Emerging markets are in trouble…

Emerging markets are in trouble…The iShares MSCI Emerging Markets ETF (EEM), which holds roughly 800 emerging-market stocks, is down 23% since last September.

And things have gotten even worse recently. EEM has now fallen for the past seven days straight.

John Burbank thinks the strong U.S. dollar is a big reason why…

Burbank founded Passport Capital, a hedge fund that manages $4.1 billion. He made a fortune betting against the U.S. housing market in 2007. Passport Capital’s main fund returned 219% that year.

Read More

Monetary Policy "Psy-Ops" - Why Central Bankers Should Be Seen And Not Heard

Submitted by Tyler Durden on 09/28/2015 - 14:19 The Fed’s policy of forward guidance and radical transparency is not working. It turns out that letting the market peer over its shoulder as it makes monetary policy sausage is, in some ways, worse than the opaque process that existed prior to the arrival of Bernanke and Yellen. It pulls back the curtain and shows the human, error prone side of the Fed. Every time the Fed’s dots move, it is an admission of failure and undermines the very confidence it was trying to inspire.

UBS Is About To Blow The Cover On A Massive Gold-Rigging Scandal

Submitted by Tyler Durden on 09/28/2015 - 12:22 Unlike previous gold probe cases, this one will have major consequences. How do we know? Because just like in LIBOR-gate, just like in FX-gate, it is the biggest rat of all, Swiss megabank UBS, that is about to turn on its former criminal peers. As Bloomberg reported earlier "UBS was granted conditional leniency in Swiss antitrust probe of possible manipulation of precious metal prices." Why would UBS do this? The same reason UBS did so on at least on two prior occasions: the regulators have definitive proof it is involved, and gave it the option to turn evidence and to rat out its cartel peers, or face even more massive financial penalties. UBS, as usual, choice the former.FX Liquidity Is Tumbling To Dangerous Levels

Submitted by Tyler Durden on 09/28/2015 - 14:00

And The Market Breaks...

Submitted by Tyler Durden on 09/28/2015 - 13:49 Stocks are down hard, JPY momo is not working, nor is VIX... time to break something...- *NYSE ARCA SUSPENDS ROUTING TO CHICAGO STOCK EXCHANGE

- *NYSE ARCA HAS DECLARED SELF-HELP AGAINST CHICAGO STOCK EXCHANGE

Confusion-nado - 2015 Rate-Hike Odds Plunge To Record Lows After Fed's Evans Dovish Comments

Submitted by Tyler Durden on 09/28/2015 - 13:45 We have had "bad cop" Dudley and so now "good cop" Evans unleashes more uncertainty, confusion, and farce:*EVANS: BEST APPROACH IS FOR LATER LIFTOFF, GRADUAL TIGHTENING

*EVANS SAYS `EXTRA-PATIENT APPROACH' TO TIGHTENING IS WARRANTED

The reaction was very clear, Fed Funds Futures dipped to record lows for October (16%) and December (41%). And worse still, "dovishness" did nothing for stocks at all...

The Next Looming "Commodity" Failure: Social Media

Submitted by Tyler Durden on 09/28/2015 - 13:26 The social media space is beginning to make one wonder if they’re looking at an iron ore chart, or bulk shipper, rather than “the hottest space it all tech.” i.e., everything social. And it’s just the beginning in my opinion. Sooner or later Wall Street is going to come knocking for either its promise of profits. Or, its money back. And when that starts (which I believe has already begun) the mad-rush to cash-in what ever value a share might have that day will be assailed with stunning speed... much like the commodity space where stalwarts of an entire sector can find themselves struggling for solvency in mere months.

Ackman Loses $700 Million Instantly After Valeant Gets Drug Pricing Subpoena

Submitted by Tyler Durden on 09/28/2015 - 13:04 Yet another nail in the Biotech Bubble's coffin as Bloomberg reports Valeant receives a subpoena from House Democrats over "massive price increases." The stock is down 12 % on the news extending the collapse of the last few days and weighing very heavily on the broad Biotech index. Very bad news for Bill Ackman and his 20 million shares...

The Echo Bubble In Housing Is About To Pop

Submitted by Tyler Durden on 09/28/2015 - 12:53 The Federal Reserve-induced Echo Housing Bubble is finally starting to roll over, and the bubble's pop won't be pretty. Why is the bubble finally popping now? All the factors that inflated the Echo Housing bubble are running dry.

Currency Warfare: Ruble Plunges As Putin Speech Ends

Submitted by Tyler Durden on 09/28/2015 - 12:37 We are sure it's just a coincidence but seconds after Vladimir Putin concluded his speech at The UN calling for a broad anti-terrorist coalition, the Russian Ruble was sold aggressively (after a relatively news-less and quiet day in the currency)...

Glencore Implodes: Stock Plunges Most Ever, CDS Blow Out To Record Up On Equity Wipeout Fears

Submitted by Tyler Durden on 09/28/2015 - 12:20 Update: And there it is: GLENCORE DEBT INSURANCE COSTS SURGE TO RECORD HIGH; 5-YR CREDIT DEFAULT SWAPS RISE 207BASIS POINTS FROM FRIDAY'S CLOSE TO 757 BASIS POINTSThose who listened to our reco to buy Glencore CDS at 170 bps in March 2014 can take the rest of the year off. As of this moment, GLEN Credit Default Swap were pushing on 600 bps, 4 times wider, and on pace to take out the 2011 liquidity crunch highs. After that, it's smooth sailing to all time wides and the start of a self-fulfilling prophecy which leads to the Companys's IG downgrade and the collapse of trillions in derivative notionals as what may be the trading desk of the biggest commodity counterparty quietly goes out of business.

from GoldSeek:

The price of gold moved up moderately, and the price of silver moved down a few cents this week. However, there were some interesting fireworks in the middle of the week. Tuesday, the prices dropped and Thursday the prices of the metals popped $23 and $0.34 respectively.

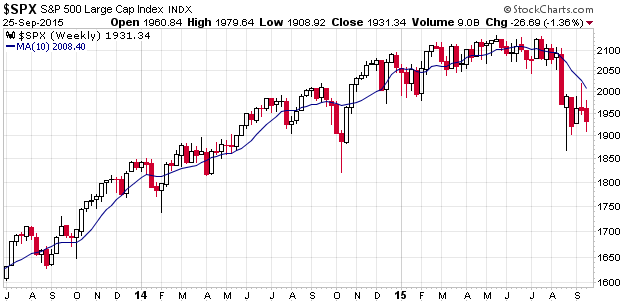

Everyone can judge the sentiment prevailing in gold and silver articles for themselves, but we think there is a growing feeling of optimism (that is a renewed fall in the dollar, which most think is a rise in gold). This goes along with a sense that the long bull run in the stock market is rolling over.

We are inclined to agree that the stock market may be overdue for its appointment with gravity.

Read More

The price of gold moved up moderately, and the price of silver moved down a few cents this week. However, there were some interesting fireworks in the middle of the week. Tuesday, the prices dropped and Thursday the prices of the metals popped $23 and $0.34 respectively.

Everyone can judge the sentiment prevailing in gold and silver articles for themselves, but we think there is a growing feeling of optimism (that is a renewed fall in the dollar, which most think is a rise in gold). This goes along with a sense that the long bull run in the stock market is rolling over.

We are inclined to agree that the stock market may be overdue for its appointment with gravity.

Read More

by Bill Holter, JS Mineset:

My Dear Extended Family,

My Dear Extended Family,

Outright financial collapse, chaos and most probably war is not only in sight, it is imminent and unavoidable now. Normally I try to write and support my conclusions with current or past events via links to news. For this writing, because of the length and scope I don’t plan to do this. It will be assumed that you as the reader have already heard of or read evidence of what is put forth as connectable dots.

This past week, the following article was forwarded all over the internet

http://investmentwatchblog.com/if-deutsche-bank-goes-under-it-will-be-lehman-times-five/ as Deutsche Bank is “all of a sudden news”. Maybe this is a “German thing” with the latest out of Volkswagen?

Read More

My Dear Extended Family,

My Dear Extended Family,Outright financial collapse, chaos and most probably war is not only in sight, it is imminent and unavoidable now. Normally I try to write and support my conclusions with current or past events via links to news. For this writing, because of the length and scope I don’t plan to do this. It will be assumed that you as the reader have already heard of or read evidence of what is put forth as connectable dots.

This past week, the following article was forwarded all over the internet

http://investmentwatchblog.com/if-deutsche-bank-goes-under-it-will-be-lehman-times-five/ as Deutsche Bank is “all of a sudden news”. Maybe this is a “German thing” with the latest out of Volkswagen?

Read More

from The Sleuth Journal:

The global drone arms race continues to accelerate. Now that it’s a foregone conclusion that every country will have armed drones within 10 years, the only race left is to acquire the most powerful weaponized drones – preferably coupled with the most sophisticated anti-drone technology.

General Atomics Aeronautical Systems, Inc., or GA–ASI, the San Diego-based company that makes the Predator and Reaper drones, is undertaking a privately funded study to integrate a 150-kilowatt solid-state laser onto its Avenger (née Predator-C) drone. If the company succeeds, a drone with a high-energy laser will be a reality at some point in 2017, company executives told Defense One.

Read More

The global drone arms race continues to accelerate. Now that it’s a foregone conclusion that every country will have armed drones within 10 years, the only race left is to acquire the most powerful weaponized drones – preferably coupled with the most sophisticated anti-drone technology.

General Atomics Aeronautical Systems, Inc., or GA–ASI, the San Diego-based company that makes the Predator and Reaper drones, is undertaking a privately funded study to integrate a 150-kilowatt solid-state laser onto its Avenger (née Predator-C) drone. If the company succeeds, a drone with a high-energy laser will be a reality at some point in 2017, company executives told Defense One.

Read More

from Western Journalism:

Following U.S. House Speaker John Boehner’s announcement Friday that he will be resigning from the position effective Oct. 30, Barack Obama issued a response some critics on both sides of the aisle found indicative of the politically cozy relationship between the two leaders.

Describing the outgoing speaker as a “good man” and “a patriot,” Obama noted his desire that Boehner’s replacement follow suit by working across party lines to achieve common goals.

Obama’s brief remark fueled Twitter complaints that Boehner did not provide a strong conservative resistance to Democrat policies.

Read More

Following U.S. House Speaker John Boehner’s announcement Friday that he will be resigning from the position effective Oct. 30, Barack Obama issued a response some critics on both sides of the aisle found indicative of the politically cozy relationship between the two leaders.

Describing the outgoing speaker as a “good man” and “a patriot,” Obama noted his desire that Boehner’s replacement follow suit by working across party lines to achieve common goals.

Obama’s brief remark fueled Twitter complaints that Boehner did not provide a strong conservative resistance to Democrat policies.

Read More

filed under (unt

by Amy Chozick, NYTimes:

Former President Bill Clinton blamed Republicans who hope to undercut

his wife’s presidential chances and a voracious political news media

uninterested in substance for the furor surrounding Hillary Rodham

Clinton’s use of a private email account and server while she was

secretary of state.

Former President Bill Clinton blamed Republicans who hope to undercut

his wife’s presidential chances and a voracious political news media

uninterested in substance for the furor surrounding Hillary Rodham

Clinton’s use of a private email account and server while she was

secretary of state.

“I have never seen so much expended on so little,” Mr. Clinton said in a taped interview with Fareed Zakaria that is scheduled to be shown Sunday on CNN. The network released excerpts on Saturday afternoon.

“She said she was sorry that her personal email caused all this confusion,” Mr. Clinton said. “And she’d like to give the election back to the American people. I think it will be all right. But it’s obvious what happened.”

Read More…

Former President Bill Clinton blamed Republicans who hope to undercut

his wife’s presidential chances and a voracious political news media

uninterested in substance for the furor surrounding Hillary Rodham

Clinton’s use of a private email account and server while she was

secretary of state.

Former President Bill Clinton blamed Republicans who hope to undercut

his wife’s presidential chances and a voracious political news media

uninterested in substance for the furor surrounding Hillary Rodham

Clinton’s use of a private email account and server while she was

secretary of state.“I have never seen so much expended on so little,” Mr. Clinton said in a taped interview with Fareed Zakaria that is scheduled to be shown Sunday on CNN. The network released excerpts on Saturday afternoon.

“She said she was sorry that her personal email caused all this confusion,” Mr. Clinton said. “And she’d like to give the election back to the American people. I think it will be all right. But it’s obvious what happened.”

Read More…

According to our soothsayers, when the Fed decided to keep interest rates where they’ve been since 2008, at near zero, rather than raise them, it should have triggered a big stock-market rally. But that’s not what happened.

Or rather, it triggered some rallies, but soon the hot air hissed out of them and they deflated. That’s what’s different this time: apparently nothing can keep these stocks propped up at these dizzying levels, not even the Fed.

Friday in the US, stocks rallied at the open, and by 1 PM, the S&P 500 hit 1,953, up 1% intraday and looking strong, when you could suddenly hear the hot air hissing out of it. In two hours it plunged 31 points to 1,922, before bouncing at the last hour to close down 1 point.

Read More

/

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/gold/t24_au_en_usoz_2.gif)

![[Most Recent Quotes from www.kitco.com]](http://www.kitconet.com/charts/metals/silver/t24_ag_en_usoz_2.gif)

No comments:

Post a Comment