Submitted by Tyler Durden on 09/21/2015 - 07:50 When The Fed's own cheerleader-in-chief (see October 2014) slams you for cheerleading, you know it's gone too far. In a stunning 30 second clip on CNBC this morning, St.Louis Fed head Jim Bullard sent a message to "your friend Cramer", saying "The Fed cannot permanently raise stock prices," adding, rather astonishingly to the anchors, "to have [Cramer] cheerleading for lower rates 24 hours a day is unsavory."

Foucault Does FOMC: Deutsche Bank Explains The Fed's Decision By Mixing Quantum Theory With Post-Modernism

Submitted by Tyler Durden on 09/21/2015 - 09:05 "The market is now observing itself from another angle as an observer of the observer of the observers."

Financial Anarchy

Submitted by Tyler Durden on 09/21/2015 - 08:49 Having no cost to money is the economic equivalent of no intelligent laws in society. The equivalent of using our money but having a baseline of zero for the benefit produced with that money. The results are what you would expect, the wild west, One might say, Financial Anarchy.

Vote of No Confidence

from The Wealth Watchman:

As Greece concludes its meaningless elections, and sends the same

powerless “yes-men” back to Athens to rubber stamp whatever schemes of

dispossession that Dijsselbloem has crafted for the Greek people, the rest of the world continues to cast the only vote that matters!

For since June, the already high levels of gold and silver purchases

have not only continued, but have soared, both in Western retail demand,

and in the far East.

As Greece concludes its meaningless elections, and sends the same

powerless “yes-men” back to Athens to rubber stamp whatever schemes of

dispossession that Dijsselbloem has crafted for the Greek people, the rest of the world continues to cast the only vote that matters!

For since June, the already high levels of gold and silver purchases

have not only continued, but have soared, both in Western retail demand,

and in the far East.

Many of those Eastern powers have also escalated the pace at which they’ve bid their US treasury holdings adieu! It’s one thing however, just to say that the world is now leaving treasuries behind, it’s quite another to show it, as this chart so powerfully does…

Read More…

from The Wealth Watchman:

As Greece concludes its meaningless elections, and sends the same

powerless “yes-men” back to Athens to rubber stamp whatever schemes of

dispossession that Dijsselbloem has crafted for the Greek people, the rest of the world continues to cast the only vote that matters!

For since June, the already high levels of gold and silver purchases

have not only continued, but have soared, both in Western retail demand,

and in the far East.

As Greece concludes its meaningless elections, and sends the same

powerless “yes-men” back to Athens to rubber stamp whatever schemes of

dispossession that Dijsselbloem has crafted for the Greek people, the rest of the world continues to cast the only vote that matters!

For since June, the already high levels of gold and silver purchases

have not only continued, but have soared, both in Western retail demand,

and in the far East.Many of those Eastern powers have also escalated the pace at which they’ve bid their US treasury holdings adieu! It’s one thing however, just to say that the world is now leaving treasuries behind, it’s quite another to show it, as this chart so powerfully does…

Read More…

Key Events In The Coming Post-FOMC Week

Submitted by Tyler Durden on 09/21/2015 - 08:30 In the week following the Fed's admission it is not only market-driven but now has a 4th mandate, which is to respond to China's hard landing on a day-to-day basis, US macro events mecrifully slow down to give everyone a chance to digest what the Fed just did. Here are the highlights.

China's "Reverse QE" Could Top $1.2 Trillion, Barclays Says

Submitted by Tyler Durden on 09/21/2015 - 08:14 "In such a downside scenario there could be pressure on the central bank to provide about 10-12% of GDP in reserves to the market to offset outflows as well as hedging demand (which could be met by intervening in forward markets). This is roughly USD1.0-1.2trn – that would be about 30% of its current reserve portfolio."

from Greg Hunter:

Bill Holter says, “All that’s left is a reset,” and the Fed is now helpless to stop the coming global financial calamity. This is not going to just be a financial problem, but a problem getting things you need to live. Holter says, “These big stores get stocked up every single night.”

“The average store only has food for about two or three days. So, this is not going to just be an issue about you paying your bills. It’s going to break down so badly it is going to be an issue about whether or not you can get food.”

On gold and silver, is this the bottom? Holter says, “To answer your question, yes, I think this is the bottom. Can they push the price down again? It’s possible, but like you say back in 2009, silver on the COMEX was trading just under $9, and to buy retail metal, you could not get anything under $15. . . . The physical market has hit a hard bottom.”

Bill Holter says, “All that’s left is a reset,” and the Fed is now helpless to stop the coming global financial calamity. This is not going to just be a financial problem, but a problem getting things you need to live. Holter says, “These big stores get stocked up every single night.”

“The average store only has food for about two or three days. So, this is not going to just be an issue about you paying your bills. It’s going to break down so badly it is going to be an issue about whether or not you can get food.”

On gold and silver, is this the bottom? Holter says, “To answer your question, yes, I think this is the bottom. Can they push the price down again? It’s possible, but like you say back in 2009, silver on the COMEX was trading just under $9, and to buy retail metal, you could not get anything under $15. . . . The physical market has hit a hard bottom.”

Frontrunning: September 21

Submitted by Tyler Durden on 09/21/2015 - 07:31- Fed is out so...BOJ brainstorms stimulus overhaul as options dwindle (Reuters)

- And... Yellen Pause Ups Pressure on Draghi as Global Pessimism Mounts (BBG)

- But... Eurozone Nears Limits of What Monetary Policy Can Do (WSJ)

- Global shares struggle on global growth concerns (Reuters)

- VW's Emissions Cheating Found by Curious Clean-Air Group (BBG)

- David Cameron allegedly fucked a dead pig's head (Mirror)

US Equity Futures Hit Overnight Highs On Renewed Hope Of More BOJ QE

Submitted by Tyler Durden on 09/21/2015 - 06:55 After sliding early in Sunday pre-market trade, overnight US equity futures managed to rebound on the now traditional low-volume levitation from a low of 1938 to just over 1950 at last check, ignoring the biggest single-name blowup story this morning which is the 23% collapse in Volkswagen shares, and instead have piggybacked on what we said was the last Hail Mary for the market: the hope of more QE from either the ECB or the BOJ. Tonight, it was the latter and while Japan's market are closed until Thursday for public holidays, its currency which is the world's preferred carry trade and the primary driver alongside VIX manipulation of the S&P500, has jumped from a low of just over 119 on Friday morning to a high of 120.4, pushing the entire US stock market with it.

"What Does The Fed Know That We Don't" - Bridgewater's Ray Dalio Answers

Submitted by Tyler Durden on 09/20/2015 - 23:29 While the rest of the levered-beta 2 and 20 chasers formerly known as "hedge funds" recently accused risk parity of blowing up their August returns (September is not shaping up much better) the biggest risk-parity fund in the world also found a scapegoat: the global economy, which according to Dalio, is the reason for All Weather's dramatic August slump. Bridgewater's message is simple: absent far more easing, what the charts above signal is that the US economy is about to slam head-on into an economic recession.Going Back To What Works: Gold Is Money Again (Thanks To Utah)

Submitted by Tyler Durden on 09/20/2015 - 22:35 As of today you really can pay your taxes, your credit cards, your mortgage, shop at Costco, and buy your groceries without so much as a bank account while using sound money.

As of today you really can pay your taxes, your credit cards, your mortgage, shop at Costco, and buy your groceries without so much as a bank account while using sound money.

from Western Journalism:

The Obama Administration wants Congress to vote on the Iran nuclear

agreement, but is refusing to answer questions about Iran’s past history

of killing Americans and Israelis.

The Obama Administration wants Congress to vote on the Iran nuclear

agreement, but is refusing to answer questions about Iran’s past history

of killing Americans and Israelis.

Sen. Marco Rubio, R-Fla., asked Secretary of State John Kerry questions regarding how many Americans and Israelis have been killed by Iran forces since the country’s 1979 revolution, but has yet to receive a concrete answer. Rubio asked the question, in various forms, on three occasions and received written replies that danced around the issue.

Read More

The Obama Administration wants Congress to vote on the Iran nuclear

agreement, but is refusing to answer questions about Iran’s past history

of killing Americans and Israelis.

The Obama Administration wants Congress to vote on the Iran nuclear

agreement, but is refusing to answer questions about Iran’s past history

of killing Americans and Israelis.Sen. Marco Rubio, R-Fla., asked Secretary of State John Kerry questions regarding how many Americans and Israelis have been killed by Iran forces since the country’s 1979 revolution, but has yet to receive a concrete answer. Rubio asked the question, in various forms, on three occasions and received written replies that danced around the issue.

Read More

from RT:

The Pentagon is reportedly reviewing and updating its contingency

plans for a war with Russia for the first time since the collapse of the

Soviet Union, with a defense official telling US media that Russia’s

“actions” prompted the assessment.

The Pentagon is reportedly reviewing and updating its contingency

plans for a war with Russia for the first time since the collapse of the

Soviet Union, with a defense official telling US media that Russia’s

“actions” prompted the assessment.

“Given the security environment, given the actions of Russia, it has become apparent that we need to make sure to update the plans that we have in response to any potential aggression against any NATO allies,” a senior defense official familiar with the plan told Foreign Policy.

According to Michèle Flournoy, a former undersecretary of defense for policy and co-founder of the Center for a New American Security, the move was prompted by the Ukraine situation.

Read More

The Pentagon is reportedly reviewing and updating its contingency

plans for a war with Russia for the first time since the collapse of the

Soviet Union, with a defense official telling US media that Russia’s

“actions” prompted the assessment.

The Pentagon is reportedly reviewing and updating its contingency

plans for a war with Russia for the first time since the collapse of the

Soviet Union, with a defense official telling US media that Russia’s

“actions” prompted the assessment.“Given the security environment, given the actions of Russia, it has become apparent that we need to make sure to update the plans that we have in response to any potential aggression against any NATO allies,” a senior defense official familiar with the plan told Foreign Policy.

According to Michèle Flournoy, a former undersecretary of defense for policy and co-founder of the Center for a New American Security, the move was prompted by the Ukraine situation.

Read More

from Wolf Street:

In Spain’s north eastern region of Catalonia, the fear-mongering and

doom-saying is reaching a deafening crescendo. If voters return a

majority of pro-independence politicians in next Sunday’s regional

elections, all manner of economic disaster will befall the region —

according to the defenders of Spain’s established political and economic

order.

In Spain’s north eastern region of Catalonia, the fear-mongering and

doom-saying is reaching a deafening crescendo. If voters return a

majority of pro-independence politicians in next Sunday’s regional

elections, all manner of economic disaster will befall the region —

according to the defenders of Spain’s established political and economic

order.

The doomsayers include the Spanish government, the main opposition party, PSOE, Angela Merkel, David Cameron, Barack Obama, John Kerry, the spokesperson of the president of the European Commission, Margaritis Schinas, and just about every business lobby representative in Spain. Some Catalan business leaders have even urged their employees to vote against independence, warning that a yes-vote on Sunday could lead to them losing their jobs — a major threat in a nation with over 20% official unemployment!

Read More

In Spain’s north eastern region of Catalonia, the fear-mongering and

doom-saying is reaching a deafening crescendo. If voters return a

majority of pro-independence politicians in next Sunday’s regional

elections, all manner of economic disaster will befall the region —

according to the defenders of Spain’s established political and economic

order.

In Spain’s north eastern region of Catalonia, the fear-mongering and

doom-saying is reaching a deafening crescendo. If voters return a

majority of pro-independence politicians in next Sunday’s regional

elections, all manner of economic disaster will befall the region —

according to the defenders of Spain’s established political and economic

order.The doomsayers include the Spanish government, the main opposition party, PSOE, Angela Merkel, David Cameron, Barack Obama, John Kerry, the spokesperson of the president of the European Commission, Margaritis Schinas, and just about every business lobby representative in Spain. Some Catalan business leaders have even urged their employees to vote against independence, warning that a yes-vote on Sunday could lead to them losing their jobs — a major threat in a nation with over 20% official unemployment!

Read More

by Christina Lin, Times of Israel:

A new article reported

that 3,500 Uyghurs are settling in a village near Jisr-al Shagour that

was just taken from Assad, close to the stronghold of Turkistan Islamic

Party (TIP) that is in the Turkey-backed Army of Conquest. They are

allegedly under the supervision of Turkish intelligence that has been

accused of supplying fake passports to recruit Chinese Uyghurs to wage jihad in Syria.

A new article reported

that 3,500 Uyghurs are settling in a village near Jisr-al Shagour that

was just taken from Assad, close to the stronghold of Turkistan Islamic

Party (TIP) that is in the Turkey-backed Army of Conquest. They are

allegedly under the supervision of Turkish intelligence that has been

accused of supplying fake passports to recruit Chinese Uyghurs to wage jihad in Syria.

A new article reported

that 3,500 Uyghurs are settling in a village near Jisr-al Shagour that

was just taken from Assad, close to the stronghold of Turkistan Islamic

Party (TIP) that is in the Turkey-backed Army of Conquest. They are

allegedly under the supervision of Turkish intelligence that has been

accused of supplying fake passports to recruit Chinese Uyghurs to wage jihad in Syria.

A new article reported

that 3,500 Uyghurs are settling in a village near Jisr-al Shagour that

was just taken from Assad, close to the stronghold of Turkistan Islamic

Party (TIP) that is in the Turkey-backed Army of Conquest. They are

allegedly under the supervision of Turkish intelligence that has been

accused of supplying fake passports to recruit Chinese Uyghurs to wage jihad in Syria.

The news comes on the heels of TIP capturing a Syrian airbase and acquiring MIG fighter jets as well as other advanced weaponry, similar to ISIS capturing Iraqi army’s advanced US weaponry.

It also comes on the heels of the Bangkok

bombing at the shrine frequented by Chinese tourists, with Thai

authorities now drawing a link to Uyghurs “and the same gang that attacked the Thai Consulate in Turkey” in reference to Turkey’s Grey Wolves.

Read More…

[Ed. Note: um, one thing: “There is no inflation”? Try this: U.S. food prices rising 367% faster than inflation]

from Northman Trader:

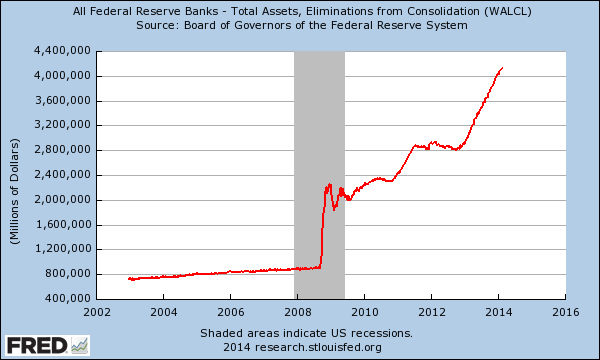

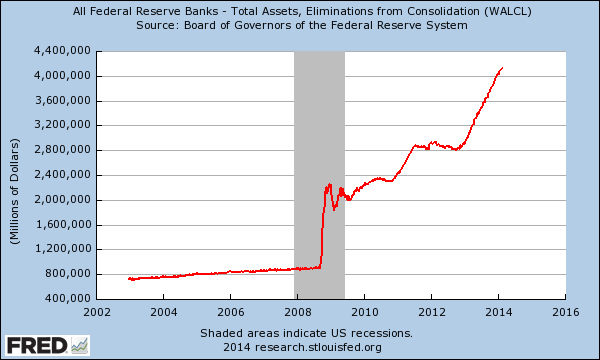

When the Fed embarked on its mission to rescue the economy in 2009 it

did so on the following premise: Save the banks by re-inflating the

housing and stock markets via easy money and, as a result, companies

would hire and the eventual scarcity of labor would produce wage growth

with the end result that the resulting inflation would permit for a

tightening cycle to normalize rates.

When the Fed embarked on its mission to rescue the economy in 2009 it

did so on the following premise: Save the banks by re-inflating the

housing and stock markets via easy money and, as a result, companies

would hire and the eventual scarcity of labor would produce wage growth

with the end result that the resulting inflation would permit for a

tightening cycle to normalize rates.

The problem: After 7 years and trillions of dollars in debt and balance sheet expansion there is no inflation nor is there any wage growth. And the reason for this is a structural one that central banks have been refusing to acknowledge and admit: The massive underlying shift in technology that is radically changing the global labor market. Not for the better, but for the worse.

Read More

from Northman Trader:

When the Fed embarked on its mission to rescue the economy in 2009 it

did so on the following premise: Save the banks by re-inflating the

housing and stock markets via easy money and, as a result, companies

would hire and the eventual scarcity of labor would produce wage growth

with the end result that the resulting inflation would permit for a

tightening cycle to normalize rates.

When the Fed embarked on its mission to rescue the economy in 2009 it

did so on the following premise: Save the banks by re-inflating the

housing and stock markets via easy money and, as a result, companies

would hire and the eventual scarcity of labor would produce wage growth

with the end result that the resulting inflation would permit for a

tightening cycle to normalize rates.The problem: After 7 years and trillions of dollars in debt and balance sheet expansion there is no inflation nor is there any wage growth. And the reason for this is a structural one that central banks have been refusing to acknowledge and admit: The massive underlying shift in technology that is radically changing the global labor market. Not for the better, but for the worse.

Read More

from The Money GPS:

[Ed. Note: Even the NY Times is finally being forced to ask the right questions!]

by Anand Giridharadas, NY Times:

A former C.I.A. officer with experience in Turkey wrote a provocative essay this

summer about the “deep state.” The phrase refers to a parallel “secret

government” embedded in the military and intelligence services, whose

purpose is to provide a check on electoral democracy.

A former C.I.A. officer with experience in Turkey wrote a provocative essay this

summer about the “deep state.” The phrase refers to a parallel “secret

government” embedded in the military and intelligence services, whose

purpose is to provide a check on electoral democracy.

by Anand Giridharadas, NY Times:

A former C.I.A. officer with experience in Turkey wrote a provocative essay this

summer about the “deep state.” The phrase refers to a parallel “secret

government” embedded in the military and intelligence services, whose

purpose is to provide a check on electoral democracy.

A former C.I.A. officer with experience in Turkey wrote a provocative essay this

summer about the “deep state.” The phrase refers to a parallel “secret

government” embedded in the military and intelligence services, whose

purpose is to provide a check on electoral democracy.

But

Turkey wasn’t the target of the essay, written by Philip Giraldi. He

was aiming, as his headline declared, at “Deep State America.”

Mr. Giraldi, executive director of the Council for the National Interest,

a foreign-policy advocacy group in Washington, called the American deep

state of today an “unelected, unappointed, and unaccountable presence

within the system that actually manages what is taking place behind the

scenes.”

Read MoreTim Young of SelfSeficientMan.com joins me today to talk about how he broke free from dependency on a failing system and forged a new path. He provides some valuable tips on prepping and self-sufficiency.

from Credit Bubble Bulletin:

September 18 – Reuters: “The world’s leading central banks are facing

the risk that their massive efforts to revive economic growth could be

dragged down again, with some officials arguing for bold new ideas to

counter the threat of slow growth for years to come. A day after the

U.S. Federal Reserve kept interest rates at zero, citing risks in the

global economy, the Bank of England’s chief economist said central banks

had to accept that interest rates might get stuck at rock bottom. In

Japan, where interest rates have been at zero for more than 20 years,

policymakers are already tossing around ideas for overhauling the Bank

of Japan’s huge monetary stimulus program as they worry that it will be

unsustainable in the future, according to sources familiar with its

thinking. Separately a top European Central Bank official said the ECB’s

bond-buying program might need to be rethought if low inflation becomes

entrenched.”

September 18 – Reuters: “The world’s leading central banks are facing

the risk that their massive efforts to revive economic growth could be

dragged down again, with some officials arguing for bold new ideas to

counter the threat of slow growth for years to come. A day after the

U.S. Federal Reserve kept interest rates at zero, citing risks in the

global economy, the Bank of England’s chief economist said central banks

had to accept that interest rates might get stuck at rock bottom. In

Japan, where interest rates have been at zero for more than 20 years,

policymakers are already tossing around ideas for overhauling the Bank

of Japan’s huge monetary stimulus program as they worry that it will be

unsustainable in the future, according to sources familiar with its

thinking. Separately a top European Central Bank official said the ECB’s

bond-buying program might need to be rethought if low inflation becomes

entrenched.”

Most just scoff at the notion that there has been a historic global Bubble, let alone that this Bubble has over recent months begun to burst. Talk of an EM and global crisis is viewed as wackoism. Except that the Federal Reserve clearly sees something pernicious in the world that requires shelving, after seven years, even the cutest little baby step move in the direction of policy normalization.

chart: Fed Balance Sheet, via MyBudget360.com

Read More

September 18 – Reuters: “The world’s leading central banks are facing

the risk that their massive efforts to revive economic growth could be

dragged down again, with some officials arguing for bold new ideas to

counter the threat of slow growth for years to come. A day after the

U.S. Federal Reserve kept interest rates at zero, citing risks in the

global economy, the Bank of England’s chief economist said central banks

had to accept that interest rates might get stuck at rock bottom. In

Japan, where interest rates have been at zero for more than 20 years,

policymakers are already tossing around ideas for overhauling the Bank

of Japan’s huge monetary stimulus program as they worry that it will be

unsustainable in the future, according to sources familiar with its

thinking. Separately a top European Central Bank official said the ECB’s

bond-buying program might need to be rethought if low inflation becomes

entrenched.”

September 18 – Reuters: “The world’s leading central banks are facing

the risk that their massive efforts to revive economic growth could be

dragged down again, with some officials arguing for bold new ideas to

counter the threat of slow growth for years to come. A day after the

U.S. Federal Reserve kept interest rates at zero, citing risks in the

global economy, the Bank of England’s chief economist said central banks

had to accept that interest rates might get stuck at rock bottom. In

Japan, where interest rates have been at zero for more than 20 years,

policymakers are already tossing around ideas for overhauling the Bank

of Japan’s huge monetary stimulus program as they worry that it will be

unsustainable in the future, according to sources familiar with its

thinking. Separately a top European Central Bank official said the ECB’s

bond-buying program might need to be rethought if low inflation becomes

entrenched.”Most just scoff at the notion that there has been a historic global Bubble, let alone that this Bubble has over recent months begun to burst. Talk of an EM and global crisis is viewed as wackoism. Except that the Federal Reserve clearly sees something pernicious in the world that requires shelving, after seven years, even the cutest little baby step move in the direction of policy normalization.

chart: Fed Balance Sheet, via MyBudget360.com

Read More

from TruthNeverTold:

[Editor’s Note: This type of criminality and lack of basic decency typifies the sordid state of Big Pharma healthcare.]

by Andrew Emett, Activist Post:

After purchasing the rights to a drug that prevents infections in

people with weakened immune systems, including AIDS patients and cancer

survivors undergoing chemotherapy, a pharmaceutical company has raised

the price of the drug by 5,000%. Instead of paying $13.50 per pill, patients with life-threatening illnesses are now forced to pay $750 per pill.

After purchasing the rights to a drug that prevents infections in

people with weakened immune systems, including AIDS patients and cancer

survivors undergoing chemotherapy, a pharmaceutical company has raised

the price of the drug by 5,000%. Instead of paying $13.50 per pill, patients with life-threatening illnesses are now forced to pay $750 per pill.

Led by a former hedge fund manager, Turing Pharmaceuticals was founded by Martin Shkreli after his first startup biotech company, Retrophin, ousted him last year amid accusations of stock impropriety. Shortly after founding Turing Pharmaceuticals, Shkreli secured the exclusive rights to sell Daraprim (pyrimethamine), which helps prevent malaria and treats toxoplasmosis.

Read More

by Andrew Emett, Activist Post:

After purchasing the rights to a drug that prevents infections in

people with weakened immune systems, including AIDS patients and cancer

survivors undergoing chemotherapy, a pharmaceutical company has raised

the price of the drug by 5,000%. Instead of paying $13.50 per pill, patients with life-threatening illnesses are now forced to pay $750 per pill.

After purchasing the rights to a drug that prevents infections in

people with weakened immune systems, including AIDS patients and cancer

survivors undergoing chemotherapy, a pharmaceutical company has raised

the price of the drug by 5,000%. Instead of paying $13.50 per pill, patients with life-threatening illnesses are now forced to pay $750 per pill.Led by a former hedge fund manager, Turing Pharmaceuticals was founded by Martin Shkreli after his first startup biotech company, Retrophin, ousted him last year amid accusations of stock impropriety. Shortly after founding Turing Pharmaceuticals, Shkreli secured the exclusive rights to sell Daraprim (pyrimethamine), which helps prevent malaria and treats toxoplasmosis.

Read More

by Karl Denninger, Market-Ticker:

The cuckservative world is agape, and the liberals are running screaming — and scared — today.

Donald J. Trump on the Right to Keep and Bear Arms

The Second Amendment to our Constitution is clear. The right of the people to keep and bear Arms shall not be infringed upon. Period.

Let me begin: While Mr. Trump’s position is miles ahead of many others in the political sphere, he could have stopped right here when it comes to the law — after all, The Second Amendment is clear.

Read More

The cuckservative world is agape, and the liberals are running screaming — and scared — today.

Donald J. Trump on the Right to Keep and Bear Arms

The Second Amendment to our Constitution is clear. The right of the people to keep and bear Arms shall not be infringed upon. Period.

Let me begin: While Mr. Trump’s position is miles ahead of many others in the political sphere, he could have stopped right here when it comes to the law — after all, The Second Amendment is clear.

Read More

/

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment