Submitted by Tyler Durden on 09/18/2015 - 09:05 In 1927, the Fed lowered US rates to try to help Europe which was then in the middle of an economic debt crisis the same as today. It is very curious how history repeats and we have just witnessed the Fed yield to international pressure once again. In doing so, they are condemning US pension funds as well as the elderly to financial doom setting in motion the next financial crisis.

As The "Prosperity" Tide Recedes, The Ugly Reality Of Wealth Inequality Is Exposed

Submitted by Tyler Durden on 09/18/2015 - 10:16 The illusion that the tide of "prosperity" is lifting all boats is dissipating into a mist that no longer offers cover to obscenely wealthy politicos disclaiming the ugly reality of rising wealth/income inequality. The question for the chattering classes is this: will the bread and circuses of sports, random shootings, Trump and the rest of the churn in the media arena be enough to distract those stuck in leaky rowboats from the political fund-raising parties on the grandiose yachts?Crappy Days are here again...

So long sad times

Hello bad times

You are here at last

Howdy bad times

Blood in the street times

You will never be a thing of the past

Crappy days are here again

The skies above are full of drones again

So let's hope it's not our turn again

Crappy days are here again

Altogether shout it now

There's no one left

Who can doubt it now

So there's nobody left to tell the world about it now

Crappy days are here again

Your cares and troubles are gone because your dead

There'll be no more from now on

From now on ...

Crappy days are here again

The skies above are full of drones again

So let's hope it's not our turn again

Crappy days are here again

Crappy times

Crappy nights

Crappy days

Are here again!

from Liberty Blitzkrieg:

This is the perfect post for Fed day, where once again America’s Banana

Republic central planning statists were too petrified to raise interest

rates. The Fed has now missed the entire economic cycle without raising

rates once. All you can do now is sit back, relax and wait for all hell

to break loose.

This is the perfect post for Fed day, where once again America’s Banana

Republic central planning statists were too petrified to raise interest

rates. The Fed has now missed the entire economic cycle without raising

rates once. All you can do now is sit back, relax and wait for all hell

to break loose.

Recently released data from the Census Bureau is nothing short of devastating to anyone who has been pushing the absurd meme of a strong U.S. economy.

Read More

This is the perfect post for Fed day, where once again America’s Banana

Republic central planning statists were too petrified to raise interest

rates. The Fed has now missed the entire economic cycle without raising

rates once. All you can do now is sit back, relax and wait for all hell

to break loose.

This is the perfect post for Fed day, where once again America’s Banana

Republic central planning statists were too petrified to raise interest

rates. The Fed has now missed the entire economic cycle without raising

rates once. All you can do now is sit back, relax and wait for all hell

to break loose.Recently released data from the Census Bureau is nothing short of devastating to anyone who has been pushing the absurd meme of a strong U.S. economy.

Read More

ECB May Launch More QE In Response To Fed Inaction, Board Member Hints

Submitted by Tyler Durden on 09/18/2015 - 08:47 Now that the Fed appears to have made a grave policy error judging by the market's initial reaction, it is up to the ECB and BOJ to step up (even if as we warned two weeks ago both are running out of monetizable material) and try to preserve some confidence, i.e., halt the selling. Sure enough, that is precisely what happened earlier today when infamous ECB board member and hedge fund leaker Benoit Coeure hinted that if only the market drives 5Y5Y's even lower, i.e., inflation expectations, the ECB will have no choice but to boost QE.

by Jeff Nielson, Sprott Money

Read More

First we had “too big to fail”. Then came “too big to jail”. Now, finally, the U.S. Department of “Justice” is letting us know what it really thinks: U.S. Big Banks simply have a license to steal.

The most amazing thing about the Justice Department’s new

guidelines on prosecution of corporate crime is that the DOJ is

effectively acknowledging there was a big problem with how it did things

before.Read More

Obama Folds Again, To Begin Syria Military Talks With Russia "Very Shortly"

Submitted by Tyler Durden on 09/18/2015 - 11:05 As NY Times reports, "though the administration has long said that President Bashar al-Assad must go for there to be a durable solution to the Syria crisis, Mr. Kerry seemed on Friday to allow for the possibility that Mr. Assad might remain in power in the short term. Mr. Assad has had Russia’s backing throughout the conflict."

from Western Journalism:

If Donald Trump has said it once, he has talked about making America a

winner 10,000 times. Just as familiar is his refrain that he will “make

America great again.”

If Donald Trump has said it once, he has talked about making America a

winner 10,000 times. Just as familiar is his refrain that he will “make

America great again.”

As those words resonate with Republican voters, they have also now found their way into the White House–as President Obama showed this week when he parroted Trump in a defense of his accomplishments.

“America’s winning right now. America is great right now,” President Obama told the Business Roundtable on Wednesday, responding to Trump’s catchphrases without a direct mention of the Republican front-runner.

Read More

If Donald Trump has said it once, he has talked about making America a

winner 10,000 times. Just as familiar is his refrain that he will “make

America great again.”

If Donald Trump has said it once, he has talked about making America a

winner 10,000 times. Just as familiar is his refrain that he will “make

America great again.”As those words resonate with Republican voters, they have also now found their way into the White House–as President Obama showed this week when he parroted Trump in a defense of his accomplishments.

“America’s winning right now. America is great right now,” President Obama told the Business Roundtable on Wednesday, responding to Trump’s catchphrases without a direct mention of the Republican front-runner.

Read More

Buiter: Migrant Crisis "May Signal The Beginning Of The End" For EU

Submitted by Tyler Durden on 09/18/2015 - 10:40 "The refugee crisis is undermining the EU’s fundamental principle of free cross-border movement within the Union… This is effectively throwing the EU’s very future in question. This may signal the beginning of the end, the stakes are extremely high."

Russia Says It May Send Troops Into Combat In Syria As A Worried Netanyahu Heads To Moscow

Submitted by Tyler Durden on 09/18/2015 - 09:25 Foreign Minister Walid al-Moualem says Syria may officially request the support of Russian combat troops in the fight to take back the country, a move that would pave the way for the Kremlin to overtly declare that Russia has joined the war in support of Bashar al-Assad. Meanwhile, Israeli Prime Minister Benjamin Netanyahu will meet with Putin on Monday to discuss concerns that Russia's involvement could end up strengthening the military capabilities of Hezbollah. Lurking in the background: the man one CIA officer once called "the most powerful operative in the Middle East today"...

from Counter Punch:

“Obama administration officials, who have been negotiating with Turkey for months, said Thursday that they had reached an agreement for manned and unmanned American warplanes to carry out aerial attacks on Islamic State positions from air bases at Incirlik and Diyarbakir. The agreement was described by one senior administration official as a “game changer.”

New York Times, July 23, 2015

The Syrian war can divided into two parts: The pre-Incirlik period and the post-Incirlik period. The pre-Incirlik period is roughly the four year stretch during which US-backed Islamic militias and al Qaida-linked groups fought the Syrian army with the intention of removing President Bashar al Assad from power. This first phase of the war ended in a draw.

Read More

“Obama administration officials, who have been negotiating with Turkey for months, said Thursday that they had reached an agreement for manned and unmanned American warplanes to carry out aerial attacks on Islamic State positions from air bases at Incirlik and Diyarbakir. The agreement was described by one senior administration official as a “game changer.”

New York Times, July 23, 2015

The Syrian war can divided into two parts: The pre-Incirlik period and the post-Incirlik period. The pre-Incirlik period is roughly the four year stretch during which US-backed Islamic militias and al Qaida-linked groups fought the Syrian army with the intention of removing President Bashar al Assad from power. This first phase of the war ended in a draw.

Read More

Stocks Give Up Week's Gains, Dow Tests Key Technical Support

Submitted by Tyler Durden on 09/18/2015 - 09:17 That escalated quickly...

Gold & Silver Pumping, Crude & Copper Dumping

Submitted by Tyler Durden on 09/18/2015 - 08:43 It appears a combination of "there's not enough growth" and "well maybe they'll ease" has driven growthy commodities down hard post-Yellen and sent investors reaching for the safety of bullion. Silver is up over 5% this week now and Gold back at 3 week highs...

Dow Dumps 450 Points From Post-Fed Euphoria Highs, Time To Unleash The Bullard

Submitted by Tyler Durden on 09/18/2015 - 08:26 It appears we are going to need more dovishness. Following The Fed's admission that all-is-not-well - despite every talking head proclaiming liftoff imminent - the implicit lower-for-longer dovishness of The Fed has not been embraced by the "market." It appears a tipping point in Fed credibility may have been reached... but then again it is a quad witching.

Futures Drop More After Gartman Turns "Net Long Of Equities"

Submitted by Tyler Durden on 09/18/2015 - 08:06 "We are, here at TGL in our retirement fund, long of Apple and long of a “tanker’s” shares, whilst we are “short” of derivatives in sufficient quantity to be modestly net long of equities ..."

UK Stocks Flash-Crash As BP, Banks Plunge; LSE Investigating

Submitted by Tyler Durden on 09/18/2015 - 08:06 Chatter of a fat-finger trade, then exaggerated by the algos, has smashed UK's FTSE 100 lower instantly this morning, dragging major firms with it...*HSBC DROPS 4.8% IN UK TRADING, QUICKLY REBOUNDS TO 2.3% LOSS

*BP DROPS 4.7% IN UK TRADING, QUICKLY REBOUNDS TO 1.8% LOSS

As with all these plunges, the machines BTFD but the rebound is weak. LSE regulators are now investigating and no trades have been DK'd (yet).

Greece Heads Back To The Polls: Full Sunday Election Preview

Submitted by Tyler Durden on 09/18/2015 - 07:51 Don't look now but Greece (remember them?) is headed back to the polls on Sunday in an election that pits a watered down version of Alex Tsipras and Syriza against the conservative New Democracy. With Syriza's original vision relegated to the realm of "wishful thinking", Greeks face a choice that really is no choice at all.

Global Stocks Slide, Futures Tumble On Confusion Unleashed By "Uber-Dovish" Fed

Submitted by Tyler Durden on 09/18/2015 - 06:54 What was one "one and done", just became "none and done" as the Fed will no longer hike in 2015 and will certainly think twice before hiking ahead of the presidential election in 2016. By then the inventory liquidation-driven recession will be upon the US and the Fed will be looking at either NIRP or QE4. Worse, the Fed just admitted it is as, if not more concerned, with the market than with the economy. Worst, suddenly the market no longer wants a... dovish Fed?

from Washington’s Blog:

So the results are in: the Federal reserve decided to keep interest rates at around zero, delaying any increase in its target for at least six more weeks.

So the results are in: the Federal reserve decided to keep interest rates at around zero, delaying any increase in its target for at least six more weeks.

The move did not come as a surprise to Wall Street – which was betting 3-to-1 against the hike. But that’s not because investors didn’t think the US economy was ready for a rates “liftoff.” Rather, it shows that markets did not believe the Fed has the will and power to raise rates for the first time since June 2006.

Unfortunately, they guessed right.

Read More

So the results are in: the Federal reserve decided to keep interest rates at around zero, delaying any increase in its target for at least six more weeks.

So the results are in: the Federal reserve decided to keep interest rates at around zero, delaying any increase in its target for at least six more weeks.The move did not come as a surprise to Wall Street – which was betting 3-to-1 against the hike. But that’s not because investors didn’t think the US economy was ready for a rates “liftoff.” Rather, it shows that markets did not believe the Fed has the will and power to raise rates for the first time since June 2006.

Unfortunately, they guessed right.

Read More

from USA Watchdog:

The Federal Reserve is not raising interest rates, but now there are hints by Fed Head Janet Yellen that it might consider negative interest rates if the economy gets bad enough.

The economy is already bad, and the Fed decision to keep a key rate near 0% says it all. I have been telling you for a couple of years that there is no real recovery on Main Street. The only real recovery is on Wall Street. Data point after data point shows the economy is not good. This is why the Fed is not raising interest rates. I wonder if the stories out this week in the mainstream media were nothing more than a huge psychological operation, or PSYOP. There were stories all over the place saying that a rate hike would “Not Likely Spook the Economy,” or an interest rate hike would be a “good thing.” Obviously, no rate hike is a much better thing, and now the Fed is hinting at negative interest rates if the economy gets bad enough. By the way, Gregory Mannarino of TradersChoice.net brought up the possibility of the Fed going to negative interest rates months ago. Mannarino also says the Fed decision NOT to raise rates shows that all is not well in the economy, and if the economy would be getting better, the Fed “would not need to continue emergency monetary policy of 0% rates.” He also says, “At some point, the dose becomes toxic and turns to poison and kills the patient.” He’s talking about the 80 months and counting of 0% interest rates, and remember, rates could be forced to go negative in the future.

The Federal Reserve is not raising interest rates, but now there are hints by Fed Head Janet Yellen that it might consider negative interest rates if the economy gets bad enough.

The economy is already bad, and the Fed decision to keep a key rate near 0% says it all. I have been telling you for a couple of years that there is no real recovery on Main Street. The only real recovery is on Wall Street. Data point after data point shows the economy is not good. This is why the Fed is not raising interest rates. I wonder if the stories out this week in the mainstream media were nothing more than a huge psychological operation, or PSYOP. There were stories all over the place saying that a rate hike would “Not Likely Spook the Economy,” or an interest rate hike would be a “good thing.” Obviously, no rate hike is a much better thing, and now the Fed is hinting at negative interest rates if the economy gets bad enough. By the way, Gregory Mannarino of TradersChoice.net brought up the possibility of the Fed going to negative interest rates months ago. Mannarino also says the Fed decision NOT to raise rates shows that all is not well in the economy, and if the economy would be getting better, the Fed “would not need to continue emergency monetary policy of 0% rates.” He also says, “At some point, the dose becomes toxic and turns to poison and kills the patient.” He’s talking about the 80 months and counting of 0% interest rates, and remember, rates could be forced to go negative in the future.

“The

Nazis poisonous legacy lives on in a thousand crazed internet

conspiracy theorists, who depict Jacob Rothschild as the ruler of a

global dominion. Their anti-Semitic ravings fueled by the family’s long

standing links with Israel.” – Channel 4 documentary ‘The Aristocrats: The Rothschilds’

by SGT, SGT Report:

While doing some research tonight I stumbled upon this glossy propagandist piece about the Rothschilds which is carefully crafted to illicit empathy for this family who were once, according to the documentary, considered to be little more than “nouveau riche Jews”, the ultimate outsiders in British high society. It’s called ‘The Aristocrats‘. Produced by Channel 4 in the UK, the documentary is described this way, ‘The Rothschilds are the most famous family in the world, known for being enormously wealthy and enormously private, fueling endless speculation about the real extent of their power.”

The first five minutes alone are worth every second of your time. In the first few minutes you will find the following sentence: “Far away from public view, the famously discreet Billionaire is hosting a private party to celebrate an art world coup. In 2007 he paid 5 million pounds for Jean Chardin’s subtle masterpiece “Boy With a House of Cards”.

My friends, the actual name of the Chardin painting is “Boy Building a House of Cards“. If you are fully awake, you must find such information about one of the world’s richest Bankers very telling, and very amusing. Jacob Rothschild bought the painting just one year prior to the 2008 economic crisis.

At 14 minutes and 40 seconds into this documentary Jacob says, “We saw clearly in 2008, of course the world’s financial system was coming to an end, and we saw that coming.” Hard cut. Channel 4 won’t allow you to hear the rest of what Jacob had to say about that.

At 4:38, there’s this absolute gem: “His guests at Waddesdon are not confined to the nobility and the newly rich. Royalty and Presidents also come here. Each time planting a tree in commemoration. Their spades left gleaming in the corridor leading to the visitor lavoratories.”

Honestly, this is priceless. The shovels that Kings, Queens and Presidents used to dig holes on the Rothschild estate are left on display in the hallway… leading to the visitor toilets. Are you starting to get the picture?

And one least thing, as you watch Jacob spend tens, and perhaps hundreds of millions of pounds on sculptures, art installations and new buildings in which to display it all, the premise here that he is worth a mere $550 million pounds becomes utterly laughable. ~SGT

by SGT, SGT Report:

While doing some research tonight I stumbled upon this glossy propagandist piece about the Rothschilds which is carefully crafted to illicit empathy for this family who were once, according to the documentary, considered to be little more than “nouveau riche Jews”, the ultimate outsiders in British high society. It’s called ‘The Aristocrats‘. Produced by Channel 4 in the UK, the documentary is described this way, ‘The Rothschilds are the most famous family in the world, known for being enormously wealthy and enormously private, fueling endless speculation about the real extent of their power.”

The first five minutes alone are worth every second of your time. In the first few minutes you will find the following sentence: “Far away from public view, the famously discreet Billionaire is hosting a private party to celebrate an art world coup. In 2007 he paid 5 million pounds for Jean Chardin’s subtle masterpiece “Boy With a House of Cards”.

My friends, the actual name of the Chardin painting is “Boy Building a House of Cards“. If you are fully awake, you must find such information about one of the world’s richest Bankers very telling, and very amusing. Jacob Rothschild bought the painting just one year prior to the 2008 economic crisis.

At 14 minutes and 40 seconds into this documentary Jacob says, “We saw clearly in 2008, of course the world’s financial system was coming to an end, and we saw that coming.” Hard cut. Channel 4 won’t allow you to hear the rest of what Jacob had to say about that.

At 4:38, there’s this absolute gem: “His guests at Waddesdon are not confined to the nobility and the newly rich. Royalty and Presidents also come here. Each time planting a tree in commemoration. Their spades left gleaming in the corridor leading to the visitor lavoratories.”

Honestly, this is priceless. The shovels that Kings, Queens and Presidents used to dig holes on the Rothschild estate are left on display in the hallway… leading to the visitor toilets. Are you starting to get the picture?

And one least thing, as you watch Jacob spend tens, and perhaps hundreds of millions of pounds on sculptures, art installations and new buildings in which to display it all, the premise here that he is worth a mere $550 million pounds becomes utterly laughable. ~SGT

from WallStForMainSt:

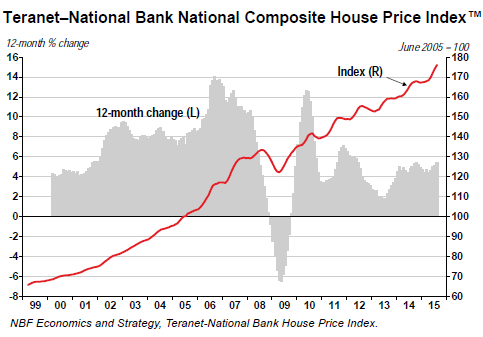

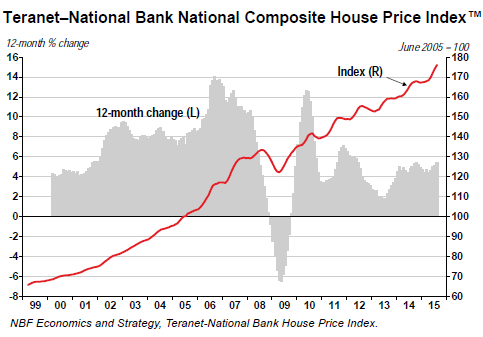

from Wolf Street:

The Bank of Canada has been fretting about the ballooning debt of

Canadian households. Last year, it repeatedly called it a risk to

“financial stability,” perhaps in preparation for raising its benchmark

interest rate. Then Canada’s economy tanked.

The Bank of Canada has been fretting about the ballooning debt of

Canadian households. Last year, it repeatedly called it a risk to

“financial stability,” perhaps in preparation for raising its benchmark

interest rate. Then Canada’s economy tanked.

In July, when the freaked-out Bank of Canada cut its benchmark rate for the second time this year, it admitted that the rate cut comes at the price of “financial stability risks” which “remain elevated.” Governor Stephen Poloz added: “Of particular note are the vulnerabilities associated with household debt and rising housing prices.”

These rate cuts didn’t do much to support Canada’s resource economy that has been spiraling down in the wake of the commodities rout. But they made up for it by inflating the housing bubble even further.

Read More

The Bank of Canada has been fretting about the ballooning debt of

Canadian households. Last year, it repeatedly called it a risk to

“financial stability,” perhaps in preparation for raising its benchmark

interest rate. Then Canada’s economy tanked.

The Bank of Canada has been fretting about the ballooning debt of

Canadian households. Last year, it repeatedly called it a risk to

“financial stability,” perhaps in preparation for raising its benchmark

interest rate. Then Canada’s economy tanked.In July, when the freaked-out Bank of Canada cut its benchmark rate for the second time this year, it admitted that the rate cut comes at the price of “financial stability risks” which “remain elevated.” Governor Stephen Poloz added: “Of particular note are the vulnerabilities associated with household debt and rising housing prices.”

These rate cuts didn’t do much to support Canada’s resource economy that has been spiraling down in the wake of the commodities rout. But they made up for it by inflating the housing bubble even further.

Read More

FEDS admit US Government forces states to accept common core. UK study says there will be a rise in mass shootings. Japan ruling party forced the war bill through. Ukraine bans reporters for 1 year. US issues warning to US citizens in Libya, get out now. Germany sides with Russia, need to create coalition to fight IS.

/

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment