Submitted by Tyler Durden on 09/24/2015 - 15:54 Did Goldman just hand out the blueprint to crush the next "Lehman" and unleash the next global bailout? Read on to find out.

It could never happen here right...

Caught On Tape: Anarchy - When Chicken Prices Hit Record Highs

Submitted by Tyler Durden on 09/24/2015 - 16:25 We have all watched the dramatic and disturbing scenes from Venezuela as 'average joes' fight over the last bar of soap or sheet of toilet paper as prices soar beyond anyone's control... and said "that could never happen here." Well with stealth-flation leaking into everyday prices wherever you look (as long as 'you' are not The Fed), we may have just witnessed the awakening. With prices for chicken having hit record highs, residents of America are brawling over the last winged feast...

Half Of Americans Think "Government Is An Immediate Threat To Liberty"

Submitted by Tyler Durden on 09/24/2015 - 19:05 Government poses a threat to liberty, that much is clear. But what may be surprising is that almost half of Americans clearly identified government as a clear and “immediate” threat, and are obviously outraged about what is going on. It is time that Americans embrace their anger at government, and focus their attention past the politicians to the real problem. Start with the bankers, follow the money, and see where it goes...

The Oligarch Recovery: 30 Million Americans Have Tapped Retirement Savings Early In Last Year

Submitted by Tyler Durden on 09/24/2015 - 17:10 The ongoing oligarch theft labeled an “economic recovery” by pundits, politicians and mainstream media alike, is one of the largest frauds we’ve witnessed in my life. The reality of the situation is finally starting to hit home, and the proof is now undeniable. So now we know what has kept meager spending afloat during this pitiful “recovery.” A combination of “alternative loans” and a bleeding of retirement accounts. The transformation of the public into a horde of broke debt serfs is almost complete.

Janet Yellen Falters During Speech, Receives Medical Attention, All-Clear Given

Submitted by Tyler Durden on 09/24/2015 - 18:30 "Yellen faltered at end of her speech. Last page was agonizing. I don't think she felt well but she seemed better when she left the stage."

Presenting The "QE Infinity Paradox", Or "The Emperor Is Naked, Long Live The Emperor"

Submitted by Tyler Durden on 09/24/2015 - 18:30 When you tie the reflexivity problem in with the fact that the excessive use of counter-cyclical policy is leading to the creation of ever larger asset bubbles by effectively short circuiting the market's natural ability to purge speculative excess and correct the misallocation of capital, what you get is a never-ending loop whereby the consequences of unconventional monetary policy serve as the excuse for doubling and tripling down on those same policies.

Uncomfortably Revisiting Yellen's Bubble Doctrine

Submitted by Tyler Durden on 09/24/2015 - 18:00 There is growing turmoil in buybacks that threatens the very fabric of the stock bubble. That was always the primary transmission of the foundation of its current manifestation, corporate debt, into asset prices; especially the huge run following QE3 and QE4. The problem once momentum fades is that investor attention turns toward valuations that were repeatedly ignored before. As long as everything is moving upward and any fundamental downside is completely contained (in perception) as “transitory” then valuations are easily set aside as one form of rationalization. The effect of reversing momentum is for a more honest measurement; particularly by force of change in economic sentiment which is almost always concurrent.

The One Phrase That Actually Matters In Yellen's Speech: "Nominal Interest Rates Cannot Go Much Below Zero"

Submitted by Tyler Durden on 09/24/2015 - 17:59 "...the federal funds rate and other nominal interest rates cannot go much below zero, since holding cash is always an alternative to investing in securities. ... the lowest the FOMC can feasibly push the real federal funds rate is essentially the negative value of the inflation rate. As a result, the Federal Reserve has less room to ease monetary policy when inflation is very low. This limitation is a potentially serious problem because severe downturns such as the Great Recession may require pushing real interest rates far below zero for an extended period to restore full employment at a satisfactory pace."All The Gold In The World

Yellen "Do-Over" Speech - Live Feed

Submitted by Tyler Durden on 09/24/2015 - 17:29 When risk sold off last week in the wake of the Fed’s so-called “clean relent,” it signalled at best a policy mistake and at worst the loss of any and all credibility. Tonight, Yellen gets a do-over.

Bank of Spain Responds, Promises It Is Not Confiscating Catalonia's Gold

Submitted by Tyler Durden on 09/24/2015 - 16:45 "Good morning. Nothing extraordinary happened yesterday in the building of Banco de España in Barcelona"...Gold Pops, Dollar Drops, As CATastrophe Slaps Stocks Ahead Of Yellen "Do-Over" Speech

Submitted by Tyler Durden on 09/24/2015 - 16:06

The VW Scandal Is Bad News For Diesel

Submitted by Tyler Durden on 09/24/2015 - 15:25 The outlook for diesel looks grim after U.S. regulators found that the world’s second biggest car manufacturer cheated on its emission tests. Now that diesel is not as clean as it appeared (with stricter emissions tests and perhaps even stricter regulation to be expected), one has to ask; does this mean the end of diesel for light vehicles? This is not just alarming for the automotive industry, but could also lead to a structural demand shift in fuel products. That shift could not have come at a worse time for diesel.

Bubble Machine Timeline: Visual Evidence Of The Fed's "Third Mandate"

Submitted by Tyler Durden on 09/24/2015 - 15:05 The problem with rushing to combat any sign of economic or financial market turmoil by resorting immediately to counter-cyclical policies is that the creative destruction that would normally serve to purge speculative excess isn’t allowed to operate and so, misallocated capital is allowed to linger from crisis to crisis, making the next boom and subsequent bust even larger than the last. The

sudden end of the Fed’s ambition to raise interest rates above the zero

bound, coupled with the FOMC’s minutes, which expressed concerns about

emerging market economies, has got financial scribblers writing about

negative interest rate policies (NIRP).

The

sudden end of the Fed’s ambition to raise interest rates above the zero

bound, coupled with the FOMC’s minutes, which expressed concerns about

emerging market economies, has got financial scribblers writing about

negative interest rate policies (NIRP).Coincidentally, Andrew Haldane, the chief economist at the Bank of England, published a much commented-on speech giving us a window into the minds of central bankers, with zero interest rate policies (ZIRP) having failed in their objectives.

Read More

Pope Francis is a screaming, monstrous hypocrite. He prattles on before Congress about global warming and a move away from fossil fuels.

Pope Francis is a screaming, monstrous hypocrite. He prattles on before Congress about global warming and a move away from fossil fuels.The truth is this: The bedrock of modern civilized society is reliable, 24×7 electrical power.

Why? Because with it you obtain modern refrigeration and clean, always-available potable water at the point-of-use which is the item in modern society that has had more impact on the quality of life than any other.

Read More

from Talk Digital Network:

from Financial Survival Network:

What’s Not Imploding Now with Andrew Hoffman:

What’s Not Imploding Now with Andrew Hoffman:

Get the details on:

Collapsing mine production, exploding PM demand

Yesterday’s and today’s articles

Post Fed “no hike”

Greek elections

Plunging commodities! all-time low currencies!

75% of Americans are concerned about out of control government corruption.

Over half of Americans fear their government.

Click HERE To Listen

What’s Not Imploding Now with Andrew Hoffman:

What’s Not Imploding Now with Andrew Hoffman:Get the details on:

Collapsing mine production, exploding PM demand

Yesterday’s and today’s articles

Post Fed “no hike”

Greek elections

Plunging commodities! all-time low currencies!

75% of Americans are concerned about out of control government corruption.

Over half of Americans fear their government.

Click HERE To Listen

from GoldSeek:

Those who see gold as a faded commodity investment with little future have already cut bait … and probably stopped reading at the end of the last paragraph.

Read More

Which of these best defines your thinking during periods when it seems failure is the likely option?

-

If at first you don’t succeed … cut bait and scram.

-

The race doesn’t always go to the swiftest of foot but the surest of step.

Those who see gold as a faded commodity investment with little future have already cut bait … and probably stopped reading at the end of the last paragraph.

Read More

from Survival Blog:

I sometimes hear misguided individuals who repeat the statement going around that if the grid goes down we will be thrown back to the days before electricity: The 1880s. The prevalent thought is that folks back then did fine so it wouldn’t be so bad for us to simply revert to that level of technology. Well, what if we examine your day in a post grid failure scenario? Here is a reality check for you to consider:

Let us say you get up ‘the day after’ and you’re cold. Bummer. Well, in the 1880s if you got up and you were cold you would simply grab an armload of firewood from the neatly stacked woodpile out in the back yard and…wait a minute.

Read More

I sometimes hear misguided individuals who repeat the statement going around that if the grid goes down we will be thrown back to the days before electricity: The 1880s. The prevalent thought is that folks back then did fine so it wouldn’t be so bad for us to simply revert to that level of technology. Well, what if we examine your day in a post grid failure scenario? Here is a reality check for you to consider:

Let us say you get up ‘the day after’ and you’re cold. Bummer. Well, in the 1880s if you got up and you were cold you would simply grab an armload of firewood from the neatly stacked woodpile out in the back yard and…wait a minute.

Read More

from SilverSeek:

In this article, I will explain first how and why silver bullion premiums have aggressively increased since the middle of summer 2015 AND how and what I am doing to take advantage of the current premiums via a bullion form sell and buy arbitrage.

So why are silver premiums so damn high right now?!

In short silver premiums have increased due to a recent combination of higher Silver Bullion Demand & lower Silver Bullion Supplies.

Silver’s paper spot price has recently fallen to 6+ year lows (touching a low price near $14 oz USD) yet physical silver bullion prices have not fallen. Instead silver bullion prices have remained flat due to a recent lack of physical bullion supplies and higher investor demand.

Read More

In this article, I will explain first how and why silver bullion premiums have aggressively increased since the middle of summer 2015 AND how and what I am doing to take advantage of the current premiums via a bullion form sell and buy arbitrage.

So why are silver premiums so damn high right now?!

In short silver premiums have increased due to a recent combination of higher Silver Bullion Demand & lower Silver Bullion Supplies.

Silver’s paper spot price has recently fallen to 6+ year lows (touching a low price near $14 oz USD) yet physical silver bullion prices have not fallen. Instead silver bullion prices have remained flat due to a recent lack of physical bullion supplies and higher investor demand.

Read More

from DAHBOO777:

Texas Republican Rep. Brian Babin introduced a bill that seeks to halt “refugee” resettlement in the US until a “thorough assessment of the costs and dangers of the process is conducted.”

Texas Republican Rep. Brian Babin introduced a bill that seeks to halt “refugee” resettlement in the US until a “thorough assessment of the costs and dangers of the process is conducted.”

from Peter Schiff:

by Gary Christenson, Gold Silver Worlds:

Simple version: Gold is good. Sovereign debt is bad.

The world has added approximately $60 Trillion in debt since 2007, much of it sovereign debt created from deficit spending on social programs, wars, and much more. In that time the world has mined perhaps 30,000 tons of gold, or about 950 million ounces, worth at September 2015 prices a little more than a $Trillion. It is easy to create debt – central banks “print” currencies by BORROWING those currencies into existence. Debt increases, currency in circulation increases, and until it crashes, life is good for the financial and political elite. But debt increasing 60 times more rapidly than gold indicates that debt is growing too rapidly and due for a reset.

Read More

Simple version: Gold is good. Sovereign debt is bad.

The world has added approximately $60 Trillion in debt since 2007, much of it sovereign debt created from deficit spending on social programs, wars, and much more. In that time the world has mined perhaps 30,000 tons of gold, or about 950 million ounces, worth at September 2015 prices a little more than a $Trillion. It is easy to create debt – central banks “print” currencies by BORROWING those currencies into existence. Debt increases, currency in circulation increases, and until it crashes, life is good for the financial and political elite. But debt increasing 60 times more rapidly than gold indicates that debt is growing too rapidly and due for a reset.

Read More

by Louis Cammarosano, Smaulgld:

India’s plan aims to reduce gold demand in physical form.

India’s plan aims to reduce gold demand in physical form.

The Indian Goverment will entice its citizens to turn their gold in exchange for interest bearing Sovereign Gold Bonds.

Will it work?

India Plans To Wrest the Gold From its Citizens

It is estimated that Indian households are in possession of over 20,000 tonnes of gold. The Indian goverment itself has under 600 tonnes. India plans to monetize some of its citizen’s gold under a plan recently passed by the Indian government. They hope to entice Indians to turn in some of their gold for interest bearing bonds. It won’t be easy.

Read More

India’s plan aims to reduce gold demand in physical form.

India’s plan aims to reduce gold demand in physical form.The Indian Goverment will entice its citizens to turn their gold in exchange for interest bearing Sovereign Gold Bonds.

Will it work?

India Plans To Wrest the Gold From its Citizens

It is estimated that Indian households are in possession of over 20,000 tonnes of gold. The Indian goverment itself has under 600 tonnes. India plans to monetize some of its citizen’s gold under a plan recently passed by the Indian government. They hope to entice Indians to turn in some of their gold for interest bearing bonds. It won’t be easy.

Read More

by Jeff Nielson, Sprott Money

Clearly the title to this piece will be viewed as controversial, if not

entirely heretical, by many readers. However, the facts (and more

importantly) the economic principles here are unequivocal. “Bigger” is

not better.

Clearly the title to this piece will be viewed as controversial, if not

entirely heretical, by many readers. However, the facts (and more

importantly) the economic principles here are unequivocal. “Bigger” is

not better.

“Small business is the biggest job-creator in the economy.” This is such a universally known proverb of economics that the corrupt politicians of our current era still preach this wisdom, even though they practice the exact opposite: throttling Small Business at every juncture, while they relentlessly feed the insatiable maw of Big Business.

Read More

Clearly the title to this piece will be viewed as controversial, if not

entirely heretical, by many readers. However, the facts (and more

importantly) the economic principles here are unequivocal. “Bigger” is

not better.

Clearly the title to this piece will be viewed as controversial, if not

entirely heretical, by many readers. However, the facts (and more

importantly) the economic principles here are unequivocal. “Bigger” is

not better.“Small business is the biggest job-creator in the economy.” This is such a universally known proverb of economics that the corrupt politicians of our current era still preach this wisdom, even though they practice the exact opposite: throttling Small Business at every juncture, while they relentlessly feed the insatiable maw of Big Business.

Read More

by Dave Kranzler, Investment Research Dynamics:

Are you prepared for impact? One of my readers alerted me to the fact

that someone bought 15,000 January 2016, 80-strike puts on the HYG high

yield bond ETF. That’s a $1.6 million cash bet on an event that has not

occurred since July 2009.

Are you prepared for impact? One of my readers alerted me to the fact

that someone bought 15,000 January 2016, 80-strike puts on the HYG high

yield bond ETF. That’s a $1.6 million cash bet on an event that has not

occurred since July 2009.

The high yield bond indices are rolling over quickly. As the graph below shows, after the QE-driven big bounce from the 2008 collapse in the financial markets, the high yield market has largely drifted sideways since the middle of 2010. Energy bonds represent about 15% of the high yield market. But the junk bond market actually began slowly rolling over a full year before the price of oil collapsed:

Read More

Are you prepared for impact? One of my readers alerted me to the fact

that someone bought 15,000 January 2016, 80-strike puts on the HYG high

yield bond ETF. That’s a $1.6 million cash bet on an event that has not

occurred since July 2009.

Are you prepared for impact? One of my readers alerted me to the fact

that someone bought 15,000 January 2016, 80-strike puts on the HYG high

yield bond ETF. That’s a $1.6 million cash bet on an event that has not

occurred since July 2009.The high yield bond indices are rolling over quickly. As the graph below shows, after the QE-driven big bounce from the 2008 collapse in the financial markets, the high yield market has largely drifted sideways since the middle of 2010. Energy bonds represent about 15% of the high yield market. But the junk bond market actually began slowly rolling over a full year before the price of oil collapsed:

Read More

from KingWorldNews:

With investors around the world still worried about the tremendous

swings in major markets, today King World News is pleased to share a

piece that illustrates what is happening in the war in the silver and

gold markets. This piece also includes two key illustrations that all

KWN readers around the world must see.

With investors around the world still worried about the tremendous

swings in major markets, today King World News is pleased to share a

piece that illustrates what is happening in the war in the silver and

gold markets. This piece also includes two key illustrations that all

KWN readers around the world must see.

his astonishing chart from SentimenTrader shows that the commercial hedgers in the silver market are now in one of the more bullish trading positions in the past decade (see chart below).

Read More

With investors around the world still worried about the tremendous

swings in major markets, today King World News is pleased to share a

piece that illustrates what is happening in the war in the silver and

gold markets. This piece also includes two key illustrations that all

KWN readers around the world must see.

With investors around the world still worried about the tremendous

swings in major markets, today King World News is pleased to share a

piece that illustrates what is happening in the war in the silver and

gold markets. This piece also includes two key illustrations that all

KWN readers around the world must see.his astonishing chart from SentimenTrader shows that the commercial hedgers in the silver market are now in one of the more bullish trading positions in the past decade (see chart below).

Read More

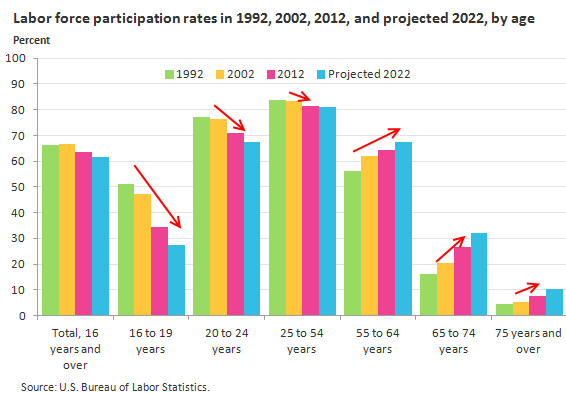

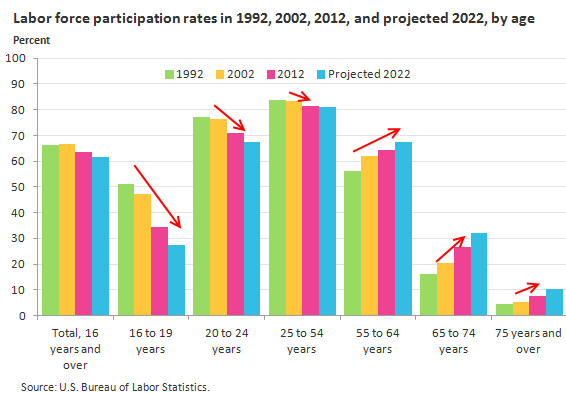

The extinction of retirement and the growing old age labor force.

from MyBudget360.com:

I was greeted by an older gentleman at a local Target store. He slowly smiled and said hello. I nodded and said hello as he proceeded to greet other shoppers. Leaving the store I was greeted by an older cashier. Over the last decade, the retail labor force is seeing a growing number of older Americans. Many don’t envision retirement as working in a low-wage job but that is simply the way of life for many. The BLS estimates that labor force participation rate for those 65 to 74 years of age is going to increase to 31.9 percent in 2022. That is an incredibly high number of older Americans eligible for Social Security still working in the labor force. This is happening as younger Americans make up a smaller portion of the labor force and as many more Americans enter into college. Yet one thing that is rarely discussed is that many older Americans are going to work until they die out of necessity. Not a few. Not a couple. A large portion of older Americans are working deep into old age because they can’t afford to retire.

Read More

from MyBudget360.com:

I was greeted by an older gentleman at a local Target store. He slowly smiled and said hello. I nodded and said hello as he proceeded to greet other shoppers. Leaving the store I was greeted by an older cashier. Over the last decade, the retail labor force is seeing a growing number of older Americans. Many don’t envision retirement as working in a low-wage job but that is simply the way of life for many. The BLS estimates that labor force participation rate for those 65 to 74 years of age is going to increase to 31.9 percent in 2022. That is an incredibly high number of older Americans eligible for Social Security still working in the labor force. This is happening as younger Americans make up a smaller portion of the labor force and as many more Americans enter into college. Yet one thing that is rarely discussed is that many older Americans are going to work until they die out of necessity. Not a few. Not a couple. A large portion of older Americans are working deep into old age because they can’t afford to retire.

Read More

from Off Grid Survival:

There is a growing possibility that the government could yet again shut down, as congress again struggles to pass a simple budget. Come October 1st 2015, we could see a repeat of the 2013 government shutdown, the shutdown where President Obama punished the American people and closed the entire National Parks systemand then threatened to arrest anyone who entered the parks.

This year’s budget crisis has been further complicated because of a battle over federal funding for Planned Parenthood and the group’s involvement in selling aborted baby parts on the open market. Democrats are refusing to defund the group, even after multiple videos surfaced showing the groups leadership approving the illegal sale of aborted babies.

Read More

There is a growing possibility that the government could yet again shut down, as congress again struggles to pass a simple budget. Come October 1st 2015, we could see a repeat of the 2013 government shutdown, the shutdown where President Obama punished the American people and closed the entire National Parks systemand then threatened to arrest anyone who entered the parks.

This year’s budget crisis has been further complicated because of a battle over federal funding for Planned Parenthood and the group’s involvement in selling aborted baby parts on the open market. Democrats are refusing to defund the group, even after multiple videos surfaced showing the groups leadership approving the illegal sale of aborted babies.

Read More

/

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment