Hot on the heels of The World Bank demanding The Fed not hike rates, China issued a statement "calling on US to jointly ensure global economic stability,"

tonight following a farcical intervention last night on record low

volumes and a small devaluation of the Yuan. Foreign Minister Wang added

"China and U.S. should also properly handle disagreements and safeguard current international order," just as another minister spewed forth "China’s economic outlook is very bright," -

well apart from the record debt, collapsing asset values, and masssive

over-capacity, you mean. Further measures detailing the new capital restrictions for forward FX transactions were announced (which will likely do for CNH what regulators did to Chinese index futures). Chinese stoicks are extending their gains in the pre-open on vapid volume as China leaves Yuan practically unchanged.

Hot on the heels of The World Bank demanding The Fed not hike rates, China issued a statement "calling on US to jointly ensure global economic stability,"

tonight following a farcical intervention last night on record low

volumes and a small devaluation of the Yuan. Foreign Minister Wang added

"China and U.S. should also properly handle disagreements and safeguard current international order," just as another minister spewed forth "China’s economic outlook is very bright," -

well apart from the record debt, collapsing asset values, and masssive

over-capacity, you mean. Further measures detailing the new capital restrictions for forward FX transactions were announced (which will likely do for CNH what regulators did to Chinese index futures). Chinese stoicks are extending their gains in the pre-open on vapid volume as China leaves Yuan practically unchanged. John Embry: “There is something seriously wrong behind the curtain in my opinion.”

John Embry: “There is something seriously wrong behind the curtain in my opinion.”The War In The Silver Market

“Last week, on three consecutive days, silver, which is incredibly undervalued and attracting significant premiums in the physical market, launched three impressive rallies which were immediately met by frenetic selling in the paper market that drove the price back down to below where the rally started. And then yesterday silver was under pressure the entire day in the London market. So there is something really strange going on in the silver market. And last Friday when gold rallied on what could only be called a disappointing jobs number in the United States, the price was immediately driven back down, falling nearly $15 in the blink of an eye. The weakness in gold was further reinforced yesterday in London.

Read More…

Japan's Nikkei 225 Just Gained 1000 Points In 20 Hours

Submitted by Tyler Durden on 09/08/2015 - 22:55 Presented with little comment aside to ask, just what did The G-20 agree to behind the scenes?

"August Sucks" MIT Quant Warns New Strategies "Are Creating Volatility"

Submitted by Tyler Durden on 09/08/2015 - 21:55 "August Sucks," concludes MIT Quant guru Andrew Lo, reflecting on the systematic-trading strategy effects on markets, and it's not going to get better any time soon. As he explains to Bloomberg, "algorithmic trading is speeding up the reaction times of these participants, so that’s the choppiness of the market. Everybody can move to the left side of the boat and the right side of the boat now within minutes as opposed to hours or days." As we have noted many time, Lo explains how "crowded trades have got to the point of alpha becoming beta," warning that volatility-targeting strategies (such as Risk-Parity) are not only "exaggerating the moves," but he cautions omniously reminiscent of the August 2007 quant crash, "I think they are creating volatility of volatility."

The Fed Is About To Unleash Deflation: Deutsche Bank Shows How

Submitted by Tyler Durden on 09/08/2015 - 20:05 When it comes to the Fed's upcoming rate hike, only one simple shorthand matters: higher rates means less liquidity, and vice versa. What does that mean for inflation/deflation and bond yields? According to the following simple and understandable analysis by Deutsche Bank, nothing good.

Fed Hike Will Unleash "Panic And Turmoil" And A New Emerging Market Crisis, Warns World Bank Chief Economist

Submitted by Tyler Durden on 09/08/2015 - 17:25 Earlier today we got the most glaring confirmation there had been absolutely zero coordination at the highest levels of authority and "responsibility", when the World Bank's current chief economist, Kaushik Basu warned that the Fed risks, and we quote, triggering “panic and turmoil” in emerging markets if it opts to raise rates at its September meeting and should hold fire until the global economy is on a surer footing, the World Bank’s chief economist has warned. And just in case casually tossing the words "panic in turmoil" was not enough, Basu decided to add a few more choice nouns, adding a rate hike "could yield a “shock” and a new crisis in emerging markets" Despotism is not solely the preview of the state. When individuals or

groups demonstrate their propensity to use savage force to inflict their

world view on others, decent society is at risk. The “Black Lives

Matter” thugs who have shown their disregard for civilized acculturation

are a prime example of the defective thinking that permeates their

shallow and twisted minds. Absent in their pomposity is any moral claim

for their warped cause that advocates violence and murder. Genetic

traits are supposed to be taboo for discussion, but when certain

elements of sociopathic conduct is evident in brutal behavior, sane

people have to ask if deplorable cultural norms are not the only factors

that breed disturbed motives for initiating a race war.

Despotism is not solely the preview of the state. When individuals or

groups demonstrate their propensity to use savage force to inflict their

world view on others, decent society is at risk. The “Black Lives

Matter” thugs who have shown their disregard for civilized acculturation

are a prime example of the defective thinking that permeates their

shallow and twisted minds. Absent in their pomposity is any moral claim

for their warped cause that advocates violence and murder. Genetic

traits are supposed to be taboo for discussion, but when certain

elements of sociopathic conduct is evident in brutal behavior, sane

people have to ask if deplorable cultural norms are not the only factors

that breed disturbed motives for initiating a race war.How ridiculous it is to advocate a clash among races when the common enemy that fosters the breakdown of civilization has affected everyone in their sites. If warfare between controllers of the system and the humble serfs that pay homage to their masters comes to be, is it not prudent to understand just who the enemy is?

Read More…

by Gary Christenson, Deviant Investor:

Supposedly crude oil prices will stay low for a long time and perhaps

drop into the $20’s. The Internet is filled with reasons explaining why

crude oil prices will drop. A few are:

Supposedly crude oil prices will stay low for a long time and perhaps

drop into the $20’s. The Internet is filled with reasons explaining why

crude oil prices will drop. A few are:

– Saudi Arabia is a swing producer and will provide what the world needs, regardless of price, because Saudi Arabia needs the revenue and employment for its people.

– Iranian oil will soon hit the market and provide even more supply.

Read More

Supposedly crude oil prices will stay low for a long time and perhaps

drop into the $20’s. The Internet is filled with reasons explaining why

crude oil prices will drop. A few are:

Supposedly crude oil prices will stay low for a long time and perhaps

drop into the $20’s. The Internet is filled with reasons explaining why

crude oil prices will drop. A few are:– Saudi Arabia is a swing producer and will provide what the world needs, regardless of price, because Saudi Arabia needs the revenue and employment for its people.

– Iranian oil will soon hit the market and provide even more supply.

Read More

by Graham Summers, via GoldSeek:

The 2008 crash was a warm up.

The 2008 crash was a warm up.

Many investors think that we could never have a financial crash again. The 2008 melt-down was a one in 100 years episode, they think.

They are wrong.

The 2008 Crisis was a stock and investment bank crisis. But it was not THE Crisis.

THE Crisis concerns the biggest bubble in financial history: the epic Bond bubble… which as it stands is north of $100 trillion… although if you include the derivatives that trade based on bonds it’s more like $500 TRILLION.

Read More

The 2008 crash was a warm up.

The 2008 crash was a warm up.Many investors think that we could never have a financial crash again. The 2008 melt-down was a one in 100 years episode, they think.

They are wrong.

The 2008 Crisis was a stock and investment bank crisis. But it was not THE Crisis.

THE Crisis concerns the biggest bubble in financial history: the epic Bond bubble… which as it stands is north of $100 trillion… although if you include the derivatives that trade based on bonds it’s more like $500 TRILLION.

Read More

Place ID as well as all credit cards, passports etc in microwave one at a time and turn on high for 1-3 seconds... you should see a flash as you destroy the RFID chips...enjoy... but it's really a waste of time if you carry around a tracking device with a phone attached to it...aka a dumb phone...

It has been speculated by those who have been researching the ongoing encroachment of the national security state that it would be fully implemented through a range of restrictions that would make it all but impossible to engage with modern society if one is “non-compliant.”

Enter the “enhanced” driver’s license.

First off, it’s worth noting that having a driver’s license at all is a restriction on one’s liberty. Nevertheless, for those who have given in to that bit of soft tyranny, it now appears that the standard license is not going to be sufficient to travel as you wish.

Read More

US Aerial Surveillance Impaired Off The East Coast Until October 1st Due To "Military Activities"

Submitted by Tyler Durden on 09/08/2015 - 20:45 It appears that aerial surveillance across much of the East Coast will be impaired until October 1 due to “military activities.”“This notam has caused considerable alarm and much confusion, while giving pilots little time to prepare. The long duration, ambiguous language, and short notice of this notam are all cause for serious concern."

British Airways Boeing 777 Catches Fire On Take Off From Las Vegas

Submitted by Tyler Durden on 09/08/2015 - 20:25

"Some People Just Don't Fit In The Economy" Buffett Explains "We Send Them Off To Afghanistan"

Submitted by Tyler Durden on 09/08/2015 - 18:20 Not to be outdone by his partner Charlie Munger (who offended many with his comments that "gold is a great thing to sew onto your garments if you're a Jewish family in Vienna in 1939,"), Berkshire Hathaway's Warren Buffett - having already taken on Europe, comparing Greece to a "dog peeing on the carpet" of Europe, suggesting Germany stop "rewarding behavior you want to get rid of" - takes aim at the military. Speaking on Bloomberg TV, the octagenerian oracle of offense just unfriended every American veteran...

Social Security Disability Fund Will Be Broke Next Year

Submitted by Tyler Durden on 09/08/2015 - 19:45 The 2015 annual report from the Social Security Board of Trustees shows that the program’s disability component is in immediate trouble. Data from the latest report show that the disability fund will be depleted as soon as next year and unable to pay full benefits to beneficiaries.

It Really Is As Simple As That

Submitted by Tyler Durden on 09/08/2015 - 17:50 Six years after we first explained the only thing that matters for this "market", JPMorgan finally figured it out.

"Liar Loans" Are Back! 2008 Here We Come

Submitted by Tyler Durden on 09/08/2015 - 17:45 Liar loans are back from the dead which means that if you look under the hood, you might just have a shoddy credit or two hiding in the collateral pool of your triple-A mortgage-backed paper. Meanwhile, in a further sign that we've learned nothing since the crisis, non-Agency RMBS is set to stage a comeback. Today King World News is featuring a piece by a man whose recently

released masterpiece has been praised around the world, and also

recognized as some of the most unique work in the gold market. Below is

the latest exclusive KWN piece by Ronald-Peter Stoeferle of Incrementum

AG out of Liechtenstein.

Today King World News is featuring a piece by a man whose recently

released masterpiece has been praised around the world, and also

recognized as some of the most unique work in the gold market. Below is

the latest exclusive KWN piece by Ronald-Peter Stoeferle of Incrementum

AG out of Liechtenstein.“If a good is to remain money, the public must not come to believe that a fast and unstoppable increase in its supply is to be expected.” — Ludwig von Mises

One Of The Most Shocking Charts Of 2015!

Read More…

Read This Before The Mainstream Media Uses A Drowned Refugee Boy To Start Another War

Submitted by Tyler Durden on 09/08/2015 - 15:30 A baby boy turned to flotsam. Washed up on the shore, face down in the mud. Warmongers in government and the media are perversely but predictably trying to conscript Aylan’s corpse into their march to escalation. They are contending that Aylan died because the West has not intervened against Syria’s dictator Bashar al-Assad, and that it must do so now to spare other children the same fate. Um, no, Aylan’s family were Kurdish refugees from Kobani who had to flee that city when it was besieged, not by Assad, but by Assad’s enemy: ISIS.

"Desperate" Chicago Schools Need Half Billion To Avoid Mass Layoffs, Partial Shutdown

Submitted by Tyler Durden on 09/08/2015 - 14:24 "It is like the board is a desperate gambler at the end of their run"...

British Navy Admits "It Was Us, Not The Russians" That Damaged Irish Trawler In April

Submitted by Tyler Durden on 09/08/2015 - 19:20 Back in April, European and US officials were quick to blame "The Russians" when a British fishing trawler's nets became entangled in a submarine. The incident, one of many, was rapidly escalated as further excuse to increase NATO forces across Europe and as evidence of Russia's aggression. There's just one small problem... As The Daily Mail reports, in this case, it wasn't the Russians - The Royal Navy has finally admitted one of its submarines damaged an Irish fishing trawler in April - five months after the Russian vessel was blamed for the incident.

MI6 "ISIS Rat Line" & The Threat To India

Submitted by Tyler Durden on 09/08/2015 - 19:00 The prosecution of a Swedish national accused of terrorist activities in Syria has collapsed at the Old Bailey after it became clear Britain’s security and intelligence agencies would have been deeply embarrassed had a trial gone ahead, the Guardian reported. "The prosecution abandoned the case, apparently to avoid embarrassing the intelligence services. The defence argued that going ahead with the trial would have been an “affront to justice” when there was plenty of evidence the British state was itself providing “extensive support” to the armed Syrian opposition. That didn’t only include the “non-lethal assistance” boasted of by the government (including body armour and military vehicles), but training, logistical support and the secret supply of “arms on a massive scale”."

Goldman Explains Why Europe's Refugee Crisis Is Actually A Blessing

Submitted by Tyler Durden on 09/08/2015 - 18:35 The refugee crisis in Europe - sparked in large part by Syria’s four-year old, bloody civil war - recently reached a tipping point and the scramble to find a workable solution both in terms of allocating asylum seekers and finding the funds to accommodate them has become the single most pressing challenge facing European policy makers. Amid the chaos, Goldman may have found the silver lining.

"The World Is Running Low On Interventionist Ammo" SocGen Warns "China Is The Dominant Black Swan"

Submitted by Tyler Durden on 09/08/2015 - 18:10 When it comes to crisis, SocGen notes that there is an abundance of case studies; and against the backdrop of the uncertainty shock delivered by China and the subsequent market tumult, market participants have been looking to the history books for clues as to what could happen next. While individual crises create their own risks, SocGen warns, the overriding risk is that markets are taking less comfort today from the idea that central banks may step in with further QE-style liquidity injections to save the world.

YHOO Flash-Crashes After IRS Fails To Rule On BABA Spin-Off

Submitted by Tyler Durden on 09/08/2015 - 17:07 Well this might explain the weakness in BABA over the last couple of days as it appears 'news' of the IRS lack of decision on the tax-free-ness of YHOO's BABA spin-off leaked out. It is decidely unclear how the IRS's decision not to issue a ruling will impact the spin-off but for now YHOO shares have flash-crashed after hours and are now hovering 5-6% lower...

"It's For The Children"

Submitted by Tyler Durden on 09/08/2015 - 16:55 Presented with no comment... Liver and kidney damage due to a diet full of genetically modified

food has already been shown in a notable, yet controversial study that

was once forced to be retracted, and then later republished by the Journal of Food and Chemical Toxicology. This study, titled the “Long Term Toxicity of Roundup Herbicide and a Roundup-Tolerant Genetically Modified Maize” is joined now by a new, peer-reviewed study

showing that even at the levels of glyphosate the general public is

exposed to in drinking water, over 4000 genes and their proper

functioning are altered in the livers and kidneys of rats.

Liver and kidney damage due to a diet full of genetically modified

food has already been shown in a notable, yet controversial study that

was once forced to be retracted, and then later republished by the Journal of Food and Chemical Toxicology. This study, titled the “Long Term Toxicity of Roundup Herbicide and a Roundup-Tolerant Genetically Modified Maize” is joined now by a new, peer-reviewed study

showing that even at the levels of glyphosate the general public is

exposed to in drinking water, over 4000 genes and their proper

functioning are altered in the livers and kidneys of rats.Are we affected too?

Read More

by Ileana Johnson, Freedom Outpost:

The late Henry Lamb and Tom DeWeese have been working tirelessly for decades to unravel the thorny and terrifying tentacles of U.N.’s Agenda 21, a soft law signed in 1992 by 178 countries. But the idea of a one world government/order has been around since the turn of the 20th century. It suffices to look at the back of a dollar bill to see the evidence. Featured prominently under the Masonic Pyramid are the Latin words, Novus Ordo Seclorum, the New World Order.

In 1891, Cecil Rhodes, of the Rhodes Scholarship fame, turned his dream–that the entire world should be governed by the British Empire–into the Society of the Elect (The Secret Society), the planting of the global governance seed. When they bought a place to headquarter his organization, it became the Chatham House Gang.

Read More

The late Henry Lamb and Tom DeWeese have been working tirelessly for decades to unravel the thorny and terrifying tentacles of U.N.’s Agenda 21, a soft law signed in 1992 by 178 countries. But the idea of a one world government/order has been around since the turn of the 20th century. It suffices to look at the back of a dollar bill to see the evidence. Featured prominently under the Masonic Pyramid are the Latin words, Novus Ordo Seclorum, the New World Order.

In 1891, Cecil Rhodes, of the Rhodes Scholarship fame, turned his dream–that the entire world should be governed by the British Empire–into the Society of the Elect (The Secret Society), the planting of the global governance seed. When they bought a place to headquarter his organization, it became the Chatham House Gang.

Read More

by Karl Denninger, Market-Ticker:

See, I told you so…

See, I told you so…

A SurveyUSA poll released Friday shows in a hypothetical matchup with Hillary Clinton, Trump is ahead 45% to 40%.

But digging into the racial breakdown of the respondents is revealing. For example, the poll finds 25% of black respondents say they would vote for Trump over Clinton.

How come?

Simple: Who gets screwed the worst by our current illegal invader full employment policy?

Read More

See, I told you so…

See, I told you so…A SurveyUSA poll released Friday shows in a hypothetical matchup with Hillary Clinton, Trump is ahead 45% to 40%.

But digging into the racial breakdown of the respondents is revealing. For example, the poll finds 25% of black respondents say they would vote for Trump over Clinton.

How come?

Simple: Who gets screwed the worst by our current illegal invader full employment policy?

Read More

from Dollar Collapse:

For about a decade there, Brazil was the Latin American country that

got it right. Under a socialist but apparently reasonable government

they kept their budgets under control, managed the population shift from

farm to city, and developed some efficient export industries that

brought in plenty of hard currency. The Brazilian real held its own on

foreign exchange markets and inflation was, as a result, moderate.

For about a decade there, Brazil was the Latin American country that

got it right. Under a socialist but apparently reasonable government

they kept their budgets under control, managed the population shift from

farm to city, and developed some efficient export industries that

brought in plenty of hard currency. The Brazilian real held its own on

foreign exchange markets and inflation was, as a result, moderate.

Then it all fell apart. The US dollar spiked, commodity prices tanked, and it was discovered that a whole range of big local players were gaming the system in various ways, sparking a corruption scandal that reaches all the way to top.

Read More

For about a decade there, Brazil was the Latin American country that

got it right. Under a socialist but apparently reasonable government

they kept their budgets under control, managed the population shift from

farm to city, and developed some efficient export industries that

brought in plenty of hard currency. The Brazilian real held its own on

foreign exchange markets and inflation was, as a result, moderate.

For about a decade there, Brazil was the Latin American country that

got it right. Under a socialist but apparently reasonable government

they kept their budgets under control, managed the population shift from

farm to city, and developed some efficient export industries that

brought in plenty of hard currency. The Brazilian real held its own on

foreign exchange markets and inflation was, as a result, moderate.Then it all fell apart. The US dollar spiked, commodity prices tanked, and it was discovered that a whole range of big local players were gaming the system in various ways, sparking a corruption scandal that reaches all the way to top.

Read More

from Armstrong Economics:

QUESTION:

QUESTION:

Mr Armstrong, interesting article today, the story of the store of value (at least long term) has always confused me. One can look at saving accounts also as an asset as it yields the interest payment and one relinquishes the access to the money. No difference to bonds.

But your article causes some questions: as you stated before the FED buying bonds does not increase real money supply, so what caused the decline of purchasing power of money in the asset class of equities? Is it that the manipulating of interest rates distorted the actual confidence and time preference in the economy which can be measured by the velocity?

Read More

QUESTION:

QUESTION: Mr Armstrong, interesting article today, the story of the store of value (at least long term) has always confused me. One can look at saving accounts also as an asset as it yields the interest payment and one relinquishes the access to the money. No difference to bonds.

But your article causes some questions: as you stated before the FED buying bonds does not increase real money supply, so what caused the decline of purchasing power of money in the asset class of equities? Is it that the manipulating of interest rates distorted the actual confidence and time preference in the economy which can be measured by the velocity?

Read More

by John Whitehead, Rutherford:

“Since mankind’s dawn, a handful of oppressors have accepted the responsibility over our lives that we should have accepted for ourselves. By doing so, they took our power. By doing nothing, we gave it away. We’ve seen where their way leads, through camps and wars, towards the slaughterhouse.” ― Alan Moore, V for Vendetta

What began with the passage of the USA Patriot Act in October 2001 has snowballed into the eradication of every vital safeguard against government overreach, corruption and abuse. Since then, we have been terrorized, traumatized, and acclimated to life in the American Surveillance State.

Read More

“Since mankind’s dawn, a handful of oppressors have accepted the responsibility over our lives that we should have accepted for ourselves. By doing so, they took our power. By doing nothing, we gave it away. We’ve seen where their way leads, through camps and wars, towards the slaughterhouse.” ― Alan Moore, V for Vendetta

What began with the passage of the USA Patriot Act in October 2001 has snowballed into the eradication of every vital safeguard against government overreach, corruption and abuse. Since then, we have been terrorized, traumatized, and acclimated to life in the American Surveillance State.

Read More

from Red List News:

On episode 17 of Red List News, Dave goes deep with the sustained Muslim invasion of America and Sharia Law in Dearborn, Michigan. Next, Jim provides an update on the fourth explosion in China, and how coincidence can now be ruled-out. Dave covers the many benefits of being a pet owner with his next report, while Jim highlights the latest move in the Obama dictatorship. Closing out the broadcast, Dave issues some sobering facts about the future our children no longer have; conversely, Jim spotlights how Russia is stabilizing their future by giving away farmland to its citizens.

On episode 17 of Red List News, Dave goes deep with the sustained Muslim invasion of America and Sharia Law in Dearborn, Michigan. Next, Jim provides an update on the fourth explosion in China, and how coincidence can now be ruled-out. Dave covers the many benefits of being a pet owner with his next report, while Jim highlights the latest move in the Obama dictatorship. Closing out the broadcast, Dave issues some sobering facts about the future our children no longer have; conversely, Jim spotlights how Russia is stabilizing their future by giving away farmland to its citizens.

by Aden Sisters, Gold-Eagle:

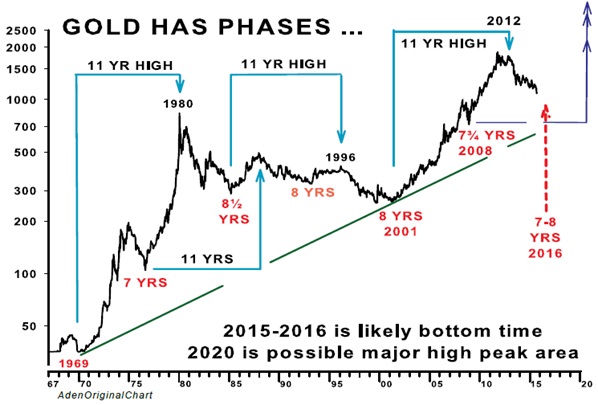

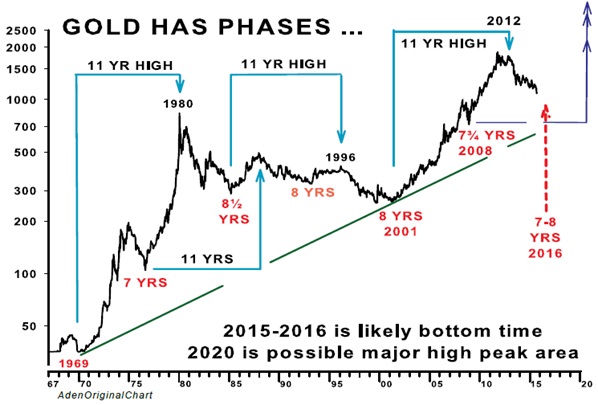

Gold prices have been volatile. Some feel the lows are behind us, but others disagree.

Gold prices have been volatile. Some feel the lows are behind us, but others disagree.

With the gold price swinging up and down, this is a good time to stand back and review what the charts are telling us, to get some perspective on the situation…

Chart 1 is our favorite big picture of the gold price. It identifies the cyclical nature of gold since the late 1960s, and how well it’s performed within these cycles since then.

First, note the lows in red. Ever since gold formed its low in 1969 it’s had a low about every seven or eight years. The last eight year low was the November 2008 low during the financial crisis.

Read More

Gold prices have been volatile. Some feel the lows are behind us, but others disagree.

Gold prices have been volatile. Some feel the lows are behind us, but others disagree.With the gold price swinging up and down, this is a good time to stand back and review what the charts are telling us, to get some perspective on the situation…

Chart 1 is our favorite big picture of the gold price. It identifies the cyclical nature of gold since the late 1960s, and how well it’s performed within these cycles since then.

First, note the lows in red. Ever since gold formed its low in 1969 it’s had a low about every seven or eight years. The last eight year low was the November 2008 low during the financial crisis.

Read More

by Chris Powell, GATA:

Dear Friend of GATA and Gold:

Russia’s government long has understood gold’s secret power over the international monetary system. In an address in June 2004 at the summer meeting of the London Bullion Market Association at the Kempinsky Hotel in Moscow, the Russian central bank’s deputy chairman, Oleg Mozhaiskov, spoke only four words in English: “Gold Anti-Trust Action Committee”:

http://www.gata.org/node/4235

As far as GATA itself knew at that time, it had never had any contact with anyone in Russia or anyone connected with the Russian government.

Read More

Dear Friend of GATA and Gold:

Russia’s government long has understood gold’s secret power over the international monetary system. In an address in June 2004 at the summer meeting of the London Bullion Market Association at the Kempinsky Hotel in Moscow, the Russian central bank’s deputy chairman, Oleg Mozhaiskov, spoke only four words in English: “Gold Anti-Trust Action Committee”:

http://www.gata.org/node/4235

As far as GATA itself knew at that time, it had never had any contact with anyone in Russia or anyone connected with the Russian government.

Read More

from Gold Silver Worlds:

Buy a few congresspersons, or preferably a president, and obtain a

“no-bid” contract to provide something to the government at a huge

markup. It could be Tamiflu vaccine, security services in Iraq, TSA

scanners, private prisons or so many other schemes. The profits can be

enormous to the point that payoffs to politicians are insignificant.

This works especially well if you are a member of the financial elite.

Buy a few congresspersons, or preferably a president, and obtain a

“no-bid” contract to provide something to the government at a huge

markup. It could be Tamiflu vaccine, security services in Iraq, TSA

scanners, private prisons or so many other schemes. The profits can be

enormous to the point that payoffs to politicians are insignificant.

This works especially well if you are a member of the financial elite.

Let the Federal Reserve ship several billion dollars in shrink-wrapped one hundred dollars bills to you, and exempt yourself from accountability. This worked in Iraq – link here.

Read More

Buy a few congresspersons, or preferably a president, and obtain a

“no-bid” contract to provide something to the government at a huge

markup. It could be Tamiflu vaccine, security services in Iraq, TSA

scanners, private prisons or so many other schemes. The profits can be

enormous to the point that payoffs to politicians are insignificant.

This works especially well if you are a member of the financial elite.

Buy a few congresspersons, or preferably a president, and obtain a

“no-bid” contract to provide something to the government at a huge

markup. It could be Tamiflu vaccine, security services in Iraq, TSA

scanners, private prisons or so many other schemes. The profits can be

enormous to the point that payoffs to politicians are insignificant.

This works especially well if you are a member of the financial elite.Let the Federal Reserve ship several billion dollars in shrink-wrapped one hundred dollars bills to you, and exempt yourself from accountability. This worked in Iraq – link here.

Read More

by Andy Hoffman, Miles Franklin:

Even I

am in awe of the cumulative lethargy of a Mainstream Media so dumbed

down by propaganda; and so beaten down by the relentless decline in its

readership and viewership; it no longer even publishes. To wit,

two days after a horrific decline to yet another horrific week – both

economically and financial market-wise; amidst the worst economic

environment of our lifetimes, and a burgeoning, global financial

crisis with “2008” written all over it – I see “nary a peep” from the

major news services. Sure, Zero Hedge is flooded with “alternative

media” commentaries; but as for actual “news” reporting, absolutely

nothing. Nada. Zip. Heck, you’d think it was a lazy, devil-may-care

summer weekend of the late 1990s, mid-2000s, or even 1987 or 1929!

Even I

am in awe of the cumulative lethargy of a Mainstream Media so dumbed

down by propaganda; and so beaten down by the relentless decline in its

readership and viewership; it no longer even publishes. To wit,

two days after a horrific decline to yet another horrific week – both

economically and financial market-wise; amidst the worst economic

environment of our lifetimes, and a burgeoning, global financial

crisis with “2008” written all over it – I see “nary a peep” from the

major news services. Sure, Zero Hedge is flooded with “alternative

media” commentaries; but as for actual “news” reporting, absolutely

nothing. Nada. Zip. Heck, you’d think it was a lazy, devil-may-care

summer weekend of the late 1990s, mid-2000s, or even 1987 or 1929!

Read More

Even I

am in awe of the cumulative lethargy of a Mainstream Media so dumbed

down by propaganda; and so beaten down by the relentless decline in its

readership and viewership; it no longer even publishes. To wit,

two days after a horrific decline to yet another horrific week – both

economically and financial market-wise; amidst the worst economic

environment of our lifetimes, and a burgeoning, global financial

crisis with “2008” written all over it – I see “nary a peep” from the

major news services. Sure, Zero Hedge is flooded with “alternative

media” commentaries; but as for actual “news” reporting, absolutely

nothing. Nada. Zip. Heck, you’d think it was a lazy, devil-may-care

summer weekend of the late 1990s, mid-2000s, or even 1987 or 1929!

Even I

am in awe of the cumulative lethargy of a Mainstream Media so dumbed

down by propaganda; and so beaten down by the relentless decline in its

readership and viewership; it no longer even publishes. To wit,

two days after a horrific decline to yet another horrific week – both

economically and financial market-wise; amidst the worst economic

environment of our lifetimes, and a burgeoning, global financial

crisis with “2008” written all over it – I see “nary a peep” from the

major news services. Sure, Zero Hedge is flooded with “alternative

media” commentaries; but as for actual “news” reporting, absolutely

nothing. Nada. Zip. Heck, you’d think it was a lazy, devil-may-care

summer weekend of the late 1990s, mid-2000s, or even 1987 or 1929!Read More

by Dave Kranzler, Investment Research Dynamics:

When everything else fails, start a war…

When everything else fails, start a war…

I’ve always said that the U.S. Government would start a World War when it was pushed to the brink of having to disclose that fact that it no longer has any gold and that the U.S. financial and economic system is nothing but one massive Ponzi scheme that rests on an unaccountably enormous maze of derivatives, debt and fraud. We saw evidence of no gold in the cupboard when the Fed failed to deliver on Germany’s request for immediate repatriation of over 600 tonnes of gold. That saga is still being written.

Following this line of thinking, it makes senses that the mainstream media is not questioning or spending resources on reporting the escalating military activities in Syria. Especially in light of the fact that the mainstream media has caught on to the fact that the U.S. Government is primary cause of the refugee problem in Europe.

Read More

When everything else fails, start a war…

When everything else fails, start a war…I’ve always said that the U.S. Government would start a World War when it was pushed to the brink of having to disclose that fact that it no longer has any gold and that the U.S. financial and economic system is nothing but one massive Ponzi scheme that rests on an unaccountably enormous maze of derivatives, debt and fraud. We saw evidence of no gold in the cupboard when the Fed failed to deliver on Germany’s request for immediate repatriation of over 600 tonnes of gold. That saga is still being written.

Following this line of thinking, it makes senses that the mainstream media is not questioning or spending resources on reporting the escalating military activities in Syria. Especially in light of the fact that the mainstream media has caught on to the fact that the U.S. Government is primary cause of the refugee problem in Europe.

Read More

/

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment