Submitted by Tyler Durden on 09/02/2015 - 21:45 Markets have "reached some kind of a tipping point," warns Marc Faber in this brief Bloomberg TV interview. Simply put, he explains, "because of modern central banking and repeated interventions with monetary policy, in other words, with QE, all around the world by central banks - there is no safe asset anymore." The purchasing power of money is going down, and Faber "would rather focus on precious metals because they do not depend on the industrial demand as much as base metals or industrial commodities," as it's now "obvious that the Chinese economy is growing at nowhere near what the Ministry of Truth is publishing."

Martin Armstrong Warns: The #1 Terrorist Group Is You, Domestic Citizens

Submitted by Tyler Durden on 09/02/2015 - 19:25

Submitted by Tyler Durden on 09/02/2015 - 19:25

Understand this now. As Jim Quinn explains, YOU are the enemy of the state. They don’t give a stuff about you. They treat you as sheep and cows to be sheared and milked. If you start questioning them, they will slaughter you. They have militarized the police forces and put you under 24 hour surveillance because they fear an uprising. There only a few hundred thousand of them and there are millions of us. A conflict is looming.

The QE End-Game Decision Tree: Not "If" But "When" Central Banks Lose Control

Submitted by Tyler Durden on 09/02/2015 - 18:42 "Not 'IF' but 'WHEN central banks lose control?' The global financial repression pushed investors to invest cash in risky assets, such as property and equity. The scale of global policy interventions is trumping all fundamental factors for now. Investors should keep in mind that the road is never straight and next month should be full of potentially disruptive events impacting sharply overcrowded assets and trades. History shows that such misallocation of resources creates bubbles that can last before fully blowing; the question is not if, but when."

In Dramatic Escalation, China Sends Five Navy Ships Off Alaska Coast For First Time Ever

Submitted by Tyler Durden on 09/02/2015 - 14:26 As WSJ reports, "five Chinese navy ships are currently operating in the Bering Sea, off the coast of Alaska, the first time the U.S. military has seen such activity in the area, Pentagon officials said Wednesday.Who Would Win World War 3? The Infographic

Submitted by Tyler Durden on 09/02/2015 - 21:10

Heresy! China Won't Stick To IMF, World Bank Lending "Religion" With AIIB

China Explained (In 1 Image)

Submitted by Tyler Durden on 09/02/2015 - 19:00 Presented with no comment... (because we do not want to be "detained")

Guest Post: Trump Can Win The GOP Nomination

Submitted by Tyler Durden on 09/02/2015 - 20:35 Many Republicans simply delude themselves that Trump is not a serious candidate who cannot, for some reason, get the nomination. We say, don’t underestimate his ego, which we know is and always has been enormous.

Presenting Never-Ending QE In One Easy Flowchart

Submitted by Tyler Durden on 09/02/2015 - 18:35 Because we know the mechanics of the currency war and the endless loop of competitive easing can be a bit confusing at times, we present the following simplified, circular flow chart from Morgan Stanley which should serve as a helpful guide to the never ending "beggar thy neighbor" loop.

Why The Federal Reserve Should Be Audited

Submitted by Tyler Durden on 09/02/2015 - 18:10 It is time for a comprehensive audit of Janet Yellen ’s Federal Reserve - and not just for the reasons presidential candidate Rand Paul and others have given. The Fed needs to be audited to see if its ruling body has broken the law by manipulating financial markets that are outside its jurisdiction.

by SGT, SGT Report.com:

Bill Holter whose work you can follow over at Jim Sinclair’s JS Mineset is back and Bill says “Something Just Happened”. In fact, something changed three weeks ago and a series of events began which has led to a cascading collapse in global markets and some very strange happenings in the precious metals markets.

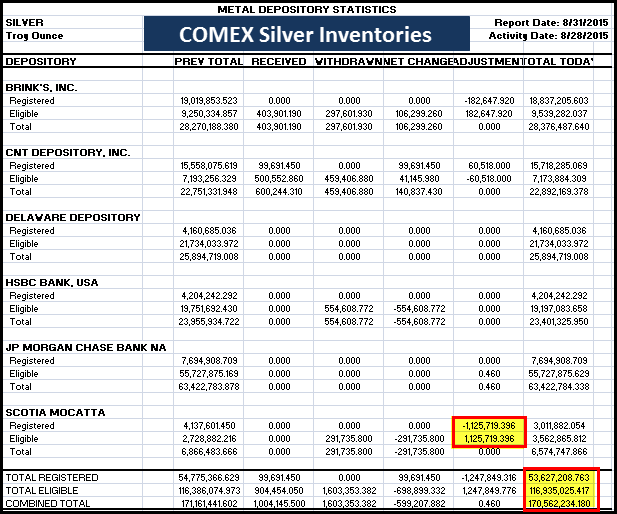

In silver last week there was confirmed volume of 122,482 contracts traded in a single day which represents 612 MILLION ounces of physical silver … or over 87% of annual global silver production. Meanwhile China has sold $100 billion worth of Treasury bonds over the last two weeks.

Bill warns, the leverage in all markets suggests a “holiday” will occur because the unwinding cannot be orderly. The “unwinding” by the way will need to undue the credit built upon credit going all the way back to Aug. 15, 1971.

Mr; Holter concludes: “We’re going to have an absolute Biblical collapse of our standard of living, and no one even has a clue that it’s coming.”

Oh, and one last note. The current 1980 inflation adjusted all time high for silver is $601 according to John Williams at Shadowstats. And that doesn’t account for all of the paper metals fraud in the system. Please bear that fact in mind as you consider what life may look like after the collapse of the Petro Dollar’s purchasing power.

Bill Holter whose work you can follow over at Jim Sinclair’s JS Mineset is back and Bill says “Something Just Happened”. In fact, something changed three weeks ago and a series of events began which has led to a cascading collapse in global markets and some very strange happenings in the precious metals markets.

In silver last week there was confirmed volume of 122,482 contracts traded in a single day which represents 612 MILLION ounces of physical silver … or over 87% of annual global silver production. Meanwhile China has sold $100 billion worth of Treasury bonds over the last two weeks.

Bill warns, the leverage in all markets suggests a “holiday” will occur because the unwinding cannot be orderly. The “unwinding” by the way will need to undue the credit built upon credit going all the way back to Aug. 15, 1971.

Mr; Holter concludes: “We’re going to have an absolute Biblical collapse of our standard of living, and no one even has a clue that it’s coming.”

Oh, and one last note. The current 1980 inflation adjusted all time high for silver is $601 according to John Williams at Shadowstats. And that doesn’t account for all of the paper metals fraud in the system. Please bear that fact in mind as you consider what life may look like after the collapse of the Petro Dollar’s purchasing power.

Something has seriously changed in the silver market as traditional

indicators no longer seem to matter. Normally when the price of a

commodity falls, so does demand. However, we are seeing quite the

opposite as investors continue to buy silver bullion hand over fist.

Something has seriously changed in the silver market as traditional

indicators no longer seem to matter. Normally when the price of a

commodity falls, so does demand. However, we are seeing quite the

opposite as investors continue to buy silver bullion hand over fist.This surge in physical silver demand has put more stress on global silver inventories. Let’s take a look at the last two COMEX Silver Inventory updates. On Monday’s update (8/31/15), the COMEX reported a total deposit of 1 million oz (Moz) and 1.6 Moz withdrawal for a net 600,000 oz decline. Actually, it was a net 599,207 oz withdrawal, but what’s a few ounces between banker friends.

Read More…

Central Banks Nervous As Alternative Currency With David Bowie's Face Goes Viral

Submitted by Tyler Durden on 09/02/2015 - 17:50 One of the best ways for the general public to take power back is to develop alternative currencies - both local and global - that allow people to trade outside of the corporate-government banking systems and central bank notes. In London, an interesting alternative currency bearing the face of pop singer David Bowie has recently come into circulation. It is officially called the “Brixton Pound.” The Bank of England has been forced to respond to these local currencies because of their popularity, deeming them “voucher schemes” and warning the public that they are unprotected when using them.

Second Largest US Pension Fund To Sell 12% Of Stocks Holdings In Advance Of "Another Downturn"

Submitted by Tyler Durden on 09/02/2015 - 17:49 While many continue to debate if what with every passing day increasingly looks like a global recession, one from which the US will not decouple no matter how many "virtual portfolio" asset managers claim the contrary, there are those who without much fanfare are already taking proactive steps to avoid the kind of fallout that the markets have hinted in the past month of trading, is inevitable. Some such as Calstrs: the nation's second largest pension fund with $191 billion in assets (smaller only than Calpers), which as the WSJ reports is "considering a significant shift away from some stocks and bonds amid turbulent markets world-wide." According to the WSJ, it will move as much as $20 billion, or 12% of the fund’s stock portfolio, into other assets, including Treasurys.eVIXeration & Gartman Send Stocks Soaring "Back To Normal"

by Tony Cartalucci, Activist Post:

The Daily Beast’s article, “Petraeus: Use Al Qaeda Fighters to Beat ISIS,” reveals the final piece to the “safe haven” or “buffer zone” puzzle,

providing the world a complete picture of how the United States and its

regional allies, including Turkey, Saudi Arabia, Israel, Jordan, and

others, plan to finally overthrow the government in Damascus, and

eliminate Syria as a functioning nation state through the use of listed

terrorist organizations responsible for over a decade of devastating

global war.

The Daily Beast’s article, “Petraeus: Use Al Qaeda Fighters to Beat ISIS,” reveals the final piece to the “safe haven” or “buffer zone” puzzle,

providing the world a complete picture of how the United States and its

regional allies, including Turkey, Saudi Arabia, Israel, Jordan, and

others, plan to finally overthrow the government in Damascus, and

eliminate Syria as a functioning nation state through the use of listed

terrorist organizations responsible for over a decade of devastating

global war.

Top Image: September 11, 2001, nearly 3,000 people would die in attacks on the World Trade Center in New York City, the Pentagon in Washington D.C., and a downed plane over Pennsylvania. The attack was attributed to Al Qaeda by the United States government tipping off over a decade of global war against “terrorism” that would leave entire nations destroyed and millions of lives ruined.

Read More

The Daily Beast’s article, “Petraeus: Use Al Qaeda Fighters to Beat ISIS,” reveals the final piece to the “safe haven” or “buffer zone” puzzle,

providing the world a complete picture of how the United States and its

regional allies, including Turkey, Saudi Arabia, Israel, Jordan, and

others, plan to finally overthrow the government in Damascus, and

eliminate Syria as a functioning nation state through the use of listed

terrorist organizations responsible for over a decade of devastating

global war.

The Daily Beast’s article, “Petraeus: Use Al Qaeda Fighters to Beat ISIS,” reveals the final piece to the “safe haven” or “buffer zone” puzzle,

providing the world a complete picture of how the United States and its

regional allies, including Turkey, Saudi Arabia, Israel, Jordan, and

others, plan to finally overthrow the government in Damascus, and

eliminate Syria as a functioning nation state through the use of listed

terrorist organizations responsible for over a decade of devastating

global war.Top Image: September 11, 2001, nearly 3,000 people would die in attacks on the World Trade Center in New York City, the Pentagon in Washington D.C., and a downed plane over Pennsylvania. The attack was attributed to Al Qaeda by the United States government tipping off over a decade of global war against “terrorism” that would leave entire nations destroyed and millions of lives ruined.

Read More

em>by Christina Sarich, Natural Society:

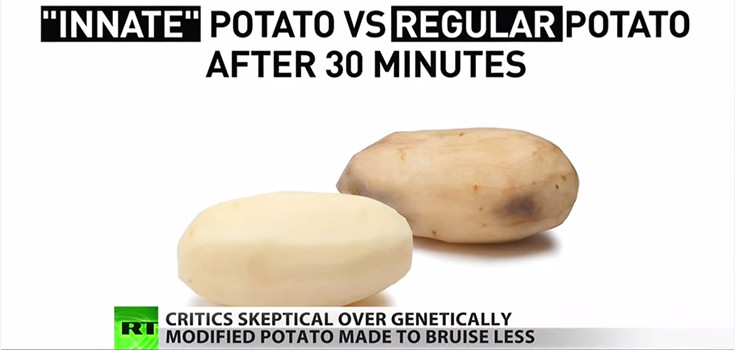

You likely already ate some GM potato without knowing it. Over 400

acres worth of GM potatoes were sold in Midwestern grocery stores over

the summer, and most of them went unlabeled as such. The second

generation of J.R. Simplot Co.’s genetically modified potato has cleared its first federal regulatory hurdle, and the Russet Burbank variety ‘Innate’ has been approved by the U.S. Department of Agriculture.

You likely already ate some GM potato without knowing it. Over 400

acres worth of GM potatoes were sold in Midwestern grocery stores over

the summer, and most of them went unlabeled as such. The second

generation of J.R. Simplot Co.’s genetically modified potato has cleared its first federal regulatory hurdle, and the Russet Burbank variety ‘Innate’ has been approved by the U.S. Department of Agriculture.

In the name of a potato that won’t brown or bruise, as this is the reason being given for its genetic alteration, we are expected to eat another genetically modified crop, and like it.

Read More

from KingWorldNews:

Japan And The Global Meltdown

Japan And The Global Meltdown

Japan Joins The Fray – As noted above, Japan was a key factor in Tuesday’s global meltdown. To avoid reinventing the wheel, I’ll let my friend and fellow market veteran, Jim Brown, over at the insightful Option Investor tell the tale. Here’s a bit of what Jim wrote on the topic:

The overnight sell off was started by news out of Japan. Capital spending by Japanese companies fell – 1.8% in Q2. This reflects a slowdown in demand because of the first sales tax increase in 17 years. Corporate revenue and profits also fell an estimated -3.2% as the economy continued to deteriorate.

Read More

You likely already ate some GM potato without knowing it. Over 400

acres worth of GM potatoes were sold in Midwestern grocery stores over

the summer, and most of them went unlabeled as such. The second

generation of J.R. Simplot Co.’s genetically modified potato has cleared its first federal regulatory hurdle, and the Russet Burbank variety ‘Innate’ has been approved by the U.S. Department of Agriculture.

You likely already ate some GM potato without knowing it. Over 400

acres worth of GM potatoes were sold in Midwestern grocery stores over

the summer, and most of them went unlabeled as such. The second

generation of J.R. Simplot Co.’s genetically modified potato has cleared its first federal regulatory hurdle, and the Russet Burbank variety ‘Innate’ has been approved by the U.S. Department of Agriculture.In the name of a potato that won’t brown or bruise, as this is the reason being given for its genetic alteration, we are expected to eat another genetically modified crop, and like it.

Read More

Japan And The Global Meltdown

Japan And The Global MeltdownJapan Joins The Fray – As noted above, Japan was a key factor in Tuesday’s global meltdown. To avoid reinventing the wheel, I’ll let my friend and fellow market veteran, Jim Brown, over at the insightful Option Investor tell the tale. Here’s a bit of what Jim wrote on the topic:

The overnight sell off was started by news out of Japan. Capital spending by Japanese companies fell – 1.8% in Q2. This reflects a slowdown in demand because of the first sales tax increase in 17 years. Corporate revenue and profits also fell an estimated -3.2% as the economy continued to deteriorate.

Read More

from Sovereign Man:

In 1543, Polish astronomer Nicolaus Copernicus published his truly revolutionary work, De revolutionibus orbium coelestium.

In 1543, Polish astronomer Nicolaus Copernicus published his truly revolutionary work, De revolutionibus orbium coelestium.

For centuries prior, humanity had held the Ptolemaic belief that the Earth was the center of the universe.

Copernicus shattered that belief, demonstrating mathematically that it was the sun at the center of the ‘universe’, with the earth revolving around it.

Though Copernicus died soon after his book was published, his ideas sparked a radical shift, not only in humanity’s view of the world, but in how we viewed our place in the universe.

Read More

In 1543, Polish astronomer Nicolaus Copernicus published his truly revolutionary work, De revolutionibus orbium coelestium.

In 1543, Polish astronomer Nicolaus Copernicus published his truly revolutionary work, De revolutionibus orbium coelestium.For centuries prior, humanity had held the Ptolemaic belief that the Earth was the center of the universe.

Copernicus shattered that belief, demonstrating mathematically that it was the sun at the center of the ‘universe’, with the earth revolving around it.

Though Copernicus died soon after his book was published, his ideas sparked a radical shift, not only in humanity’s view of the world, but in how we viewed our place in the universe.

Read More

by Andy Hoffman, Miles Franklin:

Well, “September cometh,” and with a BANG! Yet another 3% decline for the “Dow Jones Propaganda Average”

– actually 2.84%, following a last minute, PPT-inspired “Hail Mary”

rally – but let’s just “round up,” shall we? In other words, its third

such decline in the past ten days – following an astonishing, equally

PPT-inspired string of four years without a single 3% decline. I

mean, just think of all the astoundingly horrible economic, financial,

and geopolitical news since the U.S. lost its (comically undeserved)

triple-A credit rating in August 2011 – whilst I was attending GATA’s

London anti-Cartel conference, I might add; including the addition of

roughly $4.5 trillion of national debt, and countless tens of trillions

“off-balance sheet.” And yet, not a single 3% decline – which is probably why I long ago declared 2% to be the PPT’s “daily limit down” level.

Well, “September cometh,” and with a BANG! Yet another 3% decline for the “Dow Jones Propaganda Average”

– actually 2.84%, following a last minute, PPT-inspired “Hail Mary”

rally – but let’s just “round up,” shall we? In other words, its third

such decline in the past ten days – following an astonishing, equally

PPT-inspired string of four years without a single 3% decline. I

mean, just think of all the astoundingly horrible economic, financial,

and geopolitical news since the U.S. lost its (comically undeserved)

triple-A credit rating in August 2011 – whilst I was attending GATA’s

London anti-Cartel conference, I might add; including the addition of

roughly $4.5 trillion of national debt, and countless tens of trillions

“off-balance sheet.” And yet, not a single 3% decline – which is probably why I long ago declared 2% to be the PPT’s “daily limit down” level.

Read More

Well, “September cometh,” and with a BANG! Yet another 3% decline for the “Dow Jones Propaganda Average”

– actually 2.84%, following a last minute, PPT-inspired “Hail Mary”

rally – but let’s just “round up,” shall we? In other words, its third

such decline in the past ten days – following an astonishing, equally

PPT-inspired string of four years without a single 3% decline. I

mean, just think of all the astoundingly horrible economic, financial,

and geopolitical news since the U.S. lost its (comically undeserved)

triple-A credit rating in August 2011 – whilst I was attending GATA’s

London anti-Cartel conference, I might add; including the addition of

roughly $4.5 trillion of national debt, and countless tens of trillions

“off-balance sheet.” And yet, not a single 3% decline – which is probably why I long ago declared 2% to be the PPT’s “daily limit down” level.

Well, “September cometh,” and with a BANG! Yet another 3% decline for the “Dow Jones Propaganda Average”

– actually 2.84%, following a last minute, PPT-inspired “Hail Mary”

rally – but let’s just “round up,” shall we? In other words, its third

such decline in the past ten days – following an astonishing, equally

PPT-inspired string of four years without a single 3% decline. I

mean, just think of all the astoundingly horrible economic, financial,

and geopolitical news since the U.S. lost its (comically undeserved)

triple-A credit rating in August 2011 – whilst I was attending GATA’s

London anti-Cartel conference, I might add; including the addition of

roughly $4.5 trillion of national debt, and countless tens of trillions

“off-balance sheet.” And yet, not a single 3% decline – which is probably why I long ago declared 2% to be the PPT’s “daily limit down” level.Read More

by Koos Jansen, Bullion Star:

Awareness about the concept of money is making a comeback. Gone are the

decades in which the global citizenry was fooled to leave this subject

to economists, governments and banks – a setup that has proven to end in

disaster. The crisis in 2008 has spawned debate about what money is,

where it comes from and where it should come from. These developments

inspired me to write a post on the concept of money and the money

illusion. (All examples in this post are simplified.)

Awareness about the concept of money is making a comeback. Gone are the

decades in which the global citizenry was fooled to leave this subject

to economists, governments and banks – a setup that has proven to end in

disaster. The crisis in 2008 has spawned debate about what money is,

where it comes from and where it should come from. These developments

inspired me to write a post on the concept of money and the money

illusion. (All examples in this post are simplified.)

The Concept Of Money

Money is a collective human invention

Read More

Awareness about the concept of money is making a comeback. Gone are the

decades in which the global citizenry was fooled to leave this subject

to economists, governments and banks – a setup that has proven to end in

disaster. The crisis in 2008 has spawned debate about what money is,

where it comes from and where it should come from. These developments

inspired me to write a post on the concept of money and the money

illusion. (All examples in this post are simplified.)

Awareness about the concept of money is making a comeback. Gone are the

decades in which the global citizenry was fooled to leave this subject

to economists, governments and banks – a setup that has proven to end in

disaster. The crisis in 2008 has spawned debate about what money is,

where it comes from and where it should come from. These developments

inspired me to write a post on the concept of money and the money

illusion. (All examples in this post are simplified.) The Concept Of Money

Money is a collective human invention

Read More

from GoldSeek:

When I was a lad studying economics in between bouts of playing blues

guitar, surfing, and drinking fine Namibian lager, professors taught my

classmates and me the origins of paper money. Like the beginners we

were, we Economics 101 students trusted and believed them.

When I was a lad studying economics in between bouts of playing blues

guitar, surfing, and drinking fine Namibian lager, professors taught my

classmates and me the origins of paper money. Like the beginners we

were, we Economics 101 students trusted and believed them.

Years later, when I was a postgrad in Economic History, I learned that my professors were wrong. Their account of the origins of paper money was based on theoretical wishful thinking rather than real world history. When you studied actual events, you found that things weren’t so simple.

Read More

When I was a lad studying economics in between bouts of playing blues

guitar, surfing, and drinking fine Namibian lager, professors taught my

classmates and me the origins of paper money. Like the beginners we

were, we Economics 101 students trusted and believed them.

When I was a lad studying economics in between bouts of playing blues

guitar, surfing, and drinking fine Namibian lager, professors taught my

classmates and me the origins of paper money. Like the beginners we

were, we Economics 101 students trusted and believed them.Years later, when I was a postgrad in Economic History, I learned that my professors were wrong. Their account of the origins of paper money was based on theoretical wishful thinking rather than real world history. When you studied actual events, you found that things weren’t so simple.

Read More

from Gold Silver Worlds:

I’m not convinced!

I’m not convinced!

Supposedly crude oil prices will stay low for a long time and perhaps drop into the $20’s. The Internet is filled with reasons explaining why crude oil prices will drop. A few are:

Saudi Arabia is a swing producer and will provide what the world needs, regardless of price, because Saudi Arabia needs the revenue and employment for its people.

Iranian oil will soon hit the market and provide even more supply.

The global economic slow-down will reduce demand and prices for crude oil.

Read More

I’m not convinced!

I’m not convinced!Supposedly crude oil prices will stay low for a long time and perhaps drop into the $20’s. The Internet is filled with reasons explaining why crude oil prices will drop. A few are:

Saudi Arabia is a swing producer and will provide what the world needs, regardless of price, because Saudi Arabia needs the revenue and employment for its people.

Iranian oil will soon hit the market and provide even more supply.

The global economic slow-down will reduce demand and prices for crude oil.

Read More

by Dave Kranzler, Investment Research Dynamics:

Not only has volatility ramped up and several NYSE Rule 48’s issued

over the past week, but now the ETFs are broken. I’ll have more to say

about this in a future post but Bank of New York, which is the custodian

for a large number of ETFs, has not issued an updated price for any of

its ETFs for a week. And today the VIX ETFs were behaving like apes on

LSD: VIX ETFs Are In Crisis Mode

Not only has volatility ramped up and several NYSE Rule 48’s issued

over the past week, but now the ETFs are broken. I’ll have more to say

about this in a future post but Bank of New York, which is the custodian

for a large number of ETFs, has not issued an updated price for any of

its ETFs for a week. And today the VIX ETFs were behaving like apes on

LSD: VIX ETFs Are In Crisis Mode

The Fed’s points of interventions have become more obvious by the day and it’s becoming more obvious that the Fed’s ability to prop up the stock market is losing traction:

Read More

Not only has volatility ramped up and several NYSE Rule 48’s issued

over the past week, but now the ETFs are broken. I’ll have more to say

about this in a future post but Bank of New York, which is the custodian

for a large number of ETFs, has not issued an updated price for any of

its ETFs for a week. And today the VIX ETFs were behaving like apes on

LSD: VIX ETFs Are In Crisis Mode

Not only has volatility ramped up and several NYSE Rule 48’s issued

over the past week, but now the ETFs are broken. I’ll have more to say

about this in a future post but Bank of New York, which is the custodian

for a large number of ETFs, has not issued an updated price for any of

its ETFs for a week. And today the VIX ETFs were behaving like apes on

LSD: VIX ETFs Are In Crisis ModeThe Fed’s points of interventions have become more obvious by the day and it’s becoming more obvious that the Fed’s ability to prop up the stock market is losing traction:

Read More

Sing this song... you'll feel a little better while reading the real news...

If you're Screwed and you know it...

If you're Screwed and you know it, clap your hands (clap clap)

If you're Screwed and you know it, clap your hands (clap clap)

If you're Screwed and you know it, then your face will surely show it...

If you're Screwed and you know it, clap your hands. (clap clap)

If you're Screwed and you know it, stomp your feet (stomp stomp)

If you're Screwed and you know it, stomp your feet (stomp stomp)

If you're Screwed and you know it, then your face will surely show it...

If you're Screwed and you know it, stomp your feet. (stomp stomp)

If you're Screwed and you know it, shout "I'm Fucked!" (I'm-Fucked!)

If you're Screwed and you know it, shout "I'm Fucked!" (I'm-Fucked!)

If you're Screwed and you know it, then your face will surely show it...

If you're Screwed and you know it, shout "I'm-Fucked!" (I'm-Fucked!)

If you're Screwed and you know it, do all three (clap-clap, stomp-stomp, I'm-Fucked!)

If you're Screwed and you know it, do all three (clap-clap, stomp-stomp, I'm-Fucked!)

If you're Screwed and you know it, then your face will surely show it...

If you're Screwed and you know it, do all three. (clap-clap, stomp-stomp, I'm-Fucked!)

/

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment