Submitted by Tyler Durden on 09/08/2015 - 16:04

Does The Fed Really Have A Choice?

Submitted by Tyler Durden on 09/08/2015 - 08:10 We all know the global economy is slowing, so why would stocks soar from here? The basic answer is simple: The Fed has no choice, because this game is now for all the marbles.

It Really Is As Simple As That

Submitted by Tyler Durden on 09/08/2015 - 15:50 Six years after we first explained the only thing that matters for this "market", JPMorgan finally figured it out. When everything else fails, start a war…

When everything else fails, start a war…I’ve always said that the U.S. Government would start a World War when it was pushed to the brink of having to disclose that fact that it no longer has any gold and that the U.S. financial and economic system is nothing but one massive Ponzi scheme that rests on an unaccountably enormous maze of derivatives, debt and fraud. We saw evidence of no gold in the cupboard when the Fed failed to deliver on Germany’s request for immediate repatriation of over 600 tonnes of gold. That saga is still being written.

Following this line of thinking, it makes senses that the mainstream media is not questioning or spending resources on reporting the escalating military activities in Syria. Especially in light of the fact that the mainstream media has caught on to the fact that the U.S. Government is primary cause of the refugee problem in Europe.

Read More

Read This Before The Mainstream Media Uses A Drowned Refugee Boy To Start Another War

Submitted by Tyler Durden on 09/08/2015 - 15:30 A baby boy turned to flotsam. Washed up on the shore, face down in the mud. Warmongers in government and the media are perversely but predictably trying to conscript Aylan’s corpse into their march to escalation. They are contending that Aylan died because the West has not intervened against Syria’s dictator Bashar al-Assad, and that it must do so now to spare other children the same fate. Um, no, Aylan’s family were Kurdish refugees from Kobani who had to flee that city when it was besieged, not by Assad, but by Assad’s enemy: ISIS.

Goldman Warns, VIX "Is Pricing In A Lot Of Economic Damage"

Submitted by Tyler Durden on 09/08/2015 - 15:05 If the market is right, Goldman warns that current cross-asset-class volatility appears to be pricing in a lot of economic damage. As they note, VIX doesn’t just trade the economy; it also has a strong and often humbling element of risk sentiment baked in.

NYPD Cops Fire 84 Shots At Murder Suspect, Miss 83 Times

Submitted by Tyler Durden on 09/08/2015 - 14:45 "You have a running gun battle here. There are a lot of cops involved and it takes place in several different locations. It’s not as if everything was stationary."

"Desperate" Chicago Schools Need Half Billion To Avoid Mass Layoffs, Partial Shutdown

Submitted by Tyler Durden on 09/08/2015 - 14:24 "It is like the board is a desperate gambler at the end of their run"...

Why SocGen Is Very Nervous About The Recent Loss Of $9 Trillion In Global Market Cap

Submitted by Tyler Durden on 09/08/2015 - 14:20 The good news: the collapse in global market cap since May of 2015 is not the worst ever.The bad news: the $9 trillion drop in combined market cap between the MSCI All World index and Chinese stocks, is the second highest ever, surpassed only by the $13 plunge in global market capitalization in late 2008.

Android 'Porn App' Secretly Snaps Photos, Blackmails Users

Submitted by Tyler Durden on 09/08/2015 - 13:50 Forget nuclear facility sabotage; ignore stock market glitches; the world of cyber-threats just got serious. As The Telegraph reports, an Android app virus seduces users by promising porn but takes compromising photos of them to use as blackmail. The 'ransomware' demands a ransom of $500 (paid via PayPal) and warns "your device has been blocked for safety reasons listed below. All your files are encrypted. You are accused of viewing/storage and/or dissemination of banned pornography." Given the populist rhetoric among the presidential candidates (and urge for the younger demographic's vote), this would seem like a slam-dunk for any administration's cyber-crime unit.

Retail Sales Slump On Deck: Consumer Spending Slides To Lowest Since March After Worst August Since 2012

Submitted by Tyler Durden on 09/08/2015 - 13:31 according to the latest Gallup report on US consumer spending, in which a random sample of 15.724 adults were interviewed by phone, Americans' self-reported daily spending averaged just $89 in August, down not only from August in 2014 and 2013 but the fourth month in a row of year-over-year spending declines, as well as was also the lowest monthly spend since March of 2015. And this time there are no "scapegoats" to blame the spending slowdown on: the weather in August was uniformly gorgeous around the US.

FANG FUBARer - NFLX Tumbles Near Black Monday's Flash-Crash Lows

Submitted by Tyler Durden on 09/08/2015 - 13:28 One of the founder members of the so-called FANG stocks has now fallen 7 straight days and is resting Black Monday's flash-crash lows in today's session. With the media darling breaking back below its 100-day moving-average, technical pressure continues to weigh on the share price,. as it is almost down 30% from its record highs...

Unmasking Of "Mystery Treasury Buyer" Has No Impact On "Uneventful" 3 Year Auction

Submitted by Tyler Durden on 09/08/2015 - 13:17 The internals of the auction were solid if not groundbreaking: the Bid to Cover was 3.233, fractionally below the TTM average of 3.286, the Dealer take down of 41% was the highest since February, while Indirects ended up withe 51% of the takedown, above the 45.7% TTM average. Finally, Directs were awarded just 8.0% of the auction matching the lowest since February. In short: a perfectly average auction, one which did not attract particular attention for any one reason. Which is why, tomorrow's 10Y auction will be far more closely watched.

Bye Bye BABA - China's "Amazon" Plunges After Talking Down Numbers

Submitted by Tyler Durden on 09/08/2015 - 12:39 BABA Shares stalled once again in their efforts to break back above the IPO price of $68. Following a Citi tech conference which reportedly saw Alibaba investor relations talking down their numbers, BABA has plunged over 6%

Developed Market Stocks & Bonds Have Never (Ever) Been This Expensive

Submitted by Tyler Durden on 09/08/2015 - 12:35 Thanks to the new normal world of extremely loose monetary policy and extraordinary accumulations of financial assets by Central Banks, Deutsche Bank finds that we live in a period not of selectively expensive global asset prices, but of record "expensiveness" across developed market bonds, stocks, and real estate.

from SilverSeek:

How does silver perform during deflation? Which is better during a

deflation – silver or gold? The answers will depend on quite a few

things as well as what definition of deflation one uses.

How does silver perform during deflation? Which is better during a

deflation – silver or gold? The answers will depend on quite a few

things as well as what definition of deflation one uses.

If you look at monetary history, then you will find that we have moved from periods where mostly real or tangible assets like gold and silver acted as monetary claims on goods and services in the economy, to today where mostly credit or debt claims (fiat currencies like the US dollar) act as monetary claims on goods and services. Therefore, we have moved from a real asset-based monetary system to a debt-based monetary system.

Read More

How does silver perform during deflation? Which is better during a

deflation – silver or gold? The answers will depend on quite a few

things as well as what definition of deflation one uses.

How does silver perform during deflation? Which is better during a

deflation – silver or gold? The answers will depend on quite a few

things as well as what definition of deflation one uses.If you look at monetary history, then you will find that we have moved from periods where mostly real or tangible assets like gold and silver acted as monetary claims on goods and services in the economy, to today where mostly credit or debt claims (fiat currencies like the US dollar) act as monetary claims on goods and services. Therefore, we have moved from a real asset-based monetary system to a debt-based monetary system.

Read More

from KingWorldNews:

Today King World News is featuring a piece by a man whose recently

released masterpiece has been praised around the world, and also

recognized as some of the most unique work in the gold market. Below is

the latest exclusive KWN piece by Ronald-Peter Stoeferle of Incrementum

AG out of Liechtenstein.

Today King World News is featuring a piece by a man whose recently

released masterpiece has been praised around the world, and also

recognized as some of the most unique work in the gold market. Below is

the latest exclusive KWN piece by Ronald-Peter Stoeferle of Incrementum

AG out of Liechtenstein.

“If a good is to remain money, the public must not come to believe that a fast and unstoppable increase in its supply is to be expected.” — Ludwig von Mises

One Of The Most Shocking Charts Of 2015!

Read More…

Today King World News is featuring a piece by a man whose recently

released masterpiece has been praised around the world, and also

recognized as some of the most unique work in the gold market. Below is

the latest exclusive KWN piece by Ronald-Peter Stoeferle of Incrementum

AG out of Liechtenstein.

Today King World News is featuring a piece by a man whose recently

released masterpiece has been praised around the world, and also

recognized as some of the most unique work in the gold market. Below is

the latest exclusive KWN piece by Ronald-Peter Stoeferle of Incrementum

AG out of Liechtenstein.“If a good is to remain money, the public must not come to believe that a fast and unstoppable increase in its supply is to be expected.” — Ludwig von Mises

One Of The Most Shocking Charts Of 2015!

Read More…

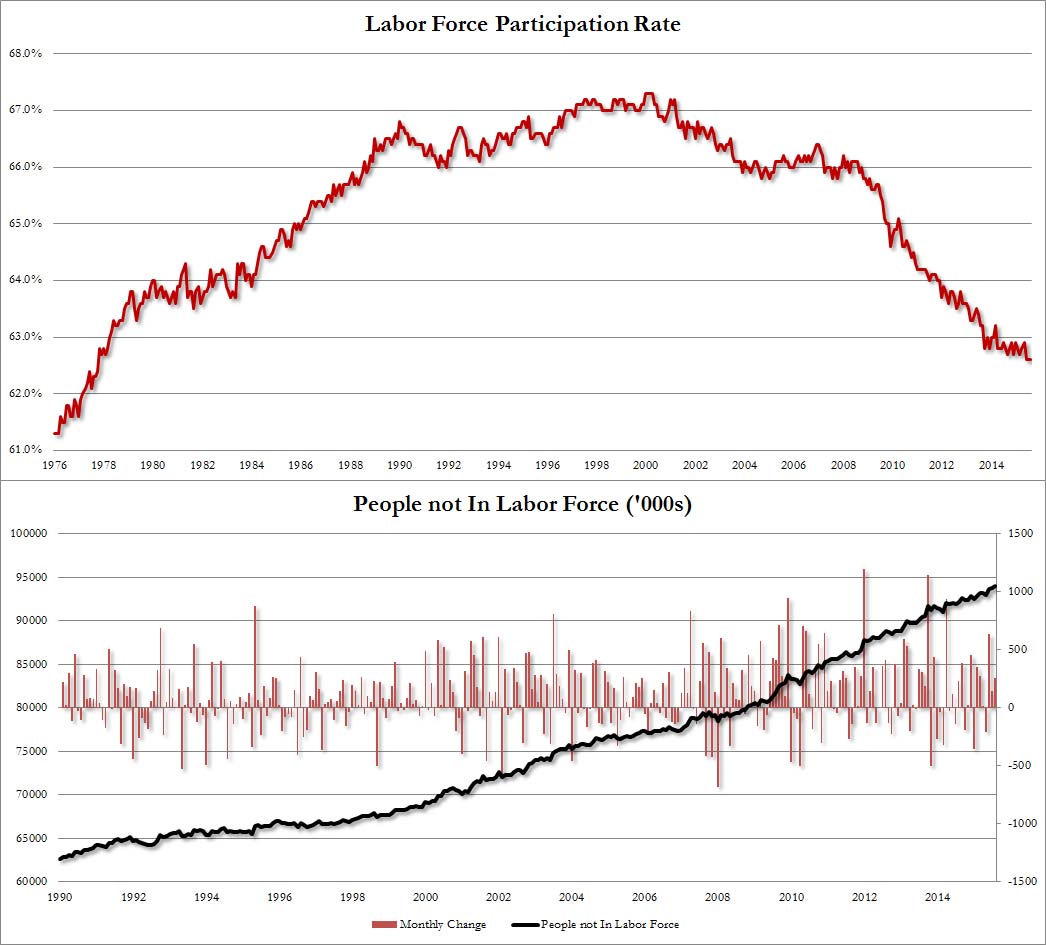

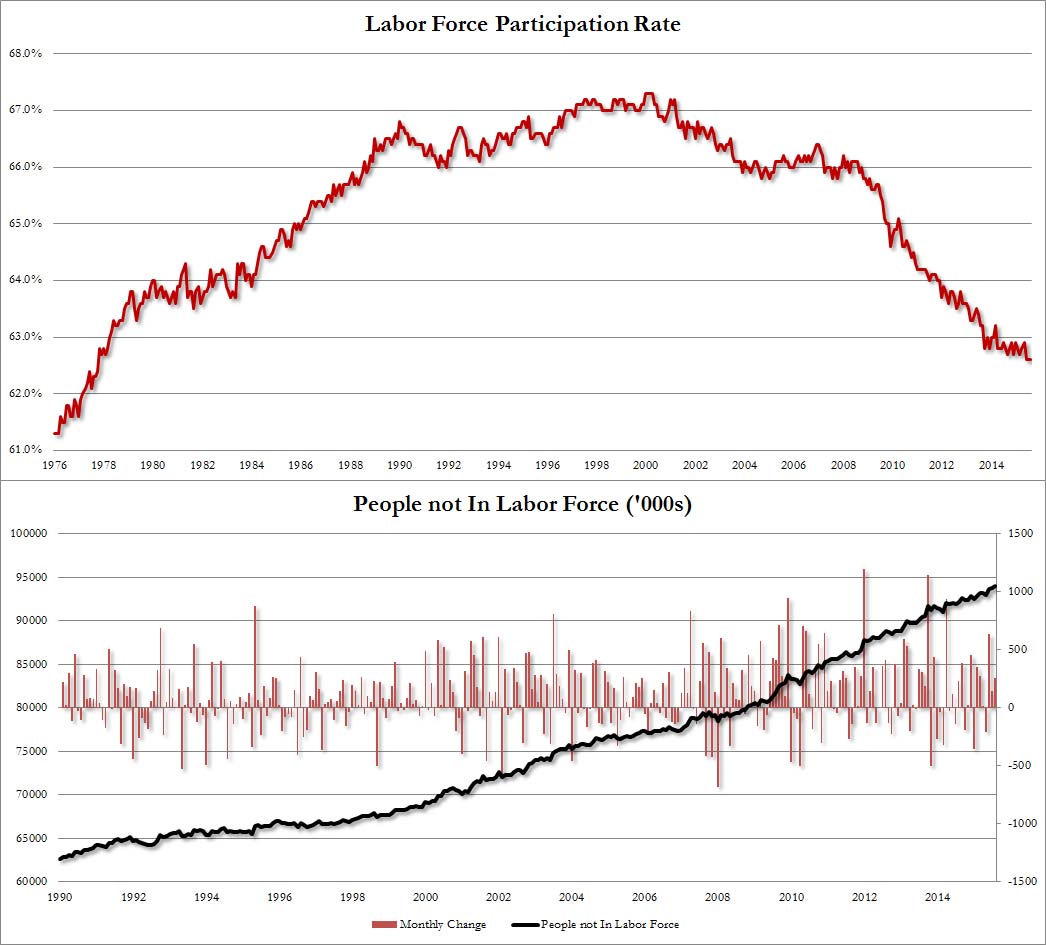

from The Money GPS:

The army of non-working Americans continues to grow.

from MyBudget360.com:

The employment numbers released a few days ago left much to be desired right before entering into the nationally celebrated Labor Day holiday. Not many people can enjoy the “labor” part of the holiday since those not in the labor force has hit another stunning record. The latest gloomy figures show that 94 million Americans are not in the labor force. This category added a stunning 261,000 people while overall jobs added came in at a lackluster 173k. When we dig into the employment figures we find that many of the jobs being added are also coming in the form of low wage jobs. The market is coming to the grim realization that something is fishy with how the employment figures are reported. We supposedly have the lowest unemployment rate in seven years yet somehow we now have 94 million Americans not in the labor force with hundreds of thousands of people dropping out each month. Those finding work are largely in McJobs with low pay, no benefits, and job security that resembles the lifespan of a fly. The army of non-working Americans continues to grow.

Read More

from MyBudget360.com:

The employment numbers released a few days ago left much to be desired right before entering into the nationally celebrated Labor Day holiday. Not many people can enjoy the “labor” part of the holiday since those not in the labor force has hit another stunning record. The latest gloomy figures show that 94 million Americans are not in the labor force. This category added a stunning 261,000 people while overall jobs added came in at a lackluster 173k. When we dig into the employment figures we find that many of the jobs being added are also coming in the form of low wage jobs. The market is coming to the grim realization that something is fishy with how the employment figures are reported. We supposedly have the lowest unemployment rate in seven years yet somehow we now have 94 million Americans not in the labor force with hundreds of thousands of people dropping out each month. Those finding work are largely in McJobs with low pay, no benefits, and job security that resembles the lifespan of a fly. The army of non-working Americans continues to grow.

Read More

from Natural News:

Huge corporations like Monsanto that have suspect agendas – such as

selling poisons worldwide and screwing with the very fabric of Nature –

have learned long ago how to implement a number of dirty tricks designed

to fool authorities and the public into believing that their methods

and products are safe.

Huge corporations like Monsanto that have suspect agendas – such as

selling poisons worldwide and screwing with the very fabric of Nature –

have learned long ago how to implement a number of dirty tricks designed

to fool authorities and the public into believing that their methods

and products are safe.

One of the ways this is accomplished is through enlisting the services of “independent experts” who publicly back the claims of a company, assuring everyone that the products and practices of such a company have been proven to be safe or harmless through their own impartial scientific research.

The problem is that far too often, these so-called experts are anything but independent. In many cases, they are nothing more than paid shills who are hired to stack the deck in the company’s favor.

Read More

Huge corporations like Monsanto that have suspect agendas – such as

selling poisons worldwide and screwing with the very fabric of Nature –

have learned long ago how to implement a number of dirty tricks designed

to fool authorities and the public into believing that their methods

and products are safe.

Huge corporations like Monsanto that have suspect agendas – such as

selling poisons worldwide and screwing with the very fabric of Nature –

have learned long ago how to implement a number of dirty tricks designed

to fool authorities and the public into believing that their methods

and products are safe.One of the ways this is accomplished is through enlisting the services of “independent experts” who publicly back the claims of a company, assuring everyone that the products and practices of such a company have been proven to be safe or harmless through their own impartial scientific research.

The problem is that far too often, these so-called experts are anything but independent. In many cases, they are nothing more than paid shills who are hired to stack the deck in the company’s favor.

Read More

by Dave Hodges, The Common Sense Show:

Prior to airtime, Steve Quayle issued the following statement in a personal message to Dave Hodges.

Prior to airtime, Steve Quayle issued the following statement in a personal message to Dave Hodges.

“A NATION UNDER JUDGMENT, AS CIVIL WAR UNFOLDS BEFORE OUR EYES. THE COMING PLANNED GENOCIDE AGAINST AMERICANS HAS STARTED”. ~STEVE QUAYLE

Sounds a bit extreme doesn’t it? But for those who know Steve Quayle and have followed his work for any length of time, you don’t need his scorecard in front of you to know how many uncovered plots and stunningly accurate revelations Steve has brought to public’s attention in the past several years.

Read More

Prior to airtime, Steve Quayle issued the following statement in a personal message to Dave Hodges.

Prior to airtime, Steve Quayle issued the following statement in a personal message to Dave Hodges.“A NATION UNDER JUDGMENT, AS CIVIL WAR UNFOLDS BEFORE OUR EYES. THE COMING PLANNED GENOCIDE AGAINST AMERICANS HAS STARTED”. ~STEVE QUAYLE

Sounds a bit extreme doesn’t it? But for those who know Steve Quayle and have followed his work for any length of time, you don’t need his scorecard in front of you to know how many uncovered plots and stunningly accurate revelations Steve has brought to public’s attention in the past several years.

Read More

from CoinWeek:

Australian sales of bullion gold and silver slowed in August compared

to July and a year ago, the latest figures from the Perth Mint show, yet

they ended sharply higher than in all but one of the months in the

first half of 2015.

Australian sales of bullion gold and silver slowed in August compared

to July and a year ago, the latest figures from the Perth Mint show, yet

they ended sharply higher than in all but one of the months in the

first half of 2015.

Bullion sales in August couldn’t compete from those in July, when the Mint’s gold sales rallied to a nine-month high and its silvers sales peaked at an eighth-month high.

As for the numbers, Perth Mint orders of gold coins and gold bars advanced 33,390 ounces last month, falling 34.6% from the 51,088 ounces delivered in July and slipping 8.2% from the 36,369 ounces sold in August 2014. For the year to date, gold sales at 253,128 ounces are down 16.3% from last year’s starting eight-month total of 302,463 ounces.

Read More

Australian sales of bullion gold and silver slowed in August compared

to July and a year ago, the latest figures from the Perth Mint show, yet

they ended sharply higher than in all but one of the months in the

first half of 2015.

Australian sales of bullion gold and silver slowed in August compared

to July and a year ago, the latest figures from the Perth Mint show, yet

they ended sharply higher than in all but one of the months in the

first half of 2015.Bullion sales in August couldn’t compete from those in July, when the Mint’s gold sales rallied to a nine-month high and its silvers sales peaked at an eighth-month high.

As for the numbers, Perth Mint orders of gold coins and gold bars advanced 33,390 ounces last month, falling 34.6% from the 51,088 ounces delivered in July and slipping 8.2% from the 36,369 ounces sold in August 2014. For the year to date, gold sales at 253,128 ounces are down 16.3% from last year’s starting eight-month total of 302,463 ounces.

Read More

/

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment