Chorus Of Global Confusion, Slashes Growth Forecasts As It Urges Rate Hike

Submitted by Tyler Durden on 09/16/2015 - 08:12 The OECD is well aware of the possibility that a Fed hike could plunge emerging markets into chaos. Nevertheless, the time to hike is apprently now...

Global Trade Bellwether FedEx Misses, Cuts Outlook, Blames Weak Industry Demand, Higher Wages

Submitted by Tyler Durden on 09/16/2015 - 07:59 Every quarter we pay particular interest to the results reported by Fedex not only due to its position as the leading company in worldwide logistics but due to its status as a bellwether in global trade. And not surprisingly, following a bevy of reports here and elsewhere confirming the plunge in global trade, Fedex did not disappoint, or rather it did when it reported non-GAAP EPS of $2.42 missing already reduced consensus expectations of $2.45, but it also cut its full year 2016 EPS guidance from $10.60-$11.10 to $10.40-$10.90 (below the consensus $10.83) proving yet again that hopes for EPS growth are just as misplaced as those for multiple expansion at a time when the Fed is preparing to hike rates and as China unleashes Quantitative Tightening.

China Plunge Protectors Unleash Berserk Buying Spree In Last Hour Of Trading As Fed Meeting Begins

Submitted by Tyler Durden on 09/16/2015 - 07:04 Ffor whatever reason starting in the last hour of trading and continuing until the close, the Shanghai Composite - after trading largely unchanged - went from red on the day to up 4.9% after hitting 5.9% minutes before the close - the biggest one day surge since March 2009 - and nearly erasing the 6.1% drop from the past two days in just about 60 minutes of trading, providing a solid hour of laughter to bystanders and observers in the process.

S&P Downgrades Japan From AA- To A+ On Doubts Abenomics Will Work - Full Text

Submitted by Tyler Durden on 09/16/2015 - 06:21 Who would have thought that decades of ZIRP, an aborted attempt to hike rates over a decade ago, and the annual monetization of well over 10% of sovereign debt would lead to a toxic debt spiral, regardless of how many "Abenomics" arrows one throws at it? Apparently Standard and Poors just had its a-ha subprime flashbulb moment and moments ago, a little over 4 years after it downgraded the US from its legendary AAA-rating which led to angry phone calls from Tim Geithner and a painful US government lawsuit, downgraded Japan from AA- to A+. The reason: rising doubt Abenomics is working.

Comexodus: JPMorgan's Vault Is One Withdrawal Away From Running Out Of Deliverable Gold

Submitted by Tyler Durden on 09/16/2015 - 01:42 As of this moment JPMogan has only 335 kilograms of deliverable gold, or just 27 "good delivery" bricks, left. It is just one withdrawal request away from running out of registered physical gold.

09/16/2015 - 00:42

America Wanted War … Not a Negotiated Peacfrom TheMoneyGPS:

by Claire Bernish, Activist Post:

What do Syria, New Jersey, Lord Jacob Rothschild, and former Governor of New Mexico Bill Richardson have in common?

Besides sounding like the introduction to a wince-worthy conspiracy quip, the most elementary answer is also nauseatingly cliche as an explanation for the penchant the U.S. government displays for inserting itself in the domestic affairs of nearly every country in the Middle East:

Oil.

Afek, a subsidiary of New Jersey-based Genie Energy, Ltd., announced the discovery of a large liquid oil reservoir and requested an extension of its exploration license for areas in “Northern Israel.”

Read More

What do Syria, New Jersey, Lord Jacob Rothschild, and former Governor of New Mexico Bill Richardson have in common?

Besides sounding like the introduction to a wince-worthy conspiracy quip, the most elementary answer is also nauseatingly cliche as an explanation for the penchant the U.S. government displays for inserting itself in the domestic affairs of nearly every country in the Middle East:

Oil.

Afek, a subsidiary of New Jersey-based Genie Energy, Ltd., announced the discovery of a large liquid oil reservoir and requested an extension of its exploration license for areas in “Northern Israel.”

Read More

from USA Watchdog:

Former Reagan Administration budget director David Stockman says the biggest crash coming is not going to be in the stock market.

Stockman warns, “I think we are headed for a central calamity. The central banks of the world have been on a 20 year campaign to massively expand their balance sheets and intrude into financial markets in ways that were never before imagined. In the process, they falsified every asset value there is from overnight money all the way to 30-year bonds and the stock market. Everything now is trading off the central banks, but the central banks have hit the end of the road. They have printed so much money and created such a massive global bubble that we are now in the process of that bubble fracturing. The central banks are now beginning to become confused and panicked about what to do. The Chinese have no idea what to do with their $28 trillion credit bubble and that house of cards in China. Our Fed is now on the verge of another meeting where they are debating if 80 months of 0% interest rates is enough. That is crazy.”

Former Reagan Administration budget director David Stockman says the biggest crash coming is not going to be in the stock market.

Stockman warns, “I think we are headed for a central calamity. The central banks of the world have been on a 20 year campaign to massively expand their balance sheets and intrude into financial markets in ways that were never before imagined. In the process, they falsified every asset value there is from overnight money all the way to 30-year bonds and the stock market. Everything now is trading off the central banks, but the central banks have hit the end of the road. They have printed so much money and created such a massive global bubble that we are now in the process of that bubble fracturing. The central banks are now beginning to become confused and panicked about what to do. The Chinese have no idea what to do with their $28 trillion credit bubble and that house of cards in China. Our Fed is now on the verge of another meeting where they are debating if 80 months of 0% interest rates is enough. That is crazy.”

/

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment